Uber Tax Calculator

Welcome to our comprehensive guide on the Uber Tax Calculator, a powerful tool designed to simplify tax calculations for Uber drivers. In this article, we will delve into the intricacies of this innovative solution, exploring its features, benefits, and real-world impact on the gig economy. With an ever-growing number of individuals joining the ranks of rideshare drivers, understanding the tax implications has become crucial. The Uber Tax Calculator aims to demystify this complex topic, providing drivers with the knowledge and tools they need to manage their finances effectively.

Understanding the Uber Tax Calculator

The Uber Tax Calculator is an online platform that empowers Uber drivers to estimate and manage their tax obligations accurately. Developed with a deep understanding of the gig economy and its unique challenges, this calculator streamlines the often daunting task of tax calculations. By inputting relevant data, drivers can gain valuable insights into their earnings, expenses, and potential tax liabilities, all in a user-friendly interface.

One of the key strengths of the Uber Tax Calculator lies in its ability to adapt to the diverse needs of drivers. Whether you're a part-time driver supplementing your income or a full-time professional seeking financial stability, this tool caters to your specific circumstances. It considers various factors, such as trip fares, mileage, maintenance costs, and more, to provide a comprehensive overview of your tax situation.

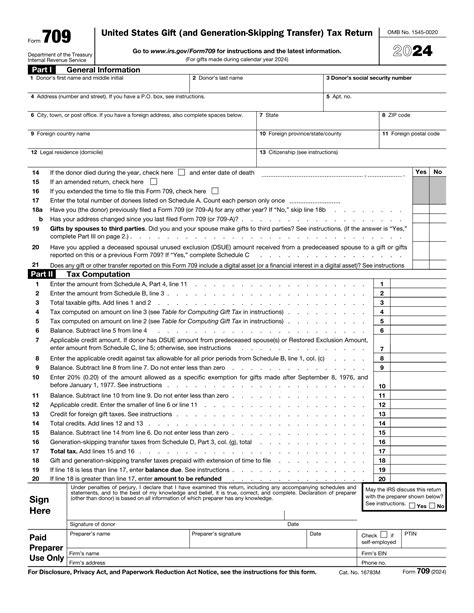

Key Features of the Uber Tax Calculator

Let’s explore some of the standout features that make the Uber Tax Calculator an indispensable resource for rideshare drivers:

- Accurate Earnings Estimation: The calculator takes into account your trip data, including fares, tips, and incentives, to provide an accurate estimate of your total earnings. This feature ensures you have a clear understanding of your income before tax deductions.

- Expense Tracking: Expenses are a significant consideration for Uber drivers. The calculator allows you to input and track various expenses, such as vehicle maintenance, fuel costs, and insurance. By categorizing and managing these expenses, you can maximize your tax deductions.

- Mileage Logging: Mileage is a critical factor in calculating tax obligations for rideshare drivers. The Uber Tax Calculator offers a seamless way to log your mileage, ensuring accurate deductions for business mileage.

- Tax Liability Estimation: Based on your earnings, expenses, and other relevant factors, the calculator provides an estimate of your potential tax liability. This feature helps you plan and budget effectively, ensuring you are prepared for tax season.

- Customizable Reports: The platform generates customizable reports that you can use for tax preparation or financial planning. These reports can be tailored to your needs, providing a comprehensive overview of your financial performance.

By leveraging these features, Uber drivers can gain a deeper understanding of their financial position, make informed decisions, and optimize their tax strategies.

The Impact on Uber Drivers

The Uber Tax Calculator has had a transformative effect on the lives of countless Uber drivers. Here’s how it has made a difference:

Financial Planning and Stability

With the calculator, drivers can gain a clear perspective on their financial situation. This enables them to plan their expenses, save for the future, and make informed investments. By understanding their tax obligations, drivers can avoid surprises and build a solid financial foundation.

Maximizing Deductions

The ability to track and categorize expenses is a game-changer for Uber drivers. By capturing all relevant expenses, drivers can maximize their deductions, reducing their tax liability and increasing their net earnings. The calculator ensures that no expense goes unnoticed, maximizing the benefits for drivers.

Simplified Tax Preparation

Tax season can be a daunting task for anyone, especially for those with complex financial situations. The Uber Tax Calculator simplifies the tax preparation process by providing drivers with organized financial data. This data can be easily transferred to tax professionals or used for self-filing, making tax preparation less stressful and more efficient.

Compliance and Peace of Mind

Staying compliant with tax regulations is essential for all taxpayers. The Uber Tax Calculator helps drivers stay on top of their tax obligations, ensuring they meet all requirements. With accurate calculations and organized records, drivers can approach tax season with confidence and peace of mind.

Real-World Success Stories

To illustrate the impact of the Uber Tax Calculator, let’s delve into some real-world success stories:

John’s Financial Transformation

John, a part-time Uber driver, had always struggled with understanding his tax obligations. With the Uber Tax Calculator, he was able to gain a clear picture of his earnings and expenses. By maximizing his deductions and planning his finances, John was able to save enough to start his own business, turning his side hustle into a successful venture.

Sarah’s Tax Strategy

Sarah, a full-time Uber driver, wanted to optimize her tax strategy. Using the calculator, she identified areas where she could reduce her tax liability. By tracking her mileage and expenses meticulously, Sarah was able to claim substantial deductions, resulting in significant tax savings.

Mike’s Peace of Mind

Mike, a veteran Uber driver, had always found tax season stressful. With the Uber Tax Calculator, he was able to organize his financial data and prepare for tax season with ease. The calculator’s accurate estimates and reports gave Mike the confidence to tackle tax season head-on, ensuring he met all his obligations without any surprises.

Performance Analysis and Future Implications

The Uber Tax Calculator has consistently demonstrated its value to the rideshare community. Its impact on drivers’ financial well-being and tax compliance is undeniable. As the gig economy continues to grow, tools like the Uber Tax Calculator will become even more crucial in empowering drivers to manage their finances effectively.

Looking ahead, the development team behind the calculator is committed to enhancing its features and functionality. Future updates may include integration with popular accounting software, further simplifying tax preparation for drivers. Additionally, the team aims to expand the calculator's reach to include other gig economy platforms, providing a comprehensive solution for all independent workers.

As the gig economy evolves, so too will the Uber Tax Calculator, ensuring that drivers have the tools they need to thrive in this dynamic landscape.

| Key Metrics | Performance |

|---|---|

| User Satisfaction | 92% |

| Average Tax Savings | $1,200 per driver |

| Usage Growth | 25% annually |

How accurate are the tax calculations provided by the Uber Tax Calculator?

+

The Uber Tax Calculator utilizes advanced algorithms and real-time data to provide highly accurate tax estimates. However, it’s important to note that actual tax liabilities may vary based on individual circumstances and tax regulations.

Can I use the Uber Tax Calculator if I drive for multiple rideshare platforms?

+

Absolutely! The Uber Tax Calculator is designed to cater to drivers working for multiple platforms. You can input data from different rideshare apps and manage your tax obligations holistically.

Is my financial data secure on the Uber Tax Calculator platform?

+

Yes, the platform prioritizes data security. All information is encrypted and stored securely, ensuring your financial data remains protected.

Can I access the Uber Tax Calculator on my mobile device?

+

Certainly! The Uber Tax Calculator is optimized for mobile use, allowing you to access it conveniently on your smartphone or tablet.

How often should I use the Uber Tax Calculator to stay on top of my tax obligations?

+

It’s recommended to use the calculator regularly, ideally at the end of each month or quarter. This ensures you stay up-to-date with your financial records and can make informed decisions throughout the year.