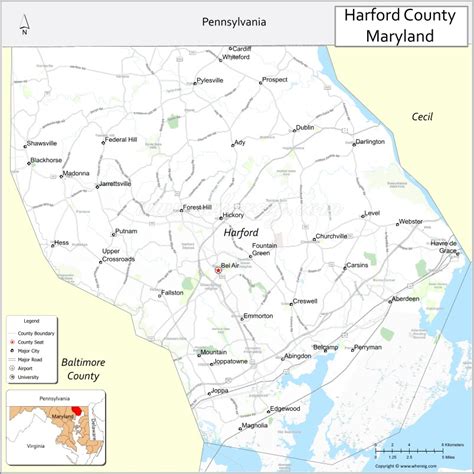

Harford County Real Estate Taxes

Understanding the intricacies of real estate taxes is crucial for homeowners and prospective buyers alike. In Harford County, Maryland, these taxes play a significant role in property ownership, influencing not only the financial obligations of homeowners but also the broader economic landscape of the region. This article aims to provide an in-depth analysis of Harford County's real estate tax system, exploring its mechanics, rates, and potential implications.

The Foundation of Harford County’s Real Estate Tax System

The real estate tax system in Harford County, like many other jurisdictions, is designed to generate revenue for the local government to fund essential services and infrastructure. This tax is levied on the assessed value of real property, including land and buildings. The assessment process is a critical component of this system, determining the taxable value of each property.

In Harford County, the Department of Assessment and Taxation is responsible for conducting assessments every three years. These assessments are based on a variety of factors, including property type, size, location, and recent sales data. The assessed value is then multiplied by the tax rate to determine the annual tax liability for each property owner.

The current assessment cycle for Harford County covers the years 2021 through 2023. During this period, the county conducted a comprehensive reassessment of all properties, with the primary goal of ensuring fairness and accuracy in the tax system. This reassessment process takes into account changes in the real estate market, ensuring that property values are reflective of current market conditions.

Assessment Methodology: A Closer Look

The assessment process in Harford County involves a detailed examination of each property. Assessors consider the property’s physical characteristics, such as the number of rooms, square footage, and any improvements or additions. They also analyze recent sales of similar properties in the area to establish a fair market value. This market-based approach aims to ensure that properties are assessed at their true and full value.

To maintain transparency and fairness, the Department of Assessment and Taxation provides property owners with access to their assessment records. This allows homeowners to review the data used to determine their property's value and, if necessary, dispute the assessment if they believe it is inaccurate or unfair. The dispute process typically involves a review by an independent assessment review board.

Real Estate Tax Rates in Harford County

The real estate tax rate in Harford County is set by the County Council and can vary from year to year. For the current fiscal year (FY) 2024, the tax rate is 0.899 per 100 of assessed value. This rate is applied uniformly across all property types, whether residential, commercial, or agricultural.

| Property Type | Tax Rate (FY 2024) |

|---|---|

| Residential | $0.899 per $100 of assessed value |

| Commercial | $0.899 per $100 of assessed value |

| Agricultural | $0.899 per $100 of assessed value |

It's important to note that the tax rate can be subject to change based on budgetary needs and the county's financial goals. Property owners should stay informed about any potential rate adjustments, as these can significantly impact their annual tax obligations.

Calculating Real Estate Taxes: A Step-by-Step Guide

Calculating real estate taxes involves a straightforward process that homeowners can follow to estimate their annual tax liability. Here’s a step-by-step guide to understanding this calculation:

-

Determine Your Property's Assessed Value: This value is set by the Department of Assessment and Taxation and is typically based on the property's fair market value. You can find this information on your property assessment notice or by contacting the assessment office.

-

Apply the Tax Rate: For the current fiscal year, the tax rate is $0.899 per $100 of assessed value. To calculate your tax liability, multiply your property's assessed value by the tax rate.

-

Consider Additional Factors: In some cases, there may be additional charges or credits that impact your final tax bill. These could include exemptions, credits, or special assessments. Check with the tax office to understand any applicable adjustments.

By following these steps, homeowners can estimate their real estate tax obligations and plan their finances accordingly. It's essential to note that while this calculation provides a useful estimate, the actual tax bill may vary slightly due to factors like changes in the tax rate or assessment adjustments.

Real-World Impact: Understanding the Financial Implications

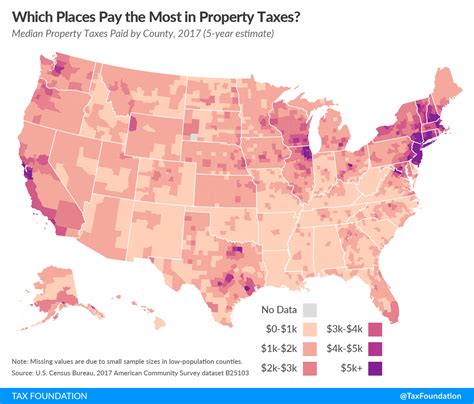

Real estate taxes in Harford County have a tangible impact on the financial well-being of homeowners and the overall economy of the region. For individual property owners, these taxes represent a significant expense, often the largest annual cost associated with homeownership.

The financial implications of real estate taxes can be substantial. A property with an assessed value of $250,000, for instance, would have an annual tax bill of approximately $2,247.50 (based on the current tax rate). This amount can vary depending on factors such as property value, tax rate changes, and any applicable credits or exemptions.

From a broader perspective, real estate taxes contribute significantly to the county's revenue stream. This revenue is crucial for funding essential services, such as education, public safety, and infrastructure development. By investing in these areas, the county can foster economic growth, improve quality of life, and attract businesses and residents.

The Impact on Homeownership

Real estate taxes can influence homeownership rates and property values. High tax burdens may deter potential buyers, especially first-time homebuyers, who may find it challenging to afford the associated costs. On the other hand, well-managed tax policies can encourage homeownership by making it more affordable.

Harford County's real estate tax system, including initiatives like the homestead tax credit, aims to strike a balance between generating revenue and promoting homeownership. By offering incentives and ensuring fair assessments, the county can create a stable housing market, benefiting both residents and the local economy.

Economic Growth and Development

Real estate taxes are a vital component of the county’s economic strategy. The revenue generated from these taxes allows Harford County to invest in infrastructure projects, support local businesses, and enhance the overall business climate. This, in turn, can lead to job creation, increased tax base, and a more vibrant local economy.

The county's commitment to responsible tax policies and efficient use of tax revenue is evident in its investment in key sectors. For instance, the allocation of funds towards education can enhance the skill set of the local workforce, making the county more attractive to businesses. Similarly, investments in infrastructure can improve transportation, communication, and utility systems, further boosting economic growth.

Navigating the Real Estate Tax Landscape: Tips for Homeowners

Understanding and managing real estate taxes is an essential part of homeownership. Here are some practical tips to help Harford County homeowners navigate the tax landscape:

-

Stay Informed: Keep yourself updated on tax rates, assessment processes, and any changes in the real estate tax system. This information is readily available on the county's official websites and can help you plan your finances effectively.

-

Review Your Assessment: When you receive your property assessment notice, review it carefully. Ensure that the details, including the property description and assessed value, are accurate. If you have any concerns or believe the assessment is incorrect, you can initiate a dispute through the assessment review process.

-

Explore Tax Credits and Exemptions: Harford County offers various tax credits and exemptions that can reduce your tax liability. These include the homestead tax credit, senior citizen tax credit, and disability tax credit. Check your eligibility and apply for these benefits to lower your tax burden.

-

Consider Tax-Efficient Home Improvements: Certain home improvements can increase your property's value, but they may also lead to higher tax assessments. Before making significant improvements, consider the potential tax implications. You may want to consult a tax professional or the assessment office for guidance.

-

Budget and Plan: Real estate taxes are a recurring expense. Include these taxes in your annual budget and plan your finances accordingly. Consider setting aside funds specifically for tax payments to ensure you can meet your obligations without financial strain.

By being proactive and informed, homeowners can effectively manage their real estate tax obligations and ensure that their financial planning aligns with the county's tax system.

The Future of Real Estate Taxes in Harford County

As Harford County continues to evolve and grow, its real estate tax system will likely undergo changes to adapt to the region’s needs. The county’s leadership and policymakers play a crucial role in shaping the future of this system, ensuring that it remains fair, efficient, and aligned with the community’s interests.

Potential Changes and Their Implications

The real estate tax landscape in Harford County could see several changes in the coming years. These may include adjustments to the tax rate, reassessment intervals, and the introduction of new tax credits or exemptions. While these changes are designed to improve the system, they can also have significant implications for homeowners.

For instance, a reduction in the tax rate could provide immediate relief to homeowners, lowering their annual tax obligations. On the other hand, a decrease in the reassessment interval (the frequency of property assessments) could lead to more frequent adjustments in tax liabilities, potentially resulting in increased taxes for some homeowners.

The introduction of new tax credits or exemptions can benefit specific groups, such as senior citizens or low-income homeowners, by reducing their tax burden. However, it's essential to consider the overall impact on the county's revenue stream and the potential need for alternative funding sources to maintain essential services.

The Role of Technology and Data

Advancements in technology and data analytics are likely to play a more significant role in Harford County’s real estate tax system. These tools can enhance the accuracy and efficiency of assessments, providing a more precise determination of property values. This, in turn, can lead to a fairer distribution of tax obligations among property owners.

By leveraging technology, the county can streamline the assessment process, making it more transparent and accessible to homeowners. This can include online platforms for property owners to access assessment records, dispute resolutions, and tax payment options. Such initiatives can improve the overall homeowner experience and foster trust in the tax system.

Community Engagement and Feedback

Community engagement is vital to shaping the future of Harford County’s real estate tax system. By involving residents in the decision-making process, the county can ensure that tax policies are reflective of the community’s needs and aspirations. This can be achieved through town hall meetings, surveys, and other forms of public consultation.

Listening to the feedback and concerns of homeowners and businesses can provide valuable insights into the effectiveness of the tax system and identify areas for improvement. This collaborative approach can lead to more equitable tax policies, fostering a sense of ownership and trust among residents.

Conclusion

In conclusion, the real estate tax system in Harford County is a critical component of the local economy, impacting both individual homeowners and the broader community. By understanding the mechanics, rates, and implications of this system, homeowners can make informed decisions and effectively manage their tax obligations.

As Harford County continues to grow and evolve, the real estate tax system will adapt to meet the changing needs of the community. By staying informed, engaging in the decision-making process, and leveraging technological advancements, the county can ensure a fair, efficient, and sustainable tax system that benefits all residents.

How often are property assessments conducted in Harford County?

+Property assessments in Harford County are conducted every three years. The current assessment cycle covers the years 2021 through 2023.

Can I dispute my property assessment if I believe it is incorrect?

+Yes, if you have concerns about the accuracy of your property assessment, you can initiate a dispute through the assessment review process. This process involves submitting a formal appeal and providing evidence to support your case.

Are there any tax credits or exemptions available in Harford County?

+Yes, Harford County offers various tax credits and exemptions, including the homestead tax credit, senior citizen tax credit, and disability tax credit. These credits can reduce your tax liability and make homeownership more affordable.

How can I stay updated on changes to the real estate tax system in Harford County?

+You can stay informed by regularly checking the official websites of Harford County and the Department of Assessment and Taxation. These websites often provide updates on tax rates, assessment processes, and any changes to the real estate tax system.

What resources are available to help me understand and manage my real estate tax obligations in Harford County?

+The Department of Assessment and Taxation offers a wealth of resources, including online tools, guides, and contact information for assistance. You can also consult tax professionals or seek advice from community organizations that specialize in homeowner support.