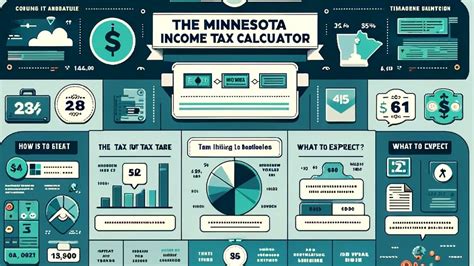

Minnesota Income Tax Calculator

The Minnesota Income Tax Calculator is a valuable tool for residents and taxpayers of the North Star State to estimate and understand their income tax obligations accurately. This comprehensive guide will delve into the intricacies of the Minnesota tax system, providing you with the knowledge and resources to calculate your taxes effectively.

Understanding Minnesota’s Tax Landscape

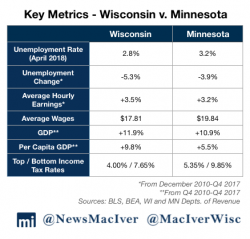

Minnesota operates a progressive income tax system, meaning that higher incomes are taxed at progressively higher rates. This system ensures fairness and contributes to the state’s robust economy. Minnesota’s tax structure is designed to support essential services, education, and infrastructure development.

Tax Rates and Brackets

As of the 2023 tax year, Minnesota has six income tax brackets, each with its own tax rate. These brackets are as follows:

| Income Bracket | Tax Rate |

|---|---|

| Up to $12,400 (single) / $18,600 (married filing jointly) | 5.35% |

| $12,400 - $24,800 (single) / $18,600 - $37,200 (married filing jointly) | 7.05% |

| $24,800 - $103,500 (single) / $37,200 - $155,000 (married filing jointly) | 7.85% |

| $103,500 - $163,000 (single) / $155,000 - $245,000 (married filing jointly) | 9.85% |

| $163,000 - $278,000 (single) / $245,000 - $417,000 (married filing jointly) | 9.85% |

| Over $278,000 (single) / Over $417,000 (married filing jointly) | 9.85% |

These rates are subject to change, so it's essential to refer to the most recent tax guidelines issued by the Minnesota Department of Revenue for the most accurate information.

Filing Status and Deductions

Minnesota offers several filing statuses, including Single, Married Filing Jointly, Married Filing Separately, and Head of Household. Each status has its own set of rules and tax implications, so it’s crucial to choose the correct status when filing.

The state also provides various deductions and credits to help reduce your taxable income. These include the Minnesota Working Family Credit, Property Tax Refund, and Child and Dependent Care Credit, among others. Understanding these deductions can significantly impact your tax liability.

Using the Minnesota Income Tax Calculator

The Minnesota Income Tax Calculator is a user-friendly online tool designed to simplify the process of estimating your income taxes. Here’s a step-by-step guide on how to use it effectively:

Step 1: Gather Your Information

Before you begin, ensure you have the following information readily available:

- Your annual gross income (before taxes)

- Your filing status (Single, Married Filing Jointly, etc.)

- Any relevant deductions or credits you plan to claim

- Information about any additional income sources, such as investments or side hustles

Step 2: Access the Calculator

Visit the official website of the Minnesota Department of Revenue or use a reputable third-party tax calculator. Ensure the calculator is up-to-date and reflects the latest tax laws.

Step 3: Input Your Data

Enter your annual income, filing status, and any applicable deductions or credits. The calculator will guide you through the process, ensuring you don’t miss any crucial information.

Step 4: Review Your Estimate

Once you’ve entered all the necessary data, the calculator will provide you with an estimated tax liability. This estimate will include your total taxable income, tax brackets, and any applicable deductions or credits.

Step 5: Adjust and Plan

If your estimated tax liability is higher than expected, consider adjusting your tax withholding or making estimated tax payments throughout the year. This can help prevent surprises come tax time and avoid potential penalties.

Advanced Tax Strategies

For those looking to optimize their tax strategy, there are several advanced techniques to consider:

Maximizing Deductions

Take advantage of all the deductions and credits you’re eligible for. This includes contributing to tax-advantaged retirement accounts like 401(k)s or IRAs, which can lower your taxable income. Additionally, consider itemizing deductions if your itemized expenses exceed the standard deduction.

Tax-Efficient Investing

Strategic investing can also impact your tax liability. Explore tax-efficient investment options, such as municipal bonds or tax-free investments, which can provide income with minimal tax implications.

Tax Planning for Business Owners

If you own a business, there are numerous tax strategies to consider. This includes structuring your business as a pass-through entity, utilizing business deductions and credits, and optimizing your business expenses to reduce taxable income.

Staying Informed and Seeking Professional Help

The world of taxes can be complex, and it’s essential to stay informed about any changes to tax laws and regulations. The Minnesota Department of Revenue provides regular updates and resources to help taxpayers navigate the system.

For those with complex tax situations or for businesses, seeking professional tax advice from a certified public accountant (CPA) or enrolled agent (EA) is highly recommended. These professionals can provide tailored advice and ensure you're taking advantage of all the deductions and credits you're entitled to.

Frequently Asked Questions

What is the Minnesota Income Tax Calculator?

+

The Minnesota Income Tax Calculator is an online tool that helps residents and taxpayers estimate their income tax liability based on their annual income, filing status, and deductions. It provides an estimate of the taxes owed to the state of Minnesota.

How accurate is the Minnesota Income Tax Calculator?

+

The calculator provides a reasonably accurate estimate based on the information entered. However, it’s important to note that it’s a simplified tool and may not account for all possible deductions or credits. For a precise calculation, consider consulting with a tax professional.

Do I need to use the Minnesota Income Tax Calculator every year?

+

It’s recommended to use the calculator annually, especially if your income, deductions, or tax laws change. This ensures you stay informed about your tax obligations and can plan accordingly.

Are there any alternative tax calculators I can use?

+

Yes, there are several reputable third-party tax calculators available online. However, it’s crucial to choose a calculator that is regularly updated and provides accurate information based on the latest tax laws.

Can I use the Minnesota Income Tax Calculator if I’m a non-resident of the state?

+

The calculator is primarily designed for Minnesota residents and taxpayers. If you’re a non-resident with income sourced from Minnesota, you may need to consult with a tax professional to determine your specific tax obligations.