Tax Form 8862

Form 8862: A Comprehensive Guide to the IRS Information for Claiming the Earned Income Credit

When it comes to navigating the complex world of tax forms, Form 8862 stands out as a critical document for individuals seeking to claim the Earned Income Credit (EIC). This credit, offered by the Internal Revenue Service (IRS), provides a financial boost to eligible taxpayers, particularly those with low to moderate income levels. Form 8862, officially titled "Information for Claiming the Earned Income Credit", is a vital tool for ensuring you receive the credits you're entitled to. In this comprehensive guide, we'll delve into the intricacies of Form 8862, exploring its purpose, requirements, and the step-by-step process of completing it accurately.

Understanding Form 8862 is essential for taxpayers looking to maximize their tax refunds and take advantage of the benefits provided by the EIC. This credit can significantly reduce your tax liability or even result in a refund, making it an important consideration for many taxpayers. Whether you're a first-time filer or a seasoned taxpayer, having a thorough grasp of Form 8862 can streamline your tax preparation process and ensure you receive the full benefits you deserve.

The Purpose and Significance of Form 8862

Form 8862 is a crucial component of the IRS's Earned Income Credit program, designed to provide financial assistance to eligible taxpayers. The EIC is a tax credit available to working individuals and families with low to moderate incomes, offering a refund of a portion of the taxes they've paid or reducing their tax liability to zero. This credit can be a significant financial boost, helping taxpayers cover essential expenses and improve their financial stability.

The purpose of Form 8862 is to ensure that taxpayers accurately claim the EIC, providing the IRS with the necessary information to verify eligibility. This form is particularly important for individuals who have been ineligible for the EIC in the past due to various reasons, such as a change in marital status, a change in income, or a lack of qualifying children. By completing Form 8862, these taxpayers can demonstrate their eligibility and receive the credit they are entitled to.

The significance of Form 8862 extends beyond simply claiming the EIC. It serves as a vital tool for promoting financial inclusion and supporting low-income households. The EIC is one of the most effective anti-poverty measures in the U.S. tax system, and Form 8862 plays a critical role in ensuring that this credit reaches those who need it most. By understanding and utilizing this form correctly, taxpayers can access the financial benefits they deserve and take a step towards financial empowerment.

Key Eligibility Criteria for the Earned Income Credit

To be eligible for the Earned Income Credit, taxpayers must meet certain criteria set by the IRS. These criteria include income limits, marital status, and the presence of qualifying children. The income limits vary based on the number of qualifying children and the taxpayer's filing status. For example, the maximum income limit for a taxpayer with three or more qualifying children is higher than that for a taxpayer with no qualifying children.

Marital status also plays a role in determining eligibility. Taxpayers who are married and filing jointly have different income limits and requirements compared to those who are single, head of household, or widowed. Additionally, the presence of qualifying children is a significant factor. A qualifying child must meet certain age, relationship, and residency requirements to be considered for the EIC. The number of qualifying children also affects the amount of the credit.

It's important for taxpayers to carefully review their circumstances and ensure they meet all the eligibility criteria before claiming the Earned Income Credit. The IRS provides detailed guidelines and resources to help taxpayers understand these criteria and determine their eligibility. By understanding these requirements, taxpayers can make informed decisions about claiming the EIC and ensure they receive the full benefits they are entitled to.

The Impact of Form 8862 on Tax Refunds

Form 8862 has a significant impact on tax refunds, as it determines whether taxpayers are eligible for the Earned Income Credit and, subsequently, the amount of their refund. The EIC is a refundable credit, which means that if the credit amount exceeds the taxpayer's tax liability, the excess is refunded to them. This can result in a substantial refund, especially for taxpayers with low incomes and qualifying children.

By accurately completing Form 8862, taxpayers can maximize their refund potential. The form requires detailed information about the taxpayer's income, family size, and other relevant factors. Providing accurate and complete information ensures that the IRS can properly calculate the EIC and issue the correct refund amount. It's crucial for taxpayers to review their information carefully and ensure its accuracy to avoid delays or errors in their refund processing.

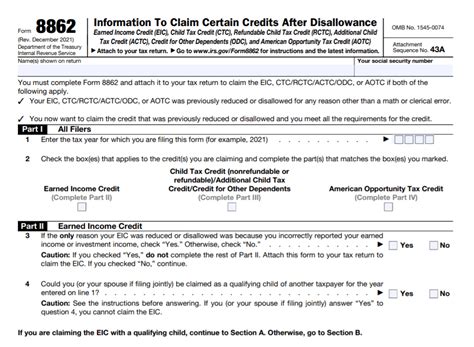

In addition to maximizing refunds, Form 8862 also helps taxpayers understand their eligibility for other tax credits and benefits. The information provided on the form can be used to determine eligibility for programs such as the Child Tax Credit, the Additional Child Tax Credit, and the American Opportunity Tax Credit. By understanding the interplay between these credits and the EIC, taxpayers can take advantage of multiple tax benefits and further reduce their tax liability or increase their refund.

Step-by-Step Guide to Completing Form 8862

Completing Form 8862 accurately is crucial to ensure you receive the Earned Income Credit you're entitled to. Here's a step-by-step guide to help you through the process:

Step 1: Gather the Necessary Information

Before you begin, gather all the required documentation and information. This includes your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), income statements (such as W-2s or 1099s), records of any earned income, and details about your qualifying children (if applicable). Ensure that all the information is accurate and up-to-date.

Having your SSN or ITIN readily available is essential, as it serves as a unique identifier for your tax records. Income statements, such as W-2s and 1099s, provide critical information about your earned income and tax withholdings. These documents are crucial for accurately reporting your income and determining your eligibility for the EIC. Additionally, if you have qualifying children, you'll need to provide their names, dates of birth, and Social Security numbers to establish their eligibility for the credit.

Step 2: Understanding the Form Sections

Form 8862 is divided into several sections, each requiring specific information. The first section collects personal information, including your name, address, and filing status. Subsequent sections delve into earned income details, such as wages, salaries, tips, and other taxable income. You'll also need to provide information about any dependents and qualifying children.

Understanding the form sections is crucial to ensure you provide the correct information in the right places. The personal information section is where you'll enter your basic details, such as your name, address, and whether you're filing as single, married filing jointly, or head of household. This information is vital for the IRS to process your tax return and issue any refunds or credits you're eligible for.

The earned income section is where you'll report all your taxable income, including wages, salaries, and tips. It's important to be accurate and thorough in reporting your income, as any discrepancies can impact your eligibility for the EIC. Additionally, if you have dependents or qualifying children, you'll need to provide their details in the appropriate sections of the form. This information is essential for the IRS to determine your eligibility for the credit and calculate the correct amount.

Step 3: Calculating Your Earned Income Credit

Form 8862 provides a worksheet to help you calculate your Earned Income Credit. This worksheet takes into account your earned income, family size, and other factors to determine your credit amount. Follow the instructions carefully and enter the appropriate information to ensure an accurate calculation.

Calculating your Earned Income Credit is a critical step in completing Form 8862. The worksheet provided with the form guides you through the process, ensuring that you consider all the relevant factors that affect your credit amount. These factors include your earned income, which is the income you receive from working, such as wages, salaries, and tips. The worksheet also takes into account your family size, including the number of qualifying children you have, as this directly impacts the amount of your EIC.

Other factors that influence your EIC calculation include your filing status and any adjustments to your income. For example, if you have certain expenses related to your work, such as childcare costs or job-related education expenses, these can be considered in the calculation. By following the instructions on the worksheet carefully and entering the correct information, you can ensure an accurate determination of your Earned Income Credit amount.

Step 4: Attaching Required Documents

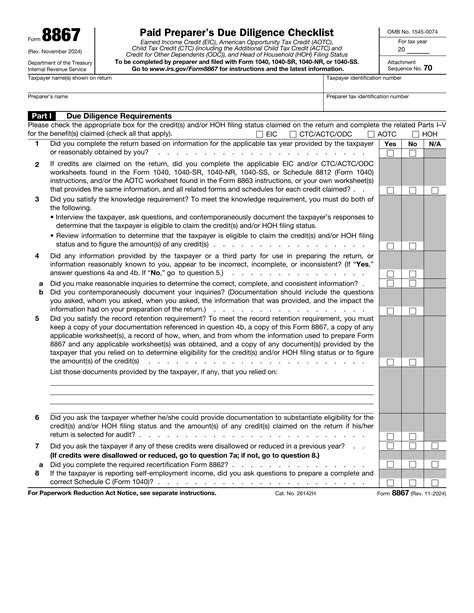

Form 8862 requires you to attach supporting documentation, such as W-2s, 1099s, and any other relevant records. Ensure that these documents are complete and accurately reflect your income and tax withholdings. Incomplete or inaccurate documentation can lead to delays or discrepancies in your tax refund.

Attaching the required documents to Form 8862 is a critical step in the tax filing process. These documents serve as proof of your income, tax withholdings, and other relevant financial information. For instance, W-2 forms are essential as they provide details about your wages, salaries, and any taxes withheld from your earnings. Similarly, 1099 forms are crucial if you've received any other forms of income, such as interest or dividends, as they provide a comprehensive overview of your financial activities.

It's important to ensure that all the attached documents are complete and accurate. Incomplete or incorrect information can lead to delays in processing your tax return or even result in penalties. Therefore, take the time to review and verify the information on these documents before attaching them to your Form 8862. Double-check names, addresses, income amounts, and any other pertinent details to avoid any discrepancies.

Step 5: Review and Sign the Form

Before submitting Form 8862, thoroughly review the entire document to ensure accuracy. Double-check all the information you've entered, including personal details, income amounts, and calculations. Once you're satisfied that everything is correct, sign and date the form to finalize your claim for the Earned Income Credit.

Reviewing Form 8862 is a critical step to ensure that all the information you've provided is accurate and complete. This includes double-checking your personal details, such as your name, address, and Social Security number, to ensure they match your tax records. Additionally, carefully review the income amounts you've entered, ensuring they correspond to your W-2s, 1099s, or other income statements. Any discrepancies in income reporting can impact your eligibility for the Earned Income Credit, so it's crucial to get this information right.

Once you've reviewed the form and confirmed that all the information is accurate, it's time to sign and date it. Signing Form 8862 is a crucial step as it signifies your agreement with the information provided and your intention to claim the Earned Income Credit. Make sure you sign the form in the designated area, and if you're filing jointly with a spouse, ensure that both of you sign the form. By signing the form, you're attesting to the truthfulness and accuracy of the information you've provided, which is essential for the IRS to process your tax return and determine your eligibility for the EIC.

Frequently Asked Questions

What is the purpose of Form 8862?

+Form 8862 is used to claim the Earned Income Credit (EIC) for taxpayers who are ineligible for the credit on their original return. It provides a way to claim the credit if certain eligibility requirements are met.

Who is eligible to file Form 8862?

+Eligible taxpayers include those who did not claim the EIC on their original return due to a change in marital status, a change in income, or a lack of qualifying children. It's also for those who received an EIC Disallowance Notice from the IRS.

How do I know if I qualify for the Earned Income Credit?

+Qualification for the EIC depends on various factors, including income, marital status, and the presence of qualifying children. You can use the IRS's EIC Assistant tool to determine if you're eligible. If you're unsure, consult a tax professional.

Can I e-file Form 8862, or do I have to mail it in?

+Form 8862 must be mailed to the IRS, as it cannot be e-filed. It's important to ensure that the form is complete, signed, and includes all required attachments before sending it in.

What happens if I make a mistake on Form 8862?

+If you discover a mistake on Form 8862 after filing, you can correct it by filing an amended return using Form 1040X. It's important to provide accurate information to avoid delays or issues with your tax refund.

In conclusion, Form 8862 is a crucial tool for taxpayers seeking to claim the Earned Income Credit. By understanding the purpose and requirements of this form, taxpayers can ensure they receive the credits they’re entitled to. With careful preparation and attention to detail, completing Form 8862 can be a straightforward process, allowing eligible taxpayers to maximize their tax refunds and benefit from the financial support provided by the EIC.