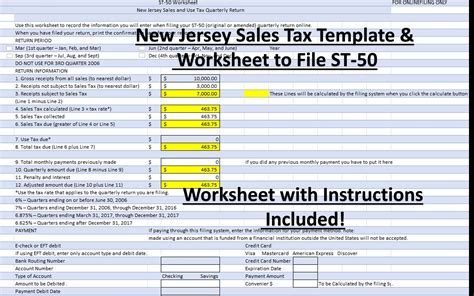

File Nj Sales Tax

In the world of business and finance, understanding the intricacies of tax regulations is crucial for any entity operating within a specific jurisdiction. One such critical aspect is the filing of sales tax, which varies from state to state in the United States. This article aims to provide an in-depth guide on filing New Jersey sales tax, covering all the essential details, real-world scenarios, and expert insights to ensure a comprehensive understanding of the process.

Understanding New Jersey Sales Tax Filing

New Jersey, often referred to as the Garden State, imposes a sales and use tax on the sale of tangible personal property, certain services, and rentals. The state’s tax system is complex, with various rates and regulations, making it imperative for businesses to grasp the specifics to avoid penalties and ensure compliance.

Sales Tax Rates in New Jersey

The New Jersey sales tax rate varies across the state, with a standard state sales tax rate of 6.625% applicable to most goods and services. However, certain jurisdictions impose additional local taxes, resulting in a combined sales tax rate that can reach up to 7.875% in some areas.

For instance, consider the city of Newark, which applies a local tax rate of 1.5%, resulting in a total sales tax rate of 8.125% for businesses operating within its boundaries. This variation in tax rates across municipalities adds a layer of complexity to the sales tax filing process.

| Jurisdiction | State Tax Rate | Local Tax Rate | Total Sales Tax Rate |

|---|---|---|---|

| Newark | 6.625% | 1.5% | 8.125% |

| Atlantic City | 6.625% | 0.75% | 7.375% |

| Camden | 6.625% | 1.25% | 7.875% |

Registration and Obligations

Businesses engaged in taxable activities within New Jersey are required to register for a Sales and Use Tax Permit with the New Jersey Division of Taxation. This permit authorizes the business to collect and remit sales tax on behalf of the state.

Once registered, businesses must file sales tax returns on a regular basis, typically monthly, quarterly, or annually, depending on their tax liability and volume of transactions. These returns must accurately report the total taxable sales and the corresponding tax amount due.

Taxable Transactions and Exemptions

New Jersey’s sales tax applies to a wide range of transactions, including the sale of goods, certain services, rentals, and admissions. However, it’s important to note that not all transactions are taxable. Certain items, such as groceries, prescription drugs, and clothing under a specific value, are exempt from sales tax.

Additionally, New Jersey offers sales tax exemptions to certain entities, such as nonprofit organizations and government agencies. These exemptions require specific documentation and registration to ensure compliance.

The Process of Filing New Jersey Sales Tax

Filing New Jersey sales tax involves a series of steps, each crucial to ensure accurate reporting and timely payment. Let’s delve into the process, exploring real-world scenarios and expert recommendations.

Step 1: Register for a Sales Tax Permit

To begin, businesses must apply for a Sales and Use Tax Permit online through the New Jersey Division of Taxation’s website. The application process requires providing detailed information about the business, including its legal structure, ownership, and the nature of its taxable activities.

Once the application is approved, the business receives a unique permit number, which serves as its identifier for all sales tax-related transactions and filings.

Step 2: Collecting Sales Tax

Upon obtaining the sales tax permit, businesses are obligated to collect sales tax from customers on all taxable transactions. The tax is typically calculated as a percentage of the sale price and is added to the final amount due.

For instance, if a business sells a product for $100 and the applicable sales tax rate is 7.875%, the customer would pay a total of $107.88, with $7.88 being the sales tax collected.

Step 3: Calculating Sales Tax Liability

Businesses must calculate their sales tax liability based on the total taxable sales made during a specific period. This involves breaking down sales by jurisdiction to determine the applicable tax rate for each transaction.

Consider a business operating in multiple municipalities with varying tax rates. It's crucial to allocate sales accurately to ensure compliance with each jurisdiction's regulations.

Step 4: Filing Sales Tax Returns

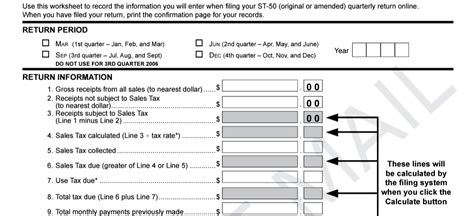

The filing of sales tax returns is a critical aspect of the process. Businesses must file returns on a regular basis, as determined by their tax liability and the volume of transactions. These returns can be filed electronically through the New Jersey Division of Taxation’s online portal.

The return form requires detailed information, including the total taxable sales, the calculated sales tax amount, and any applicable credits or deductions. It's essential to ensure accuracy in reporting to avoid penalties and interest charges.

Step 5: Remitting Sales Tax Payments

Along with filing the sales tax return, businesses must remit the calculated sales tax payments to the New Jersey Division of Taxation. These payments can be made electronically or by mail, depending on the business’s preference and the amount due.

It's crucial to ensure timely payment to avoid late fees and penalties, which can significantly impact a business's financial health.

Step 6: Record-Keeping and Documentation

Maintaining accurate records and documentation is essential for sales tax compliance. Businesses must retain records of all sales transactions, including the date, amount, and applicable tax rate. This documentation is crucial for audits and ensuring accurate reporting.

Additionally, businesses should keep records of any exemptions or credits claimed to support their sales tax filings.

Challenges and Considerations

While the process of filing New Jersey sales tax may seem straightforward, there are several challenges and considerations that businesses must navigate.

Managing Multiple Tax Rates

One of the primary challenges is managing the variety of tax rates across different jurisdictions within New Jersey. Businesses operating in multiple locations must accurately calculate and report sales tax based on each jurisdiction’s rate, ensuring compliance with local regulations.

Compliance with Exemptions and Credits

Understanding and complying with sales tax exemptions and credits is crucial to avoid overpayment or non-compliance. Businesses must stay updated on the latest regulations and requirements to ensure they claim eligible exemptions and credits accurately.

Audits and Penalties

The New Jersey Division of Taxation conducts audits to ensure compliance with sales tax regulations. These audits can be complex and time-consuming, requiring businesses to provide detailed records and documentation. Failure to comply can result in significant penalties and interest charges, impacting a business’s financial stability.

Future Implications and Trends

The landscape of sales tax regulations is constantly evolving, and businesses must stay abreast of changes to ensure continued compliance. Here are some key future implications and trends to consider when filing New Jersey sales tax.

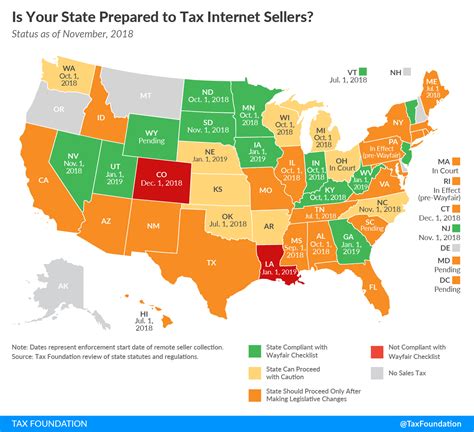

Digital Sales and Remote Sellers

With the rise of e-commerce, digital sales and remote sellers are becoming increasingly common. New Jersey, like many states, is exploring ways to tax these transactions effectively, which may lead to new regulations and reporting requirements.

Sales Tax Automation

To streamline the sales tax filing process and reduce errors, sales tax automation tools are gaining popularity. These tools integrate with accounting software, automatically calculating and filing sales tax returns, offering a more efficient and accurate approach to compliance.

International Sales and Cross-Border Transactions

As businesses expand globally, international sales and cross-border transactions present unique challenges in terms of sales tax compliance. New Jersey, and other states, may introduce regulations to address these complexities, impacting businesses operating in multiple countries.

Conclusion

Filing New Jersey sales tax is a complex yet critical process for businesses operating within the state. By understanding the intricacies of the tax system, complying with regulations, and staying updated on future trends, businesses can ensure accurate reporting and timely payment of sales tax.

This comprehensive guide has provided an in-depth analysis of the process, offering real-world examples and expert insights. With this knowledge, businesses can navigate the complexities of New Jersey sales tax filing with confidence, ensuring compliance and financial stability.

How often do businesses need to file sales tax returns in New Jersey?

+

The frequency of filing sales tax returns depends on the business’s tax liability and volume of transactions. Generally, businesses with higher tax liabilities must file monthly, while those with lower liabilities can file quarterly or annually.

Are there any penalties for late sales tax filings in New Jersey?

+

Yes, late sales tax filings can result in penalties and interest charges. The New Jersey Division of Taxation imposes a late filing fee and interest on the outstanding tax amount. It’s crucial to file returns and pay taxes on time to avoid these penalties.

Can businesses claim sales tax exemptions in New Jersey?

+

Yes, certain entities, such as nonprofit organizations and government agencies, are eligible for sales tax exemptions in New Jersey. To claim these exemptions, businesses must register and provide the necessary documentation to support their claim.