Employer Payroll Taxes 2025

In the ever-evolving landscape of business and finance, understanding the intricacies of employer payroll taxes is crucial for both compliance and strategic planning. As we navigate the complexities of the tax system, it becomes evident that staying informed about the latest regulations and trends is essential for businesses to thrive. This comprehensive guide aims to delve into the world of employer payroll taxes for the year 2025, offering an in-depth analysis and expert insights to help businesses navigate this critical aspect of their operations.

Unraveling the Complexity of Employer Payroll Taxes

Payroll taxes are a significant component of a company’s financial obligations, impacting both the employer and the employees. In 2025, with potential legislative changes and economic shifts, employers must be well-prepared to manage these taxes efficiently. This section provides an overview of the key payroll tax types and their implications.

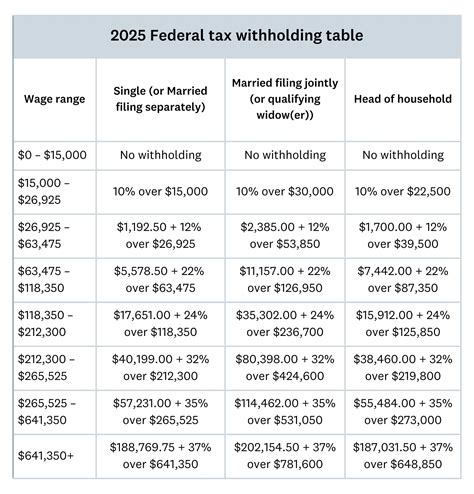

Federal Payroll Taxes: A Detailed Breakdown

Federal payroll taxes constitute a substantial portion of an employer’s tax obligations. These taxes are mandatory contributions to various social security and employment-related funds, ensuring the stability of crucial social programs and the protection of workers. Let’s explore the major federal payroll taxes and their projected rates for 2025.

| Tax Type | Rate (2025 Projection) |

|---|---|

| Social Security Tax (OASDI) | 6.2% for employers, 6.2% for employees (up to a maximum wage base) |

| Medicare Tax | 1.45% for employers, 1.45% for employees (no wage base limit) |

| Federal Unemployment Tax (FUTA) | 0.6% on the first $7,000 of employee wages (potential changes to be announced) |

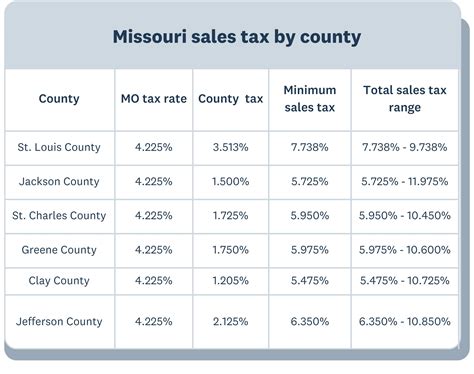

State and Local Payroll Taxes: A Diverse Landscape

State and local payroll taxes vary significantly across jurisdictions, adding a layer of complexity to payroll tax management. These taxes often include state income taxes, disability insurance, and various other contributions. Here’s a glimpse into the diverse state payroll tax landscape:

| State | Income Tax Rate (Employer Portion) | Other State Taxes |

|---|---|---|

| California | 1.5% | State Disability Insurance, Unemployment Insurance |

| New York | 2.3% | State Unemployment Insurance, Disability Contributions |

| Texas | 0% (no state income tax) | Franchise Tax, Local Payroll Taxes |

Navigating these diverse state tax landscapes requires a comprehensive understanding of local regulations and the potential for varying tax obligations based on the employer's geographic footprint.

The Role of Technology in Payroll Tax Management

In today’s digital age, leveraging technology is paramount for efficient payroll tax management. Advanced payroll software and online platforms offer a range of benefits, including automated tax calculations, real-time updates on tax law changes, and seamless integration with accounting systems. Here’s how technology can streamline payroll tax processes:

- Automated Compliance: Software solutions can automatically calculate and deduct payroll taxes, ensuring compliance with federal, state, and local regulations.

- Real-Time Updates: Online platforms provide immediate access to the latest tax rate changes, helping employers stay informed and avoid penalties.

- Efficient Record-Keeping: Digital payroll systems offer organized record-keeping, making it easier to retrieve tax-related information during audits or for strategic planning.

- Integration with Accounting: Seamless integration with accounting software simplifies the process of transferring payroll tax data, reducing the risk of errors and streamlining financial reporting.

Strategic Considerations for Effective Payroll Tax Management

Beyond the basic understanding of payroll tax types and rates, employers must adopt a strategic approach to manage these obligations effectively. This section delves into key considerations and best practices to optimize payroll tax management in 2025.

Staying Informed: The Importance of Tax Law Updates

The tax landscape is dynamic, with frequent updates and changes. Employers must prioritize staying informed about the latest tax law modifications to ensure compliance and take advantage of any beneficial adjustments. Here are some key strategies for staying updated:

- Subscribe to Tax Authority Newsletters: Sign up for newsletters or alerts from official tax authorities and government agencies to receive timely updates on tax law changes.

- Engage Tax Professionals: Consult with tax advisors or accountants who specialize in payroll taxes. They can provide expert guidance on navigating complex tax regulations and potential tax-saving strategies.

- Utilize Online Resources: Reputable tax websites and forums offer valuable insights and discussions on tax law changes. These platforms can be a great resource for staying informed and connecting with other professionals.

Efficient Payroll Processing: Best Practices

Efficient payroll processing is crucial for timely and accurate tax management. By implementing best practices, employers can streamline their payroll operations and minimize the risk of errors. Consider the following strategies:

- Regular Payroll Reviews: Conduct periodic reviews of payroll processes to identify areas for improvement. This includes reviewing tax calculations, withholding methods, and reporting practices.

- Employee Education: Provide employees with clear and concise information about payroll taxes. Educating employees about their tax obligations can reduce inquiries and potential errors in tax calculations.

- Implement Payroll Controls: Establish internal controls to ensure the accuracy and integrity of payroll data. This may include implementing dual-control processes, where two employees are involved in key payroll tasks, to minimize the risk of fraud or errors.

Tax Planning and Strategies: Maximizing Benefits

Effective tax planning can help employers optimize their tax obligations and potentially reduce their overall tax burden. Here are some strategic considerations for tax planning in 2025:

- Research Tax Credits and Incentives: Explore federal, state, and local tax credits and incentives that may be applicable to your business. These incentives can offset payroll tax liabilities and provide significant savings.

- Consider Retirement Plan Contributions: Employer contributions to retirement plans can reduce taxable income and provide a tax-efficient way to support employees' retirement savings.

- Strategic Hiring and Onboarding: Plan new hires strategically, considering the impact on payroll taxes. Onboarding new employees at the beginning of a tax year can provide more accurate tax calculations and avoid potential overpayments.

Conclusion: A Holistic Approach to Payroll Tax Management

In conclusion, managing employer payroll taxes in 2025 requires a holistic approach that combines compliance, strategic planning, and technological advancements. By staying informed about tax law changes, adopting efficient payroll processing practices, and implementing strategic tax planning, businesses can effectively navigate the complexities of payroll taxes. As we move forward into the new year, a proactive and well-informed approach to payroll tax management will be key to ensuring financial stability and compliance for businesses of all sizes.

What are the potential consequences of non-compliance with payroll tax regulations?

+Non-compliance with payroll tax regulations can lead to severe consequences, including penalties, interest, and legal action. Employers may face fines for late payments or incorrect filings, and in some cases, personal liability for tax obligations can be imposed on business owners or officers. It’s crucial to prioritize compliance to avoid these detrimental outcomes.

How can employers stay updated on payroll tax changes throughout the year?

+Employers can stay informed by subscribing to tax authority newsletters, regularly checking reputable tax websites, and engaging with tax professionals who provide updates on tax law changes. Additionally, payroll software and online platforms often offer alerts and notifications regarding tax updates.

Are there any specific tax credits or incentives that can benefit employers in 2025?

+Yes, there are various tax credits and incentives that employers can explore to reduce their tax obligations. These may include research and development tax credits, employee retention credits, and energy efficiency incentives. It’s advisable to consult with tax advisors to identify the most relevant credits for your business.