Sales Tax For Colorado Springs

When conducting business in Colorado Springs, understanding the sales tax landscape is crucial for both consumers and businesses alike. The sales tax system in Colorado, and specifically in Colorado Springs, is a complex yet integral part of the city's economic framework. This article aims to delve into the specifics of sales tax in Colorado Springs, providing an in-depth analysis and insights for those navigating the city's tax environment.

Understanding Sales Tax in Colorado Springs

Sales tax in Colorado Springs is a vital component of the city’s revenue stream, contributing significantly to the overall economic development and sustainability of the region. The tax is applied to the sale of goods and certain services, with rates varying based on several factors.

The sales tax system in Colorado Springs operates on a combined rate structure, where the state, county, and municipal taxes are combined to form a single rate. This combined rate is then applied to the taxable transactions, ensuring a seamless and standardized tax collection process.

Currently, the state of Colorado imposes a sales and use tax rate of 2.9%, which forms the base rate for all taxable transactions. This base rate is then supplemented by additional tax rates levied by the county and city governments.

El Paso County Sales Tax

El Paso County, in which Colorado Springs is located, imposes an additional 1.0% sales tax on top of the state rate. This county-wide tax is applied uniformly across the county, ensuring a fair and consistent tax structure for all businesses and consumers.

| Tax Jurisdiction | Sales Tax Rate |

|---|---|

| State of Colorado | 2.9% |

| El Paso County | 1.0% |

Colorado Springs City Sales Tax

The city of Colorado Springs further adds a 3.1% sales tax to the combined state and county rate. This additional city tax is a crucial revenue stream for the city, funding various essential services and infrastructure projects.

It's important to note that the city sales tax rate is subject to change, as the city council may adjust the rate based on budgetary needs and economic conditions. As of the latest update, the 3.1% city sales tax rate is in effect, bringing the total combined sales tax rate in Colorado Springs to 7.0%.

| Tax Jurisdiction | Sales Tax Rate |

|---|---|

| State of Colorado | 2.9% |

| El Paso County | 1.0% |

| City of Colorado Springs | 3.1% |

| Total Combined Rate | 7.0% |

Sales Tax Exemptions and Special Considerations

While the general sales tax rate in Colorado Springs is 7.0%, there are certain goods and services that are exempt from sales tax or subject to special rates. Understanding these exemptions and considerations is essential for accurate tax compliance.

Food and Groceries

In Colorado Springs, unprepared food items, including grocery staples, are exempt from sales tax. This exemption extends to most basic food items, allowing consumers to purchase essential groceries without incurring additional sales tax.

However, it's important to note that prepared foods, such as meals from restaurants or take-out services, are subject to the full sales tax rate. This distinction is crucial for both consumers and food service businesses to understand when calculating sales tax liabilities.

Prescription Drugs

Prescription drugs are another category that is exempt from sales tax in Colorado Springs. This exemption is in place to ensure that essential healthcare items are more affordable and accessible to the community.

Construction and Building Materials

Certain construction and building materials are subject to a reduced sales tax rate of 3.9% in Colorado Springs. This special rate is applied to items such as lumber, hardware, and other materials used in construction projects.

The reduced rate aims to encourage economic growth and development in the construction industry, making it more affordable for businesses and individuals to undertake construction projects.

Other Exemptions and Special Cases

Colorado Springs, like other jurisdictions in Colorado, has a range of additional exemptions and special cases that may apply to certain goods and services. These can include items such as:

- Agricultural equipment and supplies

- Manufacturing machinery

- Certain types of software

- Educational materials

- Energy-efficient appliances

It's important for businesses and consumers alike to stay informed about these exemptions and special cases to ensure compliance with the sales tax regulations in Colorado Springs.

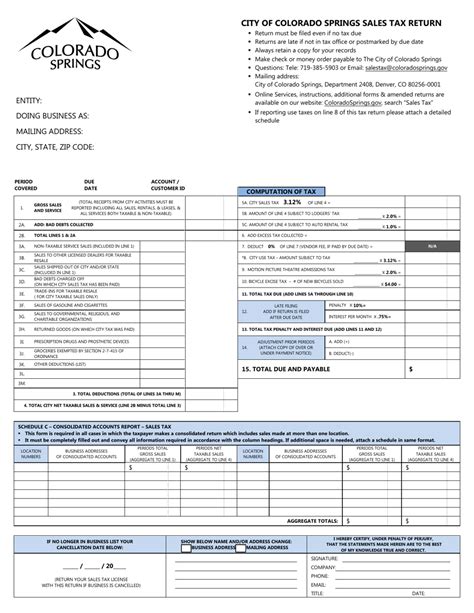

Sales Tax Compliance and Reporting

For businesses operating in Colorado Springs, compliance with sales tax regulations is a critical aspect of their financial operations. Accurate sales tax collection, reporting, and remittance are essential to avoid penalties and maintain a positive relationship with the taxing authorities.

Registering for Sales Tax

Any business selling taxable goods or services in Colorado Springs is required to register for a sales tax license with the Colorado Department of Revenue. This license allows the business to collect and remit sales tax on behalf of the taxing authorities.

The registration process involves providing detailed information about the business, including its legal name, physical location, and the types of goods and services it offers. Once registered, the business is assigned a unique sales tax number, which is used for all sales tax transactions and reporting.

Sales Tax Collection and Remittance

Businesses in Colorado Springs are responsible for collecting sales tax from customers at the point of sale. This involves adding the applicable sales tax rate to the total cost of the transaction and clearly displaying the tax amount on the customer’s receipt.

The collected sales tax must be remitted to the Colorado Department of Revenue on a regular basis, typically on a monthly or quarterly basis. The specific remittance schedule is determined by the business's sales volume and can be adjusted based on the business's needs and preferences.

Sales Tax Reporting

In addition to remitting the collected sales tax, businesses are also required to submit sales tax returns to the Colorado Department of Revenue. These returns provide a detailed breakdown of the sales tax collected, the applicable tax rates, and the total amount due to the taxing authorities.

Sales tax returns must be filed on a timely basis, with late submissions incurring penalties and interest charges. It's crucial for businesses to maintain accurate records of their sales transactions and to ensure that their sales tax returns are filed accurately and on time.

Sales Tax Audits

The Colorado Department of Revenue may conduct sales tax audits to ensure compliance with the state’s sales tax regulations. These audits can be random or targeted, and they involve a thorough review of the business’s sales records, tax returns, and other relevant documentation.

During an audit, the business must be prepared to provide detailed information about its sales transactions, including the applicable tax rates, the calculation of sales tax, and the remittance of the collected tax. It's essential for businesses to maintain proper sales tax records and to be transparent and cooperative during the audit process.

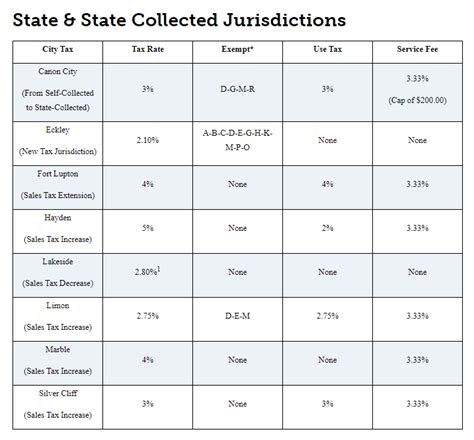

Future of Sales Tax in Colorado Springs

The sales tax landscape in Colorado Springs is subject to change, as the city and state governments may adjust tax rates and regulations based on economic conditions and budgetary needs. While the current sales tax rate of 7.0% is relatively stable, there is always the potential for future modifications.

One potential area of change is the introduction of new tax incentives or exemptions to promote specific industries or community initiatives. For instance, the city or state may consider offering tax breaks for renewable energy projects or small business development initiatives.

Additionally, as the economy evolves and new technologies emerge, the sales tax system may need to adapt to accommodate these changes. For example, with the rise of e-commerce and online sales, the state and city may need to develop new regulations and tax collection mechanisms to ensure a fair and efficient tax system for both traditional brick-and-mortar businesses and online retailers.

Staying informed about these potential changes is crucial for businesses and consumers alike, as it allows them to adapt their financial strategies and planning accordingly. Regular updates from official government sources and tax professionals can provide valuable insights into the future direction of sales tax in Colorado Springs.

What is the current sales tax rate in Colorado Springs?

+

The current sales tax rate in Colorado Springs is 7.0% as of the latest update. This rate includes the state sales tax of 2.9%, the El Paso County sales tax of 1.0%, and the city of Colorado Springs sales tax of 3.1%.

Are there any sales tax exemptions in Colorado Springs?

+

Yes, there are several sales tax exemptions in Colorado Springs. Unprepared food items, prescription drugs, and certain construction materials are among the items exempt from sales tax. It’s important to check the specific regulations for a comprehensive list of exemptions.

How often do sales tax rates change in Colorado Springs?

+

Sales tax rates in Colorado Springs can change based on economic conditions and budgetary needs. While there is no set schedule for rate changes, it’s important for businesses and consumers to stay updated through official government sources and tax professionals.

What happens if a business fails to collect and remit sales tax in Colorado Springs?

+

Failing to collect and remit sales tax in Colorado Springs can result in penalties, interest charges, and legal consequences. It’s crucial for businesses to comply with sales tax regulations to avoid these issues and maintain a positive relationship with the taxing authorities.

How can businesses stay updated on sales tax changes in Colorado Springs?

+

Businesses can stay updated on sales tax changes in Colorado Springs by regularly checking official government websites, subscribing to tax-related newsletters, and consulting with tax professionals. These sources provide the most accurate and up-to-date information on sales tax regulations and potential changes.