California Sales Tax On Vehicles

The sales tax on vehicles in California is a significant aspect of the state's tax system, impacting both residents and businesses. Understanding the intricacies of this tax is crucial, especially when considering the substantial revenue it generates for the state. This comprehensive guide aims to provide an in-depth analysis, breaking down the tax rates, exemptions, and processes involved, while also offering practical insights and expert opinions.

Understanding California’s Sales Tax on Vehicles

California’s sales tax is a critical component of the state’s revenue stream, contributing to various public services and infrastructure projects. When it comes to vehicle purchases, the tax is applied to both new and used cars, vans, trucks, and motorcycles, making it a substantial financial consideration for buyers.

The Role of Sales Tax in California’s Economy

The sales tax on vehicles plays a pivotal role in California’s economic landscape. It is a key revenue generator, contributing significantly to the state’s annual budget. The tax revenue funds essential public services, including education, healthcare, and infrastructure development. For instance, a portion of the sales tax revenue is allocated specifically for transportation projects, such as road maintenance and public transit improvements.

From a historical perspective, the sales tax on vehicles has evolved over time. It was first implemented in the mid-20th century, with rates and regulations varying across different periods. This evolution has seen the tax adapt to the changing needs of the state, reflecting the economic and social dynamics of California.

| Period | Tax Rate | Notable Changes |

|---|---|---|

| 1950s-1970s | 4-6% | Gradual increase to match inflation |

| 1980s-1990s | 7-8% | Rate fluctuations due to economic recessions |

| 2000s | 8.25% | Steady rate with additional local taxes |

| 2010s-Present | 7.25% (State) + Local Taxes | Recent reductions and local variations |

The Tax Rate Breakdown

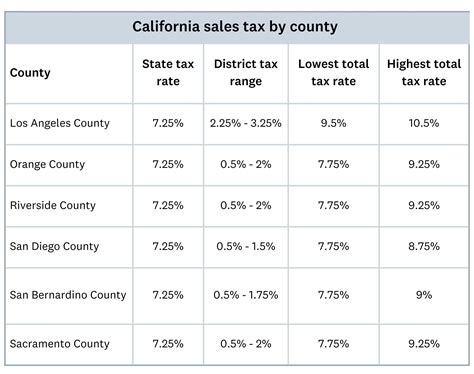

California’s sales tax on vehicles is comprised of both a state and local component. The state sales tax rate is currently set at 7.25%, which is applied uniformly across the state. However, local jurisdictions, such as cities and counties, are allowed to impose additional taxes, resulting in varying total tax rates depending on the location of the purchase.

For example, in Los Angeles County, the total sales tax rate can reach 10.25%, including both the state and local taxes. In contrast, rural areas might have lower total rates, offering a financial advantage to buyers in those regions.

| Location | State Tax | Local Tax | Total Tax Rate |

|---|---|---|---|

| Los Angeles County | 7.25% | 3% | 10.25% |

| San Francisco | 7.25% | 1.25% | 8.5% |

| Rural Counties (e.g., Modoc) | 7.25% | 0% | 7.25% |

Exemptions and Special Considerations

While the sales tax on vehicles generally applies to all purchases, there are certain exemptions and special cases worth noting. For instance, vehicles purchased for business purposes, such as commercial trucks or vans, may qualify for tax exemptions or reduced rates.

Additionally, California offers a Sales and Use Tax Exclusion for certain military personnel. Active-duty members of the U.S. Armed Forces who have been stationed in California for less than 18 months are exempt from paying sales tax on vehicle purchases. This exclusion aims to support military personnel and their families during their time in the state.

The Process of Paying Sales Tax on Vehicles

When purchasing a vehicle in California, understanding the sales tax process is essential. This section will guide you through the steps, from calculating the tax to the payment methods available.

Calculating the Sales Tax

The sales tax on a vehicle is calculated based on the purchase price of the vehicle, including any additional fees and options. Here’s a simple formula to estimate the sales tax:

Sales Tax = Purchase Price x (State Tax Rate + Local Tax Rate)

For instance, if you're buying a vehicle in Los Angeles County with a purchase price of $30,000, the sales tax calculation would be as follows:

Sales Tax = $30,000 x (0.0725 + 0.03) = $2,775

This calculation provides an estimate, and the actual tax amount may vary slightly due to additional fees and local variations.

When and How to Pay

The sales tax on a vehicle is typically paid at the time of purchase. This can be done directly to the dealership or seller, who is responsible for remitting the tax to the California Department of Tax and Fee Administration (CDTFA). The payment can be made through various methods, including:

- Cash: A straightforward method, but it might not be practical for high-value purchases.

- Check: A common payment method, offering a record of the transaction.

- Credit/Debit Card: Many dealerships accept card payments, providing an electronic record.

- Electronic Funds Transfer (EFT): A secure and efficient method, often preferred for larger transactions.

It's essential to retain a record of the sales tax payment, as it serves as proof of compliance with California's tax laws. This record can be crucial during vehicle registration and for future reference.

Registration and Title Transfer

Upon purchasing a vehicle, the next step is to register it with the California Department of Motor Vehicles (DMV) and transfer the title. This process involves paying various fees, including the Vehicle License Fee (VLF), which is calculated based on the vehicle’s value. The VLF is separate from the sales tax but is also an important consideration when budgeting for a vehicle purchase.

The registration and title transfer process typically requires the following steps:

- Complete the necessary forms, including the Application for Title or Registration (REG 343)

- Provide proof of insurance and emission testing (if applicable)

- Pay the VLF, registration fees, and any applicable taxes

- Submit the required documents to the DMV

- Receive the vehicle registration and title

Impact and Future Implications

California’s sales tax on vehicles has a significant impact on the automotive industry and consumer behavior within the state. This section explores the effects of the tax and potential future changes.

Effects on the Automotive Industry

The sales tax on vehicles influences the automotive market in California in several ways. For dealerships and manufacturers, the tax adds to the overall cost of doing business, impacting their pricing strategies and profit margins. It also affects consumer behavior, as the tax can be a substantial financial consideration for buyers, potentially influencing their purchasing decisions and the timing of their purchases.

From an economic perspective, the sales tax on vehicles contributes to the state's revenue stream, supporting various public services and infrastructure projects. However, it also adds to the overall cost of vehicle ownership in California, which can impact the state's competitiveness in the automotive market.

Consumer Behavior and Market Trends

The sales tax on vehicles can shape consumer behavior, influencing when and how individuals purchase vehicles. For instance, buyers might strategically time their purchases to take advantage of tax breaks or exemptions, such as during special sales events or when purchasing vehicles for business use.

Market trends also play a role. The increasing popularity of electric vehicles (EVs) and hybrid cars, for example, could impact the sales tax revenue if these vehicles are subject to different tax rates or exemptions. Additionally, the rise of online vehicle sales and leasing options might also affect the traditional sales tax collection process.

Potential Future Changes

The future of California’s sales tax on vehicles is subject to potential changes and reforms. Here are a few possibilities:

- Rate Adjustments: The state or local governments might consider adjusting the sales tax rate to align with economic conditions or to generate additional revenue. However, such changes could face public scrutiny and require careful consideration of their impact on consumers and businesses.

- Tax Reform: There could be proposals for tax reform, such as simplifying the tax structure or introducing new exemptions or incentives. For example, the state might consider tax breaks for environmentally friendly vehicles to promote sustainability.

- Collection Methods: With advancements in technology, there might be discussions about modernizing the tax collection process, potentially utilizing digital platforms or blockchain technology to enhance efficiency and security.

Staying informed about these potential changes is essential for both businesses and consumers, as they can significantly impact the cost and process of vehicle purchases in California.

Can I negotiate the sales tax on a vehicle purchase?

+No, the sales tax is a mandatory charge determined by the state and local jurisdictions. However, you can negotiate the purchase price of the vehicle, which will indirectly affect the sales tax amount.

Are there any online resources to estimate the sales tax on a vehicle purchase?

+Yes, the California Department of Tax and Fee Administration provides an online calculator to estimate the sales tax based on your location and purchase price. You can find it on their official website.

What happens if I fail to pay the sales tax on my vehicle purchase?

+Failure to pay the sales tax can result in penalties and interest charges. It’s important to ensure you pay the tax accurately and on time to avoid legal consequences and additional fees.

Can I claim the sales tax on my vehicle purchase as a tax deduction?

+Generally, the sales tax on a personal vehicle purchase is not deductible for federal income tax purposes. However, if the vehicle is used for business purposes, you might be able to deduct a portion of the sales tax as a business expense.

Are there any sales tax holidays for vehicle purchases in California?

+As of my last update, California does not have specific sales tax holidays for vehicle purchases. However, it’s worth checking for any temporary tax breaks or incentives that might be offered periodically.