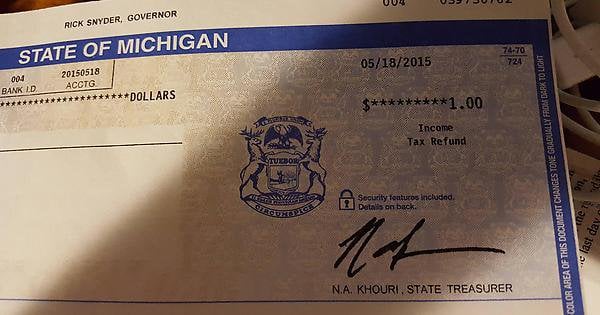

State Michigan Tax Refund

For residents of the state of Michigan, understanding the tax refund process is crucial. This comprehensive guide aims to provide an in-depth analysis of the Michigan tax refund system, covering its intricacies, benefits, and impact on taxpayers. We will explore the various aspects of tax refunds, including eligibility, calculation methods, and the overall economic implications for the state.

Unraveling the Michigan Tax Refund System

The Michigan Department of Treasury is responsible for administering tax refunds to eligible residents. This process is an integral part of the state's tax system, providing a significant boost to the economy and financial stability of many individuals and families.

One of the key features of the Michigan tax refund system is its focus on fairness and transparency. The state employs a progressive tax structure, ensuring that higher-income earners contribute a larger proportion of their income towards state revenues. This approach aims to maintain a balanced distribution of tax burden, which, in turn, influences the amount of refunds issued.

Eligibility and Qualifying Factors

To be eligible for a Michigan tax refund, taxpayers must meet certain criteria. These criteria are designed to ensure that refunds are provided to those who are most in need or have overpaid their taxes.

- Taxpayers must have filed their state income tax returns accurately and on time.

- Individuals must have a valid Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) for themselves and any dependents claimed.

- Eligibility is often based on income levels. For instance, the Michigan Homestead Property Tax Credit is available to homeowners and renters who meet specific income thresholds.

- Certain credits and deductions can also influence eligibility. For example, the Michigan Earned Income Tax Credit (EITC) provides a refund to low- and moderate-income working individuals and families, helping to offset the burden of state and local taxes.

Tax Refund Calculation Methods

The calculation of tax refunds in Michigan involves a combination of federal and state tax laws. Here's a simplified breakdown of the process:

- Income Determination: The first step is to determine the taxpayer's total income for the year. This includes wages, salaries, business income, investments, and other sources.

- Taxable Income Calculation: Next, allowable deductions and credits are applied to reduce the total income, resulting in taxable income. Michigan offers various deductions and credits, such as the standard deduction, itemized deductions, and personal exemptions.

- Tax Liability Computation: Using the taxable income, the taxpayer's tax liability is calculated based on Michigan's tax rates and brackets. The state's tax rates vary depending on income levels, with higher incomes facing higher tax rates.

- Tax Withheld or Paid: The taxpayer's tax liability is then compared to the amount of tax they have already paid or had withheld from their wages. If the withheld amount exceeds the liability, a refund is due.

- Refund Amount: The refund amount is the difference between the total tax withheld and the actual tax liability. This amount is then processed and issued to the taxpayer by the Department of Treasury.

It's important to note that Michigan, like many other states, also offers tax credits and incentives to encourage specific behaviors or support certain industries. These credits can further impact the amount of a taxpayer's refund.

| Credit | Description |

|---|---|

| Homestead Property Tax Credit | Available to homeowners and renters, this credit helps offset property taxes and is based on income and property value. |

| Michigan Earned Income Tax Credit (EITC) | A refundable tax credit for low- to moderate-income working individuals and families, designed to reduce the burden of state and local taxes. |

| Retirement Savings Tax Credit | Encourages individuals to save for retirement by providing a credit for contributions made to certain retirement plans. |

The Economic Impact of Michigan Tax Refunds

The distribution of tax refunds has a significant impact on Michigan's economy. These refunds contribute to increased consumer spending, which, in turn, stimulates economic growth and job creation.

When taxpayers receive their refunds, they often use this money to pay off debts, purchase goods and services, or invest in their future. This injection of funds into the economy has a ripple effect, benefiting businesses, employers, and the state as a whole.

Stimulating Consumer Spending

Tax refunds provide a boost to consumer spending power. According to a study by the Michigan League for Public Policy, tax refunds are often used for essential needs such as catching up on rent or mortgage payments, paying off credit card debt, or purchasing necessary items for the home.

This increased spending has a direct impact on businesses, particularly those in retail, hospitality, and entertainment sectors. It can lead to increased sales, which in turn can result in more job opportunities and a stronger local economy.

Financial Stability and Planning

For many Michigan residents, tax refunds are a crucial part of their annual financial planning. These refunds can provide a much-needed buffer for unexpected expenses or help individuals save for long-term goals.

Moreover, the anticipation of a tax refund can also influence consumer behavior throughout the year. Some individuals may adjust their spending habits, aiming to maximize their potential refund. This behavior can further drive economic activity, especially in the lead-up to tax season.

Conclusion: Navigating the Michigan Tax Refund Landscape

Understanding the Michigan tax refund system is essential for residents to make the most of their financial situation. By being aware of eligibility criteria, calculation methods, and the potential impact of tax credits, taxpayers can optimize their refund and contribute to the state's economy.

As we've explored, Michigan's tax refund system is designed to be fair, transparent, and economically stimulating. It provides financial relief to eligible taxpayers while also encouraging behaviors that benefit the state as a whole. For those navigating the complexities of taxes, this guide serves as a comprehensive resource to help make sense of the process.

Frequently Asked Questions

When will I receive my Michigan tax refund?

+The timing of tax refunds can vary. Generally, if you file your return electronically and choose direct deposit, you can expect your refund within 21 days. However, it can take up to 8 weeks if you file a paper return or opt for a check. Factors like the complexity of your return or potential errors can also delay the process.

How can I check the status of my Michigan tax refund?

+You can check the status of your refund by visiting the Michigan Department of Treasury’s website. They offer an online tool where you can input your information to track your refund’s progress. Alternatively, you can call their refund hotline for updates.

What if I haven’t received my Michigan tax refund within the estimated timeframe?

+If your refund is taking longer than expected, it’s important to check for any errors or missing information on your tax return. You can also contact the Michigan Department of Treasury for assistance. They can provide guidance and help resolve any issues delaying your refund.

Can I claim the Michigan Earned Income Tax Credit (EITC) if I didn’t work full-time?

+Yes, the Michigan EITC is available to both full-time and part-time workers. As long as you meet the income requirements and have earned income from employment or self-employment, you may be eligible for this credit.

Are there any tax preparation services or software that can help me maximize my Michigan tax refund?

+There are several reputable tax preparation services and software options available that can guide you through the process and help you identify any potential deductions or credits you may be eligible for. These tools can ensure you receive the maximum refund possible while also reducing the risk of errors.