Dallas Property Taxes

Property taxes are a significant consideration for homeowners and prospective buyers, and they play a crucial role in shaping the financial landscape of any city. In the vibrant city of Dallas, Texas, property taxes have become a topic of interest and discussion. With its thriving economy, diverse neighborhoods, and dynamic real estate market, understanding the intricacies of Dallas property taxes is essential for making informed decisions. This comprehensive article aims to delve into the world of Dallas property taxes, providing an in-depth analysis, real-world examples, and valuable insights to navigate this essential aspect of homeownership in the Lone Star State.

Unraveling the Complexities of Dallas Property Taxes

Dallas, known for its bustling business districts, cultural attractions, and sports scenes, boasts a unique property tax system that can be both fascinating and challenging to navigate. The city’s tax landscape is influenced by a variety of factors, including its position as a major economic hub, its diverse range of property types, and the intricate tax assessment and collection processes. In this section, we’ll explore the fundamental aspects of Dallas property taxes, shedding light on how they are calculated, assessed, and collected.

The Basics of Property Tax Calculation in Dallas

Property taxes in Dallas are calculated based on the assessed value of a property and the tax rate set by various taxing authorities. The assessed value is determined through a meticulous process that involves evaluating factors such as the property’s location, size, improvements, and market conditions. This assessment is conducted by the Dallas Central Appraisal District (DCAD), which is responsible for appraising all taxable properties within the city.

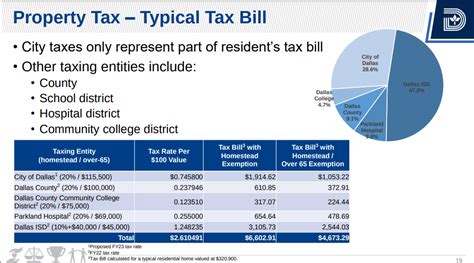

Once the assessed value is established, it is multiplied by the applicable tax rate, which varies depending on the type of property and the taxing jurisdiction. In Dallas, property taxes are levied by multiple entities, including the city itself, the county, school districts, and other special districts. Each of these entities has its own tax rate, which is used to calculate the property tax liability for each property within its jurisdiction.

| Taxing Authority | Tax Rate (Effective Tax Rate) |

|---|---|

| City of Dallas | 0.0200 (2.00%) |

| Dallas County | 0.0180 (1.80%) |

| Dallas ISD | 0.0140 (1.40%) |

| Other Special Districts | Varies |

The effective tax rate represents the total tax rate for a specific property, which is the sum of all applicable tax rates from the various taxing authorities. It is important to note that the tax rates can change annually, influenced by factors such as budget requirements, economic conditions, and voter-approved initiatives.

Tax Assessment and Collection Process

The tax assessment process in Dallas is a collaborative effort between the Dallas Central Appraisal District (DCAD) and the Dallas Appraisal Review Board (ARB). The DCAD conducts annual appraisals of all taxable properties, utilizing various valuation methods and market data to determine the assessed value. Property owners have the right to appeal their assessed value if they believe it is inaccurate or unfair.

Once the assessed values are finalized, the taxing authorities, including the city, county, and school districts, set their tax rates for the upcoming fiscal year. These rates are then applied to the assessed values to calculate the property tax liability for each property. The tax bills are typically mailed to property owners in October, with payment due by January 31 of the following year.

It is worth mentioning that Dallas offers various exemptions and tax relief programs to eligible property owners. These include homestead exemptions, which reduce the taxable value of a primary residence, as well as exemptions for seniors, disabled individuals, and veterans. Understanding these exemptions can significantly impact a property owner's tax liability and should be carefully considered.

Exploring Dallas Property Tax Rates and Comparisons

Dallas property taxes, like those in many other cities, are influenced by a multitude of factors, including the city’s tax policies, economic conditions, and the diverse range of properties within its boundaries. In this section, we will delve into the specifics of Dallas property tax rates, provide real-world examples, and offer comparisons with other major cities to gain a comprehensive understanding of how Dallas’s tax landscape stacks up.

Dallas Property Tax Rates: An In-Depth Look

As mentioned earlier, Dallas property taxes are determined by the assessed value of a property and the tax rates set by various taxing authorities. The effective tax rate, which represents the total tax burden, can vary significantly depending on the location and characteristics of the property. Here, we will delve into the specifics of Dallas’s tax rates and provide insights into how they are applied.

For residential properties in Dallas, the effective tax rate can range from approximately 1.5% to 3.0% of the assessed value. This wide range is influenced by factors such as the property's location, with properties in certain neighborhoods or school districts facing higher tax rates. Additionally, the type of property, such as single-family homes, condominiums, or multi-family units, can also impact the tax rate.

Commercial properties in Dallas are subject to a different set of tax rates. The effective tax rate for commercial properties can range from 2.0% to 4.0% of the assessed value. This higher tax rate is due to the additional services and infrastructure required to support commercial activities. It is worth noting that the tax rates for commercial properties can also vary based on the specific use of the property, with certain industries or sectors facing higher tax burdens.

To provide a clearer picture, let's consider a real-world example. Imagine a single-family home in Dallas with an assessed value of $300,000. Using the average effective tax rate of 2.5% for residential properties, the annual property tax liability for this home would be $7,500. This calculation is based on the combined tax rates from the city, county, school district, and any applicable special districts.

Similarly, for a commercial property with an assessed value of $1,000,000, the annual property tax liability, using an average effective tax rate of 3.0% for commercial properties, would be $30,000. This example highlights the significant tax burden that property owners in Dallas can face, especially for larger or more valuable properties.

Comparing Dallas Property Taxes with Other Major Cities

To gain a broader perspective, let’s compare Dallas property taxes with those in other major cities across the United States. While it’s important to note that each city has its unique tax structure and assessment methods, a comparative analysis can provide valuable insights into Dallas’s position in the national tax landscape.

| City | Effective Tax Rate (Residential) | Effective Tax Rate (Commercial) |

|---|---|---|

| Dallas, TX | 1.5% - 3.0% | 2.0% - 4.0% |

| Houston, TX | 2.0% - 2.5% | 2.5% - 3.5% |

| New York City, NY | 1.2% - 2.0% | 3.0% - 4.0% |

| Los Angeles, CA | 0.7% - 1.5% | 1.2% - 2.5% |

| Chicago, IL | 2.0% - 3.0% | 2.5% - 4.0% |

From the table above, we can observe that Dallas's property tax rates are generally on the higher end when compared to other major cities. While cities like Los Angeles and New York City have lower residential tax rates, they often make up for it with higher commercial tax rates. Houston, on the other hand, has tax rates that are relatively similar to Dallas, indicating a competitive tax landscape between these two major Texas cities.

It is important to remember that property tax rates are just one factor to consider when evaluating the overall cost of living and doing business in a city. Other factors, such as the availability of services, infrastructure, and economic opportunities, should also be taken into account. Additionally, property tax rates can be influenced by local initiatives, voter-approved bonds, and other factors unique to each city.

The Impact of Property Taxes on Dallas Homeowners

Property taxes are an essential aspect of homeownership, and in Dallas, they play a significant role in shaping the financial landscape for homeowners. From influencing buying decisions to impacting monthly budgets, property taxes are a crucial consideration for those residing in the city. In this section, we will explore the various ways in which Dallas property taxes affect homeowners, providing real-world examples and insights into their impact on the local real estate market.

Property Taxes and Home Buying Decisions

When considering purchasing a home in Dallas, prospective buyers often evaluate a multitude of factors, including the property’s location, size, amenities, and, of course, the associated property taxes. Property taxes can significantly impact the overall affordability of a home, as they represent an ongoing expense that must be factored into a buyer’s budget. Here, we will delve into how property taxes influence home buying decisions in Dallas.

Let's consider a scenario where a prospective buyer is comparing two similar homes in different neighborhoods of Dallas. Home A, located in a desirable school district with excellent amenities, has an assessed value of $400,000 and an effective tax rate of 2.8%. On the other hand, Home B, situated in a less prestigious neighborhood with fewer amenities, has an assessed value of $350,000 and an effective tax rate of 2.2%. Despite Home B being slightly less expensive, the lower tax rate makes it a more attractive option for the buyer, as it results in a lower annual property tax liability.

In this example, the difference in tax rates between the two homes can amount to a significant savings for the buyer. Over the course of several years, the cumulative savings in property taxes can add up to thousands of dollars, making Home B a more financially appealing choice. This scenario highlights how property taxes can sway buying decisions and influence the desirability of certain neighborhoods or properties.

Additionally, property taxes can impact the overall affordability of a home. In Dallas, where property values have been on the rise, higher tax rates can make it more challenging for buyers to secure affordable housing options. As a result, many buyers may opt for less expensive neighborhoods or consider other cost-saving measures, such as purchasing a smaller home or seeking properties with lower tax rates.

Managing Property Taxes: Strategies for Homeowners

For homeowners in Dallas, managing property taxes is an ongoing concern. While the tax rates are set by the various taxing authorities, there are strategies and resources available to help homeowners navigate and mitigate their property tax burden. In this section, we will explore some of the options and resources that homeowners can utilize to effectively manage their property taxes.

- Homestead Exemptions: Dallas offers homestead exemptions, which reduce the taxable value of a primary residence. To qualify, homeowners must apply for the exemption and meet certain eligibility criteria, such as being the owner-occupant of the property. Homestead exemptions can provide significant tax savings and are a valuable tool for homeowners to reduce their property tax liability.

- Tax Abatements and Incentives: Dallas, like many other cities, offers various tax abatement programs and incentives to encourage economic development and attract businesses. These programs can provide substantial tax savings for eligible properties, such as those engaged in certain industries or located in designated economic development zones. Homeowners should explore these opportunities to determine if they qualify for any tax abatements or incentives.

- Appealing Property Assessments: If a homeowner believes that their property has been assessed at a value higher than its fair market value, they have the right to appeal the assessment. The Dallas Appraisal Review Board (ARB) provides a process for homeowners to challenge their property's assessed value. By presenting evidence and supporting documentation, homeowners can potentially reduce their assessed value, leading to lower property taxes.

- Tax Payment Plans: Dallas offers various tax payment plans to assist homeowners who may struggle to pay their property taxes in full by the deadline. These plans allow homeowners to pay their taxes in installments, providing financial flexibility and preventing late fees or penalties. Homeowners should inquire with the tax office about the available payment plans and their eligibility criteria.

The Future of Dallas Property Taxes: Trends and Projections

As Dallas continues to evolve and grow, its property tax landscape is likely to undergo changes and adjustments. Understanding the future trends and projections in Dallas property taxes is crucial for homeowners, prospective buyers, and investors. In this section, we will explore the factors that may influence the future of Dallas property taxes and provide insights into potential changes and their implications.

Economic Factors and Their Impact on Property Taxes

The economic health of a city plays a significant role in shaping its property tax landscape. Dallas, with its robust economy and diverse industries, is well-positioned to withstand economic fluctuations. However, certain economic factors can still impact property taxes and influence the city’s tax policies.

One key economic factor to consider is the city's budget and revenue requirements. As the city's population grows and infrastructure needs expand, the demand for public services and investments increases. To meet these demands, the city may need to adjust tax rates or explore alternative revenue streams. For example, if the city faces budget constraints, it may propose tax rate increases to generate additional revenue. On the other hand, a strong economy and robust tax base can provide the city with more flexibility in managing its finances and maintaining stable tax rates.

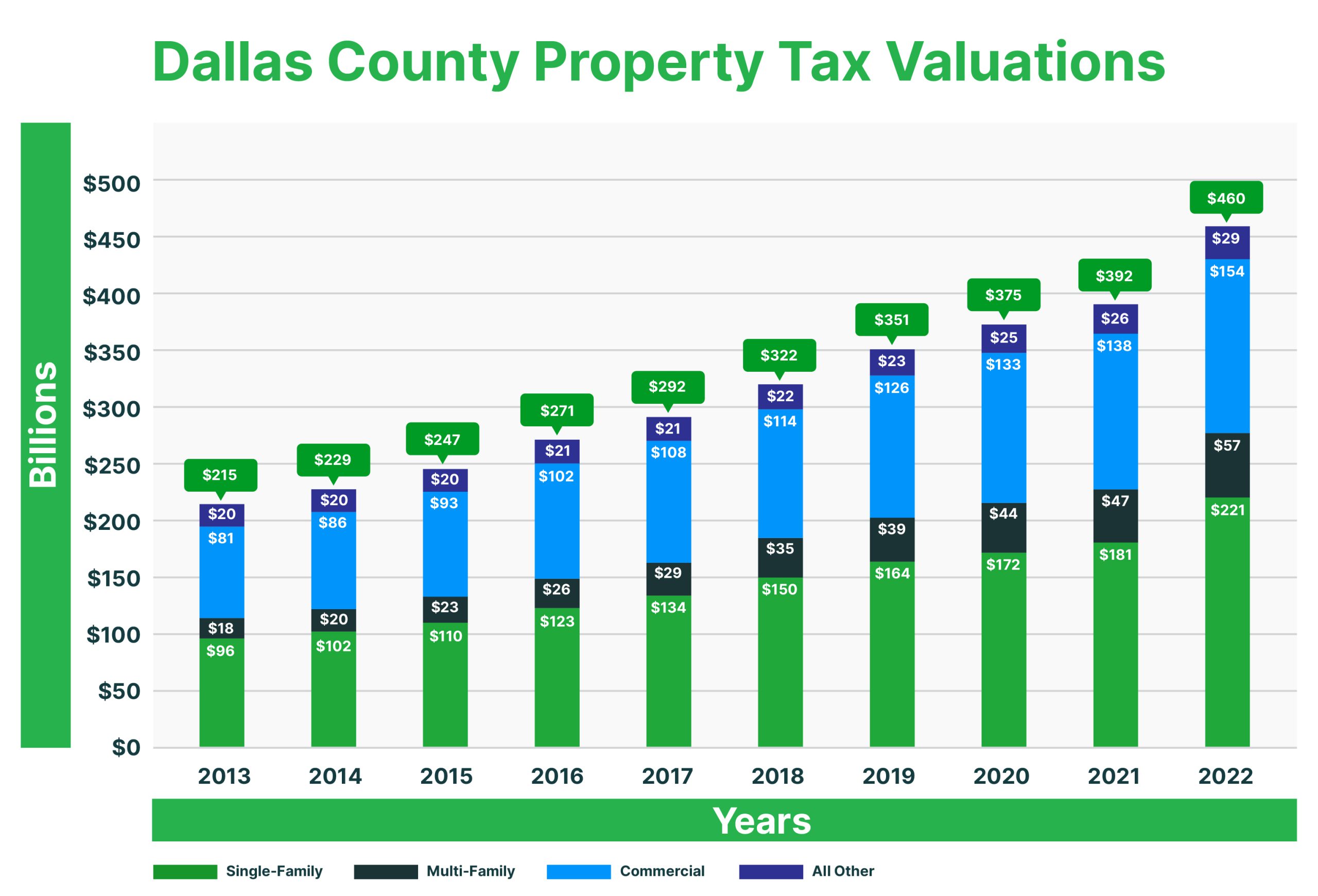

Additionally, economic factors such as the housing market, job growth, and business development can influence property values and, subsequently, property taxes. A thriving housing market with increasing property values may lead to higher assessed values, resulting in higher property taxes. Similarly, a robust job market and business expansion can attract more residents and businesses, potentially increasing the demand for services and infrastructure, which can impact tax rates.

Future Projections and Potential Changes

Looking ahead, several factors may influence the future of Dallas property taxes. Here are some potential changes and trends to consider:

- Population Growth and Urban Development: Dallas is experiencing steady population growth, which can drive up property values and potentially lead to higher tax assessments. As the city continues to develop and attract new residents, the demand for housing and amenities may increase, impacting property taxes.

- Infrastructure Investments: The city's ongoing infrastructure projects, such as transportation improvements, public works initiatives, and community development efforts, require significant funding. These investments may influence tax rates as the city seeks to balance its budget and allocate resources effectively.

- Tax Policy Changes: Dallas, like many other cities, is constantly evaluating its tax policies and exploring ways to enhance revenue generation and improve efficiency. Potential changes may include adjustments to tax rates, the introduction of new taxes or fees, or the modification of existing tax exemptions and incentives. Homeowners and investors should stay informed about any proposed tax policy changes to understand their potential impact.

- Voter-Approved Initiatives: Dallas residents have the power to influence property taxes through voter-approved initiatives. Proposals such as bond measures, which provide funding for specific projects or infrastructure improvements, can impact tax rates. Homeowners should stay engaged in local politics and be aware of upcoming elections to understand how their votes may affect property taxes.

It is important to note that while these projections provide a glimpse into the future, the actual trajectory of Dallas property taxes is subject to a multitude of factors and may evolve differently than anticipated. Staying informed, engaging with local government, and seeking expert advice are crucial for homeowners and investors to navigate the evolving tax landscape in Dallas.

Conclusion: Navigating Dallas Property Taxes with Confidence

Dallas property taxes are a complex yet essential aspect of homeownership and real estate investment in the city. By understanding the intricacies of property tax calculation, assessment, and collection, homeowners can make informed decisions and effectively manage their tax liabilities. This comprehensive guide has provided an in-depth analysis of Dallas property taxes, offering real-world examples, comparative insights, and strategies for homeowners.

As Dallas continues to thrive and evolve, staying abreast of the city's tax landscape is crucial. Economic factors, population growth, infrastructure investments, and tax policy changes will all play a role in shaping the future of Dallas property taxes. By staying informed and engaged, homeowners and investors can navigate these changes with confidence and ensure they are prepared for any potential adjustments to their tax obligations.

In conclusion, Dallas property taxes are an integral part of the city’s financial ecosystem, influencing buying decisions, budgeting, and the overall cost of living. With the knowledge and resources provided in this article, individuals can approach property taxes in Dallas with a clearer understanding and a strategic mindset