New York State Tax Forms

Welcome to our comprehensive guide on navigating the world of New York State tax forms. As an expert in the field, I aim to provide you with an in-depth understanding of the process, forms, and regulations involved in filing your New York State taxes. Whether you're a resident, a business owner, or simply curious about the intricacies of state tax systems, this article will equip you with the knowledge you need.

Understanding the New York State Tax System

New York State, often referred to as “The Empire State,” boasts a robust economy and a diverse tax landscape. The state’s tax system is designed to support its infrastructure, education, and social services, among other critical functions. It’s essential to grasp the basics before delving into the specifics of the tax forms.

The New York State Department of Taxation and Finance is the governing body responsible for administering and enforcing tax laws. They provide a comprehensive range of resources and guidance to assist taxpayers in fulfilling their obligations accurately and efficiently.

Key Tax Types in New York State

- Income Tax: New York imposes an income tax on individuals, estates, trusts, and corporations. The state uses a progressive tax system, meaning the tax rate increases as income rises.

- Sales and Use Tax: This tax applies to the sale, rental, or lease of most goods and certain services within the state. It’s an important revenue generator for the state.

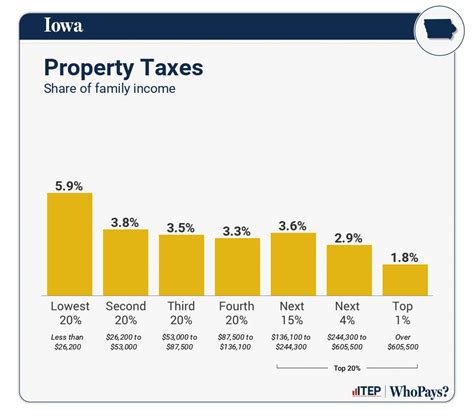

- Property Tax: Property taxes are levied by local governments, including counties, cities, towns, and villages. These taxes fund local services and infrastructure.

- Corporate Franchise Tax: Corporations conducting business in New York are subject to this tax, which is based on their net income.

- Estate and Gift Taxes: New York imposes taxes on transfers of property upon death (estate tax) and during one’s lifetime (gift tax), with certain exemptions and deductions.

Navigating the New York State Tax Forms

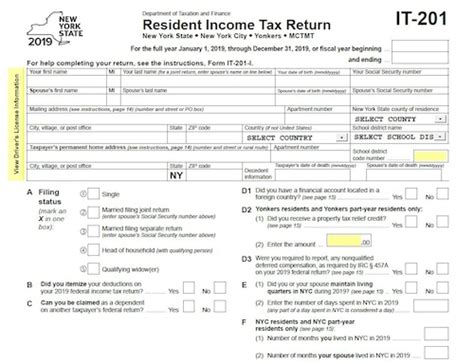

Filing your New York State taxes involves completing specific forms based on your circumstances. Here’s an overview of some of the most common forms and their purposes.

Individual Income Tax Forms

- IT-201: This is the primary form for filing individual income tax returns in New York State. It covers various sources of income, including wages, salaries, dividends, and capital gains.

- IT-203: Designed for part-year residents or non-residents with New York source income, this form is used to calculate and report taxes owed to the state.

- IT-205: The IT-205 form is specifically for claiming credits, such as the New York State Child and Dependent Care Credit or the Low-Income Tax Credit.

Business Tax Forms

- CT-6: Corporations file this form to report and pay their corporate franchise tax. It’s a comprehensive form that details the corporation’s financial activities.

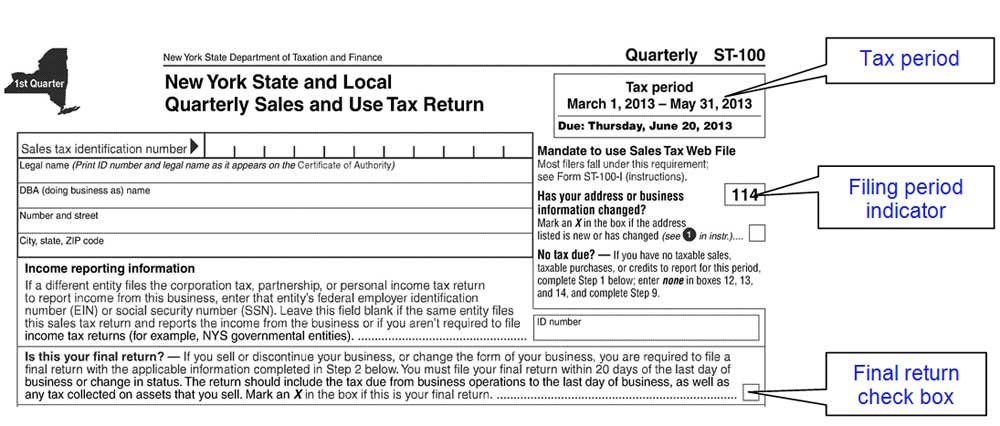

- ST-100: The ST-100 is the primary sales tax return form for businesses. It’s used to report and remit sales tax collected from customers.

- BPT-100: This form is for businesses that wish to apply for or renew their Business Tax Registration. It’s an essential step for any business operating within the state.

Other Important Forms

- IT-284: If you’re claiming a refund for overpaid taxes, the IT-284 form is used to initiate the refund process.

- IT-201-ATT: For taxpayers who need additional space to report income or deductions, the IT-201-ATT form is an attachment to the IT-201.

- IT-201-BI: This form is specifically for reporting business income and expenses on an individual tax return.

| Form | Description |

|---|---|

| IT-201 | Primary individual income tax return form |

| IT-203 | For part-year residents and non-residents with NY source income |

| IT-205 | Claim credits such as Child and Dependent Care Credit |

| CT-6 | Corporate franchise tax return |

| ST-100 | Sales tax return for businesses |

| BPT-100 | Business tax registration application/renewal |

| IT-284 | Initiate refund process for overpaid taxes |

| IT-201-ATT | Attachment for additional income/deduction reporting |

| IT-201-BI | Report business income/expenses on individual tax return |

Filing Your New York State Taxes

Filing your New York State taxes can be done online, by mail, or in person. The preferred method is electronic filing, which is not only faster but also more secure.

Online Filing

The New York State Department of Taxation and Finance offers an online filing system called NYS Online Services. This platform allows taxpayers to file their returns, make payments, and track their refund status. It’s a secure and efficient way to fulfill your tax obligations.

Paper Filing

If you prefer to file by mail, you can download and print the necessary forms from the forms library and send them to the address specified on the form. Ensure you include all required documents and payments to avoid delays.

In-Person Filing

In-person filing is available at designated tax processing centers. This option is ideal for those who need assistance or prefer a more personal approach. The centers are equipped with trained staff to guide you through the filing process.

Tax Payment Options

New York State offers a variety of payment methods to accommodate different preferences and needs.

Electronic Payment

- Credit Card: You can pay your taxes using a credit card through the NYS Online Services platform. This method incurs a convenience fee.

- Electronic Funds Transfer (EFT): An EFT allows you to transfer funds directly from your bank account to the state’s tax account. It’s a secure and efficient way to pay.

Mail-In Payment

If you prefer to pay by mail, you can include a check or money order with your tax return. Ensure that the payment is made payable to the New York State Department of Taxation and Finance and includes your tax identification number.

In-Person Payment

In-person payment is available at designated tax processing centers. This option is convenient for those who prefer to pay in cash or with a debit card.

Tax Refunds and Adjustments

If you overpaid your taxes or are eligible for tax credits, you may be entitled to a refund. The New York State Department of Taxation and Finance processes refunds promptly, and you can track their status through the NYS Online Services platform.

In some cases, you may need to make adjustments to your tax return. This could be due to changes in your personal circumstances, business income, or other factors. It's important to report these changes accurately to avoid penalties and ensure you receive the correct refund amount.

Conclusion

Navigating the world of New York State tax forms can seem daunting, but with the right knowledge and resources, it becomes a manageable task. The New York State Department of Taxation and Finance provides an extensive support network to guide taxpayers through the process.

By understanding the key tax types, choosing the correct forms, and utilizing the available filing and payment options, you can ensure a smooth and efficient tax filing experience. Remember, staying informed and seeking professional advice when needed is essential to fulfilling your tax obligations accurately.

How do I know which tax forms I need to file?

+The specific tax forms you need to file depend on your circumstances. Factors such as your residency status, income sources, and business activities play a role. The New York State Department of Taxation and Finance forms library provides guidance on which forms are relevant to your situation. Additionally, tax preparation software or a tax professional can assist in determining the appropriate forms for your needs.

What is the deadline for filing New York State taxes?

+The deadline for filing New York State taxes is typically aligned with the federal tax filing deadline. For most individuals, this is April 15th of the year following the tax year. However, it’s important to note that this deadline can change due to holidays or other factors. It’s advisable to check the official New York State tax calendar for the most up-to-date information.

Can I file my New York State taxes electronically if I don’t have internet access?

+Yes, you have options if you don’t have internet access. You can visit a designated tax processing center, where trained staff can assist you with electronic filing. Alternatively, you can utilize public libraries or other community centers that offer free internet access. Additionally, tax preparation software providers often offer offline versions of their software, allowing you to prepare and file your taxes without an internet connection.

How long does it take to receive a tax refund in New York State?

+The time it takes to receive a tax refund in New York State can vary. Typically, electronic refunds are processed within 4-6 weeks, while paper refunds may take up to 12 weeks. However, several factors can impact the processing time, such as the complexity of your return, any errors or discrepancies, or the volume of tax returns being processed. You can track the status of your refund through the NYS Online Services refund status tool.