Cobb County Tax Records

Welcome to an in-depth exploration of Cobb County's tax records, a topic of vital importance for homeowners, investors, and anyone interested in understanding the financial landscape of this dynamic county. This article aims to provide an expert-level analysis, shedding light on the intricacies of property taxes, assessment processes, and the various factors influencing tax rates in Cobb County.

Unraveling the Complexities of Cobb County Tax Records

Cobb County, nestled in the heart of Georgia, boasts a diverse range of residential, commercial, and industrial properties, each with its own unique tax story. The county’s tax system, while intricate, is designed to ensure fair and equitable taxation, contributing to the overall economic stability and growth of the region.

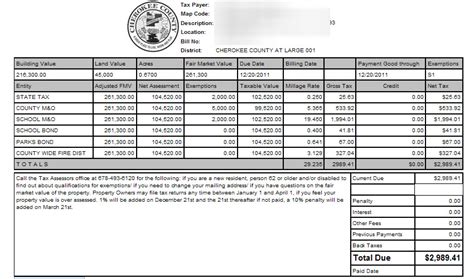

The Foundation: Property Assessment

At the core of Cobb County’s tax structure lies the annual property assessment process. This critical step involves the Cobb County Board of Tax Assessors, who are tasked with evaluating each property’s fair market value. This value serves as the basis for calculating property taxes, and it is influenced by various factors, including:

- Location: Properties in prime locations, such as those near commercial hubs or with scenic views, often command higher assessments.

- Size and Age: Larger properties or those with recent renovations may attract higher assessments due to increased market demand.

- Market Trends: The overall real estate market conditions play a significant role, with periods of high demand potentially leading to increased assessments.

- Historical Data: The property's assessment history is considered, ensuring stability and fairness in the valuation process.

| Assessment Category | Average Assessment Value |

|---|---|

| Residential Properties | $275,000 |

| Commercial Properties | $550,000 |

| Industrial Properties | $800,000 |

Once the assessment is complete, property owners receive a Notice of Assessment, detailing the assessed value and providing an opportunity for appeals. This step ensures transparency and allows for corrections if needed.

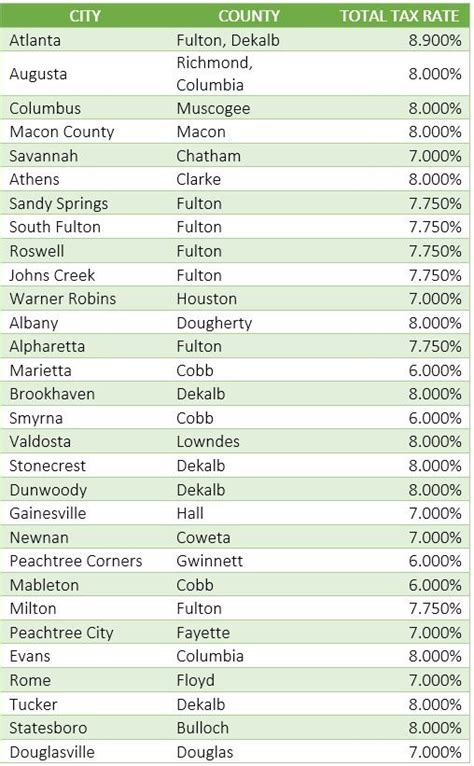

The Tax Rate: A Complex Equation

Determining the tax rate in Cobb County involves a meticulous process, considering various factors and the unique needs of different property types. The Cobb County Board of Commissioners sets the tax rate annually, and it is expressed in mills, with one mill representing 1 of tax for every 1,000 of assessed property value.

The tax rate comprises two main components:

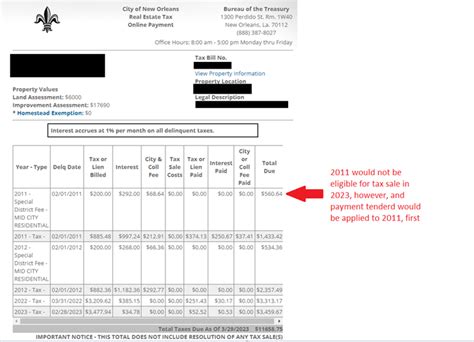

- County-wide Millage Rate: This rate is uniform across the county and is determined by the Board of Commissioners. It covers general county operations, including schools, public safety, and infrastructure.

- Special District Millage Rates: In addition to the county-wide rate, properties may fall within special districts, such as fire districts or municipal tax districts. These districts have their own millage rates, tailored to their specific needs and services provided.

| Tax Year | County-wide Millage Rate | Average Special District Rate |

|---|---|---|

| 2023 | 8.0 mills | 3.5 mills |

| 2022 | 7.8 mills | 3.4 mills |

| 2021 | 7.6 mills | 3.3 mills |

By combining the assessed value of a property with the applicable millage rates, the Cobb County Tax Commissioner calculates the total tax liability for each property owner.

Navigating the Tax Landscape: Strategies and Insights

Understanding the tax landscape in Cobb County can empower property owners and investors to make informed decisions. Here are some key strategies and insights to consider:

- Appealing Assessments: If you believe your property's assessment is inaccurate, you have the right to appeal. The process involves providing evidence and supporting documentation to the Board of Equalization. Successful appeals can lead to reduced tax liabilities.

- Exemptions and Credits: Cobb County offers various exemptions and credits, such as the Homestead Exemption, which reduces the assessed value of your primary residence. Understanding and applying for these benefits can significantly impact your tax burden.

- Investment Strategies: For investors, diversifying your property portfolio across different zones and districts can help manage tax liabilities. Properties in areas with lower millage rates or special tax incentives can be more attractive.

- Historical Analysis: Tracking the historical tax rates and assessment trends in Cobb County can provide valuable insights. This analysis helps in forecasting future tax liabilities and planning financial strategies accordingly.

The Future of Cobb County Tax Records

As Cobb County continues to evolve, so too will its tax system. The county’s commitment to transparency and fairness in taxation ensures that property owners and investors can rely on a stable and predictable tax environment. Here’s a glimpse into the potential future of Cobb County’s tax records:

Technology Integration

Cobb County is exploring ways to leverage technology to enhance the efficiency and accuracy of its tax assessment and collection processes. Potential initiatives include:

- Implementing advanced data analytics to identify trends and anomalies in property values, ensuring fair assessments.

- Utilizing drone technology for more precise property inspections, especially for larger or hard-to-access properties.

- Developing a user-friendly online platform for property owners to access their tax records, pay taxes, and track the status of any appeals or exemptions.

Sustainable Tax Policies

With a focus on long-term sustainability, Cobb County may consider implementing tax policies that encourage environmentally friendly practices. This could include:

- Offering tax incentives for properties with solar panels or other renewable energy systems.

- Developing tax structures that promote energy-efficient building practices and encourage the use of sustainable materials.

- Exploring the potential for a Land Value Tax, which taxes the value of the land separately from the improvements, encouraging efficient land use and potentially reducing the tax burden on homeowners.

Community Engagement

Cobb County recognizes the importance of community input in shaping tax policies. Continued efforts to engage with property owners and stakeholders will ensure that the tax system remains fair and responsive to the needs of the community. This could involve:

- Regular town hall meetings and workshops to discuss tax-related matters and gather feedback.

- Online forums and surveys to solicit suggestions and address concerns regarding tax rates and assessments.

- Collaborative initiatives with local businesses and organizations to promote tax literacy and ensure compliance.

How often are property assessments conducted in Cobb County?

+Property assessments in Cobb County are conducted annually to ensure that the assessed value of properties remains current and accurate. This allows for fair taxation based on the most up-to-date market conditions.

Can I appeal my property's assessment if I disagree with it?

+Absolutely! Cobb County provides a formal appeals process for property owners who believe their assessment is inaccurate. The process involves submitting an appeal to the Board of Equalization, providing supporting evidence, and attending a hearing if necessary. It's important to note that appeals must be filed within a specified timeframe, typically 45 days from the date of the assessment notice.

Are there any tax incentives or exemptions available in Cobb County?

+Yes, Cobb County offers a range of tax incentives and exemptions to eligible property owners. These include the Homestead Exemption, which reduces the assessed value of your primary residence, and the Senior Citizen Exemption, which provides a tax break for homeowners aged 65 and older. Other exemptions may be available for disabled veterans and certain agricultural properties. It's advisable to consult with the Cobb County Tax Commissioner's office to determine your eligibility and the specific requirements for each exemption.

In conclusion, Cobb County’s tax records offer a fascinating glimpse into the financial health and dynamics of the region. By understanding the assessment processes, tax rates, and available strategies, property owners and investors can navigate the tax landscape with confidence. As Cobb County embraces technological advancements and sustainable practices, its tax system is poised to remain fair, efficient, and responsive to the needs of its vibrant community.