State Tax Rate In Michigan

The state of Michigan, nestled in the heart of the Great Lakes region, boasts a diverse landscape and a rich cultural heritage. From the bustling city of Detroit to the serene shores of Lake Michigan, the state offers a unique blend of urban and natural attractions. In terms of taxation, Michigan, like many other states, has its own set of tax policies and rates that impact its residents and businesses.

Understanding Michigan’s State Tax Structure

Michigan’s tax system is designed to generate revenue for the state government, which in turn funds various public services and infrastructure projects. The state relies on a combination of taxes, including income tax, sales tax, and property tax, to support its operations and provide essential services to its citizens.

Income Tax in Michigan

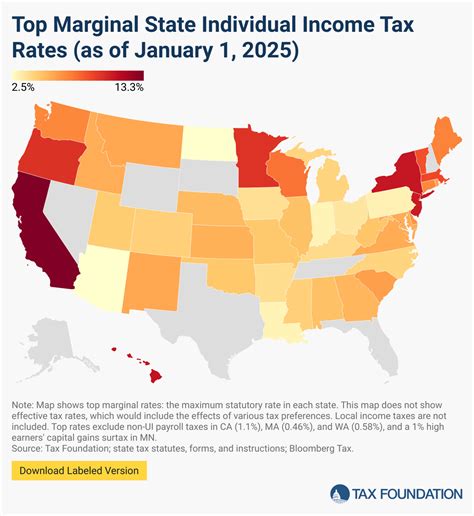

Michigan imposes an individual income tax on its residents, with rates varying depending on the taxpayer’s income bracket. As of my last update in January 2023, Michigan’s income tax rates range from 4.25% to 4.60%. These rates are applied to taxable income, which includes earnings from employment, business profits, and certain types of investment income.

For example, let’s consider a hypothetical case of a single taxpayer named John, who has an annual income of 60,000. In Michigan, John's income would fall into the 4.25% tax bracket, meaning he would owe state income tax at this rate on his taxable income.</p> <table> <tr> <th>Income Tax Bracket</th> <th>Tax Rate</th> </tr> <tr> <td>Up to 36,300 4.25% 36,301 - 54,450 4.275% 54,451 - 90,750 4.35% $90,751 and above 4.60%

It’s important to note that Michigan’s income tax system offers certain deductions and credits, such as the Michigan Earned Income Tax Credit (EITC) and deductions for retirement contributions, which can reduce the overall tax liability for eligible taxpayers.

Sales and Use Tax

Michigan also levies a sales and use tax on the purchase of goods and services within the state. As of my knowledge cutoff, the general sales tax rate in Michigan is 6%. This tax is collected by businesses and remitted to the state government.

For instance, if you buy a new television for 500 in Michigan, you would pay a sales tax of 30 (6% of 500), bringing the total cost to 530. This tax revenue is crucial for funding public projects and maintaining state infrastructure.

Property Tax

Property taxes are another significant source of revenue for Michigan. These taxes are assessed on real estate properties, including land and buildings, and are primarily used to fund local governments and schools. The property tax rates vary by location within the state and are typically determined by the local tax authorities.

Imagine you own a residential property in the city of Grand Rapids. The city’s property tax rate might be around 2% of the property’s assessed value. So, if your property is valued at 200,000, you would owe approximately 4,000 in property taxes annually.

Tax Incentives and Programs

Michigan, like many states, offers various tax incentives and programs to attract businesses and promote economic growth. These initiatives often take the form of tax credits, deductions, or exemptions for specific industries or investments.

Michigan Business Tax Credits

The state provides a range of tax credits to support business growth and job creation. Some notable examples include the Michigan Business Tax Credit, which offers tax credits for business investment and expansion, and the Michigan Economic Development Corporation’s (MEDC) tax incentives for businesses locating or expanding in Michigan.

Research and Development Tax Credits

Michigan recognizes the importance of innovation and supports research and development activities through tax credits. Businesses engaged in qualified research can claim the Michigan Research and Development Tax Credit, which provides a credit against Michigan income tax.

Tax Relief and Assistance

Michigan understands the financial challenges faced by its residents and provides various tax relief programs and assistance initiatives.

Property Tax Assistance

The state offers property tax relief programs for eligible homeowners, such as the Homestead Property Tax Credit and the Principal Residence Exemption (PRE). These programs aim to reduce the property tax burden for homeowners, especially those with limited incomes.

Sales Tax Exemptions

Michigan exempts certain items from sales tax to provide relief to specific groups. For example, groceries and certain prescription drugs are exempt from sales tax, benefiting households with tight budgets.

Future Tax Developments

Michigan’s tax landscape is subject to change and evolution, influenced by economic trends, political decisions, and the state’s financial needs. As the state continues to adapt to economic challenges and opportunities, tax policies may undergo revisions to ensure sustainable revenue generation and support for essential services.

Staying informed about tax changes is crucial for both individuals and businesses operating in Michigan. Keeping an eye on legislative updates and consulting with tax professionals can help navigate the state’s tax system effectively.

Frequently Asked Questions

What is the current income tax rate in Michigan for 2023?

+As of my knowledge cutoff, Michigan’s income tax rates range from 4.25% to 4.60% for the 2023 tax year. These rates are subject to change, so it’s advisable to consult official sources for the most up-to-date information.

Are there any tax credits or deductions for homeowners in Michigan?

+Yes, Michigan offers property tax relief programs like the Homestead Property Tax Credit and the Principal Residence Exemption (PRE). These programs provide tax relief for eligible homeowners, reducing their property tax burden.

Are there any sales tax exemptions in Michigan?

+Michigan exempts certain items from sales tax, including groceries and certain prescription drugs. These exemptions aim to provide financial relief to households, especially those with limited incomes.