Tax Free Savings Account

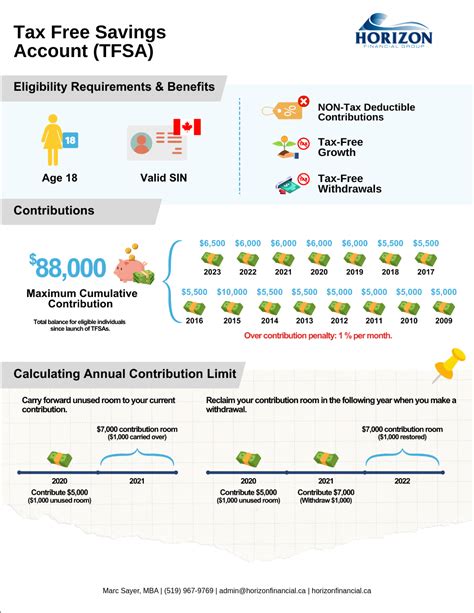

In the realm of personal finance, one of the most powerful tools at your disposal is the Tax-Free Savings Account (TFSA). This financial instrument, unique to Canada, offers a myriad of benefits that can significantly impact your financial well-being and long-term goals. With a TFSA, you can save and invest money without worrying about paying taxes on the growth or earnings, making it an attractive option for individuals seeking to maximize their savings and investments.

Unveiling the TFSA: A Comprehensive Guide

The Tax-Free Savings Account, introduced in Canada in 2009, has revolutionized the way Canadians approach their savings and investments. This flexible savings vehicle allows you to contribute up to a specified annual limit, which, as of 2024, stands at $7,500. The beauty of a TFSA lies in its tax-free nature, meaning any income earned within the account, whether from interest, dividends, or capital gains, remains free from taxation.

Key Benefits of a TFSA

One of the primary advantages of a TFSA is its versatility. You can use it for various financial goals, from short-term savings for emergencies or vacations to long-term investments for retirement or major purchases. Moreover, the TFSA is ideal for individuals who wish to grow their wealth tax-free, especially those in higher tax brackets or with substantial investment returns.

TFSA accounts offer the flexibility to hold a wide range of investments, including:

- Cash deposits

- Guaranteed Investment Certificates (GICs)

- Mutual funds

- Stocks and bonds

- Exchange-Traded Funds (ETFs)

- Real estate investment trusts (REITs)

This variety ensures that investors can tailor their TFSA portfolios to their risk tolerance and investment strategies.

| TFSA Contribution Limit | 2024 |

|---|---|

| Annual Contribution | $7,500 |

Who Can Benefit from a TFSA?

The TFSA is an excellent tool for individuals across various life stages and financial situations. Young adults can start saving early, reaping the benefits of compound growth over time. Middle-aged individuals can use it to supplement their retirement savings, especially if they’ve maxed out their Registered Retirement Savings Plan (RRSP) contributions. Even retirees can benefit, as TFSA withdrawals don’t impact government benefits like Old Age Security (OAS) or the Guaranteed Income Supplement (GIS).

Maximizing Your TFSA

To make the most of your TFSA, consider these strategies:

- Start Early: The power of compound growth is maximized when you start saving early. Even small contributions can grow significantly over time.

- Maximize Contributions: Aim to contribute the annual limit each year. If you can afford it, consider catching up on previous years' unused contribution room.

- Diversify Your Investments: A well-diversified portfolio can help manage risk and potentially increase returns. Consider a mix of stocks, bonds, and other investments to align with your risk tolerance and financial goals.

- Reinvest Returns: Take advantage of the tax-free nature of the TFSA by reinvesting any earnings or dividends. This strategy can help your wealth grow faster.

TFSA vs. RRSP: Which is Better?

Both the TFSA and the Registered Retirement Savings Plan (RRSP) are powerful savings vehicles, but they serve different purposes. The RRSP is ideal for retirement savings, offering immediate tax benefits but potentially subjecting withdrawals to taxation. In contrast, the TFSA focuses on tax-free growth, making it suitable for both short-term and long-term savings goals.

When deciding between the two, consider your financial situation and goals. If you're in a high tax bracket and expect your income to decrease in retirement, the RRSP may be more advantageous. However, if you're seeking flexibility and tax-free growth, the TFSA is an excellent choice.

Potential Challenges and Considerations

While the TFSA is a powerful tool, there are some considerations to keep in mind. One potential challenge is the annual contribution limit, which may restrict the amount you can save tax-free each year. Additionally, if you withdraw funds from your TFSA, you may face a penalty if you contribute more than your allowable limit. It’s essential to understand the rules and guidelines to avoid any penalties.

Another consideration is the impact of inflation. While the TFSA offers tax-free growth, it's important to ensure that your investments keep pace with inflation to maintain the real value of your savings.

The Future of Tax-Free Savings

The TFSA has become an integral part of Canadians’ financial planning, offering a flexible and tax-efficient way to save and invest. As the financial landscape evolves, we can expect further enhancements and potential changes to the TFSA framework. One potential development could be an increase in the annual contribution limit to keep pace with inflation and changing financial needs.

Additionally, with the growing popularity of online investing and robo-advisors, we may see more platforms offering seamless TFSA integration, making it easier for individuals to manage and optimize their tax-free savings.

Conclusion

The Tax-Free Savings Account is a powerful financial instrument that can significantly impact your financial future. By understanding its benefits, contribution limits, and investment options, you can make informed decisions to maximize your savings potential. Whether you’re a young saver or nearing retirement, the TFSA offers a flexible and tax-efficient way to achieve your financial goals.

Can I have more than one TFSA?

+Yes, you can have multiple TFSAs, but the total contributions across all your TFSAs cannot exceed your available contribution room. Each TFSA is a separate account with its own contribution limit.

What happens if I withdraw money from my TFSA?

+When you withdraw money from your TFSA, the amount withdrawn is added back to your contribution room in the following year. For example, if you withdraw 5,000 in 2024, you'll have an additional 5,000 of contribution room in 2025.

Can I contribute to both a TFSA and an RRSP in the same year?

+Absolutely! You can contribute to both a TFSA and an RRSP simultaneously. Each savings vehicle has its own contribution limits and benefits, so it’s advantageous to maximize contributions to both if possible.