Is Overtime Still Taxed

The concept of overtime work and its tax implications has long been a subject of interest and discussion among employees and employers alike. With changing labor laws and varying tax regulations across jurisdictions, the question of whether overtime pay is taxed or not is an important one to address. In this comprehensive guide, we will delve into the intricacies of overtime taxation, providing a detailed analysis of the current landscape and offering valuable insights for both employees and employers.

Understanding Overtime Taxation

Overtime pay, by definition, refers to the compensation received by an employee for working beyond their standard work hours. It is often a significant source of additional income for many workers, particularly in industries where overtime work is common. The taxation of overtime pay, however, can vary depending on a multitude of factors, including the jurisdiction, the employee’s tax bracket, and the nature of the employment contract.

In most jurisdictions, overtime pay is subject to income tax, just like regular wages. This means that the additional earnings from overtime work are included in an employee's total taxable income for the year. The tax rate applied to overtime pay is usually the same as the regular income tax rate, ensuring a consistent approach to taxation.

Tax Brackets and Overtime Earnings

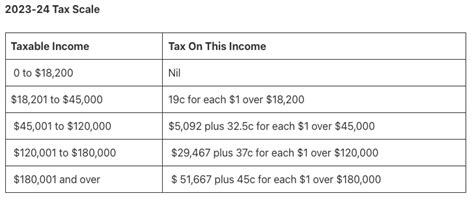

One of the key considerations when it comes to overtime taxation is the impact of tax brackets. Tax brackets determine the rate at which income is taxed, and they are typically progressive, meaning that higher income levels are taxed at a higher rate. When an employee earns overtime pay, their total income for the year may push them into a higher tax bracket, resulting in a higher tax liability.

For instance, consider an employee who typically earns an annual income that falls within the 22% tax bracket. If they work significant overtime hours and their total income exceeds the threshold for the next tax bracket (e.g., 24%), their overtime earnings will be taxed at the higher rate of 24%. This can significantly impact their overall tax liability and should be carefully considered when accepting overtime work.

Employer Contributions and Tax Withholdings

Employers play a crucial role in the taxation of overtime pay. They are responsible for withholding the appropriate amount of tax from an employee’s overtime earnings and remitting it to the relevant tax authorities. This process ensures that the employee’s tax liability is met and that they do not face unexpected tax bills at the end of the financial year.

Additionally, employers are also required to contribute to certain payroll taxes, such as social security and Medicare taxes, on overtime earnings. These contributions are typically calculated as a percentage of the employee's gross wages, including overtime pay. Therefore, employers must ensure that they accurately calculate and withhold the necessary taxes to remain compliant with tax regulations.

| Tax Type | Withholding Rate |

|---|---|

| Federal Income Tax | Varies based on tax bracket |

| Social Security Tax | 6.2% (up to an annual limit) |

| Medicare Tax | 1.45% |

Overtime Taxation: A Global Perspective

The taxation of overtime pay varies significantly across different countries and jurisdictions. While some countries have a straightforward approach, others implement more complex systems. Let’s explore a few examples to gain a broader understanding of global overtime tax practices.

United States

In the United States, overtime pay is subject to federal income tax, as mentioned earlier. Additionally, states and local governments may also impose their own income taxes, which can further impact the taxation of overtime earnings. Employees in the US should be aware of both federal and state tax obligations when accepting overtime work.

United Kingdom

The United Kingdom follows a similar approach to the US, where overtime pay is taxed as part of an employee’s total income. However, the UK also has a unique tax-free allowance known as the Personal Allowance. This allowance allows individuals to earn a certain amount of income tax-free each year. Any overtime earnings that exceed this allowance will be taxed accordingly.

Canada

Canada’s tax system is slightly more complex when it comes to overtime pay. While federal income tax is applied to overtime earnings, provinces and territories also have their own tax systems. This means that overtime pay may be subject to both federal and provincial taxes, with rates varying depending on the jurisdiction.

Australia

In Australia, overtime pay is taxed at the same rate as regular income. However, the Australian tax system also includes a progressive tax scale, similar to other countries. As an employee’s income, including overtime pay, increases, they may move into higher tax brackets, resulting in a higher tax liability.

Maximizing Overtime Earnings: Tax Strategies

For employees who regularly work overtime, understanding tax strategies can help maximize their take-home pay. Here are a few tips to consider:

- Review your tax brackets: Be aware of your current tax bracket and how overtime earnings may impact it. Plan your overtime work accordingly to minimize the tax burden.

- Utilize tax-advantaged accounts: Depending on your jurisdiction, you may be able to contribute to tax-advantaged accounts, such as retirement savings plans. This can help reduce your taxable income and provide long-term financial benefits.

- Consider tax credits and deductions: Research tax credits and deductions that may be applicable to your situation. These can help reduce your overall tax liability and increase your net earnings.

- Stay informed about tax laws: Tax laws and regulations can change, so it's essential to stay updated. Consult tax professionals or utilize reliable online resources to ensure you are aware of any changes that may impact your overtime earnings.

Employer-Employee Collaboration

Employers and employees can work together to ensure a fair and efficient taxation process for overtime pay. Here are some key considerations for both parties:

- Clear communication: Employers should provide transparent information about overtime pay rates and the associated tax implications. This helps employees make informed decisions about accepting overtime work.

- Accurate record-keeping: Both employers and employees should maintain accurate records of overtime hours worked and earnings. This ensures compliance with tax regulations and facilitates an efficient tax process.

- Regular tax consultations: Employers may consider offering tax consultation services or providing resources to help employees understand their tax obligations. This fosters a supportive work environment and reduces the risk of tax-related issues.

Future Implications and Potential Changes

The taxation of overtime pay is subject to ongoing discussions and potential reforms. As labor laws evolve and the gig economy continues to grow, there may be changes in how overtime earnings are taxed. Here are a few potential future implications to consider:

- Increased focus on fair taxation: With the rise of gig work and independent contractors, there may be a push for more equitable taxation of overtime earnings. This could involve reevaluating tax rates and brackets to ensure that all workers, regardless of employment status, are taxed fairly.

- Simplified tax systems: Some jurisdictions may consider simplifying their tax systems to make it easier for employees and employers to understand and comply with tax obligations. This could involve streamlining tax rates or introducing flat tax rates for certain income brackets.

- Digitalization of tax processes: The increasing digitalization of tax systems may further impact the taxation of overtime pay. Online platforms and mobile apps could streamline the tax process, making it more efficient and accessible for both employers and employees.

It is important for employees and employers to stay updated on any changes in tax regulations to ensure compliance and optimize their financial strategies.

Conclusion

In conclusion, the taxation of overtime pay is a complex yet essential aspect of the employment landscape. While overtime earnings are generally subject to income tax, the specific tax implications can vary greatly depending on jurisdiction and individual circumstances. By understanding the tax landscape, employees and employers can make informed decisions about overtime work and ensure compliance with tax regulations.

As the world of work continues to evolve, so too will the taxation of overtime pay. Staying informed and proactive about tax obligations will be crucial for both employees and employers in navigating this complex landscape.

Are there any tax advantages for working overtime?

+While overtime pay is generally subject to income tax, there may be certain tax advantages or credits available depending on your jurisdiction and individual circumstances. It’s important to consult with a tax professional or research specific tax laws to identify any potential benefits.

Can I reduce my tax liability on overtime earnings?

+There are strategies to minimize tax liability on overtime earnings, such as maximizing tax-advantaged accounts, claiming applicable tax credits and deductions, and staying informed about changing tax laws. Consulting a tax professional can provide personalized advice based on your situation.

What happens if I don’t pay taxes on my overtime earnings?

+Failing to pay taxes on overtime earnings can result in significant penalties and interest charges. It is important to ensure that your overtime pay is properly reported and taxed to avoid legal and financial consequences. Consult with tax authorities or a tax professional for guidance.

How do employers calculate taxes for overtime pay?

+Employers calculate taxes for overtime pay by considering the employee’s total income, including overtime earnings, and applying the appropriate tax rates. They must withhold the correct amount of tax and contribute to payroll taxes such as social security and Medicare. Accurate record-keeping and tax software can assist in this process.