Randall County Tax Office

Welcome to an in-depth exploration of the Randall County Tax Office, a crucial administrative entity that plays a pivotal role in the governance and economic fabric of the region. This comprehensive article will delve into the various facets of this office, shedding light on its functions, services, and impact on the community. From the tax assessment process to the innovative initiatives undertaken, we aim to provide a clear understanding of the operations and importance of the Randall County Tax Office.

The Randall County Tax Office: An Overview

Nestled in the heart of Randall County, the Tax Office serves as a vital hub for managing and administering the county’s tax-related affairs. Established with the primary objective of ensuring fair and efficient tax collection, this office has evolved into a multifaceted entity, offering a range of services that extend beyond the traditional scope of taxation.

At its core, the Randall County Tax Office is responsible for assessing and collecting property taxes, a critical revenue stream for the county. However, its remit goes far beyond this fundamental function. The office also plays a key role in facilitating economic development initiatives, providing valuable resources for homeowners and businesses, and fostering transparency and accountability in the county's financial dealings.

This article will provide an all-encompassing view of the Randall County Tax Office, covering its historical evolution, current practices, and future prospects. By exploring the intricate details of its operations, we aim to showcase the Tax Office as a vital component of Randall County's governance and a vital contributor to the region's economic prosperity.

Tax Assessment and Collection: A Comprehensive Process

The tax assessment process forms the backbone of the Randall County Tax Office’s operations. This intricate procedure involves a meticulous evaluation of each property within the county, ensuring that the assessed value is fair and accurate. The office employs a team of experienced professionals who conduct thorough inspections, taking into account various factors such as location, size, improvements, and market trends.

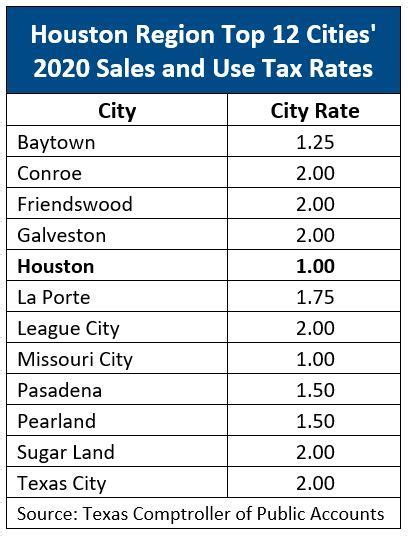

Once the assessments are complete, the Tax Office generates tax rolls, which detail the taxable value of each property. These rolls are then used to calculate the tax liability for each property owner. The office employs advanced software and data analytics to ensure accuracy and consistency in the calculation process. This level of precision not only ensures fairness for taxpayers but also facilitates efficient revenue collection for the county.

The Randall County Tax Office offers a range of payment options, including online payments, e-check services, and traditional in-person payments. The office also provides assistance to taxpayers who may face financial hardships, offering payment plans and other support mechanisms to ensure that no one is disproportionately burdened by their tax obligations.

Key Takeaways:

- The tax assessment process involves a detailed evaluation of properties, ensuring fair and accurate assessments.

- Tax rolls generated by the office provide the basis for calculating tax liabilities.

- The Tax Office offers diverse payment options, catering to various taxpayer preferences and needs.

- Supportive measures are in place to assist taxpayers facing financial challenges.

Innovative Initiatives: Driving Efficiency and Community Engagement

Beyond its core tax assessment and collection functions, the Randall County Tax Office has been at the forefront of implementing innovative initiatives to enhance its services and engage with the community. These initiatives have not only streamlined operations but have also fostered a deeper sense of trust and collaboration between the Tax Office and the residents of Randall County.

Digital Transformation

In recent years, the Tax Office has undergone a significant digital transformation, embracing technology to improve efficiency and accessibility. The office has developed a user-friendly website, complete with an online portal, where taxpayers can access their account information, view tax records, and make payments with just a few clicks. This digital platform has not only reduced the need for in-person visits but has also provided a convenient and secure way for taxpayers to manage their obligations.

Furthermore, the Tax Office has integrated advanced data analytics and machine learning techniques to enhance its assessment process. By leveraging these technologies, the office can identify patterns, detect anomalies, and ensure that assessments are not only accurate but also consistent across the county.

Community Outreach and Education

Recognizing the importance of community engagement, the Tax Office has launched a series of outreach programs aimed at educating residents about their tax obligations and rights. These initiatives include hosting workshops and seminars, distributing informative materials, and actively engaging with community groups and organizations. By demystifying the tax process, the office aims to build trust and foster a culture of compliance and transparency.

Partnerships for Economic Development

The Randall County Tax Office has also played a pivotal role in fostering economic development within the county. The office actively collaborates with local businesses and entrepreneurs, providing valuable resources and guidance on tax incentives, grants, and other financial support programs. By facilitating access to these opportunities, the Tax Office contributes to the growth and prosperity of the local business community.

Key Takeaways:

- Digital transformation has enhanced efficiency and accessibility for taxpayers.

- Advanced data analytics improve the accuracy and consistency of tax assessments.

- Community outreach programs educate residents and build trust.

- Partnerships with local businesses drive economic development and growth.

The Future of Taxation: Embracing Emerging Technologies

As the world of taxation evolves, the Randall County Tax Office is poised to embrace emerging technologies to further enhance its operations and services. The office is committed to staying at the forefront of innovation, leveraging cutting-edge solutions to streamline processes, improve accuracy, and enhance the overall taxpayer experience.

Blockchain Technology

The Tax Office is exploring the potential of blockchain technology to revolutionize the way tax records are stored and accessed. By utilizing a decentralized and secure ledger system, the office aims to enhance data integrity, improve transparency, and reduce the risk of fraud or errors. Blockchain technology also offers the potential for smart contracts, which could automate certain tax processes, further streamlining operations.

Artificial Intelligence and Machine Learning

AI and machine learning algorithms are already being employed by the Tax Office to enhance data analysis and pattern recognition. However, the office is looking to expand the application of these technologies to automate certain tasks, such as data entry and document processing. This not only reduces the risk of human error but also frees up resources, allowing the office to focus on more complex and strategic tasks.

Mobile Apps and Digital Payments

To cater to the evolving preferences of taxpayers, the Tax Office is developing mobile applications that will enable users to access their tax information and make payments on the go. These apps will offer a seamless and secure user experience, providing taxpayers with greater flexibility and convenience.

Key Takeaways:

- Blockchain technology enhances data integrity and transparency.

- AI and machine learning automate tasks, reducing errors and freeing up resources.

- Mobile apps and digital payments offer convenience and flexibility for taxpayers.

- Emerging technologies position the Tax Office for continued success and innovation.

Conclusion: A Vital Pillar of Randall County’s Governance

The Randall County Tax Office stands as a cornerstone of the county’s governance, playing a critical role in the administration of tax-related affairs and contributing to the overall economic well-being of the region. Through its meticulous tax assessment and collection processes, innovative initiatives, and commitment to embracing emerging technologies, the Tax Office has established itself as a trusted and efficient entity.

As Randall County continues to evolve and thrive, the Tax Office will remain at the forefront, adapting to the changing needs of the community and leveraging technology to provide exceptional service. With a focus on fairness, efficiency, and community engagement, the Randall County Tax Office is well-positioned to continue its vital role in shaping the future of the county.

Frequently Asked Questions

What is the primary function of the Randall County Tax Office?

+The primary function of the Randall County Tax Office is to assess and collect property taxes, which are a significant source of revenue for the county. The office also plays a crucial role in supporting economic development initiatives and providing resources to homeowners and businesses.

How does the Tax Office determine the taxable value of properties?

+The Tax Office employs a team of professionals who conduct thorough inspections, considering factors such as location, size, improvements, and market trends. Advanced software and data analytics are used to ensure accuracy and consistency in the assessment process.

What payment options does the Tax Office offer for taxpayers?

+The Tax Office offers a range of payment options, including online payments, e-check services, and traditional in-person payments. The office also provides assistance to taxpayers facing financial challenges through payment plans and other support mechanisms.

How is the Tax Office embracing emerging technologies to enhance its operations?

+The Tax Office is exploring blockchain technology to enhance data integrity and transparency. AI and machine learning are being utilized to automate tasks and improve efficiency. Additionally, mobile apps and digital payments are being developed to cater to the evolving preferences of taxpayers.