Where's My Amended Tax Return

Filing an amended tax return is a necessary step for many taxpayers, and it's important to understand the process and timeline involved. In this comprehensive guide, we will delve into the world of amended tax returns, exploring the reasons for amendments, the procedures to follow, and the potential outcomes. Whether you're a taxpayer seeking clarity or a financial professional looking for insights, this article will provide you with the knowledge and tools to navigate the amended return process successfully.

Understanding Amended Tax Returns

An amended tax return is a formal document used to correct or update previously filed tax information. It is a crucial tool for taxpayers who discover errors or changes in their financial circumstances after submitting their original tax return. The Internal Revenue Service (IRS) allows taxpayers to make amendments to ensure accurate reporting and compliance with tax laws.

There are several common scenarios that may prompt the need for an amended tax return. These include:

- Mathematical or Transcription Errors: Simple mistakes in calculations or data entry can occur, leading to incorrect tax liabilities. Amending the return ensures these errors are rectified.

- Forgotten Income or Deductions: Taxpayers may overlook certain sources of income or eligible deductions when filing their initial return. An amended return allows them to claim these entitlements and adjust their tax liability accordingly.

- Change in Filing Status: Life events such as marriage, divorce, or the birth of a child can impact your filing status. An amended return is necessary to reflect these changes and ensure the correct tax rate is applied.

- Claiming Additional Credits or Refunds: Taxpayers may become aware of additional credits or refunds they are entitled to after filing their original return. Amending the return allows them to claim these benefits and receive the full amount they are owed.

- Correcting Inaccurate Information: If you discover that you provided incorrect information on your original return, such as incorrect Social Security numbers or dependency status, an amended return is necessary to rectify these issues.

The Importance of Accuracy

Accuracy is paramount when it comes to tax returns, and this principle extends to amended returns as well. Submitting an inaccurate or incomplete amended return can lead to further complications and potential penalties. It is crucial to carefully review and verify all information before submitting any amendments.

Additionally, taxpayers should be aware of the potential consequences of intentionally misrepresenting information on tax returns, including amended ones. The IRS takes a serious approach to tax fraud and can impose significant penalties and even criminal charges for such actions.

The Amended Return Process

Filing an amended tax return involves several steps, and it’s essential to follow the correct procedures to ensure a smooth process.

Step 1: Identify the Need for Amendment

The first step is to identify the reason for amending your tax return. This could be due to errors discovered during a self-audit, changes in your financial situation, or notification from the IRS regarding discrepancies.

If you receive a notice from the IRS indicating a discrepancy or an adjustment to your tax liability, it is crucial to respond promptly. The IRS provides detailed instructions on how to address these issues, often requiring you to file an amended return to resolve the matter.

Step 2: Gather Necessary Documentation

Before initiating the amendment process, gather all relevant documentation and supporting materials. This includes:

- A copy of your original tax return and any supporting schedules or forms.

- Documentation of the changes or errors you need to correct, such as pay stubs, receipts, or bank statements.

- Any tax forms or notices received from the IRS or other tax authorities.

- Information regarding your updated financial circumstances, such as additional income, deductions, or credits.

Ensure that all documentation is accurate and up-to-date, as this will streamline the amendment process and reduce the likelihood of further delays or complications.

Step 3: Complete the Appropriate Form

The IRS provides specific forms for filing amended tax returns. The most commonly used form is Form 1040X, Amended U.S. Individual Income Tax Return. This form is used for amending federal income tax returns and should be completed carefully and accurately.

Form 1040X consists of three columns: the original amount, the corrected amount, and the difference between the two. You will need to fill out each column based on the changes you are making. It is essential to follow the instructions provided with the form and ensure that all required information is included.

For state tax returns, the process may vary depending on your state's tax authority. Some states have their own amended return forms, while others may require you to file an entirely new state tax return along with your federal amendment.

Step 4: Submit the Amended Return

Once you have completed the amended return form and gathered all necessary documentation, it’s time to submit your amendment. The IRS accepts amended returns by mail, and you should use the address provided on the form’s instructions for your specific tax year and filing status.

It is crucial to ensure that your amended return is mailed in a timely manner. The IRS generally allows taxpayers to file amended returns within three years from the date the original return was due or within two years from the date the original return was filed, whichever is later. However, it is advisable to file the amendment as soon as possible to avoid any potential delays or issues.

Step 5: Await Processing and Response

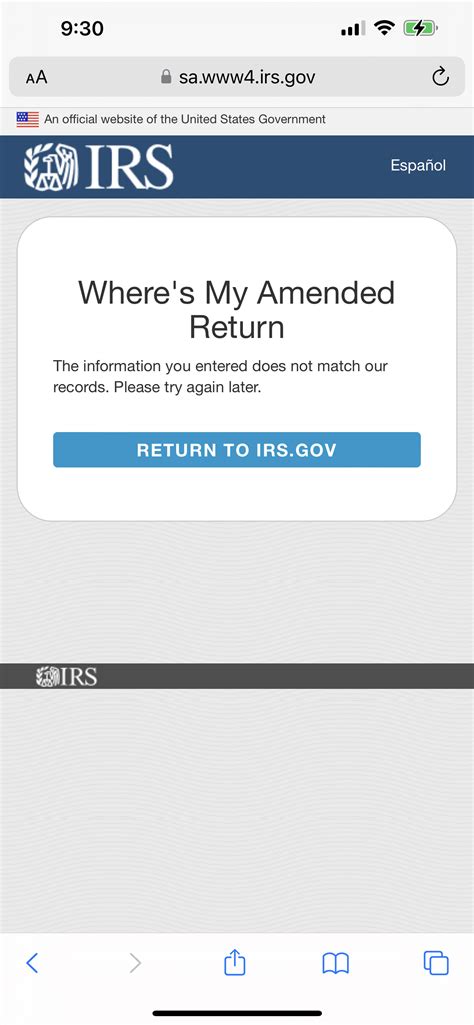

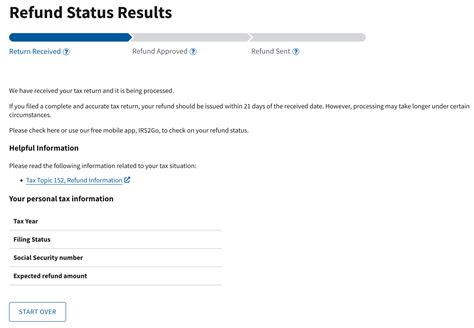

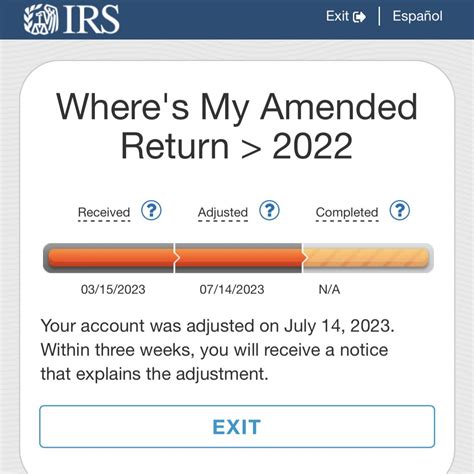

After submitting your amended return, the IRS will process it, which typically takes several weeks. During this time, it is essential to keep track of the status of your amendment and any corresponding refunds or payments.

The IRS provides various methods for checking the status of your amended return, including online tools, automated phone systems, and correspondence by mail. These resources allow you to stay informed and take appropriate actions if any issues arise.

Processing and Outcome

The processing of an amended tax return can vary depending on the complexity of the amendments and the workload of the IRS. Here’s what you can expect during the processing phase:

Review and Verification

The IRS will thoroughly review your amended return to ensure accuracy and compliance with tax laws. They will compare the information provided on the amended return with your original return and any supporting documentation.

During this review process, the IRS may identify additional issues or discrepancies that require further clarification. In such cases, they may contact you or your tax representative to request additional information or documentation. Responding promptly to these requests is crucial to avoid delays in processing.

Adjustment and Notification

Once the IRS completes the review process and verifies the accuracy of your amended return, they will make the necessary adjustments to your tax liability. This could result in:

- Increased Refund: If your amendments lead to a reduction in your tax liability, you may receive an increased refund. The IRS will calculate the difference and issue a refund check accordingly.

- Reduced Refund or Additional Payment: In some cases, the amendments may result in an increase in your tax liability. This could lead to a reduced refund or even an additional payment being due. The IRS will notify you of this outcome and provide instructions on how to make the necessary payment.

- No Change: In certain situations, the amendments may not impact your tax liability, and you may receive a notification indicating that no changes are required.

Correspondence and Appeals

If you disagree with the IRS’s determination or believe that an error has been made, you have the right to appeal their decision. The IRS provides a comprehensive appeals process, allowing taxpayers to present their case and seek a resolution.

It is essential to carefully review any notices or correspondence received from the IRS and respond within the specified time frames. Seeking professional advice or representation during the appeals process can be beneficial, especially for complex cases or when significant amounts of money are at stake.

Tips for a Smooth Amended Return Process

To ensure a seamless experience when filing an amended tax return, consider the following tips:

- Seek Professional Assistance: If you're unsure about the amendment process or have complex tax situations, consulting a tax professional or accountant can provide valuable guidance and support.

- Organize Your Records: Keep all relevant tax documents organized and easily accessible. This will simplify the process of gathering information and supporting materials for your amendment.

- Double-Check Your Calculations: Accuracy is crucial. Double-check all calculations and ensure that the amounts on your amended return are correct before submission.

- Stay Informed: Stay updated on tax laws and regulations. Changes in tax policies can impact your amendments, so staying informed can help you make accurate adjustments.

- Follow Up: Keep track of the status of your amended return. If you have not received a response within a reasonable timeframe, follow up with the IRS to ensure your amendment is being processed efficiently.

Conclusion

Filing an amended tax return is a necessary step to correct errors or update financial information. By understanding the process, gathering the right documentation, and following the appropriate procedures, taxpayers can ensure a smooth and accurate amendment. Remember, accuracy and promptness are key when dealing with tax matters, and seeking professional guidance can provide additional support and peace of mind.

Frequently Asked Questions

Can I file an amended return if I’ve already received my original refund?

+

Yes, you can file an amended return even if you’ve already received your original refund. If your amendments result in an increased refund, the IRS will issue a supplemental check for the difference.

How long does it take for the IRS to process an amended return?

+

The processing time for amended returns can vary, typically taking several weeks. However, it’s important to note that processing times may be longer during peak tax seasons or if your amendment is complex.

Can I file an amended return electronically?

+

No, amended returns cannot be filed electronically. The IRS requires amended returns to be mailed using the appropriate address provided on the form’s instructions.

What happens if I make a mistake on my amended return?

+

If you discover a mistake on your amended return after submission, you should file a new amended return to correct the error. Ensure that you provide a clear explanation of the correction and any supporting documentation.

Can I amend multiple tax years at once?

+

Yes, you can file amended returns for multiple tax years simultaneously. However, each amended return must be submitted separately and should include the appropriate tax year and form.