New Mexico Tax Return Status

For New Mexico residents, staying informed about the status of their tax returns is crucial, especially as the tax season approaches. Understanding the various stages of the tax return process and having access to real-time updates can help taxpayers plan their finances effectively and address any potential issues promptly. This comprehensive guide aims to provide an in-depth look at the New Mexico Tax Return Status, covering everything from the initial filing to the final refund or payment.

Understanding the New Mexico Tax Return Process

The New Mexico Taxation and Revenue Department (TRD) handles all matters related to state taxes, including income tax returns. The process of filing a tax return in New Mexico involves several key stages, each with its own timeline and requirements. By breaking down these stages, taxpayers can gain a clearer understanding of where their return stands and what to expect next.

Filing the Return

The first step in the New Mexico tax return journey is filing the return itself. Taxpayers can choose from various filing methods, including online filing through the TRD’s website, using tax preparation software, or mailing in a paper return. The due date for filing typically aligns with the federal tax deadline, which is usually April 15th. However, it’s essential to note that this date may vary for certain situations, such as military personnel or those affected by natural disasters.

During the filing process, taxpayers must ensure they have all the necessary documentation, such as W-2 forms, 1099 forms, and any relevant deductions or credits. The TRD provides detailed instructions and forms on its website, making it easier for individuals to navigate the filing process accurately.

Processing and Verification

Once the tax return is filed, it enters the processing stage. This is when the TRD’s system evaluates the return for accuracy and completeness. The processing time can vary depending on the complexity of the return and the volume of returns received. Simple returns with straightforward income and deductions may be processed more quickly, while those with business income, rental properties, or other complexities might take longer.

During the processing stage, the TRD may identify errors or missing information. In such cases, they may contact the taxpayer to request additional documentation or clarification. It’s crucial for taxpayers to respond promptly to any such requests to avoid delays in the processing of their return.

| Return Complexity | Estimated Processing Time |

|---|---|

| Simple Returns (Wages Only) | 2-4 Weeks |

| Complex Returns (Business Income, Rental Properties) | 4-8 Weeks |

Refund or Payment

After the processing stage, taxpayers can expect one of two outcomes: a refund or a payment. If the return indicates that the taxpayer is due a refund, the TRD will issue the refund promptly. The method of refund issuance depends on the taxpayer’s preference, which can be specified during the filing process. Options include direct deposit into a bank account, a paper check mailed to the taxpayer’s address, or a credit to their New Mexico state income tax account for future use.

On the other hand, if the taxpayer owes a payment to the state, the TRD will notify them of the amount due. Taxpayers have the option to pay the full amount or set up a payment plan if needed. It’s important to note that failure to pay the owed amount by the due date may result in penalties and interest charges.

Checking Your New Mexico Tax Return Status

Knowing how to check the status of your New Mexico tax return is essential for staying informed and taking prompt action if needed. The TRD offers several convenient methods for taxpayers to track their return status.

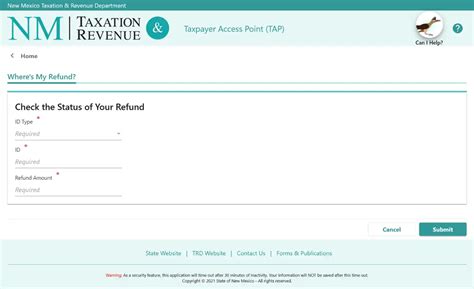

Online Status Check

The most efficient way to check your New Mexico tax return status is through the TRD’s online status check tool. This tool provides real-time updates on the progress of your return, from the moment it’s received by the TRD to the final refund or payment. To use this tool, you’ll need your Social Security Number or Individual Taxpayer Identification Number (ITIN) and the exact amount of your refund or payment.

The online status check tool is user-friendly and provides clear, concise information about the current stage of your return. It also offers helpful tips and guidance if there are any issues or delays.

Telephone Status Inquiry

For those who prefer a more personal touch, the TRD also offers a telephone status inquiry service. Taxpayers can call the TRD’s dedicated status line and speak with a representative who can provide an update on their return. This option is particularly useful for those who may have questions or concerns that require further explanation.

When calling the status line, be prepared to provide your Social Security Number or ITIN, as well as any other relevant details that can help the representative locate your return. The representative will guide you through the process and answer any questions you may have.

Written Status Request

In certain situations, taxpayers may prefer to request a written status update. This can be done by sending a letter to the TRD’s designated address, clearly stating the request for a status update and providing all relevant identification information. While this method is less immediate than the online or telephone options, it can be a useful backup if those methods are not accessible.

Addressing Delays and Errors

Despite the best efforts of the TRD, delays and errors can occasionally occur in the tax return process. Understanding how to address these issues promptly can help minimize their impact on your finances.

Common Causes of Delays

There are several reasons why a tax return may be delayed. Some common causes include missing or incorrect information, complex returns requiring additional review, or issues with the taxpayer’s identity or address. Additionally, the TRD may need to verify certain deductions or credits, which can also cause a delay.

It’s important to note that delays are not always indicative of an error or problem with the return. In some cases, it may simply take longer for the TRD to process certain types of returns or to address a high volume of returns during peak seasons.

Resolving Errors and Delays

If you believe your tax return is delayed or there is an error in the processing, it’s essential to take prompt action. Start by checking your return status using one of the methods outlined above. If you identify an issue, reach out to the TRD through their online help center, telephone support, or by mail.

When contacting the TRD, be prepared to provide detailed information about your return, including the date it was filed, the method of filing, and any specific issues you’ve encountered. The TRD’s support team will work with you to resolve the issue and get your return back on track.

Conclusion: Staying Informed for a Smooth Tax Season

Staying informed about the status of your New Mexico tax return is crucial for effective financial planning and timely resolution of any issues. By understanding the various stages of the tax return process and utilizing the TRD’s status check tools, taxpayers can ensure a smoother tax season experience.

Remember, being proactive and responsive to any inquiries or issues is key to a successful tax return journey. With the right tools and information, taxpayers can navigate the New Mexico tax system with confidence and peace of mind.

How can I check the status of my New Mexico tax return online?

+To check your New Mexico tax return status online, visit the TRD’s official website and navigate to the “Where’s My Refund?” or “Check My Return Status” section. You’ll need your Social Security Number or ITIN, as well as the exact amount of your refund or payment.

What should I do if my return is delayed or there’s an error?

+If you believe your return is delayed or there’s an error, start by checking your return status using the TRD’s online tool or by calling their status line. If you identify an issue, contact the TRD through their help center or by mail, providing detailed information about your return.

How long does it typically take to receive my New Mexico tax refund?

+The time it takes to receive your New Mexico tax refund can vary depending on the complexity of your return and the volume of returns being processed. Simple returns may be processed within 2-4 weeks, while complex returns can take up to 8 weeks or more. The TRD provides estimated processing times on their website.

Can I check my return status if I filed a paper return?

+Yes, you can still check the status of your paper return using the TRD’s online status check tool or by calling their status line. You’ll need to provide your Social Security Number or ITIN, as well as the exact amount of your refund or payment.