Federal Estate Tax Exemption 2025

In the world of estate planning and tax strategies, the Federal Estate Tax Exemption is a crucial consideration for individuals and families with substantial assets. This exemption, also known as the applicable exclusion amount, determines the threshold at which an individual's estate may be subject to federal estate tax. As we approach 2025, it is essential to understand the current landscape and future implications of this exemption to effectively plan for the transfer of wealth.

Understanding the Federal Estate Tax Exemption

The Federal Estate Tax is a tax imposed on the transfer of a deceased individual’s estate to their heirs. However, to encourage the transfer of wealth and minimize the tax burden on families, the Internal Revenue Service (IRS) provides an exemption, allowing a certain amount of an estate to pass tax-free. This exemption amount varies from year to year and is subject to adjustments based on inflation and legislative changes.

For the year 2025, the Federal Estate Tax Exemption is expected to play a significant role in estate planning strategies. Let's delve into the details and explore how this exemption can impact individuals and their financial plans.

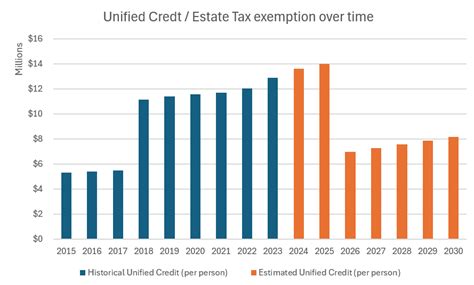

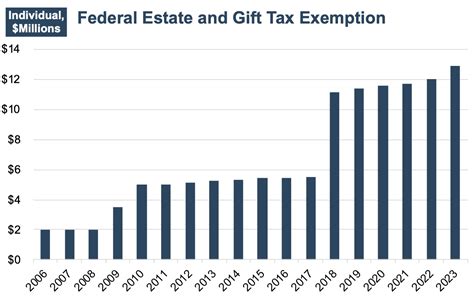

The Evolution of the Exemption

The Federal Estate Tax Exemption has undergone notable changes over the years. In 2017, the Tax Cuts and Jobs Act temporarily increased the exemption amount, providing a significant relief to many estates. This increase was set to expire at the end of 2025, but recent legislative developments have introduced the possibility of making these higher exemption amounts permanent.

| Year | Exemption Amount (in USD) |

|---|---|

| 2024 | $12.92 million (individual) / $25.84 million (married couples) |

| 2025 (Projected) | $13.24 million (individual) / $26.48 million (married couples) |

The table above provides a glimpse of the projected Federal Estate Tax Exemption for 2025. These figures are based on historical trends and inflation adjustments, but it's important to note that they may be subject to change based on future legislative actions.

Benefits and Implications for 2025

The increased exemption amount for 2025 offers several advantages for individuals with substantial assets. Here are some key benefits:

- Tax Savings: With a higher exemption, more estates will be able to transfer assets tax-free, reducing the overall tax burden on heirs.

- Simplified Estate Planning: Higher exemptions provide more flexibility in estate planning, allowing individuals to focus on other aspects of their financial goals.

- Preservation of Wealth: The increased exemption ensures that a larger portion of an individual’s wealth can be passed on to the next generation without significant tax implications.

However, it's essential to consider the potential drawbacks and plan accordingly. Here are some key points to keep in mind:

- Legislative Uncertainty: While the exemption is projected to increase in 2025, legislative changes could impact these figures. It is crucial to stay updated on any developments to avoid surprises.

- Complex Strategies: For estates exceeding the exemption amount, more intricate planning may be required to minimize tax liabilities. Consulting with tax professionals and estate planners is advisable.

- Gift Tax Considerations: The Federal Gift Tax, which is closely tied to the Estate Tax, may also see adjustments. Understanding the implications of gifting strategies is essential to maximize tax efficiency.

Estate Planning Strategies for 2025 and Beyond

With the potential for a higher Federal Estate Tax Exemption in 2025, individuals with substantial assets should consider the following strategies to optimize their estate plans:

1. Review and Update Existing Plans

If you already have an estate plan in place, it is crucial to review and update it to reflect the changing exemption amounts. Ensure that your plan aligns with your current financial goals and considers the potential tax implications.

2. Utilize Lifetime Gifts

Given the higher exemption, individuals may consider making lifetime gifts to reduce their taxable estate. This strategy can help transfer wealth tax-efficiently and ensure that assets are distributed according to your wishes.

3. Explore Trust Options

Trusts can be powerful tools for estate planning. Depending on your goals, you may consider establishing irrevocable trusts or utilizing other trust structures to minimize tax liabilities and provide asset protection.

4. Consider Business Succession Planning

For business owners, the Federal Estate Tax Exemption can impact the transfer of business interests. Developing a comprehensive business succession plan can help ensure a smooth transition and minimize tax consequences.

5. Stay Informed on Legislative Changes

The world of tax legislation is dynamic, and staying updated on any changes to the Federal Estate Tax Exemption is crucial. Regularly consult with tax professionals to ensure your estate plan remains compliant and optimized.

Real-World Examples and Case Studies

Let’s explore a few real-world scenarios to illustrate the impact of the Federal Estate Tax Exemption on individuals’ financial planning:

Case Study 1: The Smith Family

The Smith family, with a net worth of 15 million, is planning for the future. With the projected exemption of 13.24 million for 2025, they can strategically utilize lifetime gifts to reduce their taxable estate. By gifting a portion of their assets to their children, they can ensure a more tax-efficient transfer of wealth.

Case Study 2: Entrepreneurial Success

John, a successful entrepreneur, has built a thriving business with a substantial valuation. With the higher exemption, he can explore business succession planning options, such as establishing a trust to transfer ownership to his children while minimizing tax liabilities.

Case Study 3: International Considerations

For individuals with international assets and estates, the Federal Estate Tax Exemption can have unique implications. Understanding the interaction between the U.S. estate tax and foreign inheritance laws is crucial for comprehensive planning.

Conclusion: A Strategic Approach to Wealth Transfer

The Federal Estate Tax Exemption for 2025 offers a valuable opportunity for individuals to optimize their estate plans and transfer wealth efficiently. By staying informed, seeking professional guidance, and implementing strategic planning, individuals can navigate the complexities of estate tax laws and ensure a secure financial future for their heirs.

As we move forward, it is essential to stay vigilant and adapt to any changes in the legislative landscape. With a proactive approach, individuals can make the most of the available exemptions and achieve their estate planning goals.

How often does the Federal Estate Tax Exemption change?

+

The Federal Estate Tax Exemption is typically adjusted annually to account for inflation. However, significant legislative changes, such as the Tax Cuts and Jobs Act, can result in more substantial adjustments.

What happens if the exemption amount decreases in the future?

+

A decrease in the exemption amount could result in more estates becoming subject to federal estate tax. It is crucial to regularly review and update your estate plan to ensure compliance with any changes.

Are there any other taxes to consider when planning for estate transfer?

+

Yes, the Federal Gift Tax and state-level estate and inheritance taxes are important considerations. Understanding the interplay between these taxes is essential for comprehensive estate planning.

Can I change my estate plan after establishing it?

+

Absolutely! Estate plans can be modified to reflect changes in your financial situation, family dynamics, or legislative updates. Regular reviews ensure your plan remains aligned with your goals.