Sales Tax In South Dakota

South Dakota, known for its diverse economy and vibrant business landscape, has a unique approach to sales tax regulations. This article delves into the specifics of sales tax in South Dakota, providing an in-depth analysis of the rates, regulations, and their impact on businesses and consumers alike.

Understanding South Dakota’s Sales Tax Structure

South Dakota’s sales tax system is a crucial aspect of the state’s revenue generation and economic policies. It plays a significant role in funding various public services and initiatives.

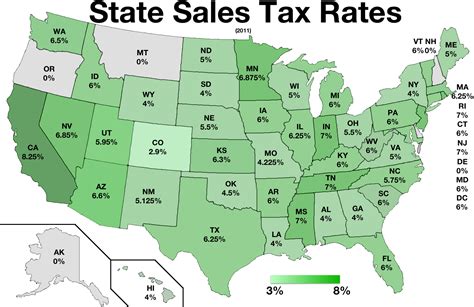

The state imposes a 4.5% general sales tax on most retail transactions. This base rate is applied uniformly across the state, ensuring a consistent tax environment for businesses and consumers.

However, South Dakota's sales tax structure goes beyond the general rate. The state allows local jurisdictions, such as counties and municipalities, to levy additional sales taxes, known as local option taxes. These local taxes can vary significantly, resulting in a patchwork of sales tax rates across the state.

Local Option Taxes: A Closer Look

Local option taxes are a key feature of South Dakota’s sales tax landscape. These taxes are authorized by the state legislature and are typically used to fund specific projects or initiatives within a local jurisdiction.

The rates for local option taxes can range from 0% to 6%, depending on the location. For instance, certain counties or cities may impose a 2% local option tax on top of the state's 4.5% rate, resulting in a 6.5% combined sales tax for consumers in those areas.

Here's a breakdown of some notable local option tax rates in South Dakota:

| Jurisdiction | Local Option Tax Rate |

|---|---|

| City of Sioux Falls | 2% |

| Pennington County | 1.5% |

| Lincoln County | 1% |

| Hughes County | 3% |

Sales Tax Exemptions and Special Considerations

While the majority of retail transactions are subject to sales tax in South Dakota, there are certain exemptions and special considerations worth noting.

Exempt Goods and Services

Some goods and services are exempt from sales tax in South Dakota. These exemptions include:

- Prescription medications

- Certain medical devices

- Non-prepared food items

- Residential rent

- Educational services

- Most agricultural equipment and supplies

It's important for businesses to stay updated on the latest exemptions to ensure they comply with the law and provide accurate tax information to consumers.

Special Tax Districts

South Dakota also has special tax districts, which are areas designated for specific purposes, such as economic development or infrastructure projects. These districts may have unique tax rates or rules.

For example, the Minnehaha County Stadium District was established to fund the construction and maintenance of a new sports stadium. Businesses operating within this district are subject to a 0.5% sales tax in addition to the state and local option taxes.

Sales Tax Registration and Compliance

Businesses operating in South Dakota are required to register for sales tax with the South Dakota Department of Revenue. This process involves obtaining a sales tax permit and understanding the obligations associated with collecting and remitting sales tax.

Registration Process

To register for sales tax, businesses typically need to provide the following information:

- Business name, address, and contact details

- Federal Employer Identification Number (FEIN) or Social Security Number (SSN)

- Expected monthly sales volume

- Details of the goods or services being sold

Once registered, businesses receive a sales tax permit number, which must be displayed at the point of sale and used on all sales tax filings.

Sales Tax Filing and Remittance

Sales tax filings in South Dakota are typically due monthly, although businesses with lower sales volumes may qualify for quarterly or annual filings. The filing due dates are aligned with the state’s fiscal calendar.

Businesses must calculate the sales tax owed based on their taxable sales, which includes the state's general sales tax rate and any applicable local option taxes. This amount is then remitted to the Department of Revenue along with the appropriate filing forms.

The Impact of Sales Tax on Businesses and Consumers

South Dakota’s sales tax structure has a significant impact on both businesses and consumers. Understanding these impacts can provide valuable insights into the state’s economic landscape.

Effects on Businesses

For businesses, sales tax can be a complex and time-consuming aspect of operations. The varying rates and regulations across the state can make it challenging to manage sales tax obligations accurately.

However, sales tax also provides an opportunity for businesses to compete on price. By strategically locating their operations in areas with lower sales tax rates, businesses can offer competitive pricing to consumers, potentially boosting sales and market share.

Consumer Behavior and Price Sensitivity

Consumers in South Dakota are likely to be sensitive to sales tax rates, especially in areas with higher combined rates. Price-conscious consumers may seek out retailers in lower-tax jurisdictions or opt for online purchases to avoid higher sales taxes.

This behavior can influence consumer spending patterns and potentially impact local businesses. It's important for businesses to consider these dynamics when setting their pricing strategies and marketing efforts.

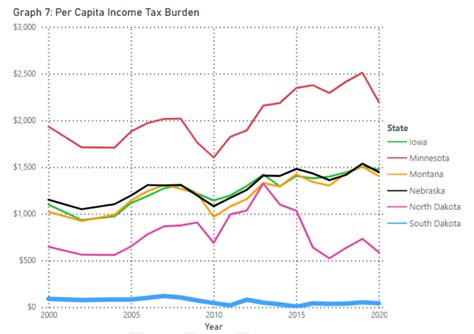

Economic Development and Revenue Generation

South Dakota’s sales tax structure, including local option taxes, plays a critical role in funding various economic development initiatives and public services.

The revenue generated from sales taxes supports infrastructure projects, education, public safety, and other essential services. It also contributes to the state's economic growth and stability.

Staying Informed: Sales Tax Updates and Resources

Given the dynamic nature of sales tax regulations, it’s crucial for businesses and consumers to stay informed about any updates or changes.

Sales Tax Resources in South Dakota

The South Dakota Department of Revenue provides a wealth of resources and information on sales tax regulations, including:

- Detailed guides and publications on sales tax obligations

- Online tools for calculating sales tax

- Information on exemptions and special considerations

- Updates on legislative changes and new tax laws

Additionally, businesses can benefit from consulting tax professionals or utilizing tax compliance software to ensure accurate and timely sales tax management.

Conclusion: Navigating South Dakota’s Sales Tax Landscape

South Dakota’s sales tax system is a dynamic and integral part of the state’s economic framework. With its uniform state rate and diverse local option taxes, businesses and consumers face a unique tax environment.

By understanding the nuances of South Dakota's sales tax regulations, businesses can navigate these complexities and make informed decisions to stay compliant and competitive. Consumers, too, can make more informed purchasing choices based on their understanding of sales tax rates.

As South Dakota continues to evolve its economic policies and initiatives, sales tax will remain a critical aspect of the state's revenue generation and business environment.

How often do sales tax rates change in South Dakota?

+Sales tax rates in South Dakota are subject to change through legislative actions. While major changes are relatively infrequent, it’s important to stay updated on any proposed or enacted changes that may impact your business or purchasing decisions.

Can businesses pass on sales tax to consumers?

+Yes, businesses typically include sales tax in the advertised price of goods or services. However, it’s important to ensure that the sales tax is accurately calculated and reflected on sales receipts to maintain transparency and compliance.

Are there any sales tax holidays in South Dakota?

+South Dakota does not currently have sales tax holidays. However, certain items, such as clothing or school supplies, may be exempt from sales tax during specific promotional periods.