State Tax In Louisiana

Welcome to a comprehensive guide on State Tax in Louisiana, a topic of great interest to both residents and businesses operating within the Pelican State. Louisiana, with its unique cultural heritage and diverse economic landscape, offers a tax system that reflects its history and the needs of its citizens. This article will delve into the specifics of Louisiana's state tax system, exploring the various taxes imposed, their rates, and the impact they have on individuals and businesses.

Understanding Louisiana’s State Tax Landscape

Louisiana, like many other states, employs a multifaceted tax system to generate revenue for essential government services. The state collects taxes on various fronts, including income, sales, property, and more. This section provides an overview of Louisiana’s tax structure, highlighting the key taxes that contribute to the state’s revenue stream.

Income Tax: A Variable Approach

Louisiana’s income tax system is progressive, meaning that higher incomes are taxed at a higher rate. The state offers six tax brackets, with rates ranging from 2% to 6%, depending on taxable income. For the tax year 2022, these brackets were as follows:

- 0% on taxable income up to 12,500</li> <li>2% on income between 12,501 and 25,000</li> <li>4% on income between 25,001 and 50,000</li> <li>5% on income between 50,001 and 100,000</li> <li>5.25% on income between 100,001 and 250,000</li> <li>6% on income over 250,000

These rates are subject to change, so it’s essential to stay updated with the latest tax guidelines. The state also offers various deductions and credits to reduce the tax burden on residents, such as the Louisiana Earned Income Tax Credit and the Louisiana Taxpayer Refund.

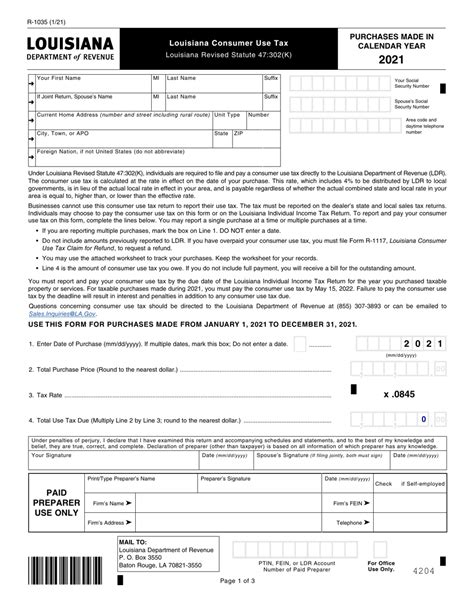

Sales and Use Tax: A Complex Web

Louisiana’s sales and use tax system is a significant revenue generator for the state. The state imposes a general sales tax rate of 4.45%, which is applicable to most retail sales. However, this rate can vary across parishes, with some parishes imposing additional local sales taxes. For instance, the city of New Orleans has a 5% sales tax rate, bringing the total sales tax to 9.45% within the city limits.

The state’s sales tax also extends to various services, including telecommunications, lodging, and rental car services. The specific rates for these services can differ, with some being taxed at the standard rate while others may be subject to a higher or lower rate.

In addition to the state and local sales taxes, Louisiana also imposes a use tax on out-of-state purchases that are brought into the state for use. This tax is designed to ensure that all purchases are taxed, regardless of where they are made.

Property Tax: Assessing Real Estate

Property taxes in Louisiana are primarily levied by local governments, including parishes, cities, and school boards. The state does not impose a statewide property tax. Instead, each parish sets its own tax rates, resulting in a wide variation across the state.

The assessment of property value for tax purposes is a critical aspect of the system. The Louisiana Tax Commission sets the guidelines for property assessment, ensuring uniformity across the state. However, the actual assessment is conducted by local assessors, who determine the taxable value of properties within their jurisdictions.

Louisiana offers various property tax exemptions and credits to eligible homeowners, including homestead exemptions and disability exemptions. These incentives aim to reduce the tax burden on homeowners and encourage homeownership.

Impact of State Taxes on Residents and Businesses

Louisiana’s state tax system has a significant influence on the financial well-being of its residents and the economic climate for businesses.

Tax Burden on Individuals

The progressive income tax structure ensures that higher-income earners contribute a larger share of their income to state revenues. This can lead to a heavier tax burden for those in higher tax brackets. However, the availability of deductions and credits can help mitigate this burden for some residents.

The sales and use tax system impacts residents through the tax on daily purchases. While the general sales tax rate is relatively low compared to some other states, the addition of local taxes can increase the overall tax burden. This is particularly notable in parishes with higher local sales tax rates.

Property taxes can vary significantly across parishes, affecting the affordability of homeownership. While exemptions and credits can reduce the tax burden for some homeowners, the wide variation in tax rates can make it challenging for residents to plan their financial strategies.

Tax Implications for Businesses

Businesses operating in Louisiana face a range of tax obligations. The state’s income tax applies to corporate income, with rates ranging from 4% to 8%, depending on the type of corporation and its income level. This can impact the profitability of businesses and influence their investment decisions.

The sales and use tax system affects businesses in two primary ways. First, businesses must collect and remit sales tax on their sales to customers. Second, they must also pay sales tax on their purchases of goods and services, which can increase their operating costs. The varying local sales tax rates can make it challenging for businesses to navigate the tax landscape, especially for those operating in multiple parishes.

Property taxes can also impact businesses, particularly those that own real estate or operate in leased spaces. The variability of tax rates across parishes can influence business location decisions and affect the bottom line.

Louisiana’s Tax Climate: A Comparative Analysis

How does Louisiana’s tax system stack up against other states? Let’s delve into a comparative analysis to understand the state’s tax position.

Income Tax: A Moderate Approach

Louisiana’s income tax rates are relatively moderate compared to some neighboring states. For instance, Texas has no state income tax, while Mississippi and Alabama have lower top tax rates. However, Louisiana’s rates are more competitive when compared to states like California and New York, which have higher top tax brackets.

Sales and Use Tax: A Varied Landscape

Louisiana’s sales tax rates, including local taxes, are generally in line with or slightly higher than the national average. However, the variability of local sales tax rates can make certain parishes more attractive for businesses and consumers.

Property Tax: A Complex Picture

The absence of a statewide property tax makes it challenging to compare Louisiana’s property tax climate directly with other states. However, the variation in tax rates across parishes can make certain areas more or less attractive for businesses and homeowners.

Future Outlook and Potential Reforms

Louisiana’s tax system is not static; it evolves in response to economic trends, political priorities, and the needs of its residents and businesses. Let’s explore some potential reforms and future directions.

Income Tax Reform: Simplification and Equity

One potential reform could involve simplifying the income tax structure by reducing the number of tax brackets or flattening the rates. This could make the tax system more straightforward and reduce compliance costs. Additionally, there have been discussions about introducing a state Earned Income Tax Credit to further support low- and moderate-income earners.

Sales and Use Tax: Targeted Reforms

Reforms in the sales and use tax system could focus on streamlining the collection process and reducing compliance burdens for businesses. This might involve exploring the implementation of a sales tax holiday or adjusting the tax rates to better align with economic trends.

Property Tax: Equitable Assessment and Relief

To ensure fairness in the property tax system, reforms could focus on ensuring equitable assessment practices across parishes. This could involve more standardized assessment guidelines or increased oversight to reduce variability. Additionally, exploring ways to provide targeted property tax relief to certain segments of the population, such as seniors or low-income homeowners, could be beneficial.

| Tax Type | Key Rates |

|---|---|

| Income Tax | 2% - 6% |

| Sales Tax | 4.45% (state) + variable local rates |

| Property Tax | Varies by parish |

What is the current income tax rate in Louisiana for the year 2023?

+The income tax rates in Louisiana for 2023 remain the same as the previous year. There are six tax brackets with rates ranging from 2% to 6%, depending on taxable income. These rates are subject to change, so it’s advisable to check with official sources for the most up-to-date information.

Are there any sales tax holidays in Louisiana, and if so, when are they?

+Louisiana does not have a specific sales tax holiday like some other states. However, there are certain tax-free periods or exemptions for specific items, such as the Second Amendment Sales Tax Holiday, which applies to certain firearms and ammunition purchases. It’s recommended to check the Louisiana Department of Revenue website for the latest updates on any sales tax exemptions or holidays.

How often are property tax assessments conducted in Louisiana?

+Property tax assessments in Louisiana are conducted annually. The local assessors are responsible for determining the taxable value of properties within their jurisdictions each year. This ensures that property values are up-to-date and reflect any changes in the real estate market.