California Car Sales Tax Calculator

The Golden State, California, is renowned for its vibrant culture, diverse landscapes, and, of course, its love for automobiles. For those looking to purchase a new or used car in this sun-soaked state, understanding the car sales tax is crucial. This article aims to provide an in-depth guide to calculating the car sales tax in California, offering a comprehensive breakdown of the process, along with real-world examples and expert insights.

Understanding California’s Car Sales Tax

California, like many other states, imposes a sales tax on the purchase of vehicles. This tax is a percentage of the vehicle’s purchase price and is collected by the state to fund various public services and infrastructure projects. It’s an essential component of the state’s revenue stream and plays a significant role in shaping the automotive market within its borders.

The California car sales tax is a bit more complex than a straightforward percentage, as it varies based on several factors. These factors include the location of the dealership, the type of vehicle being purchased, and any applicable discounts or exemptions. Understanding these nuances is key to accurately calculating the sales tax on a vehicle purchase.

How Does the California Car Sales Tax Work?

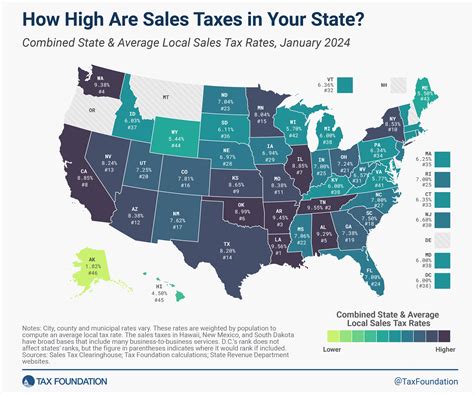

California’s car sales tax is primarily levied by the state, with additional local taxes imposed by counties and cities. These local taxes can vary significantly, adding a layer of complexity to the tax calculation. As of the latest information, the state sales tax rate for cars in California stands at 7.25%, but this is just the starting point.

On top of the state sales tax, California counties and cities can add their own sales taxes, which can range from 0% to 3%, depending on the location. For instance, in Los Angeles County, the local sales tax is 0.25%, while in San Francisco, it's 1.5%. These local taxes are then added to the state sales tax, resulting in a combined rate that can vary significantly across the state.

To illustrate this, let's consider an example. If you're buying a car in San Diego, which has a local sales tax of 0.5%, the total sales tax you'd pay would be 7.75% (state tax of 7.25% + local tax of 0.5%). On the other hand, if you were making the same purchase in Santa Monica, where the local sales tax is 1%, the total sales tax would be 8.25%.

| Location | State Sales Tax | Local Sales Tax | Total Sales Tax |

|---|---|---|---|

| San Diego | 7.25% | 0.5% | 7.75% |

| Santa Monica | 7.25% | 1% | 8.25% |

Calculating Car Sales Tax: Step by Step

Now that we understand the basics of California’s car sales tax, let’s delve into the step-by-step process of calculating it.

Step 1: Determine the Vehicle’s Purchase Price

The first step in calculating the car sales tax is to establish the purchase price of the vehicle. This is typically the price negotiated with the dealership, including any discounts or incentives offered. It’s essential to get a clear understanding of this price before proceeding.

Let's say you're eyeing a used Toyota Camry, and the dealership quotes a price of $25,000. This will be the basis for our tax calculation.

Step 2: Find the Applicable Sales Tax Rate

The next step is to identify the applicable sales tax rate for your location. As mentioned earlier, this rate consists of both the state sales tax and any local taxes. You can find this information on the California Franchise Tax Board website or by contacting your local tax authority.

For our example, let's assume you're purchasing the car in Los Angeles County, where the state sales tax is 7.25% and the local tax is 0.25%. This gives us a total sales tax rate of 7.5%.

Step 3: Calculate the Sales Tax

With the purchase price and sales tax rate in hand, calculating the sales tax is straightforward. Simply multiply the purchase price by the sales tax rate.

In our case, the sales tax calculation would be:

$25,000 x 0.075 = $1,875

So, the sales tax on our used Toyota Camry purchase in Los Angeles County would be $1,875.

Step 4: Add the Sales Tax to the Purchase Price

Finally, to determine the total cost of the vehicle, add the sales tax to the purchase price.

For our example, the total cost would be:

$25,000 + $1,875 = $26,875

So, the total cost of purchasing the used Toyota Camry in Los Angeles County, including sales tax, would be $26,875.

Exemptions and Discounts

While the standard sales tax rate applies to most vehicle purchases, there are certain exemptions and discounts that can reduce the tax burden. These can include:

- Trade-in Discounts: If you're trading in your old vehicle as part of the purchase, the value of the trade-in can reduce the taxable purchase price.

- Military Discounts: Active-duty military personnel and their families may be eligible for reduced sales tax rates.

- Vehicle Type Exemptions: Certain types of vehicles, like electric or hybrid cars, may qualify for reduced sales tax rates or exemptions.

- First-Time Buyer Programs: Some states offer programs that provide sales tax relief for first-time car buyers.

It's essential to check with your local tax authority or a tax professional to understand if you qualify for any of these exemptions or discounts.

The Impact of Car Sales Tax on the Automotive Market

The car sales tax in California, and in many other states, plays a significant role in shaping the automotive market. It influences consumer behavior, dealership strategies, and even the types of vehicles available in the market.

Consumer Perspective

For consumers, the car sales tax can be a significant factor in their purchasing decision. It adds to the overall cost of the vehicle and can influence the affordability of a particular make and model. Consumers often factor in the sales tax when comparing different vehicles and dealerships.

Dealership Strategies

Dealerships, on the other hand, have to navigate the sales tax landscape to remain competitive. They may offer incentives or negotiate on the purchase price to make up for the tax burden. Some dealerships might also highlight the tax savings associated with certain vehicle types or purchasing programs.

Market Trends

The car sales tax can also impact the types of vehicles available in the market. In states with high sales taxes, consumers might opt for more affordable models or consider alternative purchasing options, such as leasing or buying used vehicles. This can influence the sales and marketing strategies of automotive manufacturers and dealerships.

Future Implications and Trends

The car sales tax landscape is subject to change, both in California and across the nation. Here are some potential future implications and trends to consider:

Increasing Tax Rates

As state and local governments face budgetary challenges, there’s a possibility of increasing sales tax rates to generate more revenue. This could make vehicle purchases more expensive and further influence consumer behavior.

Alternative Vehicle Incentives

With the growing popularity of electric and hybrid vehicles, states may offer incentives or reduced tax rates for these environmentally friendly options. This could encourage more consumers to make the switch, reducing carbon emissions and promoting sustainability.

Online Sales and Remote Transactions

The rise of online sales and remote transactions in the automotive industry could present challenges for tax collection. States may need to adapt their tax collection methods to ensure they’re capturing revenue from these transactions.

Conclusion

Calculating the car sales tax in California requires an understanding of the state’s tax structure and local variations. By following the step-by-step process outlined in this article, consumers can accurately calculate the sales tax on their vehicle purchases. It’s essential to stay informed about any changes in tax rates and exemptions to make informed purchasing decisions.

As the automotive market continues to evolve, the role of sales tax will remain a crucial factor. Consumers, dealerships, and manufacturers will need to adapt to changing tax landscapes and market trends to remain competitive and meet the needs of car buyers.

Can I negotiate the sales tax on my car purchase?

+No, the sales tax is a mandatory fee set by the state and local governments. While you can negotiate the purchase price of the vehicle, the sales tax will remain fixed.

Are there any ways to reduce the sales tax I pay on my car purchase?

+Yes, there are potential ways to reduce the sales tax. These include trading in your old vehicle, qualifying for military discounts, or purchasing a vehicle that falls under specific exemptions, such as electric or hybrid cars.

Do I need to pay sales tax if I’m buying a car from a private seller?

+It depends on the state and local regulations. In some cases, you may need to pay a use tax if you don’t pay sales tax at the time of purchase. It’s important to check with your local tax authority to understand the specific regulations in your area.

Can I deduct car sales tax from my taxes?

+Whether you can deduct car sales tax from your taxes depends on your individual circumstances and the specific tax laws in your state. It’s advisable to consult with a tax professional to understand your eligibility for any tax deductions or credits.