Monmouth Tax Records

Monmouth Tax Records: Unveiling Insights into Local Property Values and Municipal Operations.

Introduction to Monmouth Tax Records

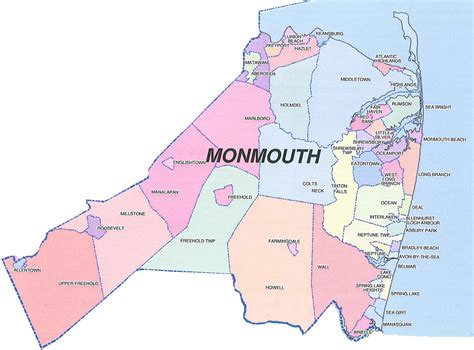

Monmouth County, nestled in the picturesque state of New Jersey, boasts a rich history and a thriving community. At the heart of its administrative functions lies the intricate system of property tax records, which provide a unique lens into the county’s economic landscape and the operations of its municipalities. This comprehensive guide delves into the world of Monmouth Tax Records, shedding light on their significance, accessibility, and the wealth of information they offer to residents, researchers, and stakeholders alike.

Understanding the Monmouth Property Tax System

The property tax system in Monmouth County is a cornerstone of local governance, playing a crucial role in funding essential services such as education, public safety, infrastructure development, and community initiatives. Property taxes are calculated based on the assessed value of each property, which is determined by the county’s tax assessor’s office. This process ensures that property owners contribute fairly to the maintenance and enhancement of their local communities.

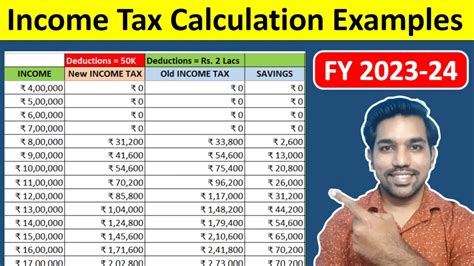

Assessed Value and Tax Rates

The assessed value of a property is typically a percentage of its market value, and it is this assessed value that forms the basis for tax calculations. Tax rates, on the other hand, are set by local governing bodies, such as county boards of taxation or municipal councils. These rates are expressed as a millage rate, which represents the amount of tax owed per 1,000 of assessed property value. For instance, a millage rate of 3.5 means that for every 1,000 of assessed value, the property owner will pay $3.50 in taxes.

Tax Bill Components

A Monmouth property tax bill typically includes several components, each contributing to the overall tax liability. These components may include:

- School Tax: Funds dedicated to local school districts.

- County Tax: Supports county-wide services and operations.

- Municipal Tax: Allocates resources for town or city-specific initiatives.

- Open Space Tax: Designated for preserving and maintaining natural areas.

- Fire District Tax: Finances fire department operations.

- Library Tax: Supports local library services.

- Sewer Tax: Covers wastewater management and treatment.

Accessing Monmouth Tax Records

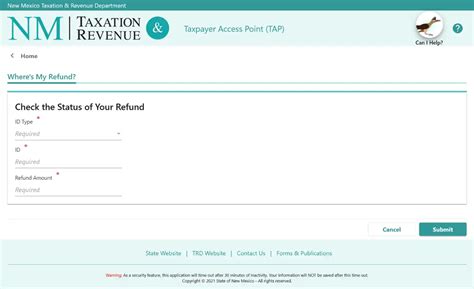

Monmouth County offers a user-friendly platform for residents and interested parties to access tax record information. The Monmouth County Property Tax Payment and Lookup website provides a comprehensive database where users can search for tax records by owner name, property address, or tax map and lot number. This online tool offers a convenient way to obtain detailed tax information, including assessed values, tax rates, and payment due dates.

Online Search Tools

The Monmouth County website provides a straightforward search interface. Users can simply enter the required details, such as an owner’s name or a property address, and the system will generate a list of matching records. Each record provides a wealth of information, including:

- Property owner’s name and contact details.

- Property address and location.

- Tax map and lot number.

- Assessed value of the property.

- Tax rates for various components (school, county, municipal, etc.).

- Tax due dates and payment history.

- Any applicable exemptions or abatements.

Tax Record Accessibility and Privacy

While Monmouth County ensures the accessibility of tax records for the general public, certain privacy measures are in place to protect sensitive information. Personal details such as phone numbers and email addresses are typically redacted from publicly accessible records. However, essential property information, including assessed values and tax rates, remains readily available to promote transparency and enable informed decision-making.

Analyzing Monmouth Tax Records: Insights and Applications

Monmouth Tax Records offer a treasure trove of data that can be leveraged for various purposes, from understanding local property values to evaluating the effectiveness of municipal operations.

Property Value Trends

By analyzing historical tax records, residents and real estate professionals can identify trends in property values over time. This information is invaluable for homebuyers and investors, providing insights into the stability and growth potential of the local real estate market. For instance, a consistent increase in assessed values over several years may indicate a robust and desirable neighborhood, while sudden fluctuations could suggest market volatility or changing demographics.

Comparative Analysis

Monmouth Tax Records enable a comparative analysis of property values and tax rates across different municipalities within the county. This comparison can highlight disparities in tax burdens and property values, shedding light on the economic disparities between towns. Such insights can inform policy discussions and initiatives aimed at promoting equitable development and resource allocation.

Municipal Budgeting and Planning

Tax records play a crucial role in municipal budgeting and long-term planning. Local governments rely on tax revenue to fund essential services and infrastructure projects. By analyzing tax records, municipal leaders can assess the effectiveness of their tax policies, identify potential revenue shortfalls, and make informed decisions to ensure the financial sustainability of their communities.

Community Engagement and Transparency

The transparency provided by Monmouth Tax Records fosters community engagement and trust. Residents can easily access information about their own property taxes and compare them with those of their neighbors, promoting a sense of fairness and accountability. Additionally, the availability of tax records allows community members to actively participate in budget discussions and town hall meetings, armed with the knowledge necessary to engage in meaningful dialogue with local officials.

Challenges and Future Developments

While Monmouth County’s tax record system is robust and user-friendly, there are ongoing challenges and potential areas for improvement.

Data Accuracy and Timeliness

Maintaining accurate and up-to-date tax records is essential for effective decision-making. Monmouth County strives to ensure that tax assessments reflect the current market conditions and property characteristics. However, rapid changes in the real estate market or property improvements may lag in the official records, leading to potential discrepancies. Addressing these challenges requires a dynamic and responsive assessment process, incorporating advanced technologies for more accurate and timely updates.

Digital Transformation and Security

As Monmouth County embraces digital transformation, ensuring the security and integrity of tax records becomes paramount. With an increasing reliance on online platforms and digital storage, the county must invest in robust cybersecurity measures to protect sensitive taxpayer information from potential breaches or cyberattacks. Additionally, the user experience of the online tax record platform can be enhanced through intuitive design and easy-to-understand data visualization tools.

Community Education and Engagement

Promoting awareness and understanding of the property tax system among residents is essential for fostering a sense of ownership and participation. Monmouth County can initiate educational campaigns, workshops, and online resources to demystify the tax process, explain the role of tax records, and encourage community members to utilize the available data for their benefit. By empowering residents with knowledge, the county can strengthen its relationship with the community and enhance transparency and trust.

Conclusion

Monmouth Tax Records serve as a vital resource, offering a glimpse into the economic fabric of the county and the inner workings of its municipalities. By providing transparent and accessible tax information, Monmouth County empowers its residents, investors, and stakeholders to make informed decisions, participate in community discussions, and contribute to the growth and prosperity of their local areas. As the county continues to evolve, the refinement and optimization of its tax record system will play a pivotal role in shaping a fair, sustainable, and thriving future for all.

How often are Monmouth property tax records updated?

+Monmouth County aims to update property tax records annually to reflect the most recent assessed values and tax rates. However, in some cases, updates may be more frequent to accommodate significant changes in property characteristics or market conditions.

Can I contest my property’s assessed value if I disagree with it?

+Yes, Monmouth County provides a process for property owners to appeal their assessed values. This typically involves submitting evidence and documentation to support your claim, and the county’s tax assessor’s office will review and determine if an adjustment is warranted.

How can I pay my Monmouth property taxes online?

+Monmouth County offers an online payment portal on its official website. You can access this portal by visiting the Property Tax Payment page and following the provided instructions. Online payments are secure and convenient, allowing you to manage your tax obligations efficiently.