Greenville Sc Tax

The city of Greenville, South Carolina, is known for its vibrant culture, thriving business landscape, and picturesque surroundings. However, when it comes to financial matters, understanding the tax system and its implications is crucial for both residents and businesses. In this comprehensive guide, we delve into the intricacies of Greenville SC Tax, offering an expert analysis to help navigate the tax landscape with ease.

Unraveling Greenville’s Tax Structure

Greenville, like many other cities, operates within a complex tax system that comprises federal, state, and local taxes. While the federal and state taxes are relatively standardized, it is the local taxes that often present a unique set of rules and regulations. Let’s explore the key components of Greenville’s tax structure.

Property Taxes

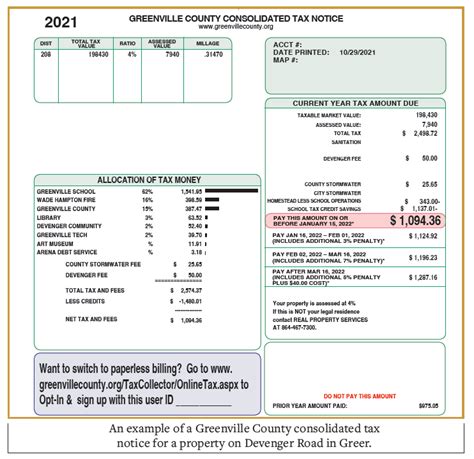

Property taxes form a significant part of Greenville’s tax revenue. These taxes are levied on both real estate and personal property owned within the city limits. The tax rate is determined by the Greenville County Assessor’s Office, which assesses the value of properties annually. Here’s a breakdown of the property tax process in Greenville:

- Assessment: Properties are assessed based on their fair market value. The assessor takes into account factors such as location, size, improvements, and recent sales of similar properties.

- Tax Rate: The tax rate is set by the local government and is applied to the assessed value of the property. The rate can vary depending on the type of property (residential, commercial, or industrial) and the specific location within Greenville.

- Payment: Property owners receive a tax bill, usually once a year, and are responsible for making timely payments. Late payments may incur penalties and interest.

It is worth noting that Greenville offers certain exemptions and tax relief programs to eligible homeowners, such as the Homestead Exemption and the Disabled Veterans Exemption. These initiatives aim to provide financial relief to specific segments of the community.

Sales and Use Taxes

Sales and use taxes are another vital source of revenue for Greenville. These taxes are imposed on the sale of goods and services within the city. The tax rate consists of a combination of state and local taxes, with the state sales tax rate currently set at 6%. Greenville County, including the city of Greenville, adds an additional 1% local sales tax, making the total sales tax rate 7% within the city limits.

Use taxes are applicable when goods or services are purchased outside of Greenville but used or consumed within the city. This tax ensures fairness and prevents tax evasion. The use tax rate mirrors the sales tax rate, ensuring consistency.

Income Taxes

Greenville, being located in South Carolina, does not impose a city-level income tax. However, residents of Greenville are subject to the state income tax, which has a graduated rate structure. The income tax rates range from 0% to 7%, depending on the taxpayer’s filing status and income level. It is essential for individuals and businesses to understand the state income tax obligations to ensure compliance.

Business Taxes

Greenville provides a welcoming environment for businesses, but like any other city, it requires businesses to fulfill their tax obligations. Here’s an overview of the key business taxes in Greenville:

- Business License Tax: All businesses operating within Greenville are required to obtain a business license. The license fee varies depending on the type of business and its annual gross receipts. This tax ensures that businesses contribute to the city’s revenue and provides a means of regulation.

- Occupation Tax: This tax is levied on businesses based on the number of employees they have within Greenville. It is a flat rate per employee and is payable annually. The occupation tax helps fund various city services and infrastructure development.

- Hospitality Tax: Greenville imposes a 2% hospitality tax on the sale of prepared food and beverages, as well as admission fees to certain entertainment venues. This tax supports the city’s tourism and hospitality industry, promoting economic growth.

Compliance and Tax Resources

Understanding and complying with tax regulations can be a daunting task. Fortunately, Greenville offers a range of resources to assist taxpayers in navigating the tax landscape. Here are some key resources to consider:

- Greenville County Tax Assessor’s Office: This office is responsible for assessing property values and providing information on property taxes. They offer resources such as tax maps, assessment data, and guidelines for appealing property tax assessments.

- Greenville County Treasurer’s Office: This office handles the collection of property taxes and provides payment options, tax statements, and information on tax relief programs.

- South Carolina Department of Revenue: The state’s revenue department offers comprehensive resources on state taxes, including income tax, sales tax, and business taxes. They provide tax forms, publications, and online tools to assist taxpayers.

- Greenville Chamber of Commerce: The local chamber of commerce can be a valuable resource for businesses, offering guidance on tax obligations, incentives, and networking opportunities.

- Tax Professionals: Engaging the services of a qualified tax professional, such as a certified public accountant (CPA) or tax attorney, can provide specialized advice and ensure compliance with Greenville’s tax laws.

Tax Incentives and Programs

Greenville recognizes the importance of encouraging economic growth and supporting businesses. As such, the city offers a range of tax incentives and programs to attract and retain businesses. Here are some notable initiatives:

- Business Incentive Grants: Greenville provides grants to businesses that meet certain criteria, such as job creation or investment in specific industries. These grants can offset business taxes and provide a financial boost to eligible businesses.

- Tax Increment Financing (TIF): TIF is a tool used by Greenville to stimulate economic development in targeted areas. It allows the city to capture the increased property tax revenue generated by new development and reinvest it in infrastructure improvements.

- Enterprise Zones: Certain areas within Greenville are designated as enterprise zones, offering tax benefits to businesses that locate or expand within these zones. These benefits can include reduced property taxes, sales tax exemptions, and job tax credits.

- Small Business Assistance: Greenville offers resources and support to small businesses, including tax workshops, mentorship programs, and access to financing options. These initiatives aim to foster entrepreneurship and help small businesses thrive.

Performance Analysis and Future Implications

Greenville’s tax system plays a crucial role in funding essential city services, infrastructure development, and economic initiatives. By analyzing the performance of the tax system, we can gain insights into its effectiveness and potential areas for improvement.

One key aspect to consider is the distribution of tax revenue across different tax sources. While property taxes form a significant portion of Greenville’s tax revenue, it is essential to ensure that the tax burden is distributed fairly among residents and businesses. Regular assessments and evaluations can help identify any imbalances and guide policy decisions.

Additionally, monitoring the economic impact of tax incentives and programs is vital. By evaluating the success of initiatives such as business grants, TIF, and enterprise zones, Greenville can make informed decisions to maximize the benefits for both the city and its residents. This data-driven approach ensures that tax policies are aligned with the city’s long-term goals and vision.

As Greenville continues to grow and evolve, the tax system must adapt to meet the changing needs of its residents and businesses. Staying informed about tax reforms, both at the state and local levels, is crucial for taxpayers. Regular updates and communications from the city and relevant tax authorities will help keep taxpayers abreast of any changes or new initiatives.

In conclusion, understanding the intricacies of Greenville SC Tax is essential for residents and businesses alike. By unraveling the tax structure, exploring compliance resources, and analyzing performance, taxpayers can navigate the tax landscape with confidence. Greenville’s tax system, with its mix of property, sales, and business taxes, plays a vital role in funding the city’s operations and promoting economic growth. By staying informed and engaged, taxpayers can contribute to the city’s prosperity while ensuring compliance with the law.

How often are property taxes assessed in Greenville?

+Property taxes in Greenville are assessed annually by the Greenville County Assessor’s Office. This assessment determines the fair market value of properties, which forms the basis for tax calculations.

Are there any tax relief programs for homeowners in Greenville?

+Yes, Greenville offers tax relief programs to eligible homeowners. The Homestead Exemption provides a reduction in property taxes for primary residences, while the Disabled Veterans Exemption offers tax relief to qualifying veterans.

How can businesses stay updated on tax obligations and incentives in Greenville?

+Businesses can stay informed by regularly checking the Greenville County website, which provides updates on tax obligations, incentives, and any changes to tax policies. Additionally, engaging with the Greenville Chamber of Commerce and tax professionals can offer valuable insights.