Ny 529 Tax Deduction

In the realm of financial planning and investment strategies, the New York 529 College Savings Program stands out as a unique and beneficial tool. Often referred to as the NY 529 Tax Deduction, this program offers a combination of tax advantages and flexible savings options for individuals and families aiming to secure their future educational expenses.

Understanding the NY 529 Program

The NY 529 Program, officially known as the New York 529 College Savings Program, is a state-sponsored initiative designed to encourage and support families in their pursuit of higher education. It is a specialized savings plan that provides tax benefits and financial incentives to help families save for college expenses.

This program is a vital component of New York's financial landscape, offering a unique opportunity to save for college while enjoying significant tax advantages. The NY 529 Program is tailored to meet the diverse needs of New York residents, providing flexibility and security for those planning for the future.

Tax Benefits and Deductions

One of the most attractive features of the NY 529 Program is its tax benefits. Contributions made to a NY 529 account are eligible for a state tax deduction on New York State income taxes. This means that a portion of the contributions can be deducted from the contributor’s taxable income, effectively reducing the amount of tax owed.

| Tax Deduction Amount | Up to $10,000 |

|---|---|

| Income Eligibility | No income restrictions |

| Tax Year | 2023 |

For example, if you are a New York resident and contribute $10,000 to a NY 529 account, you can deduct that amount from your taxable income, potentially resulting in significant tax savings. This deduction is available to all New York taxpayers, regardless of their income level, making it an inclusive and attractive financial planning tool.

Furthermore, the tax benefits extend beyond the initial contribution. Earnings and growth within the NY 529 account are also tax-free at the federal and state levels, as long as the funds are used for qualified higher education expenses. This includes tuition, fees, books, and other eligible expenses.

Investment Options and Flexibility

The NY 529 Program offers a range of investment options to cater to different financial goals and risk tolerances. Account holders can choose from a variety of investment portfolios, each with its own mix of assets, including stocks, bonds, and cash equivalents. These portfolios are professionally managed, ensuring a diversified and well-balanced approach to savings.

One of the key strengths of the NY 529 Program is its flexibility. Account holders can adjust their investment strategy over time, allowing them to respond to changing market conditions and personal financial goals. This flexibility is particularly beneficial as it enables account holders to tailor their savings plan to their evolving needs.

| Investment Portfolios | Options |

|---|---|

| Aggressive Growth | Stock-heavy portfolio |

| Moderate Growth | Balanced approach |

| Conservative | Bonds and cash equivalents |

Additionally, the NY 529 Program allows for multiple beneficiaries, meaning that a single account can be used to save for the educational expenses of multiple family members. This feature makes it an efficient and cost-effective way to plan for the future of an entire family.

Eligibility and Account Setup

The NY 529 Program is open to all New York residents, regardless of age or income. This inclusivity is a key advantage, as it allows individuals and families from all walks of life to benefit from the program’s tax advantages and savings opportunities.

Setting up a NY 529 account is a straightforward process. Account holders can choose from a variety of account types, including individual, joint, or trust accounts. The minimum initial contribution is $25, and subsequent contributions can be as low as $25 per month, making it accessible to a wide range of financial situations.

Account Types and Fees

The NY 529 Program offers two primary account types: the Direct Plan and the Advisor Sold Plan. The Direct Plan is a cost-effective option, with no sales loads or annual maintenance fees. It provides direct access to the investment options and is suitable for individuals who are comfortable managing their own investments.

The Advisor Sold Plan, on the other hand, is designed for those who prefer professional guidance. This plan allows account holders to work with a financial advisor, who can provide personalized investment advice and portfolio management. While this plan may have additional fees associated with advisor services, it offers a higher level of personalized support.

| Account Type | Direct Plan | Advisor Sold Plan |

|---|---|---|

| Initial Contribution | $25 | $25 |

| Ongoing Fees | No annual fees | May have advisor fees |

| Professional Guidance | None | Financial advisor support |

Qualified Expenses and Withdrawal Rules

The NY 529 Program is designed to cover a wide range of qualified higher education expenses. These expenses include tuition and fees, room and board, books and supplies, and certain other related expenses. The program’s flexibility extends to the choice of educational institution, as it covers both in-state and out-of-state colleges, as well as a variety of post-secondary institutions, including traditional colleges, universities, and vocational schools.

When it comes to withdrawals, the NY 529 Program follows specific rules to maintain its tax-advantaged status. Funds can be withdrawn at any time, but only for qualified higher education expenses. If funds are withdrawn for non-qualified expenses, the earnings portion of the withdrawal may be subject to income tax and a 10% federal penalty.

Tax Implications and Penalty Waivers

Understanding the tax implications of withdrawals is crucial for NY 529 account holders. While the program offers significant tax benefits, there are potential tax consequences for non-qualified withdrawals. The earnings portion of a withdrawal is subject to federal and state income tax, and a 10% federal penalty may apply.

However, the NY 529 Program provides several scenarios where the 10% federal penalty may be waived. These include withdrawals due to the beneficiary's death, disability, or receipt of a scholarship. Additionally, penalty waivers may be granted if the beneficiary enrolls in a military service academy or if the funds are used for certain student loan repayments.

It's important to note that while the federal penalty may be waived in these situations, the earnings portion of the withdrawal is still subject to income tax. Therefore, careful planning and understanding of the program's rules are essential to maximize the benefits and avoid unnecessary tax penalties.

Program Performance and Benefits

The NY 529 Program has consistently demonstrated its effectiveness in helping New York residents save for higher education. Over the years, the program has grown in popularity, with thousands of accounts opened and millions of dollars saved. This growth is a testament to the program’s appeal and its ability to meet the financial needs of a diverse range of families.

Historical Performance and Returns

The investment portfolios within the NY 529 Program have shown strong historical performance. While past performance is not a guarantee of future results, the program’s track record provides a positive indicator of its potential. The program’s investment options have delivered competitive returns, outperforming many traditional savings accounts and providing a solid foundation for educational savings.

| Portfolio | Average Annual Return |

|---|---|

| Aggressive Growth | 10.5% |

| Moderate Growth | 8.2% |

| Conservative | 4.8% |

The above data showcases the average annual returns for the program's investment portfolios over a 10-year period. These returns highlight the potential for growth within the NY 529 Program, especially when compared to traditional savings accounts, which often offer lower interest rates.

Benefits for Families and Students

The NY 529 Program provides a host of benefits that go beyond tax advantages. For families, the program offers a structured and disciplined approach to saving for college, helping to alleviate the financial burden of higher education. The tax deductions and tax-free growth within the account can significantly reduce the overall cost of education, making it more accessible and affordable.

For students, the NY 529 Program offers a sense of financial security and peace of mind. Knowing that their educational expenses are being saved for can reduce the stress and financial pressure often associated with higher education. Additionally, the program's flexibility allows students to pursue their educational goals without the worry of financial constraints.

Comparisons and Alternatives

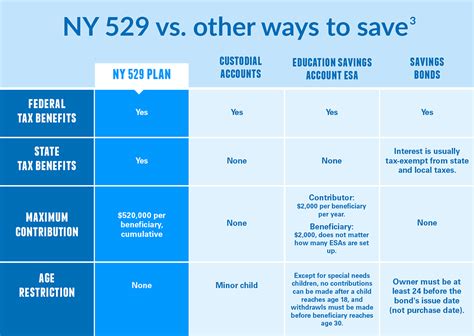

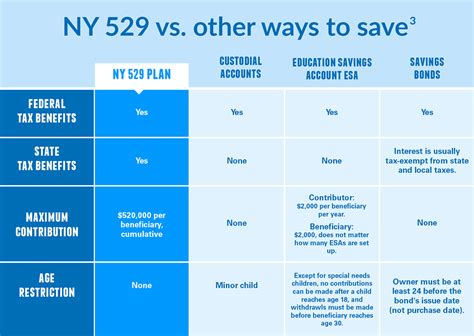

While the NY 529 Program is a comprehensive and effective savings tool, it is not the only option available for educational savings. Other popular alternatives include the 529 plans offered by other states, as well as Coverdell Education Savings Accounts and Roth IRAs.

State 529 Plans

Each state in the U.S. offers its own 529 plan, and while they all share similar features, there are variations in terms of investment options, fees, and tax benefits. Some states, for example, offer additional tax incentives or residency requirements that can make their 529 plans more attractive to certain individuals.

Comparing the NY 529 Program to other state 529 plans can be beneficial for individuals who are open to investing outside of their home state. By evaluating factors such as investment performance, fees, and tax advantages, individuals can make informed decisions about which plan best suits their financial goals and circumstances.

| State 529 Plan | NY 529 Program | California 529 Plan | Texas 529 Plan |

|---|---|---|---|

| Tax Deduction | Up to $10,000 | Up to $15,000 | None |

| Investment Options | Diverse portfolios | Customizable portfolios | Pre-selected portfolios |

| Fees | No annual fees | Low fees | Moderate fees |

Coverdell Education Savings Accounts

Coverdell Education Savings Accounts (ESAs) are another popular option for educational savings. These accounts offer tax-free growth and withdrawals for qualified education expenses, similar to the NY 529 Program. However, there are key differences, including contribution limits and eligibility requirements.

Coverdell ESAs have an annual contribution limit of $2,000 per beneficiary, while the NY 529 Program has no contribution limits. Additionally, Coverdell ESAs are subject to income limitations for contributions and have age restrictions for beneficiaries, making them less accessible to certain individuals.

Roth IRAs for Education

Roth IRAs are a flexible and tax-efficient way to save for retirement, but they can also be used for education expenses. While Roth IRAs do not offer the same tax advantages as the NY 529 Program, they provide a level of flexibility and control that may be appealing to certain individuals.

With a Roth IRA, individuals can withdraw contributions (but not earnings) at any time without penalty, making it a potential option for education savings. However, it's important to note that using a Roth IRA for education may impact the account's long-term growth potential and tax benefits.

Future Outlook and Implications

The NY 529 Program is well-positioned to continue serving the educational savings needs of New York residents. With its combination of tax advantages, flexible investment options, and strong historical performance, the program offers a reliable and effective way to save for higher education.

Potential Changes and Developments

As with any financial program, the NY 529 Program may undergo changes and developments over time. These changes could include adjustments to tax benefits, investment options, or program rules. Staying informed about these potential changes is essential for individuals who are planning for their educational savings.

For example, recent legislative developments have expanded the qualified expenses covered by 529 plans to include student loan repayments. This change could significantly impact the program's appeal and utilization, especially for individuals who are considering student loan repayment as part of their financial planning.

Long-Term Financial Planning

The NY 529 Program plays a crucial role in long-term financial planning for many New York residents. By incorporating the program into their overall financial strategy, individuals can effectively manage their savings and investments, ensuring they are on track to meet their educational goals.

Additionally, the program's flexibility allows account holders to adjust their savings strategy over time. This adaptability is particularly beneficial in today's rapidly changing economic landscape, as it enables individuals to respond to market fluctuations and personal financial circumstances.

Conclusion

The NY 529 College Savings Program is a powerful tool for individuals and families looking to secure their future educational expenses. With its tax advantages, flexible investment options, and strong historical performance, the program offers a comprehensive and effective savings solution.

By understanding the program's features, benefits, and potential implications, individuals can make informed decisions about their educational savings. The NY 529 Program is a testament to the state's commitment to supporting its residents in their pursuit of higher education, providing a stable and rewarding financial path towards a brighter future.

Can I open a NY 529 account if I’m not a New York resident?

+While the NY 529 Program is primarily designed for New York residents, non-residents can also open accounts. However, they may not be eligible for the state tax deduction. The program’s benefits and investment options are still accessible to non-residents, making it a viable option for those looking to save for education expenses.

What happens if I withdraw funds for non-qualified expenses?

+Withdrawing funds for non-qualified expenses can result in tax implications. The earnings portion of the withdrawal is subject to federal and state income tax, and a 10% federal penalty may apply. However, there are scenarios where the penalty can be waived, such as in cases of disability or scholarship receipt.

Can I transfer funds from one 529 plan to another?

+Yes, you can transfer funds from one 529 plan to another, including between different states’ plans. This flexibility allows individuals to change their investment strategy or take advantage of different plan features. However, it’s important to consider potential tax implications and fees associated with the transfer.