Kentucky State Tax Refund

In Kentucky, the state tax system plays a crucial role in the financial landscape, impacting individuals and businesses alike. Understanding the tax refund process is essential for residents and taxpayers, as it can provide a welcome boost to their financial well-being. This article aims to delve into the intricacies of the Kentucky State Tax Refund, offering a comprehensive guide to help taxpayers navigate this process with confidence.

Navigating the Kentucky Tax Refund Process

The Kentucky Department of Revenue administers the state’s tax refund system, ensuring a fair and efficient process for taxpayers. This section will provide an in-depth look at the steps involved in claiming a refund, the timelines to expect, and the various methods of refund receipt.

Filing Your Kentucky Tax Return

The first step in claiming a Kentucky state tax refund is filing your tax return accurately and timely. Residents can choose from various filing methods, including online platforms, software, or traditional paper forms. The state offers a user-friendly online filing system, Kentucky Online Gateway, which simplifies the process for individuals and small businesses.

When preparing your tax return, it's crucial to gather all relevant documents, such as W-2 forms, 1099s, and receipts for deductions. Kentucky's tax system follows a standard deduction, along with the option for itemized deductions, allowing taxpayers to optimize their returns based on their financial circumstances.

Understanding Refund Eligibility

Not every taxpayer will be eligible for a refund. The eligibility criteria depend on various factors, including the taxpayer’s income, deductions, and credits claimed. For instance, individuals with low to moderate income may qualify for the Kentucky Earned Income Tax Credit (EITC), a refundable credit designed to benefit working families.

Additionally, taxpayers who have overpaid their estimated taxes throughout the year may be eligible for a refund. The state's tax system also offers credits for specific expenses, such as the Kentucky Education Expense Credit, which can further impact refund amounts.

| Credit/Deduction | Description |

|---|---|

| Kentucky EITC | Refundable credit for low- to moderate-income earners. |

| Education Expense Credit | Credit for eligible educational expenses. |

| Child and Dependent Care Credit | Credit for childcare expenses. |

Timelines and Processing

The Kentucky Department of Revenue aims to process tax returns and issue refunds promptly. Generally, refunds are issued within 4-6 weeks from the date of filing for taxpayers who file electronically and choose direct deposit. For those filing paper returns or opting for a refund check, the process may take slightly longer, typically up to 8 weeks.

During peak tax season, processing times may increase due to the high volume of returns. It's advisable to file early to avoid potential delays and to ensure timely receipt of your refund.

Methods of Refund Receipt

Kentucky taxpayers have several options for receiving their state tax refund. The most common methods include direct deposit into a bank account, which is the fastest and most secure option, and receiving a refund check by mail.

Additionally, taxpayers can opt for a portion or all of their refund to be applied to their Kentucky state income tax liability for the following year. This option is particularly beneficial for taxpayers who anticipate owing taxes in the future and can help simplify their financial planning.

Maximizing Your Kentucky Tax Refund

Beyond understanding the refund process, taxpayers can take steps to maximize their Kentucky state tax refund. This section will explore strategies and tips to ensure taxpayers receive the highest possible refund, offering a detailed look at deductions, credits, and planning opportunities.

Exploring Deductions and Credits

Kentucky offers a range of deductions and credits that can significantly impact a taxpayer’s refund. Here’s a closer look at some of the key deductions and credits available:

- Standard Deduction: Kentucky taxpayers can claim a standard deduction, which reduces their taxable income. The amount of the standard deduction depends on the taxpayer's filing status.

- Itemized Deductions: For those with substantial deductions, itemizing may be beneficial. Itemized deductions include expenses such as mortgage interest, state and local taxes, medical expenses, and charitable contributions.

- Kentucky EITC: As mentioned earlier, the Kentucky Earned Income Tax Credit is a valuable credit for low- to moderate-income earners. The credit amount depends on the taxpayer's income and family size.

- Education Credits: Kentucky residents can benefit from education credits, including the Kentucky Education Expense Credit and the American Opportunity Credit. These credits can offset the cost of higher education.

- Child and Dependent Care Credit: Taxpayers who incur childcare expenses while working or attending school may be eligible for this credit, which can help offset the cost of childcare.

Planning Strategies for Maximizing Refunds

To optimize your Kentucky state tax refund, consider these planning strategies:

- Maximize Deductions: Review your eligible deductions and ensure you claim all applicable deductions on your tax return. This includes deductions for charitable contributions, medical expenses, and state and local taxes.

- Explore Tax Credits: Familiarize yourself with the various tax credits available in Kentucky. For instance, the Kentucky EITC can provide a significant boost to your refund, especially if you have a low to moderate income.

- Consider Tax-Advantaged Accounts: Contributions to certain tax-advantaged accounts, such as Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs), can reduce your taxable income and potentially increase your refund.

- Plan for Education Expenses: If you or your dependents are pursuing higher education, be sure to take advantage of education credits and deductions. These can include tuition and fees, books, and other eligible expenses.

- Review Tax Withholdings: Ensure that your tax withholdings are set appropriately throughout the year. If you anticipate a refund, you may want to consider adjusting your withholdings to receive a larger refund or reducing them to increase your take-home pay.

Special Considerations for Kentucky Taxpayers

Kentucky’s tax landscape offers unique considerations and opportunities for taxpayers. This section will delve into specific scenarios, including military service members, students, and taxpayers with complex financial situations, providing tailored advice and insights.

Military Service Members and Kentucky Taxes

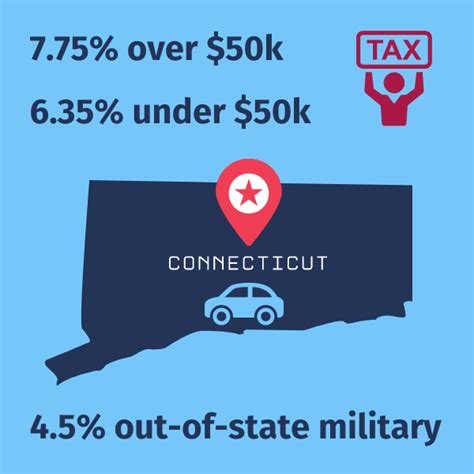

Military service members stationed in Kentucky or with Kentucky income face unique tax considerations. Here are some key points to consider:

- Military Income Exclusion: Kentucky offers an income exclusion for military basic pay, which can reduce the amount of income subject to state tax. This exclusion applies to active-duty military personnel and their spouses.

- Tax Residency: Determining tax residency can be complex for military families. Kentucky follows the federal definition of residency, which is based on the service member's permanent duty station. However, temporary duty assignments may impact residency status.

- Military Benefits: Certain military benefits, such as housing allowances and combat pay, may be exempt from Kentucky income tax. It's important to understand which benefits are taxable and which are exempt to ensure accurate tax reporting.

Students and Kentucky Tax Benefits

Kentucky offers a range of tax benefits for students and their families. Here’s a look at some key considerations:

- Education Credits and Deductions: As mentioned earlier, Kentucky provides education credits and deductions that can significantly reduce the tax burden for students and their families. These include the Kentucky Education Expense Credit and the American Opportunity Credit.

- Student Loan Interest Deduction: Kentucky allows a deduction for student loan interest paid during the tax year. This deduction can help reduce taxable income and potentially increase your refund.

- Scholarships and Grants: Income from scholarships and grants used for qualified education expenses is generally exempt from Kentucky income tax. However, it's important to understand the rules surrounding scholarship income and taxable amounts.

Complex Financial Situations

For taxpayers with complex financial situations, such as multiple sources of income, investments, or business ownership, navigating the Kentucky tax system can be challenging. Here are some considerations:

- Business Income and Expenses: If you own a business, you'll need to report business income and claim eligible business expenses. Kentucky allows for various deductions and credits related to business activities, including the Kentucky Small Business Deduction and the Business Expense Credit.

- Investment Income: Income from investments, such as dividends, capital gains, and rental income, is generally taxable in Kentucky. However, there are strategies to minimize the tax impact, including utilizing tax-advantaged investment accounts and optimizing capital gains.

- Alternative Minimum Tax (AMT): Kentucky has an alternative minimum tax system, which can impact taxpayers with certain types of income or deductions. Understanding the AMT rules and calculating your potential liability is crucial for accurate tax planning.

Future Implications and Tax Planning

Staying informed about potential changes to Kentucky’s tax landscape is crucial for effective tax planning. This section will explore emerging trends, potential tax law changes, and strategies for long-term tax optimization.

Emerging Tax Trends in Kentucky

Kentucky’s tax system is continually evolving, and taxpayers should stay abreast of emerging trends. Here are some key areas to watch:

- Tax Reform: Kentucky has periodically undergone tax reform efforts, which can impact tax rates, deductions, and credits. Stay informed about any proposed or enacted reforms to understand how they may affect your tax situation.

- Economic Development Incentives: Kentucky offers various economic development incentives, such as tax credits and exemptions, to attract businesses and create jobs. These incentives can benefit both businesses and individuals, so it's worth exploring whether you may qualify.

- Telecommuting and Remote Work: With the rise of remote work, Kentucky has implemented rules regarding the taxation of nonresident employees working remotely in the state. Understanding these rules is crucial for accurate tax reporting and compliance.

Strategies for Long-Term Tax Optimization

To optimize your tax situation over the long term, consider these strategies:

- Regular Tax Planning: Make tax planning a regular part of your financial strategy. Review your tax situation annually and adjust your withholdings or estimated tax payments as needed to optimize your refund or reduce your tax liability.

- Explore Retirement Accounts: Contributions to tax-advantaged retirement accounts, such as IRAs or 401(k)s, can reduce your taxable income and provide long-term tax benefits. Consult a financial advisor to determine the best retirement savings strategy for your circumstances.

- Review Investment Strategies: Work with a financial advisor to optimize your investment portfolio for tax efficiency. This may include strategies such as tax-loss harvesting, optimizing capital gains, and utilizing tax-advantaged investment vehicles.

- Consider Estate Planning: For taxpayers with significant assets, estate planning can help minimize tax liabilities upon death. This may include utilizing trusts, gifting strategies, and other estate planning tools to reduce the tax burden on your heirs.

Frequently Asked Questions

How long does it typically take to receive a Kentucky state tax refund after filing?

+The Kentucky Department of Revenue aims to process refunds within 4-6 weeks for electronic filings with direct deposit. For paper returns or refund checks, the process may take up to 8 weeks.

What happens if I don’t receive my Kentucky tax refund within the expected timeframe?

+If you haven’t received your refund within the expected timeframe, you can check the status of your refund online or contact the Kentucky Department of Revenue for assistance. They can provide an update on the processing of your refund.

Can I receive my Kentucky state tax refund as a direct deposit if I filed a paper return?

+Yes, even if you filed a paper return, you can still choose to receive your refund as a direct deposit. You’ll need to provide your banking information when completing your tax return.

Are there any income limits for claiming the Kentucky EITC (Earned Income Tax Credit)?

+Yes, the eligibility for the Kentucky EITC is based on income limits. These limits vary depending on your filing status and the number of qualifying children you have. It’s best to consult the Kentucky Department of Revenue’s guidelines for the most accurate information.

Can I apply for an extension to file my Kentucky state tax return if I’m unable to meet the deadline?

+Yes, you can request an extension to file your Kentucky state tax return by submitting Form 765, Application for Automatic Extension of Time to File Kentucky Income Tax Return. However, an extension to file does not extend the time to pay any taxes owed.