Montana State Income Tax

The state of Montana is known for its beautiful landscapes, vibrant outdoor activities, and a unique tax system. One of the key aspects of Montana's tax landscape is its state income tax, which plays a significant role in funding various public services and infrastructure projects. In this comprehensive article, we will delve into the intricacies of Montana's state income tax, exploring its history, structure, rates, and its impact on individuals and businesses within the state.

The History and Evolution of Montana’s State Income Tax

Montana’s journey with state income tax began relatively late compared to many other states. The Montana Income Tax Act was first introduced in 1935, during the depths of the Great Depression. This legislation aimed to provide a stable source of revenue for the state, enabling it to support critical public services and recover from the economic crisis.

Initially, the income tax system in Montana was designed with a progressive rate structure, similar to the federal income tax. This meant that taxpayers with higher incomes were subject to higher tax rates. Over the years, the state has made several amendments to its income tax laws, primarily to adapt to changing economic conditions and to ensure fairness for taxpayers.

One of the most significant reforms occurred in 1972 when Montana introduced its Uniform State Income Tax Act. This act streamlined the tax code, simplified the filing process, and introduced a standard deduction. It also established a single tax rate for all taxpayers, regardless of their income level. This flat tax rate system was a departure from the traditional progressive structure and aimed to provide a more consistent and predictable tax environment.

Since then, Montana has periodically adjusted its tax rates to account for inflation and economic growth. The state has also implemented various tax credits and deductions to support specific industries, promote economic development, and provide relief to certain taxpayer groups.

Understanding Montana’s Current State Income Tax Structure

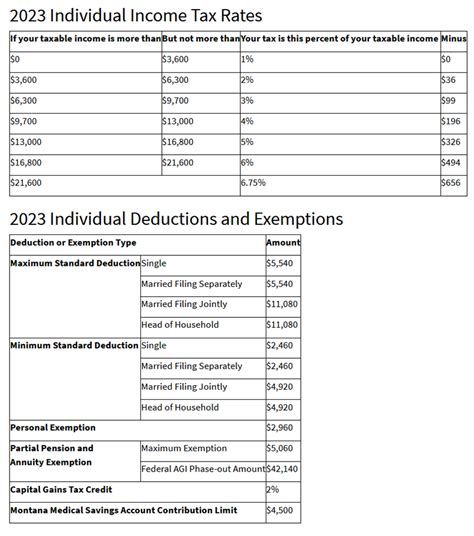

As of my last update in January 2023, Montana operates a flat-rate income tax system, meaning all taxpayers, regardless of their income level, are subject to the same tax rate. This system is straightforward and ensures simplicity in tax filing. The current income tax rate in Montana is set at 6.75% for all taxable income.

It's important to note that Montana's income tax applies to various sources of income, including wages, salaries, commissions, bonuses, and self-employment income. Additionally, income from investments, such as interest, dividends, and capital gains, is also subject to state income tax.

Montana offers several deductions and credits to help reduce the tax burden on individuals and businesses. These include standard deductions, personal exemptions, and credits for specific expenses like child care, education, and property taxes. Moreover, the state allows taxpayers to itemize their deductions, providing flexibility for those with significant medical expenses, charitable contributions, or other eligible expenses.

The state income tax filing process in Montana is relatively straightforward. Taxpayers can file their returns electronically or through traditional paper filing. The state provides user-friendly online tools and resources to assist taxpayers in navigating the process efficiently.

Taxable Income Thresholds

Montana’s income tax applies to all taxable income exceeding a certain threshold. As of my last update, the income threshold for single filers is 2,320</strong>, while for married couples filing jointly, it is <strong>3,090. Any income above these thresholds is subject to the 6.75% tax rate.

| Filing Status | Income Threshold |

|---|---|

| Single | $2,320 |

| Married Filing Jointly | $3,090 |

Impact on Individuals and Businesses

Montana’s state income tax has a direct impact on both individuals and businesses operating within the state. For individuals, the flat tax rate ensures that regardless of their income level, they are treated equally under the tax code. This can provide a sense of fairness and predictability in tax obligations.

The tax system also encourages economic growth by providing a stable and consistent tax environment. Businesses can plan their financial strategies with confidence, knowing that their tax liabilities will remain consistent year after year. This predictability can attract new businesses to the state and foster a thriving business community.

However, it's important to note that the flat tax rate may not provide the same level of progressivity as seen in states with graduated tax systems. Higher-income earners pay the same rate as those with lower incomes, which can result in a less progressive tax structure overall. Nonetheless, Montana's tax system, combined with its business-friendly environment and low cost of living, makes it an attractive destination for entrepreneurs and businesses.

Comparison with Other States

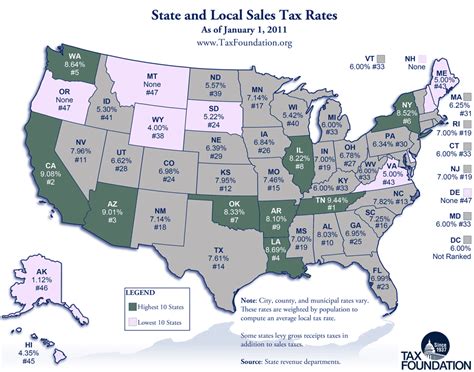

When compared to other states, Montana’s state income tax system stands out for its simplicity and flat rate structure. Many states have progressive tax systems with multiple tax brackets, resulting in varying tax rates for different income levels. Montana’s approach is unique and offers a contrast to the more complex tax landscapes of other states.

For instance, neighboring states like Idaho and Wyoming also have flat tax rates, while states like California and New York have progressive tax systems with multiple brackets. This variability in tax structures across states allows individuals and businesses to make informed decisions about where to reside or operate, considering their tax obligations alongside other factors such as cost of living and business opportunities.

Future Outlook and Potential Reforms

Montana’s state income tax system is continually evolving to meet the needs of its residents and businesses. As the state’s economy grows and adapts to changing times, so too must its tax policies. Future reforms may focus on ensuring the tax system remains fair, efficient, and responsive to the needs of Montanans.

One potential area of focus could be tax incentives for specific industries or regions within the state. By offering targeted tax credits or deductions, Montana could encourage economic development in underserved areas or support emerging industries. This approach has been successful in other states and could provide a strategic tool for Montana's economic growth.

Additionally, with the increasing prevalence of remote work and digital nomads, Montana could explore ways to attract these individuals through tax incentives. By offering favorable tax rates or deductions for remote workers, the state could position itself as an attractive destination for professionals seeking a high quality of life and a low tax burden.

Lastly, as technology advances and tax filing processes become more streamlined, Montana could invest in modernizing its tax administration systems. This could lead to faster refunds, more efficient tax collection, and improved taxpayer services, ultimately enhancing the overall tax experience for Montanans.

Conclusion

Montana’s state income tax system, with its flat rate structure and straightforward filing process, plays a vital role in funding public services and contributing to the state’s economic growth. The tax landscape in Montana provides a balanced approach, offering simplicity and fairness to taxpayers while supporting the state’s vibrant economy.

As Montana continues to evolve and adapt to the changing needs of its residents and businesses, the state income tax system will likely undergo further reforms and improvements. By staying responsive to economic trends and taxpayer needs, Montana can ensure its tax policies remain effective and contribute to the overall well-being of the state.

What is the current state income tax rate in Montana?

+As of my last update, the state income tax rate in Montana is 6.75%.

Does Montana have a progressive tax system?

+No, Montana operates a flat-rate income tax system, meaning all taxpayers, regardless of income level, pay the same tax rate.

Are there any deductions or credits available for taxpayers in Montana?

+Yes, Montana offers various deductions and credits, including standard deductions, personal exemptions, and credits for specific expenses like child care and education.

How does Montana’s state income tax compare to other states?

+Montana’s flat tax rate and simple filing process make it unique compared to states with progressive tax systems and multiple tax brackets. Its tax structure provides a contrast to more complex systems in other states.