Income Tax In Seattle Washington

Income tax is an essential component of the financial landscape in Seattle, Washington, impacting individuals, businesses, and the overall economy of the region. This comprehensive guide delves into the intricacies of income tax in Seattle, exploring its unique characteristics, regulations, and implications for taxpayers.

Understanding Income Tax in Seattle: An Overview

Income tax is a crucial revenue source for state and local governments, including the city of Seattle. In Washington state, the income tax system is primarily focused on levying taxes on businesses and corporations, while individuals are not subject to a state-level income tax. However, this does not mean that residents of Seattle are exempt from income tax altogether.

Seattle operates within the framework of the federal income tax system, which means that individuals and businesses must comply with federal tax laws and regulations. The Internal Revenue Service (IRS) is responsible for collecting and administering federal taxes, and its guidelines apply to taxpayers in Seattle and across the nation.

While Seattle residents do not pay state income tax, they are still required to file federal income tax returns annually. This federal obligation ensures that individuals and businesses contribute to the national revenue stream, which supports various federal programs and initiatives.

The Seattle Business and Occupation (B&O) Tax

One of the unique aspects of Seattle’s tax system is the Business and Occupation (B&O) tax, a gross receipts tax levied on businesses operating within the city limits. The B&O tax is a key revenue generator for Seattle, contributing significantly to the city’s budget and funding vital public services.

The B&O tax is calculated based on the gross income or revenue generated by a business. The tax rate varies depending on the business activity and is applied to the total income received from the specified activity. This means that businesses engaged in multiple activities may have different tax rates applied to their respective income streams.

| Business Activity | Tax Rate |

|---|---|

| Retail Sales | 0.471% |

| Wholesale Sales | 0.484% |

| Service and Other Activities | 0.484% |

| Manufacturing | 0.164% |

| Public Utility | 2.089% |

For instance, a retail business in Seattle would pay a tax of 0.471% on its total sales revenue, while a service-based business would be subject to a rate of 0.484%. The tax rates are designed to encourage certain economic activities, such as manufacturing, which has a lower tax rate compared to other sectors.

The B&O tax is self-assessed, meaning that businesses are responsible for calculating and remitting their own tax payments. The city of Seattle provides resources and guidance to help businesses understand their tax obligations and ensure compliance. Failure to pay the B&O tax can result in penalties and interest, so it is crucial for businesses to stay informed and up-to-date with their tax responsibilities.

Federal Income Tax: Implications for Seattle Residents

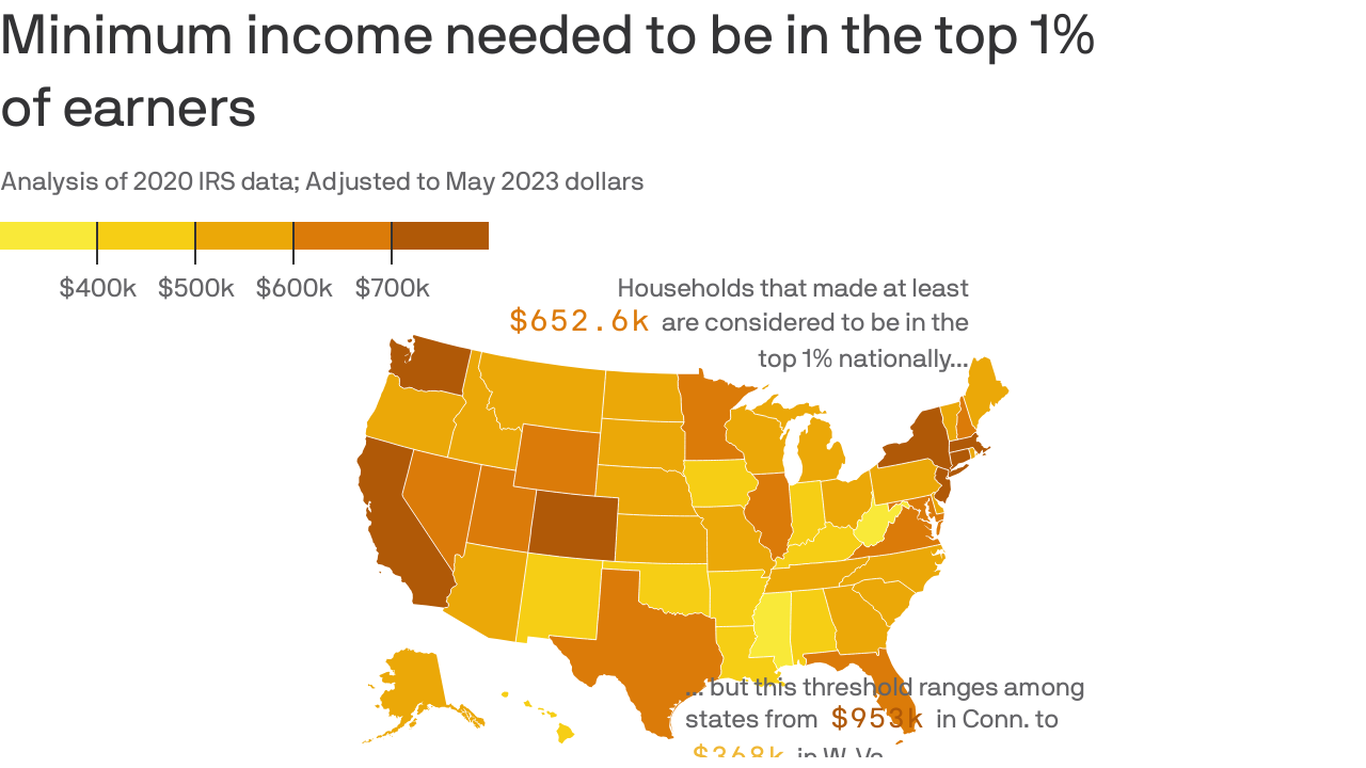

Although Seattle residents do not pay state income tax, they are subject to federal income tax laws. The federal tax system is progressive, meaning that tax rates increase as income levels rise. The IRS determines the tax brackets and rates, which can change periodically.

As of the current tax year, the federal income tax brackets for individuals are as follows:

| Tax Bracket | Tax Rate | Single Filers | Married Filing Jointly |

|---|---|---|---|

| 10% | Up to $9,950 | Up to $9,950 | Up to $19,900 |

| 12% | $9,951 - $40,525 | $9,951 - $40,525 | $19,901 - $81,050 |

| 22% | $40,526 - $86,375 | $40,526 - $86,375 | $81,051 - $172,750 |

| 24% | $86,376 - $164,925 | $86,376 - $164,925 | $172,751 - $329,850 |

| 32% | $164,926 - $209,425 | $164,926 - $209,425 | $329,851 - $418,850 |

| 35% | $209,426 - $523,600 | $209,426 - $523,600 | $418,851 - $628,300 |

| 37% | Over $523,600 | Over $523,600 | Over $628,300 |

These tax brackets apply to taxable income, which is the income remaining after deductions and exemptions have been applied. The federal tax system offers various deductions and credits to reduce the taxable income and, consequently, the tax liability.

Seattle residents have access to a range of tax credits and deductions, such as the Child Tax Credit, the Earned Income Tax Credit, and deductions for mortgage interest, state and local taxes, and charitable contributions. These tax benefits can significantly reduce the tax burden for individuals and families.

Tax Planning and Strategies for Seattle Residents

Given the unique tax landscape in Seattle, it is essential for residents to engage in effective tax planning. Here are some strategies to consider:

- Utilize Deductions and Credits: Take advantage of the available tax deductions and credits to reduce your taxable income. This can include contributions to retirement accounts, education expenses, and charitable donations.

- Maximize Retirement Savings: Contribute to tax-advantaged retirement accounts such as IRAs or 401(k)s. These accounts allow your investments to grow tax-free or tax-deferred, providing significant long-term benefits.

- Understand Business Tax Obligations: If you own a business in Seattle, ensure you are familiar with the B&O tax and its implications. Proper tax planning can help minimize your tax liability and ensure compliance with city regulations.

- Consider Tax-Efficient Investments: Explore investment options that offer tax advantages, such as municipal bonds or tax-efficient mutual funds. These investments can help reduce your overall tax burden.

- Seek Professional Advice: Consulting with a tax professional or accountant can provide valuable insights tailored to your specific financial situation. They can help you navigate the complexities of the tax system and optimize your tax strategy.

Conclusion: Navigating the Tax Landscape in Seattle

Income tax in Seattle is a multifaceted system, with unique characteristics that set it apart from other regions. While Seattle residents are exempt from state income tax, they still have obligations under the federal tax system. The city’s Business and Occupation tax is a significant revenue source, impacting businesses operating within its borders.

Effective tax planning is essential for individuals and businesses in Seattle to manage their tax obligations and take advantage of available tax benefits. By staying informed, seeking professional advice, and implementing strategic tax planning, Seattle residents can navigate the tax landscape with confidence and ensure compliance with the relevant tax laws.

What is the purpose of the Business and Occupation (B&O) tax in Seattle?

+The B&O tax is a gross receipts tax levied on businesses operating in Seattle. It is a significant revenue source for the city, funding essential public services. The tax is designed to encourage economic activity and contribute to the city’s economic growth.

Are there any tax benefits specifically for Seattle residents?

+While Seattle residents do not have a state-level income tax, they can still take advantage of federal tax credits and deductions. These include the Child Tax Credit, Earned Income Tax Credit, and deductions for various expenses such as mortgage interest and charitable contributions.

How can I calculate my federal income tax liability as a Seattle resident?

+To calculate your federal income tax liability, you need to determine your taxable income and apply the appropriate tax bracket and rate. You can use IRS tax calculators or consult with a tax professional to ensure accuracy.

Are there any tax incentives for businesses operating in Seattle?

+Seattle offers various tax incentives and programs to attract and support businesses. These may include tax breaks for certain industries, research and development credits, and incentives for job creation. It’s advisable to consult with a tax advisor or the city’s economic development office for specific details.

Can I claim deductions for state and local taxes on my federal tax return if I live in Seattle?

+Yes, you can claim deductions for state and local taxes, including property taxes and sales taxes, on your federal tax return. However, there are limitations and restrictions, so it’s best to consult with a tax professional to ensure you are claiming the correct deductions.