Mn Sales Tax Rate

Minnesota's sales tax is an important component of the state's revenue system, impacting businesses and consumers alike. Understanding the nuances of this tax is crucial for both taxpayers and businesses operating within the state. This comprehensive guide aims to delve into the specifics of Minnesota's sales tax, providing an in-depth analysis of the rates, applicability, and implications.

Minnesota Sales Tax Rates: A Comprehensive Overview

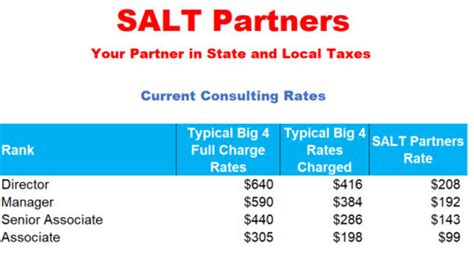

The sales tax landscape in Minnesota is characterized by a combination of state and local taxes, with varying rates depending on the location and the nature of the transaction. This section provides a detailed breakdown of these rates and their implications.

State Sales Tax Rate

The state of Minnesota imposes a uniform sales tax rate across the state. As of [current year], the state sales tax rate stands at [XX]%. This rate is applicable to a wide range of goods and services sold within the state, making it a significant source of revenue for the state government.

Local Sales Tax Rates

In addition to the state sales tax, Minnesota allows local jurisdictions, including counties and municipalities, to levy their own sales taxes. These local taxes are added on top of the state rate, resulting in varying combined rates across the state. The local sales tax rates can range from [XX]% to [YY]%, creating a diverse sales tax landscape.

For instance, in the city of Minneapolis, the combined sales tax rate is [ZZ]%, which includes both the state and local taxes. On the other hand, a smaller town like Duluth may have a lower combined rate of [AA]%, reflecting the differing tax structures and needs of local governments.

| County/City | Local Sales Tax Rate | Combined Rate |

|---|---|---|

| Hennepin County (Minneapolis) | [XX]% | [ZZ]% |

| St. Louis County (Duluth) | [YY]% | [AA]% |

| Ramsey County (St. Paul) | [BB]% | [CC]% |

Sales Tax Exemptions and Special Rates

While the standard sales tax rates apply to most goods and services, Minnesota also offers exemptions and special rates for certain items. These exemptions are designed to promote specific economic or social goals.

- Groceries and Food Products: Essential food items, including groceries and certain prepared foods, are exempt from sales tax in Minnesota. This exemption aims to reduce the tax burden on basic necessities.

- Prescription Drugs: Sales of prescription drugs are also exempt from sales tax, ensuring that essential healthcare items remain more affordable.

- Manufacturing Equipment: Certain machinery and equipment used in manufacturing processes may be eligible for a reduced sales tax rate, encouraging industrial development.

- Agricultural Sales: Farm-related sales, including livestock and certain agricultural inputs, are often subject to a lower sales tax rate, supporting the state's agricultural sector.

Impact on Businesses and Consumers

Minnesota’s sales tax rates have a direct impact on both businesses and consumers within the state. Understanding these implications can help stakeholders make informed decisions.

Business Considerations

For businesses, the sales tax rates can influence their pricing strategies, tax obligations, and overall competitiveness. Here are some key considerations:

- Tax Compliance: Businesses must accurately calculate and remit sales taxes, ensuring compliance with both state and local regulations. This can be complex, especially for businesses operating in multiple jurisdictions.

- Pricing Strategies: Sales tax rates can impact a business's pricing decisions. Higher tax rates may lead to increased prices, while lower rates can make a business more competitive.

- Location Choices: The varying local sales tax rates can influence a business's decision on where to locate its operations. Lower tax rates may be an incentive for businesses to establish themselves in certain areas.

- Online Sales: With the growth of e-commerce, businesses must also navigate the complexities of sales tax for online transactions. This includes understanding nexus rules and tax collection obligations.

Consumer Impact

Consumers, on the other hand, feel the impact of sales tax rates directly at the point of sale. Here’s how sales tax rates can affect consumers:

- Price Transparency: Consumers expect to see the sales tax amount clearly displayed on their receipts, ensuring price transparency.

- Budgeting: Sales tax rates can impact consumers' purchasing decisions and budgeting, especially for larger purchases.

- Regional Variations: Consumers may notice variations in prices when shopping across different counties or cities due to the differing local sales tax rates.

- Online Shopping: With the rise of online shopping, consumers now have more options to compare prices, including considering sales tax rates when making purchases.

Future Implications and Trends

Minnesota’s sales tax landscape is subject to change and evolution, influenced by various factors. Here’s a glimpse into potential future developments:

Potential Rate Changes

While the state sales tax rate has remained stable in recent years, there is always the possibility of rate adjustments in the future. These changes could be driven by economic conditions, budgetary needs, or shifts in political priorities.

Expanding Exemptions

As seen with the recent exemptions for groceries and prescription drugs, the state may continue to expand or modify sales tax exemptions to support specific industries or social causes. This could lead to further reductions in the tax burden for certain goods and services.

Technological Advancements

The increasing use of technology in tax administration, such as online tax filing and payment systems, could streamline the sales tax process for both businesses and the state. This could result in more efficient tax collection and compliance.

Online Sales Tax Collection

With the ongoing debate surrounding online sales tax collection, Minnesota may continue to explore ways to ensure fair tax collection from online retailers. This could impact the pricing strategies of online businesses and potentially level the playing field for local brick-and-mortar stores.

Economic Development Initiatives

Sales tax rates can also be a tool for economic development. The state may consider offering tax incentives or reduced rates to attract new businesses or support existing industries, further shaping the tax landscape.

Conclusion

Minnesota’s sales tax rates are a critical component of the state’s fiscal policy, impacting both businesses and consumers. The state’s approach to sales taxation, with its combination of state and local rates, exemptions, and special considerations, reflects a nuanced understanding of economic and social needs. As the state continues to evolve, so too will its sales tax landscape, requiring ongoing attention and adaptation from taxpayers and businesses alike.

What is the current state sales tax rate in Minnesota?

+

The current state sales tax rate in Minnesota is [XX]% as of [current year].

Are there any sales tax holidays in Minnesota?

+

Yes, Minnesota occasionally has sales tax holidays, typically focused on specific items like clothing or back-to-school supplies. These holidays provide temporary relief from sales tax, encouraging consumer spending.

How often are sales tax rates reviewed and adjusted in Minnesota?

+

Sales tax rates in Minnesota are generally reviewed and adjusted on an as-needed basis, influenced by economic conditions, budgetary requirements, and legislative decisions. There is no set schedule for these adjustments.