Ca State Tax Withholding Form

The California state tax withholding form is an essential document for employees and employers alike, ensuring proper tax deductions and compliance with state regulations. This comprehensive guide will delve into the intricacies of the CA State Tax Withholding Form, offering an in-depth analysis of its purpose, structure, and implications.

Understanding the CA State Tax Withholding Form

The CA State Tax Withholding Form, also known as Form DE 4, is a crucial component of California’s tax system. It serves as an instruction manual for employers, guiding them on how much state income tax to withhold from an employee’s wages. This form plays a vital role in ensuring that employees pay their fair share of taxes and that the state receives the necessary revenue to fund public services.

The Purpose and Importance of Form DE 4

The primary purpose of Form DE 4 is to determine the correct tax withholding amount for each employee. It achieves this by considering various factors, including the employee’s filing status, allowances, and other deductions. By accurately completing this form, employers can ensure that employees’ tax obligations are met, reducing the likelihood of penalties or surprises at tax time.

Moreover, the form's role extends beyond mere tax collection. It is an essential tool for maintaining financial stability and promoting economic growth in California. By ensuring a steady flow of tax revenue, the state can invest in infrastructure, education, healthcare, and other critical areas, ultimately benefiting its residents and businesses.

Key Components and Instructions

Form DE 4 is a straightforward document, designed to be user-friendly for both employees and employers. It typically consists of the following sections:

- Employee Information: This section requires basic details such as the employee's name, address, Social Security Number, and date of birth. It is crucial to provide accurate information to avoid processing delays and potential identity issues.

- Withholding Allowances: Here, employees indicate their filing status (single, married, head of household, etc.) and the number of allowances they wish to claim. This section directly impacts the amount of tax withheld from their wages.

- Additional Withholding: Some employees may choose to have additional tax withheld from their paychecks to cover potential tax liabilities or to save for specific financial goals. This section allows them to specify the additional amount they wish to have deducted.

- Certifications and Signatures: Both the employee and the employer must sign the form, acknowledging its accuracy and understanding of the withholding instructions. This section also includes important certifications regarding the employee's tax status and the employer's responsibility to withhold taxes.

The form provides clear instructions and examples to guide employees and employers through the process. It is essential to read and follow these instructions carefully to ensure accurate tax withholding.

Navigating the Withholding Process

The tax withholding process in California is designed to be efficient and straightforward. However, understanding the various factors that influence withholding can be complex. Here’s a closer look at some key aspects:

Determining Withholding Allowances

The number of withholding allowances an employee claims on Form DE 4 is a critical factor in determining their tax liability. Allowances reduce the amount of tax withheld from an employee’s paycheck, effectively increasing their take-home pay. The number of allowances claimed should reflect the employee’s personal circumstances and financial obligations.

For instance, employees with dependents may claim additional allowances, reducing their tax burden. On the other hand, employees with significant income or high tax liabilities may choose to claim fewer allowances to ensure they do not owe a large tax bill at the end of the year.

Considerations for Employers

Employers play a vital role in the tax withholding process. They are responsible for ensuring that Form DE 4 is completed accurately and that the appropriate amount of tax is withheld from each employee’s wages. Here are some key considerations for employers:

- Timely Filing: Employers must ensure that Form DE 4 is submitted to the Employment Development Department (EDD) within the specified timeframe. Late submissions can result in penalties and interest charges.

- Accuracy: Accurate completion of the form is essential to avoid employee dissatisfaction and potential legal issues. Employers should double-check the information provided by employees and ensure it aligns with their records.

- Withholding Calculations: Employers must calculate the correct amount of tax to withhold based on the information provided on Form DE 4. This involves using the California Withholding Tax Tables and considering any additional state or local taxes that may apply.

- Regular Review: Tax laws and regulations can change frequently. Employers should stay updated on any changes that may impact their withholding obligations. Regularly reviewing and updating withholding practices is essential to maintain compliance.

California’s Tax Structure and Implications

California’s tax system is complex, with various taxes and rates that can impact individuals and businesses. Understanding these taxes is crucial for both taxpayers and those responsible for withholding.

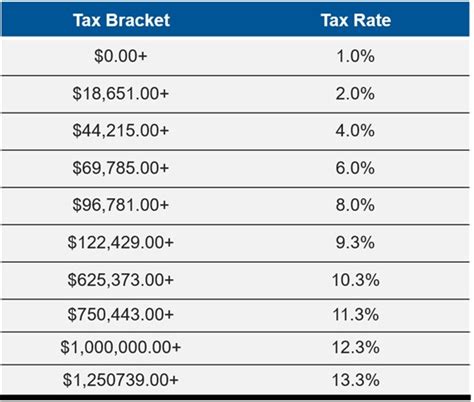

Income Tax Rates and Brackets

California has a progressive income tax system, meaning that higher incomes are taxed at higher rates. The state’s income tax rates range from 1% to 12.3%, with seven tax brackets. The tax rate an individual pays depends on their taxable income, filing status, and the number of allowances claimed.

| Tax Bracket | Tax Rate | Single Filers (Taxable Income) | Married Filing Jointly (Taxable Income) |

|---|---|---|---|

| 1 | 1% | Up to $9,225 | Up to $18,450 |

| 2 | 2% | $9,226 - $21,150 | $18,451 - $42,300 |

| 3 | 4% | $21,151 - $39,000 | $42,301 - $78,000 |

| 4 | 6% | $39,001 - $51,000 | $78,001 - $102,000 |

| 5 | 8% | $51,001 - $248,000 | $102,001 - $496,000 |

| 6 | 9.3% | $248,001 - $570,000 | $496,001 - $1,140,000 |

| 7 | 12.3% | Over $570,000 | Over $1,140,000 |

It's important to note that these rates and brackets are subject to change, and taxpayers should refer to the most recent tax tables and guidelines provided by the Franchise Tax Board (FTB).

Other State Taxes and Withholding Considerations

In addition to income tax, California levies several other taxes that may impact withholding. These include:

- Personal Income Tax: This tax is levied on all taxable income, including wages, salaries, and other sources of income. It is the primary source of revenue for the state.

- Sales and Use Tax: California imposes a sales tax on most goods and services purchased within the state. While this tax is not directly related to withholding, employers should be aware of it when calculating the overall tax burden for employees.

- Property Tax: Property taxes are assessed on real estate and are typically paid by property owners. However, employers should consider the impact of property taxes on their business operations and the potential implications for their employees.

Frequently Asked Questions

What happens if I make a mistake on Form DE 4?

+If you realize you made a mistake on Form DE 4, you should correct it as soon as possible. Employers should submit a corrected form to the EDD, and employees should notify their employer. Delayed corrections may result in penalties or interest charges.

Can I change my withholding allowances during the year?

+Yes, you can change your withholding allowances at any time during the year. You will need to complete a new Form DE 4 and submit it to your employer. This allows you to adjust your tax withholding based on changes in your personal circumstances or financial goals.

How often should employers update their withholding practices?

+Employers should review and update their withholding practices at least annually, but more frequent reviews are recommended. This ensures compliance with changing tax laws and regulations and helps maintain accurate withholding for employees.

Are there any tax credits or deductions available in California?

+Yes, California offers various tax credits and deductions to help reduce the tax burden for individuals and businesses. These include the California Earned Income Tax Credit, Child and Dependent Care Credit, and Personal Income Tax Deductions. It’s important to research and understand these credits and deductions to maximize your tax savings.

Where can I find more information and resources about California state taxes?

+The Franchise Tax Board (FTB) and the Employment Development Department (EDD) are excellent resources for information about California state taxes. Their websites provide comprehensive guides, forms, and updates on tax laws and regulations. Additionally, consulting a tax professional can provide personalized advice and assistance.