What Sales Tax In New York

The sales tax in New York is a crucial aspect of doing business in the state, impacting both retailers and consumers alike. With a complex tax structure and varying rates, understanding the ins and outs of New York sales tax is essential for compliance and strategic planning. This article aims to provide an in-depth exploration of the topic, covering everything from the basic mechanics to advanced considerations.

Unraveling New York Sales Tax

New York's sales tax is a consumption tax imposed on the sale of goods and certain services within the state. The tax is collected by retailers at the point of sale and remitted to the New York State Department of Taxation and Finance (NYSDTF). The tax revenue generated is a significant source of funding for state and local governments, supporting vital services and infrastructure.

The sales tax in New York operates on a multi-level tax system, with rates varying across different counties and municipalities. The state sets a base sales tax rate, which is then supplemented by local tax rates, resulting in a combined sales tax rate unique to each jurisdiction.

The Base Sales Tax Rate

The base sales tax rate in New York is currently set at 4%. This rate applies uniformly across the state, serving as the foundation for the more complex local tax rates.

Local Sales Tax Rates

On top of the base rate, local governments in New York have the authority to impose additional sales taxes. These local taxes can vary significantly, leading to a diverse range of sales tax rates across the state.

| County/Municipality | Local Sales Tax Rate | Combined Rate |

|---|---|---|

| Albany County | 3% | 7% |

| New York City | 4.5% | 8.875% |

| Erie County | 3% | 7% |

| Monroe County | 2% | 6% |

| Onondaga County | 3% | 7% |

The table above provides a glimpse into the diverse local sales tax rates in New York. It's important to note that this is just a snapshot, as each county and municipality may have unique rates and additional considerations.

Exemptions and Special Considerations

New York's sales tax system also includes various exemptions and special considerations, which can further complicate the tax landscape. Some goods and services are exempt from sales tax, while others may be subject to reduced tax rates or special tax treatment. For instance, certain food items, prescription drugs, and clothing below a certain price point are often exempt from sales tax.

Compliance and Registration

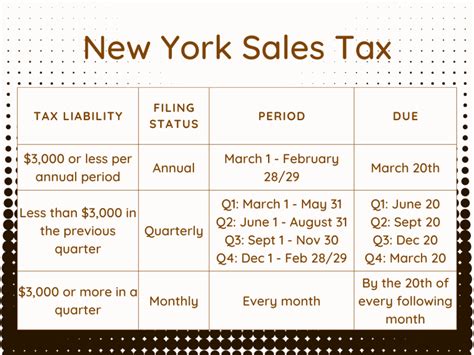

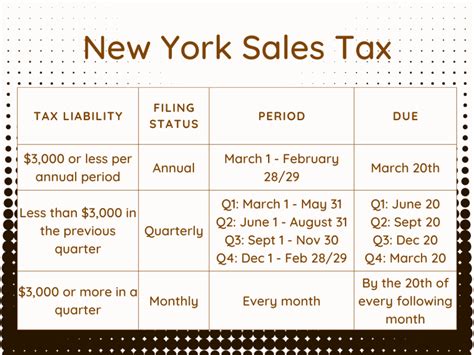

For businesses operating in New York, understanding and complying with sales tax regulations is essential. This involves registering with the NYSDTF, collecting and remitting sales tax accurately, and keeping detailed records. Non-compliance can result in penalties and interest charges, making it crucial for businesses to stay informed and up-to-date with the latest tax regulations.

Businesses with a physical presence in New York, such as brick-and-mortar stores, are generally required to collect and remit sales tax on all taxable sales within the state. However, the rise of e-commerce has introduced new considerations, with remote sellers often required to collect and remit sales tax based on specific criteria.

Sales Tax for Consumers

From a consumer perspective, understanding sales tax is essential for budgeting and financial planning. The sales tax rate applicable to a purchase depends on the location of the sale, with consumers often paying the combined sales tax rate of the jurisdiction where the purchase is made.

For online purchases, the sales tax rate can be more complex, as it may depend on the ship-to location or the seller's nexus (physical presence) in the state. Consumers should be aware of these nuances, as they can impact the final cost of their purchases.

Strategic Considerations for Businesses

The diverse sales tax landscape in New York presents both challenges and opportunities for businesses. Strategic planning can help businesses navigate these complexities, optimize their tax obligations, and potentially reduce their tax burden.

For instance, businesses with multiple locations or online sales may benefit from tax software and automation tools to ensure accurate tax collection and reporting. Additionally, understanding the tax implications of inventory management, drop shipping, and fulfillment strategies can help businesses make informed decisions to minimize tax liabilities.

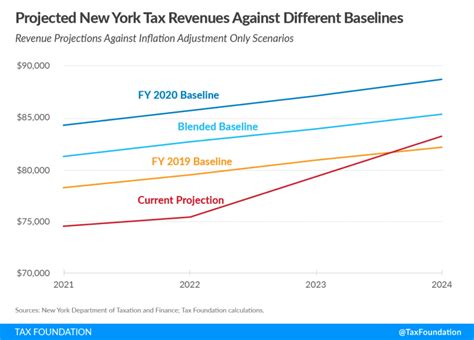

The Future of New York Sales Tax

The sales tax landscape in New York is dynamic, with ongoing debates and potential reforms. As e-commerce continues to grow, the state may explore new ways to collect sales tax from remote sellers, ensuring a fair and equitable tax system. Additionally, there may be discussions around simplifying the tax structure or introducing new exemptions to support specific industries or initiatives.

Staying informed about these potential changes is crucial for businesses and consumers alike, as they can significantly impact financial planning and strategic decision-making.

Conclusion

New York's sales tax is a multifaceted topic, with a diverse range of rates, exemptions, and considerations. Whether you're a business owner navigating the complexities of tax compliance or a consumer planning your finances, understanding the sales tax landscape is essential. This article aims to provide a comprehensive guide, offering valuable insights and strategic considerations to help you navigate the world of New York sales tax.

What is the current base sales tax rate in New York?

+The current base sales tax rate in New York is 4%.

Are there any goods or services exempt from sales tax in New York?

+Yes, New York has various exemptions, including certain food items, prescription drugs, and clothing below a certain price threshold.

How does New York collect sales tax from remote sellers?

+New York has specific criteria for remote sellers, often based on their nexus or economic presence in the state. Remote sellers may be required to collect and remit sales tax if they meet these criteria.

Can businesses in New York offer tax-free promotions?

+Yes, businesses can absorb the sales tax or offer tax-free promotions to boost sales and customer loyalty. However, there may be restrictions and considerations to ensure compliance.

How often do sales tax rates change in New York?

+Sales tax rates can change periodically, often as a result of legislative changes or local government decisions. It’s essential to stay updated with the latest rates to ensure compliance.