Pulaski County Property Tax

Welcome to this comprehensive guide on the Pulaski County Property Tax system, a crucial aspect of local governance and finance in Arkansas. Understanding property taxes is essential for homeowners, investors, and anyone with an interest in the county's real estate market. This article will delve into the intricacies of Pulaski County's property tax process, shedding light on its workings, benefits, and implications for residents and property owners.

Understanding the Pulaski County Property Tax Landscape

Pulaski County, nestled in the heart of Arkansas, boasts a vibrant real estate market and a diverse range of properties, from historic homes to modern developments. The property tax system plays a pivotal role in funding essential public services, including schools, infrastructure, and community initiatives. This guide aims to provide a detailed overview of how property taxes are assessed, calculated, and utilized in Pulaski County, offering valuable insights for property owners and taxpayers.

The Role of Assessors and Tax Appraisal

At the core of the property tax system is the assessment process, which determines the value of each property within the county. This critical step is undertaken by trained assessors who employ various methods to appraise properties accurately. Assessors consider factors such as:

- Market Value: The current fair market value of the property based on recent sales of comparable properties.

- Location: The influence of the property's location on its value, including neighborhood desirability and proximity to amenities.

- Improvements: Any enhancements made to the property, such as renovations, additions, or upgrades.

- Tax Rates: The applicable tax rates set by local governing bodies, which vary based on the property's location and use.

The assessment process ensures that property taxes are levied fairly and proportionally, reflecting the actual value of each property. This transparency and accuracy are fundamental to maintaining a stable and equitable tax system.

Property Tax Calculation: A Step-by-Step Breakdown

Once the assessed value of a property is determined, the property tax calculation process begins. This involves a series of steps, each contributing to the final tax amount owed by the property owner. Here’s a simplified breakdown:

- Assessment Ratio: The assessed value is multiplied by the assessment ratio, which is a predetermined percentage set by the county. This ratio ensures consistency and fairness across properties.

- Tax Rate: The resulting value is then multiplied by the tax rate, which is determined by the local government and reflects the tax revenue needed to fund public services. Tax rates can vary based on the type of property (e.g., residential, commercial) and its location within the county.

- Adjustments and Exemptions: Certain properties may be eligible for tax adjustments or exemptions, such as those owned by veterans or used for charitable purposes. These adjustments are applied to the calculated tax amount, reducing the final tax liability.

- Tax Bill: The final tax amount, along with any applicable fees or penalties, is presented to the property owner as a tax bill. This bill outlines the due date and payment options, ensuring transparency and accountability.

Property owners have the right to review their tax assessments and calculations, ensuring accuracy and fairness. This process fosters trust and accountability in the tax system, benefiting both taxpayers and the community as a whole.

Benefits and Impact of Pulaski County Property Taxes

The property tax system in Pulaski County has a profound impact on the community, offering several key benefits:

- Funding for Essential Services: Property taxes are a primary source of revenue for local governments, funding vital services such as education, public safety, healthcare, and infrastructure development. This ensures that residents have access to quality public amenities and a thriving community.

- Stability and Planning: A well-managed property tax system provides stability and predictability for both taxpayers and the county. Property owners can plan their finances effectively, while the county can budget and allocate resources efficiently, leading to long-term economic growth.

- Equitable Tax Distribution: The assessment and calculation process ensures that property taxes are distributed fairly among residents. Properties of similar value are taxed at the same rate, promoting fairness and preventing disproportionate burdens on any segment of the community.

- Community Development: Property taxes contribute to community development initiatives, including urban renewal projects, affordable housing programs, and environmental sustainability efforts. These investments enhance the quality of life for residents and attract new businesses and residents to the county.

The positive impact of property taxes extends beyond the county borders, influencing regional economic growth and overall community well-being.

Navigating the Property Tax Process: A Comprehensive Guide

For property owners in Pulaski County, understanding the property tax process is essential for effective financial planning and engagement with local governance. Here’s a detailed guide to help navigate each step of the process:

Step 1: Understanding Your Property Assessment

The first step in the property tax journey is to comprehend the assessment process and the factors that influence your property’s value. Assessors consider various aspects, including:

- Market Conditions: The overall real estate market trends and sales data in your area impact your property's value. Keep an eye on local market reports to understand the factors driving property values.

- Property Characteristics: Your property's unique features, such as square footage, number of bedrooms and bathrooms, age, and condition, all contribute to its assessed value. Ensure that these details are accurately reflected in your assessment.

- Location: The desirability of your neighborhood and its proximity to amenities can significantly affect your property's value. Consider the appeal of your location and how it may influence your tax assessment.

- Recent Renovations: Any improvements or renovations you've made to your property can increase its value and, consequently, your tax assessment. Ensure that these improvements are accurately documented and reflected in your assessment.

By understanding these factors, you can actively participate in the assessment process and ensure that your property is valued fairly.

Step 2: Reviewing and Challenging Your Assessment (If Necessary)

If you believe your property assessment is inaccurate or unfair, you have the right to challenge it. Here’s a step-by-step guide to this process:

- Gather Evidence: Collect supporting documentation, such as recent appraisals, comparable property sales data, and photographs of your property's condition. This evidence will strengthen your case.

- File an Appeal: Contact the Pulaski County Assessor's Office to initiate the appeal process. They will guide you on the necessary steps and provide information on appeal deadlines.

- Present Your Case: Prepare a clear and concise argument, highlighting why you believe your assessment is inaccurate. Use your gathered evidence to support your claim.

- Negotiate or Mediate: If your appeal is successful, the assessor's office may negotiate a new assessment with you. In some cases, mediation may be offered to reach a mutually agreeable solution.

- Appeal to Higher Authorities: If your appeal is unsuccessful, you may have the option to appeal to a higher authority, such as the Arkansas Property Tax Appeal Board. This step requires careful preparation and legal advice.

Remember, challenging an assessment is a legal process, and it's advisable to seek professional guidance to ensure a successful outcome.

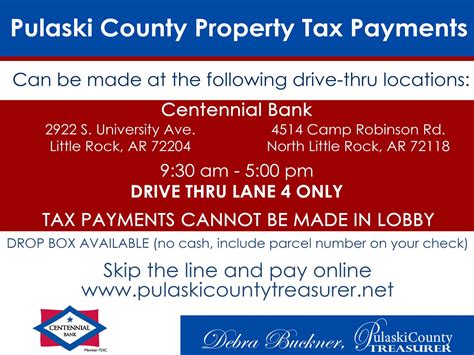

Step 3: Paying Your Property Taxes: A Comprehensive Guide

Once your tax assessment is finalized, it’s time to understand and pay your property taxes. Here’s a detailed guide to ensure a smooth payment process:

- Understand Your Tax Bill: Carefully review your tax bill, which outlines the assessed value of your property, the applicable tax rates, and the total tax amount due. Ensure that all information is accurate and up-to-date.

- Payment Options: Pulaski County offers various payment methods, including online payments through secure portals, in-person payments at designated locations, and mail-in payments. Choose the option that suits your preferences and convenience.

- Due Dates and Penalties: Be mindful of the tax bill's due date to avoid late payment penalties. Mark your calendar with the due date and set reminders to ensure timely payment.

- Payment Assistance Programs: If you're facing financial challenges, explore payment assistance programs offered by the county. These programs may provide relief for eligible property owners, ensuring that everyone has the opportunity to fulfill their tax obligations.

- Tax Relief for Seniors and Veterans: Pulaski County recognizes the contributions of seniors and veterans by offering tax relief programs specifically tailored to their needs. Explore these programs to determine your eligibility and potential tax savings.

By staying informed and taking advantage of available resources, you can navigate the property tax process with confidence and ensure a positive impact on your financial well-being.

Future Implications and Trends in Pulaski County Property Taxes

As Pulaski County continues to evolve and adapt to changing economic and social landscapes, the property tax system will play a pivotal role in shaping the future of the community. Here’s a glimpse into the potential future implications and trends:

Sustainable Growth and Development

Pulaski County is committed to sustainable growth and development, ensuring that the community thrives while preserving its unique character and natural resources. The property tax system will continue to play a crucial role in funding initiatives that promote environmental sustainability, such as green infrastructure projects, renewable energy initiatives, and urban planning efforts that prioritize walkability and accessibility.

By investing in sustainable development, the county can enhance its attractiveness to residents, businesses, and visitors, fostering long-term economic prosperity while preserving the natural beauty and quality of life that define the region.

Technological Innovations for Enhanced Efficiency

The digital age has brought about unprecedented opportunities for streamlining administrative processes, and the property tax system is no exception. Pulaski County is exploring innovative technologies to enhance the efficiency and accuracy of property assessments, tax calculations, and payment processes. This includes:

- Online Assessment Tools: Developing user-friendly online platforms that allow property owners to access their assessment information, track changes, and provide feedback, fostering transparency and engagement.

- Digital Payment Solutions: Implementing secure and convenient digital payment options, including mobile apps and online portals, to streamline the tax payment process and reduce administrative burdens.

- Data Analytics for Fair Assessments: Utilizing advanced data analytics and machine learning techniques to analyze vast datasets, ensuring accurate and fair property assessments that reflect market trends and individual property characteristics.

By embracing technological innovations, the county can improve the overall property tax experience for residents and businesses, enhancing efficiency, fairness, and transparency.

Community Engagement and Transparency

Pulaski County recognizes the importance of community engagement and transparency in building trust and fostering a sense of ownership among residents. The property tax system will continue to prioritize open communication and collaboration, ensuring that taxpayers have a voice in the decision-making process.

The county aims to enhance public participation through:

- Town Hall Meetings: Hosting regular town hall meetings and community forums where residents can engage directly with local officials, express their concerns, and provide valuable input on tax-related matters.

- Online Platforms for Feedback: Developing interactive online platforms and social media channels to facilitate ongoing dialogue between taxpayers and government officials, enabling residents to share their experiences, suggestions, and feedback on the property tax system.

- Taxpayer Education Programs: Launching educational initiatives to empower residents with the knowledge and tools they need to understand the property tax process, their rights, and the impact of their contributions on the community's well-being.

By fostering a culture of engagement and transparency, Pulaski County can build a stronger, more resilient community, ensuring that the property tax system remains fair, efficient, and responsive to the needs of its residents.

Conclusion: A Vibrant Future for Pulaski County

The property tax system in Pulaski County is a vital engine driving the community’s growth, development, and prosperity. By understanding the assessment process, participating in the tax system, and leveraging available resources, property owners can actively contribute to the vibrant future of the county.

As Pulaski County continues to evolve, embracing sustainable practices, technological advancements, and community engagement, the property tax system will remain a cornerstone of its success, funding essential services, promoting equity, and shaping a brighter future for all its residents.

FAQ

How often are property assessments conducted in Pulaski County?

+Property assessments in Pulaski County are typically conducted every two years. However, in certain circumstances, such as significant improvements or renovations to a property, the assessor’s office may conduct reassessments to ensure accuracy.

What happens if I miss the deadline for paying my property taxes?

+Missing the deadline for paying your property taxes can result in late payment penalties and interest charges. It’s crucial to stay informed about the due dates and make timely payments to avoid additional financial burdens.

Are there any tax relief programs available for seniors in Pulaski County?

+Yes, Pulaski County offers a Senior Citizen Property Tax Freeze Program, which allows eligible seniors to freeze their property taxes at a fixed rate, providing financial relief and stability. To learn more, contact the Pulaski County Assessor’s Office or visit their website for detailed eligibility criteria and application instructions.

Can I pay my property taxes online?

+Absolutely! Pulaski County offers convenient online payment options through its official website. You can make secure payments using a credit card, debit card, or electronic check. This option provides flexibility and ease, allowing you to manage your tax obligations from the comfort of your home.