Ct Tax Percentage

In the state of Connecticut, the tax landscape is an important aspect for residents and businesses alike. The tax system plays a crucial role in funding various public services and infrastructure projects, making it a vital component of the state's economy. The Connecticut tax percentage refers to the rates at which individuals and entities are taxed on their income, sales, and property. Understanding these tax rates is essential for financial planning and compliance with state regulations.

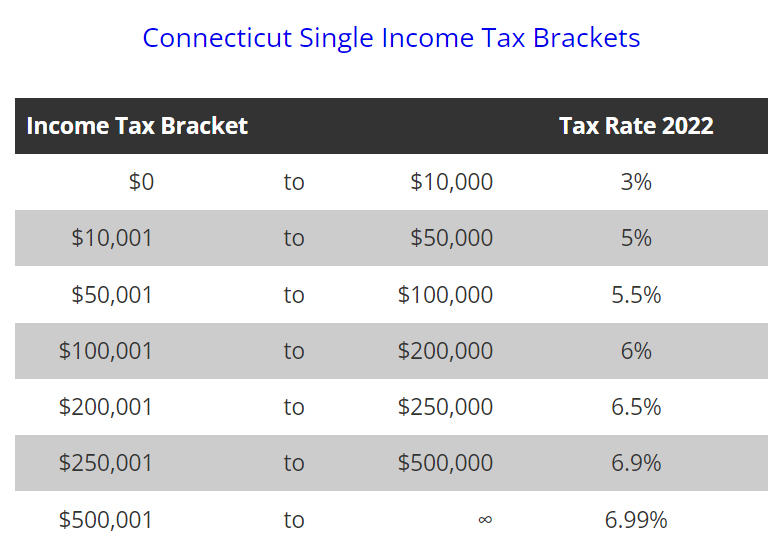

Connecticut Income Tax Rates

The income tax structure in Connecticut is progressive, meaning that the tax rate increases as income rises. This system aims to ensure that higher-income earners contribute a larger proportion of their income to the state’s revenue. As of my last update in January 2023, Connecticut’s income tax brackets and rates are as follows:

| Income Bracket (Single Filers) | Income Bracket (Married Filing Jointly) | Tax Rate |

|---|---|---|

| < $10,000 | < $20,000 | 3.03% |

| $10,000 - $50,000 | $20,000 - $100,000 | 3.03% - 5.00% |

| $50,000 - $100,000 | $100,000 - $200,000 | 5.00% - 6.70% |

| $100,000 - $200,000 | $200,000 - $400,000 | 6.70% - 6.99% |

| > $200,000 | > $400,000 | 6.99% |

These rates are subject to change, so it's advisable to refer to the latest tax guidelines provided by the Connecticut Department of Revenue Services for the most accurate and up-to-date information.

Taxable Income and Deductions

Connecticut allows residents to deduct certain expenses from their taxable income, including medical expenses, state and local taxes, and charitable contributions. The state also offers various credits, such as the Earned Income Tax Credit (EITC) and the Child and Dependent Care Credit, which can reduce the tax liability for eligible taxpayers.

Non-Resident Tax Rates

Individuals who are non-residents of Connecticut but earn income within the state are subject to different tax rates. These rates are typically based on the percentage of income derived from Connecticut sources. Non-residents are required to file a Connecticut non-resident tax return and may be eligible for certain deductions and credits as well.

Sales and Use Tax

Connecticut imposes a sales and use tax on the sale of tangible personal property and certain services. As of my knowledge cutoff in January 2023, the general sales tax rate in Connecticut is 6.35%. However, it’s important to note that some municipalities may have additional local sales tax rates, which can increase the overall sales tax burden.

Sales Tax Exemptions

Certain items are exempt from sales tax in Connecticut, including prescription medications, most non-prepared food items, and clothing and footwear under $60. Additionally, charitable organizations, religious institutions, and certain government entities are exempt from paying sales tax on qualifying purchases.

Property Tax

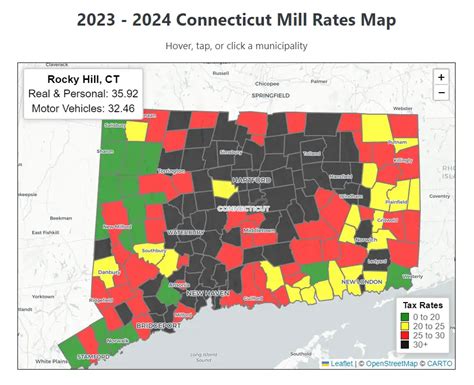

Property taxes are a significant source of revenue for local governments in Connecticut. These taxes are levied on real estate, personal property, and motor vehicles. The property tax rates vary widely across the state, as they are set by individual towns and cities.

Assessment and Mill Rate

Property taxes are calculated based on the assessed value of the property and the mill rate, which is the tax rate per thousand dollars of assessed value. For example, a mill rate of 20 mills means that the property tax rate is 20 for every 1,000 of assessed value. It’s important to note that the assessed value of a property may differ from its market value.

Tax Abatement Programs

Connecticut offers various tax abatement programs to encourage economic development and support specific industries. These programs may provide tax incentives for businesses that invest in certain sectors or create jobs in targeted areas. Local governments may also offer property tax abatements to attract new businesses or retain existing ones.

FAQs

How often are Connecticut’s tax rates updated?

+Connecticut’s tax rates are typically updated annually, with changes effective for the upcoming fiscal year. However, it’s important to note that emergency tax legislation can also lead to mid-year rate adjustments.

Are there any tax incentives for green energy initiatives in Connecticut?

+Yes, Connecticut offers various tax incentives for green energy projects, including tax credits for installing solar panels and other renewable energy systems. These incentives aim to promote sustainable practices and reduce carbon emissions.

How can I calculate my estimated property taxes in Connecticut?

+To estimate your property taxes in Connecticut, you can use the mill rate of your town or city and multiply it by the assessed value of your property. Keep in mind that this is a basic calculation, and other factors like exemptions or abatements may apply.

Are there any tax breaks for seniors or veterans in Connecticut?

+Yes, Connecticut offers tax relief programs for eligible seniors and veterans. These programs can provide reduced property tax assessments or even total exemptions, depending on the individual’s circumstances and the specific program.

How can I stay informed about tax changes and deadlines in Connecticut?

+Staying informed about tax changes and deadlines in Connecticut can be done by regularly checking the official website of the Connecticut Department of Revenue Services. They provide up-to-date information, tax guides, and important dates for various tax obligations.