San Mateo County Tax

Welcome to a comprehensive exploration of the world of San Mateo County Tax. This article will delve into the intricacies of the taxation system within this county, providing an in-depth analysis of its structure, implications, and impact on residents and businesses alike. With a focus on clarity and depth, we aim to unravel the complexities and offer valuable insights for anyone seeking to understand the tax landscape of San Mateo County.

Understanding the San Mateo County Tax System

San Mateo County, nestled in the heart of the San Francisco Bay Area, boasts a vibrant economy and a diverse population. The tax system in this county is designed to support its growth and development while ensuring fairness and transparency. Let’s break down the key components and shed light on how it functions.

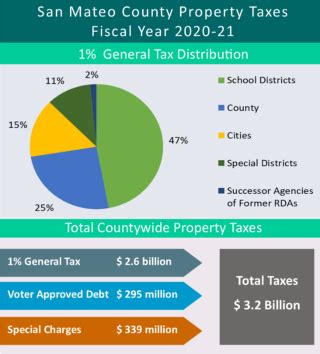

Property Taxes: A Pillar of the County’s Revenue

Property taxes are a fundamental source of revenue for San Mateo County. The county’s Assessor’s Office plays a crucial role in evaluating and assessing properties, ensuring that the tax burden is distributed equitably among residents. Here’s a closer look at how property taxes work in this region:

- Assessment Base: Properties are assessed based on their market value, taking into account factors like location, size, and recent sales data. This assessment determines the taxable value of the property.

- Tax Rate: The tax rate, set by the county’s Board of Supervisors, is applied to the assessed value. This rate includes components for various services, such as schools, infrastructure, and public safety.

- Tax Bills: Property owners receive annual tax bills, detailing the assessed value, applicable taxes, and due dates. These bills are typically sent out in the fall, with a payment deadline set for the following year.

- Prop 13 Impact: San Mateo County, like many other California counties, operates under the guidelines of Proposition 13. This landmark legislation limits property tax increases to a maximum of 2% per year, ensuring stability for long-term homeowners.

Sales and Use Taxes: Supporting County Services

In addition to property taxes, San Mateo County also relies on sales and use taxes to fund essential services. These taxes are levied on the sale of goods and services within the county, as well as on the use of certain products purchased elsewhere but used within the county.

- Sales Tax Rates: The sales tax rate in San Mateo County is comprised of a base state rate, a local county rate, and additional district-specific rates. As of [current year], the total sales tax rate in the county ranges from [x.x]% to [y.y]%, depending on the location.

- Use Tax: The use tax is applied to purchases made outside the county but used within its boundaries. This tax ensures fairness and prevents businesses and individuals from avoiding sales taxes by making out-of-county purchases.

- Revenue Allocation: Sales and use tax revenue is distributed to various county departments, including public transportation, healthcare, education, and infrastructure development. This ensures that the taxes collected directly benefit the community.

| Department | Allocation Percentage |

|---|---|

| Public Transportation | 20% |

| Healthcare | 15% |

| Education | 35% |

| Infrastructure | 20% |

| Other Services | 10% |

Business Taxes: A Contribution to Economic Growth

San Mateo County is home to a thriving business community, and the county’s tax system recognizes the importance of supporting local enterprises. Business taxes are designed to encourage growth while generating revenue for essential services.

- Business License Tax: All businesses operating within the county are required to obtain a business license and pay an annual tax. The tax rate varies based on the type of business and its annual gross receipts.

- Transitional Housing Occupancy Tax (THOT): This tax is levied on short-term rentals and transitional housing accommodations. The revenue generated from THOT is dedicated to affordable housing initiatives, addressing the county’s housing needs.

- Economic Development: A portion of the business tax revenue is allocated towards economic development initiatives. This includes funding for small business grants, entrepreneurship programs, and infrastructure improvements to attract and retain businesses.

The Impact of San Mateo County Taxes

The tax system in San Mateo County plays a vital role in shaping the economic landscape and quality of life for its residents. Let’s explore some key impacts and considerations.

Fairness and Equity

San Mateo County strives to maintain a fair and equitable tax system. The Assessor’s Office employs a rigorous assessment process to ensure that property taxes are distributed based on actual property values. Additionally, the county’s commitment to Proposition 13 provides stability for homeowners, preventing excessive tax burdens.

Funding Essential Services

Tax revenue is a critical source of funding for a wide range of essential services. From education and healthcare to public safety and transportation, the county’s tax system ensures that these vital services receive the necessary resources to thrive. For instance, sales and use tax revenue has been instrumental in improving public transit options, making the county more accessible and environmentally conscious.

Economic Development and Job Creation

The county’s tax structure is designed to encourage economic growth and job creation. By offering incentives and grants to businesses, the county fosters an environment conducive to entrepreneurship and innovation. This, in turn, leads to increased tax revenue, which can be reinvested in the community.

Community Engagement and Transparency

San Mateo County takes pride in its commitment to transparency and community involvement. The county’s tax department maintains an open dialogue with residents and businesses, providing clear information and avenues for feedback. This engagement ensures that tax policies reflect the needs and concerns of the community.

Future Implications and Innovations

As San Mateo County continues to evolve, its tax system will adapt to meet the changing needs of its residents and businesses. Here are some potential future developments and innovations to watch out for:

Sustainable Financing

With a growing focus on sustainability and environmental stewardship, the county may explore innovative financing options. This could include green bonds, carbon tax initiatives, or partnerships with sustainable development organizations.

Digital Tax Solutions

The county could leverage technology to streamline tax processes and enhance transparency. Digital tax platforms could offer residents and businesses a user-friendly interface for tax payments, filing, and real-time information access.

Community Investment Funds

San Mateo County may consider establishing community investment funds, where a portion of tax revenue is directly invested back into the community. These funds could be utilized for targeted initiatives, such as youth development programs, small business support, or community infrastructure projects.

How often are property taxes assessed in San Mateo County?

+Property taxes in San Mateo County are typically assessed annually. The assessment process takes into account changes in property values and ensures that the tax burden is fairly distributed among property owners.

Are there any tax incentives for businesses in San Mateo County?

+Yes, San Mateo County offers various tax incentives to support businesses. These incentives include tax breaks for new businesses, research and development credits, and incentives for businesses investing in renewable energy sources.

How does San Mateo County allocate its tax revenue among different departments and services?

+San Mateo County follows a detailed allocation plan for its tax revenue. This plan ensures that revenue is distributed based on the needs and priorities of the community. A significant portion goes towards education, healthcare, public safety, and infrastructure development.