Tax Map Nyc

Welcome to our comprehensive guide on the Tax Map NYC, an essential tool for understanding the intricate world of property taxes in New York City. As a resident or property owner in this vibrant metropolis, it's crucial to have a clear understanding of the tax assessment process and how it impacts your finances. This article will delve into the details of the Tax Map NYC, exploring its purpose, functionality, and its role in determining property values and tax liabilities.

Unveiling the Tax Map NYC: A Comprehensive Guide

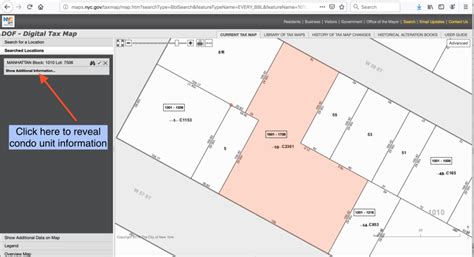

The Tax Map NYC, officially known as the New York City Tax Map, is a sophisticated digital mapping system that serves as a fundamental resource for property tax assessment and management. Developed and maintained by the New York City Department of Finance, this innovative tool plays a pivotal role in ensuring the fairness and efficiency of the city's property tax system.

The Tax Map NYC provides a detailed visual representation of every taxable property in the city, offering a wealth of information that is vital for property owners, real estate professionals, and government agencies alike. By integrating advanced geographic information systems (GIS) technology, the Tax Map NYC presents a comprehensive view of the city's property landscape, enabling users to explore and analyze property data with precision and ease.

The Purpose and Functionality of the Tax Map NYC

At its core, the Tax Map NYC serves as a critical tool for property tax assessment, providing a visual framework for the city's complex tax system. Here's a closer look at its key purposes and functionalities:

- Property Identification: The Tax Map NYC assigns a unique identification number to each taxable property in the city. This number, known as the Block and Lot Number, serves as a crucial identifier for property records and tax assessments.

- Geographic Representation: The Tax Map NYC offers a visual map of New York City, displaying the location and boundaries of every taxable property. This visual representation is invaluable for understanding the spatial distribution of properties and their relationships to surrounding areas.

- Property Attributes: By accessing the Tax Map NYC, users can retrieve detailed information about individual properties. This includes data such as property dimensions, land area, building size, and any relevant improvements or structures. These attributes are essential for accurate property valuation and tax assessment.

- Tax Assessment Information: The Tax Map NYC integrates with the city's tax assessment records, providing access to crucial tax-related data. Users can view property assessments, tax rates, and estimated tax liabilities. This information is vital for property owners to understand their tax obligations and for real estate professionals to make informed investment decisions.

- Historical Data: The Tax Map NYC maintains a historical record of property assessments and tax-related changes. This feature allows users to track the evolution of property values over time, providing valuable insights into market trends and property appreciation.

Navigating the Tax Map NYC: A User's Guide

Exploring the Tax Map NYC is a straightforward process, thanks to its user-friendly interface and intuitive design. Here's a step-by-step guide to help you navigate this powerful tool:

- Access the Tax Map NYC: Visit the official website of the New York City Department of Finance, where you'll find a dedicated section for the Tax Map NYC. The website provides clear instructions and a user-friendly interface to guide you through the process.

- Search for a Property: Begin by entering the address or Block and Lot Number of the property you wish to explore. The system will then display the property's location on the map, along with relevant details and attributes.

- Explore Property Information: Click on the property's icon or marker on the map to access a detailed information panel. Here, you'll find key attributes, assessment data, and tax-related information. You can also zoom in and out to explore the property's surroundings and neighboring properties.

- Analyze Historical Data: The Tax Map NYC allows you to delve into historical records by selecting a specific year. This feature provides a unique perspective on property value changes and market trends over time.

- Download and Share Data: The Tax Map NYC offers the option to download property data in various formats, such as CSV or PDF. This allows you to save and share the information for future reference or analysis.

The Impact of the Tax Map NYC on Property Owners

The Tax Map NYC has a significant impact on property owners in New York City, offering numerous benefits and empowering them with valuable insights. Here's how it affects property owners:

- Transparency and Fairness: The Tax Map NYC ensures transparency in the property tax assessment process. Property owners can access their own assessment data and compare it with neighboring properties, promoting fairness and accountability in the tax system.

- Understanding Tax Obligations: With access to detailed tax assessment information, property owners can gain a clear understanding of their tax liabilities. This knowledge enables them to plan their finances effectively and make informed decisions regarding property ownership.

- Appealing Assessments: In cases where property owners believe their assessment is inaccurate, the Tax Map NYC provides the necessary data to support their case. By presenting precise property attributes and historical trends, property owners can make a compelling argument for a tax assessment appeal.

- Market Insights: The Tax Map NYC offers valuable insights into the real estate market. Property owners can analyze property values and trends in their neighborhood, helping them make informed decisions about property investments, renovations, or even selling their properties.

The Future of Property Tax Assessment in NYC

The Tax Map NYC represents a significant advancement in property tax assessment and management. As technology continues to evolve, the future of this system holds even more promise. Here's a glimpse into the potential advancements:

- Integration with Real-Time Data: Future iterations of the Tax Map NYC may integrate with real-time data sources, such as property sales records and market trends. This would provide an even more dynamic view of property values and market conditions.

- AI-Powered Analysis: Artificial Intelligence (AI) can play a crucial role in enhancing the Tax Map NYC's capabilities. AI algorithms can analyze vast amounts of data, identify patterns, and provide predictive insights, further improving the accuracy and efficiency of property tax assessments.

- Mobile Accessibility: With the increasing reliance on mobile devices, a mobile-optimized version of the Tax Map NYC could be developed. This would allow property owners and professionals to access property data and perform assessments on the go, enhancing convenience and accessibility.

- Community Engagement: The Tax Map NYC could be expanded to include community engagement features, allowing residents to provide feedback and report property-related issues. This collaborative approach could improve the accuracy of property data and foster a sense of community involvement.

Conclusion

The Tax Map NYC is an invaluable resource for property owners, real estate professionals, and government agencies alike. By providing a comprehensive view of the city's property landscape and offering detailed tax assessment information, it empowers users to make informed decisions and ensures a fair and efficient tax system. As technology continues to advance, the Tax Map NYC is poised to play an even more pivotal role in shaping the future of property tax assessment in New York City.

How often is the Tax Map NYC updated with new data?

+The Tax Map NYC is updated periodically, typically once a year, to reflect the latest property assessments and tax-related changes. These updates ensure that the data remains accurate and up-to-date.

Can I challenge my property assessment using the Tax Map NYC data?

+Absolutely! The Tax Map NYC provides valuable data that can be used to support a property assessment challenge. By comparing your property’s assessment with neighboring properties and analyzing historical trends, you can build a strong case for an appeal.

Is the Tax Map NYC accessible to the general public?

+Yes, the Tax Map NYC is accessible to the general public. Anyone with an interest in property tax assessment or real estate can explore the tool and access valuable property data. It is a powerful resource for both professionals and individuals alike.