Williamson County Property Tax

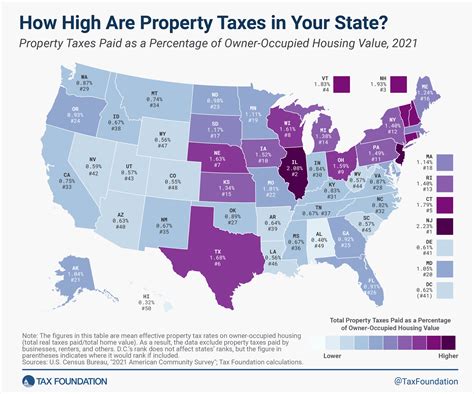

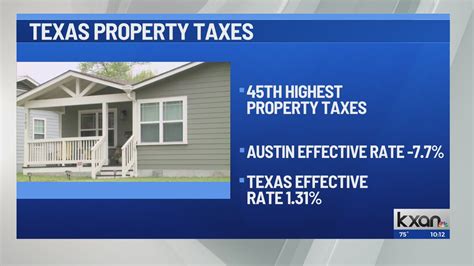

Property taxes are a significant concern for homeowners and property owners alike. In Williamson County, Texas, the property tax system is an intricate process that affects a large number of residents. This comprehensive guide aims to provide an in-depth analysis of Williamson County's property tax landscape, offering valuable insights and information to those interested in understanding the ins and outs of this essential financial obligation.

Understanding Williamson County’s Property Tax System

Williamson County, often referred to as “WilCo,” is a rapidly growing county in the state of Texas, known for its vibrant communities and thriving economy. The property tax system in this county is a vital component of its financial structure, contributing significantly to the overall revenue stream.

Property taxes in Williamson County are primarily determined by the Appraisal District, which assesses the value of each property within the county. This value assessment is a critical factor in calculating the amount of tax each property owner must pay. The Appraisal District employs a team of professionals who conduct regular evaluations to ensure accurate and fair assessments.

The property tax rate in Williamson County is set by various taxing entities, including the county itself, cities, school districts, and special districts. These entities rely on property taxes to fund essential services and infrastructure projects. The tax rate is expressed as a percentage, and it can vary significantly depending on the specific location within the county.

| Taxing Entity | Tax Rate (2023) |

|---|---|

| Williamson County | 0.3521% |

| City of Austin (portion in Williamson County) | 0.4956% |

| Round Rock ISD | 1.4705% |

| Georgetown ISD | 1.5048% |

| Leander ISD | 1.3910% |

| Hutto ISD | 1.3900% |

| Other Special Districts (e.g., MUDs, WCWCID) | Varies |

The property tax bill that homeowners receive is a result of multiplying the appraised value of their property by the tax rate applicable to their location. This calculation can become quite complex, especially in areas where multiple taxing entities overlap. However, the Williamson Central Appraisal District provides resources and tools to help property owners understand their tax obligations.

Property Tax Assessment Process

The property tax assessment process in Williamson County begins with the Appraisal District conducting a comprehensive review of each property’s characteristics. This includes physical inspections, market analysis, and consideration of any improvements or changes made to the property.

After the initial assessment, property owners are sent a notice of appraised value. This notice provides an estimate of the property's value and gives owners an opportunity to review and challenge the assessment if they believe it is inaccurate. The challenge process involves submitting evidence and supporting documentation to the Appraisal Review Board, which is an independent body that reviews and adjusts appraised values as necessary.

Once the appraisal review process is complete, the taxing entities set their tax rates, and the Appraisal District calculates the final tax bills. These bills are then mailed to property owners, usually in October or November, with payment due by January 31st of the following year. Failure to pay by the deadline can result in penalties and interest, so it's essential for property owners to stay informed and manage their tax obligations promptly.

Impact of Property Taxes on Residents

Property taxes in Williamson County can have a significant impact on residents’ financial planning and overall cost of living. The tax burden can vary widely depending on the location and the assessed value of the property. For example, a homeowner in a high-value area like Round Rock ISD may pay substantially more in property taxes than someone in a lower-value area like Hutto ISD.

The impact of property taxes is particularly noteworthy for those on fixed incomes or with limited financial means. While the county offers exemptions and discounts for certain qualifying individuals, such as seniors and disabled veterans, the overall tax burden can still be a challenge for many residents. This has led to ongoing discussions and initiatives aimed at finding a balance between funding essential services and ensuring property taxes remain manageable for all residents.

Strategies for Managing Property Taxes in Williamson County

Navigating the property tax landscape in Williamson County requires a strategic approach. Here are some key strategies and considerations for property owners:

1. Stay Informed

Keeping up-to-date with the latest information on property taxes is crucial. The Williamson Central Appraisal District provides a wealth of resources, including online tools, guides, and workshops, to help property owners understand their rights and responsibilities. Regularly checking their website and attending informational sessions can empower property owners to make informed decisions.

2. Challenge Assessments

If a property owner believes their assessed value is inaccurate, they have the right to challenge it. The Appraisal Review Board is an impartial body that reviews and adjusts values based on evidence provided by the property owner. Gathering comparable sales data, hiring a professional appraiser, or demonstrating that the assessment is inconsistent with similar properties can be effective strategies for challenging an assessment.

3. Utilize Exemptions and Discounts

Williamson County offers a range of exemptions and discounts to eligible property owners. These include homestead exemptions for primary residences, over-65 exemptions, and disability exemptions. Additionally, the county provides a school tax limitation, known as the “school tax ceiling,” which caps the amount of school taxes that can be collected on a property, providing some relief for homeowners.

It's important for property owners to research and understand the qualifications and application processes for these exemptions and discounts. The Williamson Central Appraisal District website provides detailed information and application forms for each type of exemption.

4. Consider Investment Strategies

For investors or those looking to purchase property in Williamson County, it’s crucial to factor in property taxes as part of their financial planning. Strategies such as purchasing in areas with lower tax rates or investing in properties that offer rental income to offset tax obligations can be effective approaches. Additionally, understanding the potential for future growth and development in an area can influence investment decisions and tax implications.

The Future of Property Taxes in Williamson County

As Williamson County continues to experience rapid growth and development, the property tax landscape is likely to evolve as well. The county’s leaders and residents are engaged in ongoing discussions and initiatives to address the challenges and opportunities associated with property taxes.

Addressing Tax Relief and Fairness

One of the key focuses in Williamson County is ensuring that property taxes remain fair and manageable for all residents. This involves ongoing efforts to balance the need for revenue with the impact on taxpayers. Initiatives such as increasing the school tax ceiling or exploring alternative revenue sources are being considered to provide relief while maintaining essential services.

Technological Innovations

The Williamson Central Appraisal District is committed to utilizing technology to enhance the property tax process. This includes developing user-friendly online platforms, implementing data analytics for more accurate assessments, and exploring blockchain technology for secure and transparent record-keeping. These innovations aim to improve efficiency, reduce administrative burdens, and provide better service to property owners.

Community Engagement and Education

Williamson County recognizes the importance of engaging with its residents and providing educational resources. The county hosts public meetings, town halls, and workshops to discuss property tax issues and gather feedback. Additionally, the Appraisal District and local government entities actively engage with community groups and organizations to ensure that residents have the information and support they need to navigate the property tax system effectively.

Conclusion

Understanding and managing property taxes in Williamson County requires a comprehensive understanding of the local tax system, assessment processes, and available strategies. By staying informed, engaging with the community, and utilizing the resources provided by the Williamson Central Appraisal District, property owners can effectively navigate their tax obligations and contribute to the vibrant communities within the county.

How often are property values assessed in Williamson County?

+Property values are assessed annually by the Williamson Central Appraisal District. This ensures that the tax burden is based on the current market value of the property.

What happens if I don’t agree with my property’s assessed value?

+If you disagree with your property’s assessed value, you have the right to protest the assessment. You can file a protest with the Appraisal Review Board, providing evidence to support your case. The board will review your protest and make a decision.

Are there any tax breaks or exemptions available for property owners in Williamson County?

+Yes, Williamson County offers various exemptions and discounts to eligible property owners. These include homestead exemptions, over-65 exemptions, disability exemptions, and the school tax limitation. It’s important to research and apply for these exemptions to reduce your tax burden.

How can I stay informed about changes to property tax rates and assessments in Williamson County?

+Staying informed is crucial. You can regularly check the Williamson Central Appraisal District’s website for updates, attend public meetings and workshops, and subscribe to their newsletter or follow their social media accounts for the latest information.

What happens if I fail to pay my property taxes on time in Williamson County?

+If you fail to pay your property taxes by the deadline, you may incur penalties and interest. It’s important to manage your tax obligations promptly to avoid additional costs and potential legal consequences.