How to Overcome Common Challenges in Finding Tax Accountant Jobs

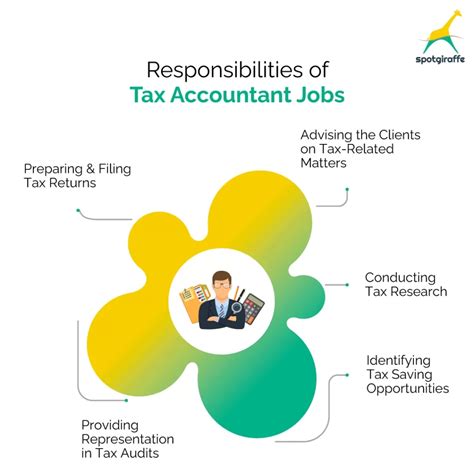

Securing a position as a tax accountant can be a rewarding career move, offering stability and the opportunity to work within a vital financial sector. However, candidates often encounter a spectrum of challenges—from stiff competition and fluctuating market demands to credentialing hurdles and skill gaps. Understanding the multifaceted landscape of job searching within this specialized field necessitates a balanced exploration of the obstacles and the potential pathways to overcome them. This article critically evaluates the common difficulties faced by aspiring tax accountants, examines differing strategies for success, and ultimately presents an informed synthesis grounded in industry standards and professional insights.

Understanding the Landscape of Tax Accountant Job Opportunities

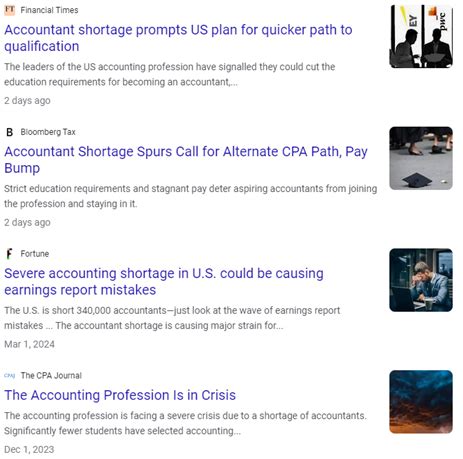

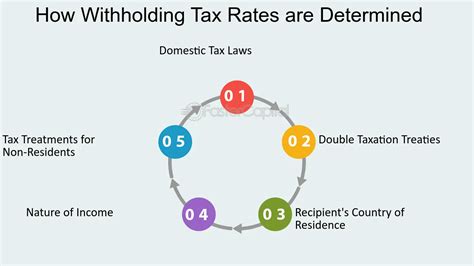

The journey to landing an ideal tax accountant role involves navigating a competitive and evolving employment market. The rise of automation, regulatory shifts, and technological advancements—such as cloud-based accounting platforms—have transformed traditional hiring practices. In this context, the quest for relevant roles often becomes a complex interplay between prerequisite qualifications, practical experience, and the capacity to adapt to industry changes. It is important to recognize that while demand for tax professionals remains high due to complex compliance requirements, the supply of qualified candidates has increased, intensifying competition. This dynamic calls for strategic approaches tailored to both the current market conditions and personal career objectives.

Challenges in Credentialing and Skill Development

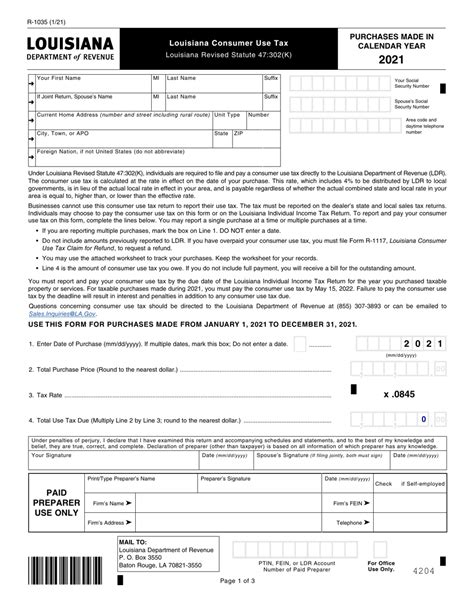

One of the prominent barriers encountered by job seekers is the necessity for formal credentials, typically the Certified Public Accountant (CPA) designation or equivalent. According to the American Institute of CPAs, the CPA credential significantly elevates employability, accounting for over 70% of tax-related positions that specify certification requirements. Achieving this credential involves passing a rigorous examination, fulfilling specific educational requirements, and gaining relevant experience—often a considerable investment in time, effort, and finances.

Beyond credentialing, the rapid advancement of technology necessitates proficiency in specialized software like QuickBooks, ProSeries, or advanced Excel functions. Candidates often report that a lack of technical skills or familiarity with emerging tools hampers their job applications. Industry reports indicate that up to 65% of hiring managers prioritize candidates who demonstrate not only technical expertise but also adaptability to new digital workflows and data analytics. Therefore, continuous learning and certification in the latest accounting methodologies are crucial for overcoming these skill gaps.

| Relevant Category | Substantive Data |

|---|---|

| Certification Rate | Over 70% of tax roles require or prefer CPA certification (source: AICPA) |

| Technology Skills | 65% of hiring managers prioritize familiarity with accounting software and data analytics tools (source: Journal of Accountancy) |

| Time to Qualification | Average CPA certification process takes approximately 18-24 months, including study and examination |

Networking and Experience: Critical Yet Overlooked Barriers

While credentials and technical skills form the foundation of a successful application, networking often plays an outsized role in uncovering hidden opportunities. Many entry-level or mid-career professionals struggle with establishing meaningful industry connections due to limited access to professional events or mentorship networks. According to a 2022 survey by the National Association of Tax Professionals (NATP), about 58% of job placements for tax accountants are influenced significantly by referrals or internal recommendations.

Furthermore, experience remains a key differentiator. Entry-level candidates frequently find themselves in a catch-22 where they need experience to gain experience—all while being unable to secure their first role. Contract positions, internships, or volunteering in pro bono tax work can bridge this gap, yet these opportunities are often scarce or not adequately promoted.

Industry-specific platforms, such as LinkedIn, industry forums, and professional associations, provide pathways for relationship-building. Strategies such as participating in webinars, contributing to industry blogs, or engaging with local chapters of professional bodies can increase visibility and open doors to unadvertised roles. Evidence suggests that proactive networking can boost interview invitations by as much as 40%, emphasizing its strategic importance.

Impact of Competition and Geographic Factors

The geographic location of a candidate influences employment opportunities significantly. Urban centers with a concentration of financial institutions and corporate headquarters tend to offer a broader array of roles than rural or less-developed regions. However, with the rise of remote work, geographic barriers are gradually diminishing. Yet, this shift introduces its own challenges, such as increased competition on a national level and the need to stand out through local engagement or specialized skill sets.

Another obstacle is the saturation of recent graduates and seasoned professionals vying for similar roles. Industry data indicate that the average number of applicants per tax accountant position has risen from 45 to over 70 in the last five years, compounding the difficulty of securing interviews and job offers.

| Relevant Category | Substantive Data |

|---|---|

| Applicants per Position | Average of 70+ in 2023, up from 45 in 2018 (source: Institute of Management Accountants) |

| Remote Work Adoption | Over 60% of tax firms now offer remote options, expanding candidate pools but increasing competition (source: RemoteWork Insights) |

| Regional Job Availability | Urban areas host approximately 75% of tax roles nationwide; rural positions constitute less than 10% |

Differing Strategies to Overcome Challenges

Successfully navigating these obstacles necessitates a multifaceted approach. Some professionals advocate for aggressive credential pursuit coupled with targeted technical training, while others emphasize strategic networking and geographic flexibility. Critical evaluation reveals that no single approach guarantees success but adopting a layered strategy increases resilience.

Pursuit of Certifications and Continuing Education

Many successful candidates prioritize achieving CPA certification early in their careers, viewing it not merely as a credential but as a gateway to higher-tier roles. Additional certifications such as Enrolled Agent (EA), Certified Management Accountant (CMA), or specialization in niche areas like transfer pricing can differentiate candidates. Enrolling in online courses, attending seminars, and participating in industry certification programs facilitate continuous skill development, aligning with evolving employment standards.

Building a Strong Professional Network

Active participation in professional associations like NATP, the American Taxation Association, and local chambers introduces candidates to mentors, job leads, and industry insights. Engaging in volunteer tax preparation during tax season not only helps build experience but also enhances reputation within local professional communities. Furthermore, crafting a compelling LinkedIn profile and engaging regularly with industry content fosters visibility among recruiters and hiring managers.

Leveraging Technology and Remote Opportunities

The digitization of tax accounting workflows has made remote work increasingly viable. Candidates proficient in virtual collaboration tools and cloud-based software can access a broader spectrum of opportunities. Highlighting such skills in applications and interviews can provide a decisive advantage, especially when local market opportunities are limited. Companies are also increasingly adopting AI-driven candidate screening systems, emphasizing the importance of keyword optimization and skill-tailored resumes.

| Strategy | Impact |

|---|---|

| Certification Pathways | Enhanced job prospects, increased earning potential, industry recognition |

| Networking Efforts | Uncover hidden opportunities, gain mentorship, strengthen professional reputation |

| Technology Skills | Access to remote roles, futuristic skill profile, increased competitiveness |

Synthesis and Final Perspectives

Overcoming the common challenges in securing a tax accountant position requires navigating a nuanced landscape shaped by credential requirements, technological evolution, and competitive dynamics. While pursuing relevant certifications like the CPA or EA forms the bedrock, augmenting this with targeted technical skills and active networking creates a resilient foundation. Geographic flexibility enabled by remote work expands potential employment pools but intensifies competition, necessitating strategic differentiation through specialization or niche expertise.

The core of effective navigation lies in recognizing that no universal blueprint exists. Instead, tailored strategies that consider individual strengths, market demands, and emergent industry trends provide the best prospects. Keeping pace with technological innovations, cultivating professional relationships, and maintaining adaptability are indispensable in this competitive arena. In essence, those who embed continuous learning, strategic outreach, and technological agility into their career plans will markedly improve their chances of overcoming the hurdles standing between them and their ideal tax accountant role.