Santa Cruz County Property Tax

Welcome to a comprehensive guide on Santa Cruz County property taxes, an essential aspect of homeownership in this vibrant coastal region. Understanding property taxes is crucial for both current and prospective homeowners, as they are a significant factor in the cost of owning a home and can impact financial planning and budgeting. This article will delve into the specifics of property taxes in Santa Cruz County, California, covering tax rates, assessment processes, payment options, and strategies to manage these expenses effectively.

Unraveling the Complexities of Santa Cruz County Property Taxes

Property taxes in Santa Cruz County are governed by a unique set of rules and regulations, reflecting the diverse landscape and thriving communities within the county. With its picturesque beaches, redwood forests, and thriving tech industry, Santa Cruz County offers a desirable lifestyle, but it also presents unique challenges when it comes to property taxation. This section aims to provide an in-depth analysis of the key aspects that homeowners and investors need to be aware of.

Understanding the Property Tax Assessment Process

The assessment process in Santa Cruz County is a critical component of property taxation. It involves the evaluation of each property’s value by the Santa Cruz County Assessor’s Office, which determines the basis for calculating property taxes. This process considers factors such as location, size, improvements, and market conditions. Properties are typically assessed annually, with adjustments made to reflect changes in the real estate market.

One unique aspect of Santa Cruz County's assessment process is the declining-value assessment method, which takes into account the age and depreciation of a property. This method ensures that older properties are not overvalued and can result in lower property taxes for homeowners with long-term residences. However, it also means that newer properties may face higher initial assessments.

The assessor's office maintains a comprehensive Property Information Database, accessible to the public, which provides details on each property's assessment history, ownership records, and relevant tax information. This transparency allows homeowners to understand their property's valuation and how it compares to others in the county.

Santa Cruz County Property Tax Rates: A Comprehensive Breakdown

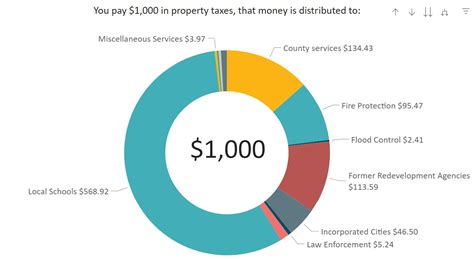

Property tax rates in Santa Cruz County are set by a combination of local, county, and special district agencies. These rates are expressed as a percentage of a property’s assessed value and can vary significantly depending on the specific location within the county.

For the 2023-2024 fiscal year, the average property tax rate in Santa Cruz County is 1.07%, which includes the base rate of 1% set by the State of California, as well as additional rates for local services and infrastructure. However, this average rate can vary greatly depending on the city or area within the county. For instance, properties in the City of Santa Cruz may have a slightly higher rate due to additional city-specific taxes.

| Taxing Agency | Tax Rate (%) |

|---|---|

| Santa Cruz County | 0.2701 |

| Santa Cruz County Education | 0.2186 |

| City of Santa Cruz | 0.2478 |

| Other Special Districts | Varies |

It's important to note that properties within special assessment districts, such as those for flood control or mosquito abatement, may have additional taxes added to their bill. These special assessments are typically used to fund specific services or infrastructure improvements within a defined geographic area.

Managing Property Tax Payments: Strategies and Options

Understanding your payment options and staying on top of your property tax obligations is crucial to maintaining good standing with the county and avoiding penalties. Santa Cruz County offers a variety of payment methods to accommodate different preferences and needs.

Homeowners can choose to pay their property taxes in two installments, typically due in February and November of each year. The county provides a tax bill, which outlines the total amount due, the payment due dates, and any applicable penalties for late payments. It's essential to review these bills carefully to ensure accuracy and to take advantage of any available discounts for early payment.

Santa Cruz County also offers an online payment portal, allowing homeowners to pay their taxes securely via credit card, e-check, or electronic funds transfer. This portal provides real-time updates on payment status and offers the convenience of managing tax payments from anywhere with an internet connection.

For those who prefer more traditional methods, the county accepts payments by mail or in person at the Treasurer-Tax Collector's Office. Payments can be made by check, money order, or cash, with the latter option available only in person. It's important to note that cash payments over $10,000 are not accepted due to federal regulations.

In addition to these standard payment methods, Santa Cruz County also participates in the California Property Tax Deferral Program, which allows eligible senior citizens and disabled homeowners to defer their property tax payments until their property is sold, transferred, or upon the death of the homeowner. This program provides much-needed financial relief for those who may struggle with the burden of high property taxes.

Challenging Your Property Tax Assessment: When and How

In some cases, homeowners may feel that their property’s assessed value is inaccurate or unfair. Santa Cruz County provides a process for appealing property tax assessments, allowing homeowners to challenge the assessed value of their property and potentially lower their tax bill.

The first step in the appeal process is to carefully review your property assessment notice, which is typically mailed out in March of each year. This notice provides details on your property's assessed value, the basis for the assessment, and any changes from the previous year. If you believe the assessed value is incorrect, you can file an Assessment Appeal Application with the Assessment Appeals Board.

To support your appeal, you'll need to provide evidence that your property's assessed value is significantly higher than similar properties in the area or that there are errors in the assessment process. This could include comparable sales data, appraisals, or other relevant documentation. The Assessment Appeals Board will review your application and may schedule a hearing to further evaluate your case.

It's important to note that the appeal process can be complex and time-consuming. To increase your chances of success, it's often beneficial to consult with a property tax professional or attorney who specializes in assessment appeals. They can guide you through the process, help gather the necessary evidence, and represent you at the hearing if needed.

The Impact of Property Taxes on Real Estate Transactions

Property taxes are a significant factor in real estate transactions, influencing both buyers’ decisions and sellers’ strategies. For buyers, understanding the property tax implications can help them budget for their new home and assess the long-term financial viability of a potential purchase.

Sellers, on the other hand, may need to consider the impact of property taxes on their asking price and be prepared to address buyer concerns about tax assessments. It's not uncommon for buyers to request a property tax review as part of their due diligence, especially in areas with high tax rates or complex assessment processes.

Real estate professionals play a crucial role in educating their clients about property taxes and their implications. They can provide insights into local tax rates, assessment practices, and potential strategies to mitigate tax burdens. For example, they might advise buyers on the potential benefits of purchasing a property with a lower assessed value or suggest sellers consider the tax implications when setting their asking price.

Exploring Strategies to Reduce Property Tax Burdens

For homeowners facing high property tax bills, there are several strategies that can help reduce the financial burden. One common approach is to take advantage of any available exemptions or deductions, such as the Homeowners’ Exemption, which can reduce the assessed value of a property by up to $7,000.

Another strategy is to consider a tax appeal, as mentioned earlier. While the appeal process can be complex, a successful appeal can result in a significant reduction in property taxes. Homeowners should carefully evaluate their property's assessed value and compare it to similar properties in the area to determine if an appeal is warranted.

Additionally, homeowners can explore property tax relief programs offered by the state or local government. These programs often provide financial assistance to eligible homeowners, such as seniors, disabled individuals, or those facing financial hardship. For example, the California Property Tax Postponement Program allows eligible homeowners to postpone their property tax payments until their property is sold or transferred.

Homeowners can also consider making strategic improvements to their property that may result in a lower assessed value. For instance, addressing any deferred maintenance issues or making energy-efficient upgrades can potentially reduce the assessed value, especially if these improvements are made prior to the annual assessment date.

The Future of Property Taxation in Santa Cruz County

As Santa Cruz County continues to grow and evolve, the landscape of property taxation is likely to change as well. The county’s leaders and policymakers are constantly evaluating the tax system to ensure it remains fair, efficient, and aligned with the needs of the community.

One key area of focus is ensuring that the property tax system remains equitable, especially as property values continue to rise. The county is exploring ways to balance the need for adequate funding for public services with the potential burden on homeowners, particularly those on fixed incomes or facing economic challenges.

Additionally, the county is investing in technology and data analytics to improve the accuracy and efficiency of the assessment process. By leveraging advanced tools and data-driven insights, the county aims to ensure that property values are assessed fairly and consistently across all neighborhoods and property types.

Looking ahead, the future of property taxation in Santa Cruz County is poised to be shaped by a combination of technological advancements, community input, and a commitment to fairness and transparency. As the county navigates these changes, homeowners can expect a more streamlined and equitable tax system, better aligned with the unique needs and characteristics of this vibrant coastal community.

How are property taxes calculated in Santa Cruz County?

+Property taxes in Santa Cruz County are calculated based on the assessed value of the property, which is determined by the county assessor. The assessed value is then multiplied by the applicable tax rate, which includes the base rate set by the state, as well as additional rates for local services and infrastructure. This calculation results in the total property tax due for the year.

When are property taxes due in Santa Cruz County?

+Property taxes in Santa Cruz County are due in two installments. The first installment is typically due in February, and the second installment is due in November. It’s important to pay these installments on time to avoid late fees and penalties.

How can I pay my property taxes in Santa Cruz County?

+Santa Cruz County offers several payment options for property taxes. You can pay online through the county’s secure payment portal, by mail with a check or money order, or in person at the Treasurer-Tax Collector’s Office. Additionally, you can set up automatic payments through the online portal for added convenience.

What happens if I don’t pay my property taxes on time?

+If you fail to pay your property taxes on time, you may be subject to late fees and penalties. The county may also place a lien on your property, which can affect your credit rating and could lead to foreclosure if the taxes remain unpaid.

Are there any exemptions or deductions available to reduce my property taxes in Santa Cruz County?

+Yes, there are several exemptions and deductions available in Santa Cruz County that can help reduce your property tax burden. These include the Homeowners’ Exemption, which can lower your assessed value by up to $7,000, and the Senior Citizen’s Exemption, which provides a partial or full exemption for eligible seniors. It’s worth exploring these options to see if you qualify.