Is 529 Tax Deductible

In the world of education savings plans, the 529 plan has become a popular choice for many parents and investors looking to secure their children's future educational expenses. But one common question that arises is whether contributions to a 529 plan are tax deductible. This article aims to provide a comprehensive understanding of the tax implications of 529 plans, offering insights into their benefits and potential drawbacks.

Understanding 529 Plans and Tax Deductibility

A 529 plan, officially known as a “qualified tuition plan,” is a tax-advantaged savings plan designed to help families save for future qualified higher education expenses. These plans are sponsored by states, state agencies, or educational institutions and are regulated by the Internal Revenue Code (IRC) Section 529, hence the name.

When it comes to tax deductibility, the answer is not as straightforward as one might hope. While 529 plans offer significant tax benefits, the deductibility of contributions largely depends on the state in which the plan is established and the specific tax rules of that state.

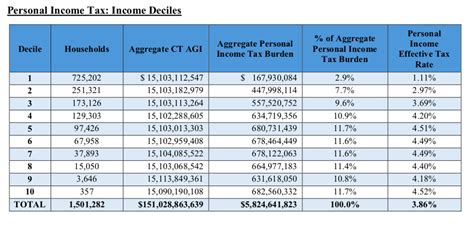

State-Specific Tax Deductions

Many states offer tax incentives for contributions to 529 plans, including tax deductions or tax credits. For instance, in states like Arizona, California, and Pennsylvania, residents can deduct contributions made to their state’s 529 plan from their state income taxes.

| State | Tax Benefit |

|---|---|

| Arizona | Up to $2,000 tax deduction for contributions to Arizona's 529 plan |

| California | California offers a tax credit of up to $3,000 for contributions to its 529 plan |

| Pennsylvania | Pennsylvania residents can deduct up to $14,000 in contributions per beneficiary |

However, it's important to note that not all states offer tax deductions for 529 plan contributions. In states like Florida and Texas, for example, there are no state tax deductions available.

Federal Tax Treatment

At the federal level, contributions to a 529 plan are not tax deductible on your federal income tax return. However, the earnings within the plan grow tax-free, and withdrawals used for qualified higher education expenses are also tax-free at the federal level.

Qualified higher education expenses include tuition, fees, books, supplies, and equipment required for enrollment or attendance at an eligible educational institution. This can cover a wide range of educational institutions, from traditional colleges and universities to vocational schools and even some foreign institutions.

Potential Drawbacks

While 529 plans offer significant tax advantages, there are a few potential drawbacks to consider. One key consideration is the impact on financial aid eligibility. The Free Application for Federal Student Aid (FAFSA) considers 529 plan assets as part of the expected family contribution, which could reduce the amount of financial aid a student is eligible for.

Another potential drawback is the limited investment options. 529 plans typically offer a range of pre-set investment portfolios, and while some plans offer a self-directed brokerage option, the investment choices are often more limited compared to other investment vehicles.

Maximizing Tax Benefits with 529 Plans

Despite the potential drawbacks, 529 plans can be an excellent tool for saving for higher education expenses, especially when combined with other tax-advantaged strategies.

Strategies for Maximizing Tax Benefits

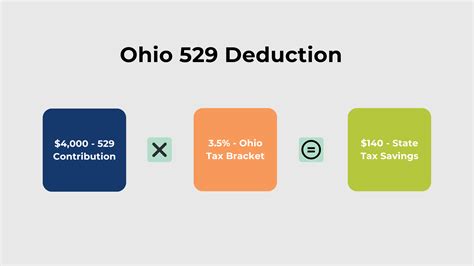

One effective strategy is to take advantage of state tax deductions, if available. By contributing to your state’s 529 plan and claiming the tax deduction, you can reduce your state income tax liability while also saving for education expenses.

Additionally, considering the gift tax exclusion can be beneficial. The IRS allows individuals to gift up to $16,000 per beneficiary per year without triggering the gift tax. This means that you can contribute up to $16,000 to a 529 plan for each beneficiary without incurring any gift tax liability.

Choosing the Right 529 Plan

When selecting a 529 plan, it’s essential to consider not just the tax benefits but also the investment options, fees, and the flexibility of the plan. Some plans offer more investment choices, while others may have lower fees or more flexible withdrawal options.

Researching and comparing different 529 plans, both within your state and in other states, can help you find the plan that best suits your needs and investment goals. It's also advisable to consult with a financial advisor who can provide personalized guidance based on your financial situation and goals.

Future Outlook and Implications

The tax landscape for 529 plans is subject to change, and it’s essential to stay informed about any updates or new developments. Recent changes, such as the expansion of qualified expenses to include K-12 tuition and student loan repayments, have broadened the appeal of 529 plans.

Looking ahead, it's possible that states may continue to offer or expand tax incentives for 529 plan contributions to encourage savings for higher education. Additionally, with the increasing cost of education, the tax-free growth and withdrawals offered by 529 plans are likely to remain a valuable tool for families planning for their children's educational future.

Conclusion

While the tax deductibility of 529 plan contributions varies by state, the tax benefits at the federal level make these plans an attractive option for saving for higher education expenses. By understanding the tax implications and maximizing the available tax benefits, investors can make the most of their 529 plan contributions.

Whether you're a parent planning for your child's future or an investor looking to help a loved one with their educational expenses, a 529 plan can be a valuable addition to your financial strategy. With careful planning and an understanding of the tax rules, you can take advantage of these tax-advantaged plans to secure a brighter future for your beneficiaries.

Can I deduct 529 plan contributions on my federal income tax return?

+No, contributions to a 529 plan are not deductible on your federal income tax return. However, the earnings within the plan grow tax-free, and qualified withdrawals are also tax-free at the federal level.

Are there any state tax deductions available for 529 plan contributions?

+Yes, some states offer tax deductions or credits for contributions to their state’s 529 plan. It’s important to research the specific tax benefits offered by your state’s plan.

What are the potential drawbacks of 529 plans?

+Potential drawbacks include the impact on financial aid eligibility and the limited investment options. It’s important to consider these factors when deciding whether a 529 plan is the right choice for your situation.

How can I maximize the tax benefits of a 529 plan?

+You can maximize tax benefits by taking advantage of state tax deductions (if available), considering the gift tax exclusion, and choosing a 529 plan with favorable investment options and fees.