Denmark Tax Rate

Denmark, known for its progressive tax system, plays a pivotal role in shaping the economic landscape of the country. Understanding its intricacies is essential for both residents and businesses navigating the Danish fiscal environment. This guide aims to demystify Denmark's tax structure, offering a comprehensive overview of its rates, implications, and unique features.

Introduction to Denmark’s Progressive Tax System

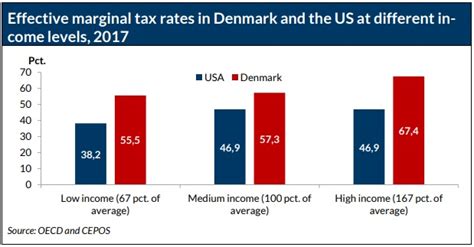

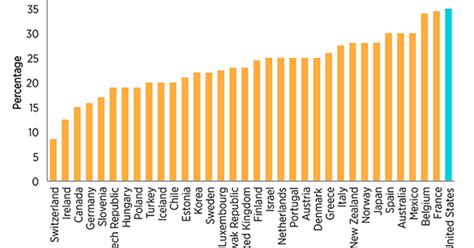

The Danish tax system is characterized by its progressive nature, meaning that higher incomes are taxed at higher rates. This approach ensures that the tax burden is distributed fairly across the population, fostering a sense of social equality. The tax rates in Denmark are not only significant for individuals but also have a profound impact on businesses, influencing investment decisions and economic growth.

The country's tax system is designed to support a robust welfare state, funding public services such as healthcare, education, and social security. As a result, Denmark consistently ranks highly in global quality of life indices, with its tax policies playing a crucial role in maintaining this standard.

Personal Income Tax Rates

Tax Brackets and Rates

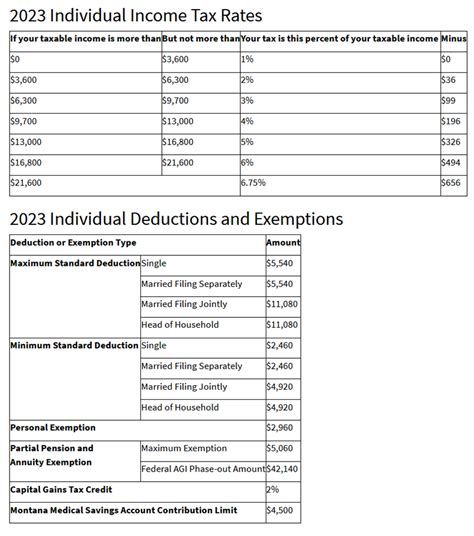

Denmark employs a comprehensive tax bracket system for personal income tax, with rates varying based on income levels. As of [current year], the tax brackets and corresponding rates are as follows:

| Income Bracket (DKK) | Tax Rate (%) |

|---|---|

| Up to 435,900 | 37.87 |

| 435,901 - 653,850 | 42.05 |

| 653,851 - 980,775 | 47.15 |

| 980,776 and above | 55.42 |

These rates are applicable to individuals' taxable income, which includes wages, salaries, and other sources of earnings. The progressive nature of these brackets ensures that those with higher incomes contribute a larger proportion of their earnings to the tax system.

Tax Deductions and Credits

Denmark offers a range of tax deductions and credits to alleviate the burden on certain income groups. These include deductions for pension contributions, childcare expenses, and certain health-related costs. Additionally, individuals with specific circumstances, such as disability or caregiving responsibilities, may qualify for additional tax benefits.

For instance, individuals with significant medical expenses exceeding a certain threshold may be eligible for a tax credit, effectively reducing their overall tax liability. Similarly, those investing in energy-efficient home improvements can benefit from tax deductions, promoting environmentally friendly practices.

Corporate Tax Rates

Corporate Taxation in Denmark

Denmark imposes a corporate tax rate of [current rate]% on the profits of limited companies. This rate applies to both domestic and foreign-owned companies operating within the country. The corporate tax system is designed to encourage investment and business growth, offering a stable and transparent fiscal environment.

However, it's important to note that certain sectors may be subject to additional taxes or regulations. For example, the financial sector often faces specific tax requirements, ensuring a level playing field and contributing to the overall financial stability of the nation.

International Tax Considerations

Denmark has a robust network of double tax treaties with numerous countries, mitigating the risk of double taxation for multinational corporations. These treaties ensure that businesses operating in multiple jurisdictions are not subject to excessive tax burdens, fostering a favorable environment for international trade and investment.

Furthermore, Denmark's participation in the OECD's Base Erosion and Profit Shifting (BEPS) project demonstrates its commitment to global tax fairness and transparency. This initiative aims to address the challenges posed by the digital economy and ensure that multinational enterprises pay their fair share of taxes.

Value Added Tax (VAT)

VAT Rates and Registration

Denmark’s VAT system is a crucial component of its tax structure, with rates varying based on the nature of goods and services. The standard VAT rate in Denmark is [current rate]%, applicable to most goods and services. However, there are reduced rates for specific items, such as [reduced rate example], and zero-rated items, like [zero-rated example], which are essential for maintaining affordability and accessibility.

Businesses with an annual turnover exceeding [threshold amount] are required to register for VAT, ensuring compliance with the country's fiscal regulations. This process involves obtaining a unique VAT number, which is necessary for all VAT-related transactions.

VAT Exemptions and Refunds

Certain sectors, such as healthcare, education, and financial services, are exempt from VAT in Denmark. This exemption ensures that these vital services remain accessible and affordable to the general public. Additionally, tourists and non-residents may be eligible for VAT refunds on certain purchases, provided they meet specific criteria and follow the refund process.

The refund process typically involves obtaining a VAT refund form at the point of sale and presenting it, along with the original receipts, at the airport or designated refund offices. This system ensures that non-residents can reclaim the VAT paid on eligible purchases, enhancing the attractiveness of Denmark as a tourist destination.

Local Taxes and Fees

Municipal Taxes

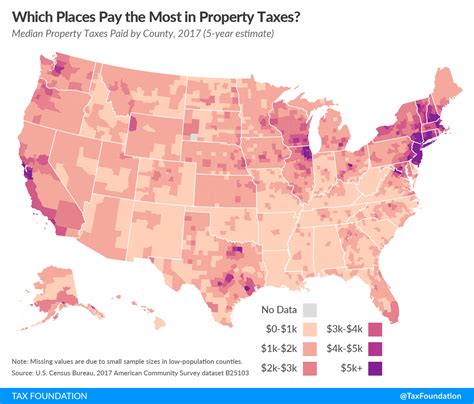

In addition to national taxes, Denmark’s municipalities impose local taxes to fund public services and infrastructure. These taxes vary across regions and are typically based on property values or income levels. Municipal taxes contribute significantly to the overall tax burden, supporting local development and community initiatives.

For instance, residents in Copenhagen may pay a higher municipal tax rate compared to those in rural areas, reflecting the city's higher cost of living and the need for robust public services. This regional variation ensures that local authorities have the necessary resources to address the unique needs of their communities.

Special Fees and Charges

Denmark also levies specific fees and charges for certain services and activities. These can include environmental charges for pollution or waste disposal, road tolls for certain highways, and license fees for various professional services. These fees are designed to fund targeted initiatives and maintain the sustainability of specific sectors.

For example, the Danish government imposes a carbon tax on fossil fuels, encouraging the transition to renewable energy sources and reducing the country's carbon footprint. This tax, while targeting specific industries, ultimately benefits the environment and contributes to Denmark's global sustainability goals.

Tax Planning and Compliance

Navigating Denmark’s Tax Landscape

Navigating Denmark’s tax system requires a thorough understanding of its complex regulations and potential pitfalls. Whether you’re an individual or a business, proper tax planning is essential to ensure compliance and optimize your fiscal obligations.

For businesses, this may involve structuring your operations to take advantage of tax incentives, such as research and development credits or investment tax breaks. For individuals, it's crucial to understand the tax implications of various income sources and deductions, ensuring you maximize your refunds or minimize your liability.

Professional Guidance

Given the intricacies of Denmark’s tax system, seeking professional advice is often beneficial. Tax advisors and accountants can provide personalized guidance, ensuring you navigate the tax landscape effectively. They can help structure your finances, optimize tax efficiency, and ensure compliance with the latest regulations.

Frequently Asked Questions

How does Denmark's tax system compare to other Nordic countries?

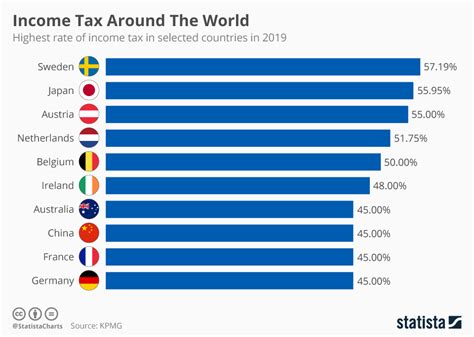

+Denmark's tax system shares similarities with other Nordic countries, such as Sweden and Norway, in its emphasis on social welfare and progressive taxation. However, each country has unique tax rates and regulations, reflecting their specific economic and social priorities.

Are there any tax incentives for startups in Denmark?

+Yes, Denmark offers various tax incentives to support startups and innovative businesses. These include tax breaks for research and development activities, as well as favorable tax treatment for venture capital investments. These measures aim to foster entrepreneurship and technological advancement.

How does Denmark's VAT system affect online shopping?

+Denmark's VAT system applies to both domestic and international online purchases. Businesses selling to Danish consumers must charge and collect VAT, while consumers may be eligible for VAT refunds on certain international purchases, provided they follow the refund process.

Denmark’s tax system is a complex yet integral part of its economic framework, supporting a robust welfare state and sustainable development. Understanding these rates and regulations is crucial for anyone interacting with the Danish economy, ensuring compliance and optimal fiscal management.