Pay Pa Taxes Online

Paying your Pennsylvania state taxes online offers a convenient and efficient way to fulfill your tax obligations. The Pennsylvania Department of Revenue provides a user-friendly platform for residents and businesses to make tax payments securely and promptly. This article will guide you through the process of paying your PA taxes online, offering a step-by-step breakdown, highlighting the benefits, and addressing frequently asked questions to ensure a seamless and stress-free experience.

Understanding the Online Tax Payment Process in Pennsylvania

The PA Department of Revenue has implemented an online tax payment system to streamline the process for taxpayers. This system offers a secure platform for individuals and businesses to pay their taxes promptly and conveniently. Here’s a comprehensive guide to help you navigate the online tax payment process:

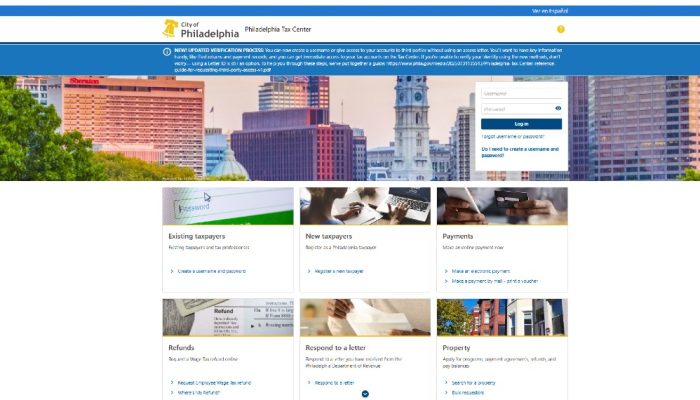

Registration and Login

To access the online tax payment system, you’ll need to register for an account on the PA Department of Revenue website. The registration process is straightforward and typically requires your personal or business details, including your name, address, and taxpayer identification number. Once registered, you’ll receive login credentials to access your account securely.

Selecting the Appropriate Tax Form

The PA tax system covers various tax types, including income tax, sales tax, corporate tax, and more. When logging into your account, you’ll be prompted to select the specific tax form relevant to your payment. Ensure you choose the correct form to avoid any processing delays or errors.

Filling Out the Tax Form

After selecting the appropriate tax form, you’ll be guided through a series of fields to complete. These fields typically include personal or business information, income details, deductions, and any applicable credits. Take your time to ensure accuracy, as any mistakes can lead to additional audits or penalties.

Payment Options

The PA Department of Revenue offers a range of payment options to accommodate different preferences and needs. You can choose to pay via credit or debit card, electronic check, or even through your bank’s online bill pay service. Each option has its advantages, so select the one that best suits your financial situation.

Review and Submit

Before finalizing your payment, carefully review all the information you’ve entered. Ensure that the tax form, payment details, and personal information are accurate and up-to-date. Once you’re satisfied, submit your payment, and you’ll receive a confirmation number for your records.

Receipt and Record-Keeping

After successfully submitting your payment, you’ll receive an electronic receipt via email. It’s essential to keep this receipt and any other tax-related documents for your records. These documents may be required for future reference, such as during an audit or for personal financial planning.

Benefits of Paying PA Taxes Online

Paying your Pennsylvania taxes online offers several advantages that make the process more convenient and efficient:

Convenience and Accessibility

The online tax payment system allows you to make payments from the comfort of your home or office. You can access your account and pay your taxes at any time, eliminating the need for in-person visits to tax offices or long waits in line.

Secure and Reliable

The PA Department of Revenue employs advanced security measures to protect your personal and financial information. Rest assured that your data is safe and secure throughout the online payment process.

Real-Time Payment Tracking

When you pay your taxes online, you gain access to real-time payment tracking. This feature allows you to monitor the status of your payment, ensuring that it has been processed and received by the PA Department of Revenue.

Efficient and Timely Payments

Online tax payments are processed quickly, ensuring that your payment reaches the PA Department of Revenue promptly. This efficiency helps you meet your tax obligations without any unnecessary delays.

Reduced Paperwork

By paying your taxes online, you significantly reduce the amount of paperwork involved. The online system automates many processes, eliminating the need for manual forms and reducing the risk of errors associated with paper-based systems.

Frequently Asked Questions (FAQ)

What are the accepted payment methods for PA taxes online?

+The PA Department of Revenue accepts various payment methods, including credit and debit cards (Visa, MasterCard, Discover, and American Express), electronic checks, and online bill pay services through your bank.

How do I know if my online tax payment has been successful?

+After submitting your payment, you’ll receive an electronic confirmation via email. This confirmation serves as proof of your successful payment and includes a unique confirmation number for future reference.

Can I pay my PA taxes in installments online?

+Yes, the PA Department of Revenue offers an installment payment plan for certain taxes. You can set up this plan online, allowing you to make regular payments over a specified period. Contact the PA Department of Revenue for more details and eligibility requirements.

Are there any fees associated with online tax payments in PA?

+The PA Department of Revenue does not charge any fees for online tax payments. However, third-party payment processors may impose their fees for credit or debit card transactions. Always review the terms and conditions of the payment processor before finalizing your payment.

What should I do if I encounter technical issues while paying my taxes online?

+If you face any technical difficulties, contact the PA Department of Revenue’s technical support team. They can assist you with troubleshooting and ensure a smooth online payment experience. You can reach them through their website or by phone during business hours.

Paying your Pennsylvania taxes online is a secure, efficient, and convenient way to fulfill your tax obligations. By following the step-by-step guide and leveraging the benefits of the online system, you can ensure a stress-free tax payment process. Remember to keep your tax-related documents organized and reach out to the PA Department of Revenue for any further assistance or inquiries.