Does Mississippi Have A State Tax

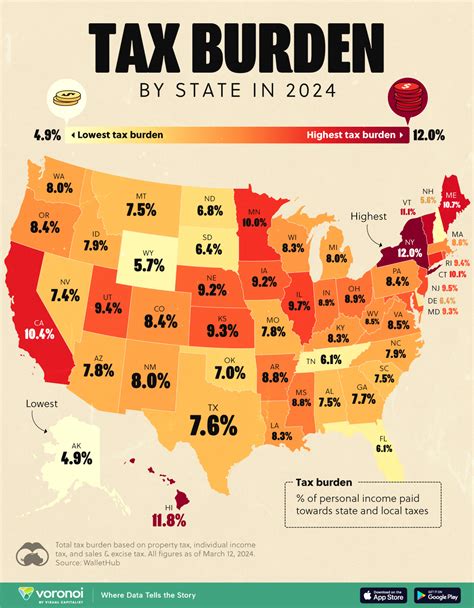

In the state of Mississippi, tax policies play a crucial role in shaping the economic landscape and influencing the lives of its residents. The state tax system in Mississippi is designed to generate revenue for various public services and infrastructure development. This article aims to provide an in-depth analysis of Mississippi's state tax system, exploring its structure, key components, and implications for individuals and businesses within the state.

Understanding Mississippi’s State Tax Structure

Mississippi, like many other states in the United States, imposes a variety of taxes to fund essential government operations and public projects. The state tax structure in Mississippi primarily consists of:

- Income Tax: Mississippi levies an individual income tax on residents and non-residents with taxable income earned within the state. The income tax rates vary based on income brackets, with higher rates applied to higher income levels.

- Sales and Use Tax: This tax is imposed on the sale of tangible personal property and certain services. The state sales tax rate in Mississippi is [X%], and it is collected by retailers at the point of sale. Additionally, a use tax is applied to out-of-state purchases that are brought into Mississippi for use.

- Property Tax: Mississippi relies on property taxes to fund local governments and school districts. The property tax rate is determined by the assessed value of the property and varies across counties and municipalities.

- Corporate Income Tax: Businesses operating in Mississippi are subject to a corporate income tax. The tax rate and filing requirements vary depending on the legal structure of the business, such as corporations, partnerships, or limited liability companies (LLCs).

- Other Taxes: Mississippi also imposes various other taxes, including franchise taxes, estate and inheritance taxes, and fuel taxes. These taxes contribute to specific government programs and infrastructure projects.

Income Tax: A Closer Look

The income tax system in Mississippi follows a progressive tax structure, meaning that higher income earners pay a higher percentage of their income in taxes. The state’s income tax brackets and rates are regularly reviewed and adjusted to ensure fairness and revenue adequacy.

| Income Bracket | Tax Rate |

|---|---|

| Up to $5,000 | 2.0% |

| $5,001 - $10,000 | 3.5% |

| $10,001 - $25,000 | 4.0% |

| $25,001 - $50,000 | 5.0% |

| Over $50,000 | 5.5% |

Mississippi offers several tax credits and deductions to individuals and families to reduce their taxable income. These include credits for dependent care expenses, educational expenses, and certain charitable contributions. Additionally, the state provides tax incentives to attract businesses and promote economic growth.

Sales and Use Tax: Impact on Consumers

The sales and use tax in Mississippi affects consumers directly, as it is added to the purchase price of goods and services. While the state sales tax rate remains consistent across the state, local governments have the authority to impose additional sales taxes, leading to variations in the total sales tax rate across different municipalities.

For example, in the city of Jackson, the combined state and local sales tax rate is [X%], while in the town of Hattiesburg, it is [Y%]. These differences can influence consumer behavior and business decisions, as individuals may choose to shop in areas with lower sales tax rates.

Property Tax: Funding Local Services

Property taxes in Mississippi are an essential source of revenue for local governments and school districts. The property tax rate is determined by the assessed value of the property and the millage rate set by the local taxing authority. Millage rates vary significantly across counties and municipalities, leading to differences in property tax burdens.

For instance, in County A, the millage rate is [X mills], resulting in an effective property tax rate of [Y%], while in County B, the millage rate is [Z mills], leading to an effective rate of [W%]. These variations can impact the affordability of homeownership and the overall cost of living in different regions of the state.

Tax Incentives and Economic Development

Mississippi offers a range of tax incentives to attract businesses and promote economic growth. These incentives are designed to encourage investment, job creation, and business expansion within the state. Some of the key tax incentives include:

- Enterprise Zones: Designated areas within the state offer reduced tax rates and other incentives to businesses that locate or expand within these zones.

- Research and Development Credits: Mississippi provides tax credits for businesses engaged in research and development activities, encouraging innovation and technological advancements.

- Job Creation Incentives: The state offers tax credits and exemptions to businesses that create a significant number of new jobs, particularly in targeted industries.

- Infrastructure Investment Credits: Businesses that invest in infrastructure improvements, such as building or expanding manufacturing facilities, may be eligible for tax credits.

Impact on Business Growth

These tax incentives have proven to be effective in attracting new businesses and supporting existing ones. By offering reduced tax burdens and other benefits, Mississippi has been able to foster economic growth and create a favorable business environment. As a result, the state has experienced an influx of new businesses and investments, particularly in industries such as manufacturing, technology, and healthcare.

Tax Administration and Compliance

The Mississippi Department of Revenue is responsible for administering and enforcing the state’s tax laws. The department provides guidance, assistance, and resources to taxpayers to ensure compliance with tax regulations. It also conducts audits and enforces tax collection to maintain revenue integrity.

Taxpayers in Mississippi have access to various resources and support, including online tax filing platforms, tax guides, and taxpayer assistance centers. The state encourages taxpayers to stay informed about their tax obligations and offers resources to help navigate the tax system effectively.

Conclusion: Mississippi’s Tax Landscape

Mississippi’s state tax system is a vital component of the state’s economic framework, generating revenue to support essential services and infrastructure development. The state’s tax policies, including income, sales, and property taxes, along with various incentives, shape the economic landscape and influence the lives of its residents and businesses.

By understanding the structure and implications of Mississippi's state tax system, individuals and businesses can make informed decisions, plan their finances effectively, and contribute to the state's economic growth. As Mississippi continues to evolve and adapt its tax policies, the state remains committed to creating a balanced and sustainable tax environment for its citizens and businesses.

What is the current state sales tax rate in Mississippi?

+The current state sales tax rate in Mississippi is [X%]. This rate is applied to the sale of tangible personal property and certain services.

Are there any tax breaks or incentives for senior citizens in Mississippi?

+Yes, Mississippi offers tax exemptions and credits for senior citizens. These include exemptions on certain types of property taxes and credits for qualified senior citizen homeowners.

How does Mississippi compare to other states in terms of corporate income tax rates?

+Mississippi’s corporate income tax rate is relatively competitive compared to other states. The state offers a flat tax rate of [X%] for corporations, which is lower than many other states in the region.

Are there any special tax incentives for renewable energy projects in Mississippi?

+Yes, Mississippi provides tax incentives for renewable energy projects. These incentives include tax credits for the installation of solar and wind energy systems, as well as exemptions for certain renewable energy equipment.

How often are Mississippi’s tax laws reviewed and updated?

+Mississippi’s tax laws are regularly reviewed and updated to ensure fairness and align with the state’s economic goals. The Mississippi Legislature convenes annually to consider tax policy changes, and amendments to tax laws are proposed and enacted through the legislative process.