Dekalb County Land Taxes

Land taxes, also known as property taxes, are an essential component of local government revenue, playing a crucial role in funding various public services and infrastructure. In DeKalb County, Georgia, understanding the intricacies of land taxes is vital for both property owners and those considering investing in the area. This comprehensive guide aims to demystify the process, shedding light on how land taxes are calculated, assessed, and paid in DeKalb County.

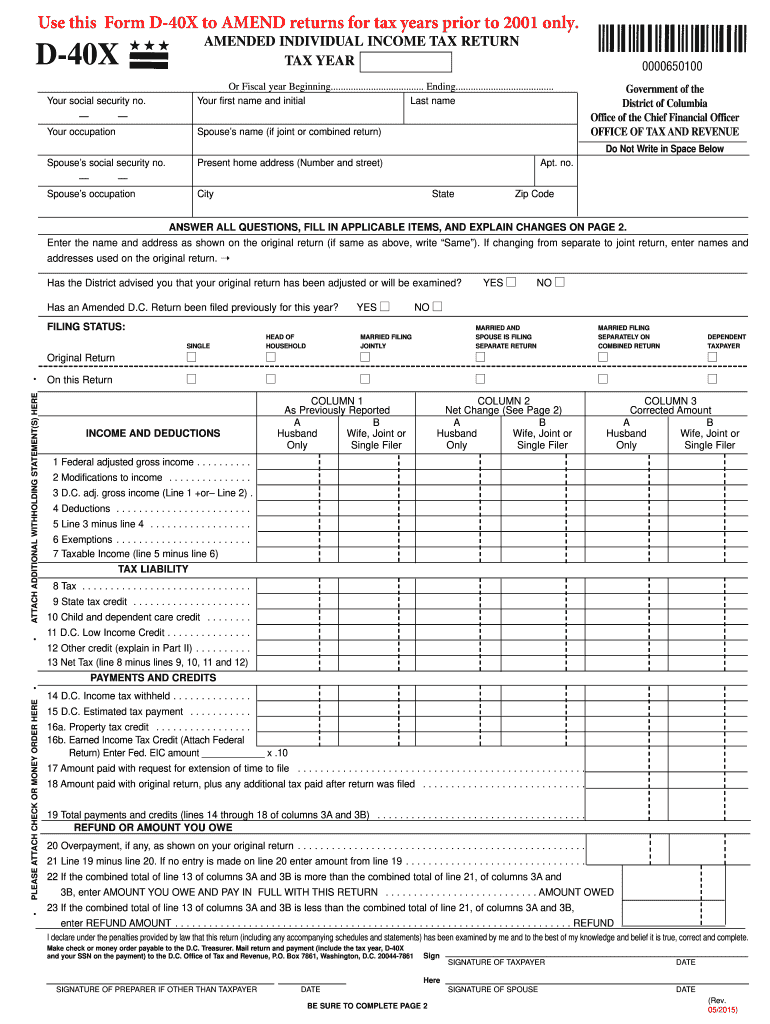

Understanding DeKalb County’s Land Tax System

DeKalb County’s land tax system operates under a set of regulations and procedures that determine the tax obligations of property owners. The county’s tax assessor’s office is responsible for evaluating properties annually, ensuring that tax assessments are fair and accurate. This process involves assessing the property’s value, taking into account factors such as location, size, improvements, and market conditions.

Property Valuation and Assessment

The valuation of a property is a critical step in determining its land tax liability. DeKalb County employs a mass appraisal system, where properties are grouped into classes based on their use, such as residential, commercial, or industrial. Each class is then assessed based on a percentage of its fair market value, as determined by the county’s tax assessor.

| Property Class | Assessment Rate |

|---|---|

| Residential | 40% |

| Commercial | 40% |

| Industrial | 40% |

For instance, a residential property valued at $300,000 would have an assessed value of $120,000 (40% of $300,000) for tax purposes.

Tax Rates and Calculations

Once the assessed value of a property is determined, the applicable tax rate is applied to calculate the land tax liability. DeKalb County’s tax rates are set annually by the county government and are subject to change. These rates are expressed as millage rates, where one mill represents 1 of tax for every 1,000 of assessed property value.

| Tax Jurisdiction | 2023 Millage Rate |

|---|---|

| DeKalb County | 17.41 mills |

| DeKalb County School System | 21.89 mills |

| City of Atlanta (for properties within city limits) | 11.99 mills |

Using the example above, a residential property with an assessed value of $120,000 would incur the following land tax liability:

DeKalb County Tax: $120,000 x 17.41 mills = $2,089.20

DeKalb County School System Tax: $120,000 x 21.89 mills = $2,626.80

City of Atlanta Tax (if applicable): $120,000 x 11.99 mills = $1,438.80

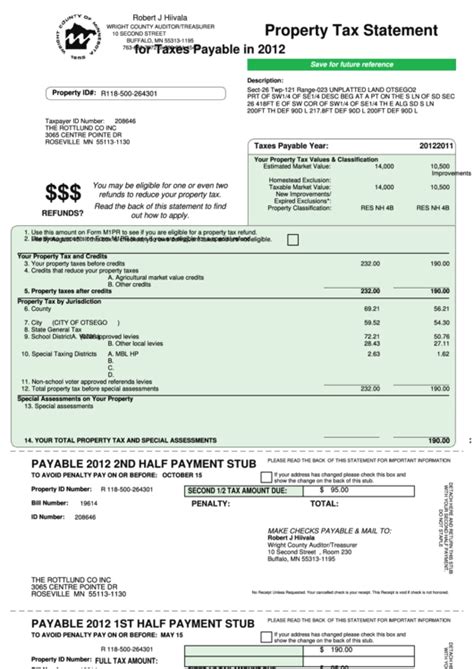

Tax Relief and Exemptions

DeKalb County offers various tax relief programs and exemptions to eligible property owners. These include homestead exemptions, which reduce the taxable value of a primary residence, and disability exemptions for qualifying individuals. Additionally, the county provides tax relief for seniors and low-income homeowners.

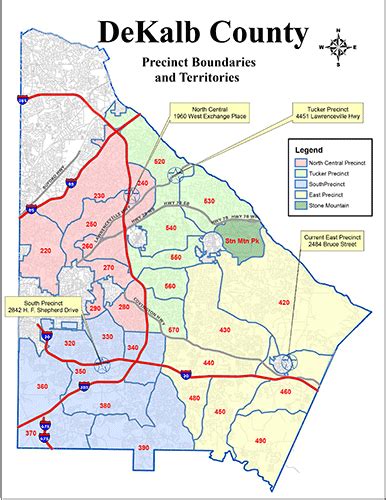

Payment and Collection Process

Land taxes in DeKalb County are due twice a year, with payments typically due in March and September. Property owners receive tax bills from the county’s tax commissioner, which detail the amount due, payment deadlines, and options for paying online or by mail.

Online Payment Options

DeKalb County offers a convenient online payment system, allowing property owners to pay their land taxes securely through the county’s website. This system provides real-time confirmation of payments and allows for easy tracking of tax balances.

Late Payment Penalties

Failure to pay land taxes by the due date can result in late payment penalties and interest charges. It’s important for property owners to stay informed about payment deadlines to avoid additional fees and potential legal consequences.

Challenging Property Assessments

Property owners who believe their property has been unfairly assessed have the right to appeal the assessment. DeKalb County provides a formal appeals process, which involves submitting documentation and evidence to support the claim of an incorrect assessment. The county’s board of equalization reviews these appeals and makes final decisions on assessment adjustments.

Common Grounds for Appeals

Appeals may be based on factors such as errors in the property’s assessed value, incorrect classification, or changes in the property’s condition since the last assessment. It’s crucial for property owners to gather relevant evidence, such as recent sales of similar properties, to support their case.

Future Implications and Changes

The land tax system in DeKalb County is subject to ongoing review and potential changes. As property values fluctuate and the county’s financial needs evolve, tax rates and assessment procedures may be adjusted to ensure the system remains fair and sustainable.

Frequently Asked Questions

What happens if I miss the land tax payment deadline in DeKalb County?

+

Missing the land tax payment deadline in DeKalb County can result in late payment penalties and interest charges. It’s important to stay informed about payment due dates to avoid these additional fees. The county typically sends reminder notices, but it’s the property owner’s responsibility to ensure timely payment.

Are there any tax relief programs for seniors in DeKalb County?

+

Yes, DeKalb County offers tax relief programs specifically designed for senior citizens. These programs provide reduced tax rates or exemptions based on age and income. To qualify, seniors must meet certain criteria and apply for the program through the county’s tax commissioner’s office.

How often are property assessments conducted in DeKalb County?

+

Property assessments in DeKalb County are conducted annually. The county’s tax assessor’s office evaluates properties each year to ensure that tax assessments reflect current market values and any changes to the property. This annual assessment process helps maintain fairness and accuracy in the land tax system.

Can I pay my land taxes in installments in DeKalb County?

+

Yes, DeKalb County offers an installment payment plan for property taxes. This plan allows property owners to pay their taxes in multiple installments throughout the year, making it more manageable for those with larger tax liabilities. To enroll in the installment plan, property owners must meet certain eligibility criteria and complete the necessary paperwork.

How can I stay updated on changes to land tax rates and assessment procedures in DeKalb County?

+

Staying informed about changes to land tax rates and assessment procedures in DeKalb County is crucial for property owners. The county provides various resources to keep the public informed, including its official website, local news outlets, and community meetings. Additionally, subscribing to the county’s tax commissioner’s newsletter can provide regular updates on tax-related matters.