Sales And Use Tax Florida

Sales and Use Tax (SUT) is an integral part of the revenue system in the United States, and Florida, being one of the most populous and economically significant states, plays a crucial role in this fiscal landscape. This article aims to delve deep into the intricacies of Sales and Use Tax in Florida, exploring its definition, purpose, rates, collection methods, exemptions, and impact on businesses and consumers. By understanding these aspects, we can gain valuable insights into the economic dynamics of the Sunshine State.

Unraveling Sales and Use Tax in Florida

Sales and Use Tax, often referred to as SUT, is a consumption tax levied on the sale or use of goods and services within a state. It is a critical component of state revenue generation, with Florida, like many other states, relying heavily on this tax to fund essential services and infrastructure. The SUT system in Florida is designed to ensure fairness, transparency, and efficiency in tax collection, which is vital for the state's economic health.

Understanding the Basics of Sales and Use Tax

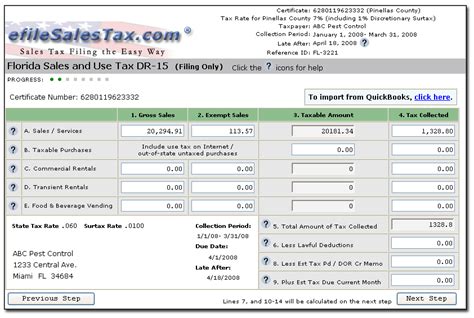

At its core, Sales and Use Tax is a percentage-based tax applied to the sale price of most tangible personal property and some services. The tax is typically paid by the buyer and collected by the seller, who then remits it to the state government. The use tax, on the other hand, is levied on items purchased from out-of-state vendors and used within Florida. This ensures that all purchases made by Florida residents, regardless of where they are bought, are subject to tax.

Florida's SUT system is governed by the Florida Department of Revenue, which sets the tax rates, defines the tax base, and establishes rules for tax collection and administration. The department ensures compliance through a network of tax auditors and offers a range of resources to help businesses and individuals understand their tax obligations.

| Tax Type | Rate | Description |

|---|---|---|

| Sales Tax | 6.0% | Applied to most tangible personal property sales. |

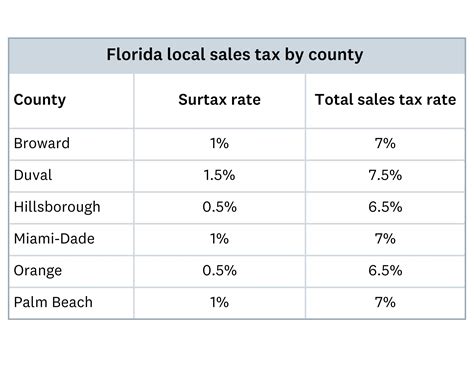

| Discretionary Sales Surcharge | 1.5% | A county-level tax that can be imposed by local governments. |

| Use Tax | Matches the sales tax rate | Levied on purchases made outside Florida and used within the state. |

The above table provides a snapshot of the current tax rates in Florida. However, it's important to note that these rates can vary depending on the specific county or municipality where the transaction occurs. For instance, the discretionary sales surcharge is a local option tax that can be imposed by county governments, resulting in a higher overall tax rate in certain areas.

Exemptions and Special Considerations

While Sales and Use Tax applies to a wide range of goods and services, there are certain exemptions and special considerations in Florida's tax code. These exemptions are designed to encourage certain economic activities, promote social welfare, or support specific industries.

- Food and Drugs: Many groceries and over-the-counter medications are exempt from sales tax in Florida.

- Manufacturing: Sales of manufacturing equipment and machinery are exempt, as are certain raw materials used in manufacturing.

- Agricultural Sales: Many agricultural products, such as livestock, seeds, and feed, are exempt from sales tax.

- Educational Resources: Sales of textbooks and other educational materials are often exempt.

- Medical Devices: Certain medical devices and equipment are exempt from sales tax.

These exemptions can significantly impact the tax obligations of businesses and consumers in Florida. For instance, a farmer purchasing feed for their livestock or a teacher buying textbooks for their classroom would not be subject to sales tax on these items.

The Impact on Businesses and Consumers

Sales and Use Tax has a profound impact on both businesses and consumers in Florida. For businesses, particularly those in the retail sector, the tax adds to their operational costs and complexity. They must collect the tax from customers, maintain accurate records, and remit the tax to the state regularly. Non-compliance can result in significant penalties and legal consequences.

For consumers, the SUT is a visible cost added to their purchases. While it may not be a significant burden for smaller, everyday items, it can add up quickly for larger purchases like vehicles, appliances, or electronics. However, the tax also ensures that essential state services, such as education, healthcare, and infrastructure development, are funded adequately.

Future Implications and Potential Changes

The landscape of Sales and Use Tax in Florida, like in many other states, is constantly evolving. As the economy changes and new technologies emerge, the tax system must adapt to ensure it remains effective and fair. One significant trend is the increasing complexity of tax collection and administration due to the growth of e-commerce and online sales.

With the rise of online shopping, Florida, like other states, is facing challenges in collecting sales tax from out-of-state sellers. This has led to calls for federal legislation to simplify the process and ensure fair tax collection from online retailers. Additionally, the state is exploring ways to streamline tax collection and compliance for businesses, particularly small and medium-sized enterprises, to reduce administrative burdens.

Looking ahead, Florida may also consider adjustments to its tax rates or exemptions to align with changing economic realities and revenue needs. For instance, the state could explore tax incentives to encourage investment in certain industries or regions, or it might consider expanding exemptions to promote social welfare or environmental initiatives.

What is the difference between sales tax and use tax in Florida?

+Sales tax is levied on tangible personal property and certain services sold within Florida, while use tax is applied to items purchased from out-of-state vendors and used within the state. This ensures that all purchases made by Florida residents are subject to tax, regardless of where they are bought.

How does Florida’s Sales and Use Tax affect businesses?

+Businesses in Florida must collect sales tax from customers, maintain tax records, and remit the tax to the state. This adds to their operational costs and complexity. However, the state also offers various resources and incentives to support businesses in complying with tax obligations.

Are there any sales tax holidays in Florida?

+Yes, Florida has designated sales tax holidays during which certain items are exempt from sales tax. These holidays typically occur around back-to-school and disaster preparedness periods, encouraging consumers to make tax-free purchases of specific items like school supplies and emergency preparedness goods.