Cabell County Wv Tax Lookup

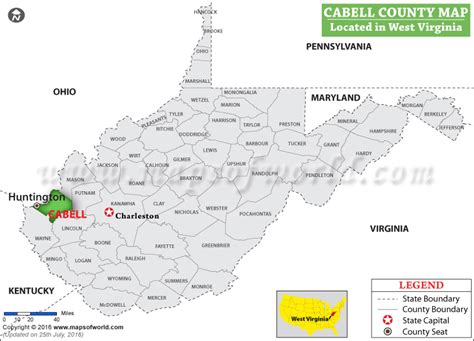

Welcome to the comprehensive guide on exploring the world of Cabell County, West Virginia's tax information and how to access it efficiently. In this expert-led article, we delve into the intricacies of the Cabell County Wv Tax Lookup, a vital tool for residents, businesses, and anyone interested in understanding the tax landscape of this vibrant county.

Understanding the Cabell County Tax System

Cabell County, nestled in the picturesque state of West Virginia, boasts a unique tax system that plays a crucial role in the county’s economic framework. The tax structure is designed to support the growth and development of the region while ensuring fairness and transparency for all taxpayers.

At the heart of this system is the Cabell County Assessor's Office, which holds the key to unlocking vital tax information. This office, headed by the elected County Assessor, is responsible for assessing the value of properties within the county, a critical step in determining tax liabilities.

The Role of the County Assessor

The County Assessor is a pivotal figure in Cabell County’s tax administration. Their primary responsibility is to ensure that all taxable properties are accurately assessed, maintaining a fair and equitable tax system. This involves regular evaluations of properties, taking into account various factors such as location, improvements, and market trends.

The Assessor's office also plays a crucial role in providing taxpayers with detailed information about their properties, including assessed values, tax rates, and any applicable exemptions. This transparency fosters trust and understanding among residents and businesses, making the tax system more accessible and understandable.

Property Assessment Process

The property assessment process in Cabell County is a meticulous endeavor. Assessors utilize a range of tools and methodologies to determine the fair market value of properties. This includes physical inspections, analysis of sales data, and consideration of economic factors that may impact property values.

Property owners in Cabell County can access their assessment information through the Cabell County Tax Lookup portal. This online platform provides a user-friendly interface, allowing residents to retrieve detailed information about their properties, including assessed values, tax liabilities, and historical data. It's a powerful tool for taxpayers to stay informed and engaged in the tax process.

Exploring the Cabell County Tax Lookup Portal

The Cabell County Tax Lookup portal is a digital gateway to a wealth of tax-related information. Designed with user experience in mind, it offers a seamless and efficient way to access property tax details.

Features and Benefits

- Real-time Data Access: Users can retrieve up-to-date property tax information, ensuring they have the most current data at their fingertips.

- Detailed Property Reports: The portal provides comprehensive reports on individual properties, including ownership details, assessed values, and tax history.

- Tax Calculation Tools: It offers built-in calculators to estimate tax liabilities based on various scenarios, helping taxpayers plan and budget effectively.

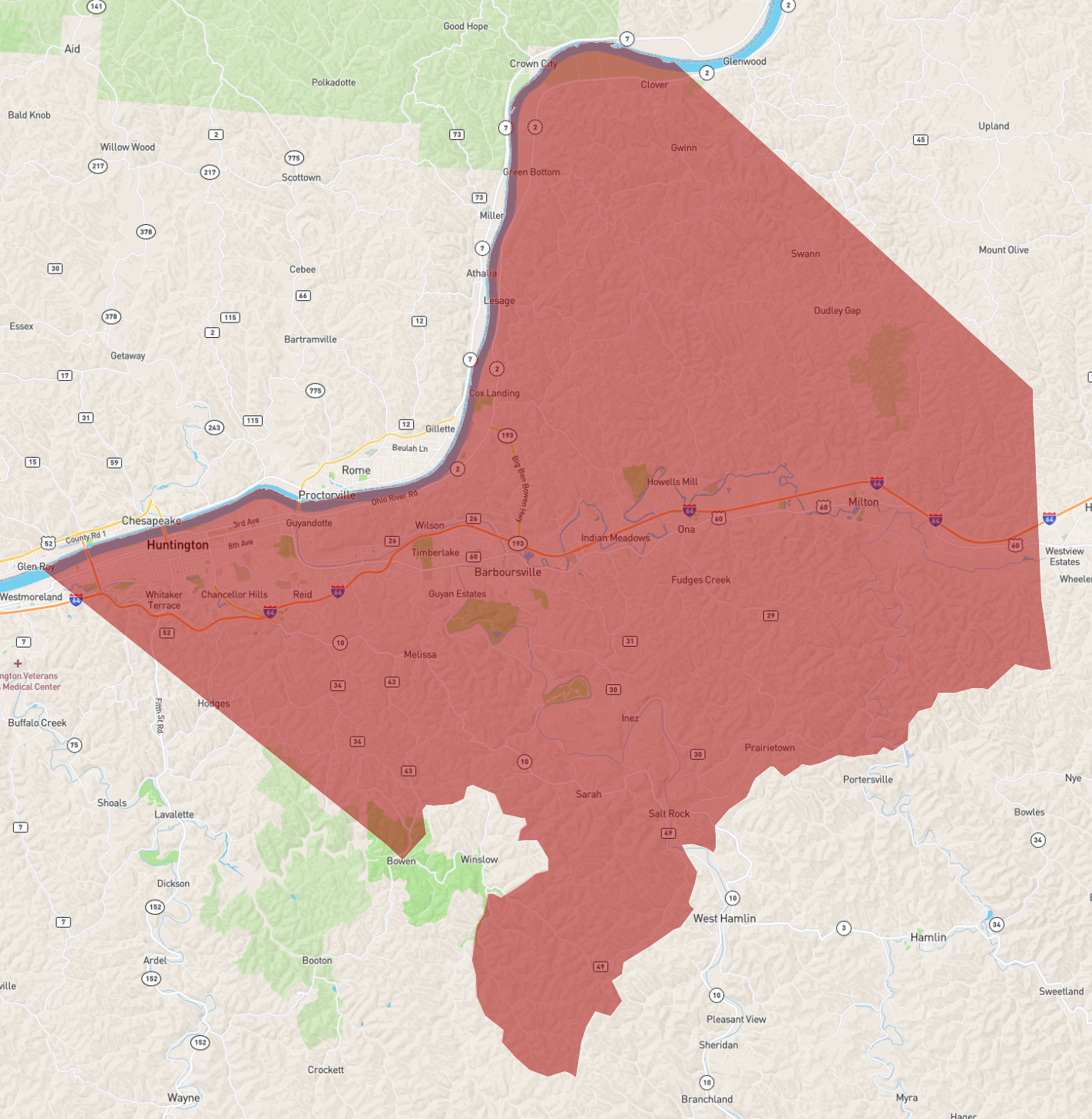

- Interactive Maps: An interactive map feature allows users to visualize property locations and assess their proximity to key amenities, providing valuable context for tax-related decisions.

- Notification System: The portal includes a notification system, alerting users to any changes in tax rates, assessment values, or relevant updates.

How to Use the Tax Lookup Portal

Navigating the Cabell County Tax Lookup portal is straightforward. Users can access the platform through the official Cabell County website or by using dedicated apps available for both iOS and Android devices.

- Registration: Users may need to create an account to access certain features, especially if they require personalized tax information. Registration is a quick process, requiring basic details such as name, contact information, and property address.

- Property Search: Once logged in, users can search for their properties using various criteria, including address, parcel number, or owner's name. The search results provide a snapshot of the property's tax details.

- Detailed Reports: By selecting a property, users can access in-depth reports, including historical tax data, assessment details, and any applicable exemptions.

- Tax Calculations: The portal's tax calculator allows users to input different scenarios, such as changes in property value or tax rate, to estimate their potential tax liabilities.

- Notifications and Alerts: Users can customize their notification preferences to receive updates on tax-related matters, ensuring they stay informed about any changes that may impact their tax obligations.

Tax Rates and Exemptions in Cabell County

Understanding the tax rates and exemptions in Cabell County is essential for both residents and businesses. The county operates with a range of tax rates, including property taxes, sales taxes, and various other levies.

Property Tax Rates

Property taxes in Cabell County are calculated based on the assessed value of the property and the applicable tax rate. The tax rate is determined by the County Commission, taking into account the budget needs of various county services, such as education, public safety, and infrastructure development.

| Tax Rate Type | Tax Rate |

|---|---|

| Residential Property Tax Rate | 0.78% |

| Commercial Property Tax Rate | 0.85% |

| Agricultural Property Tax Rate | 0.50% |

Sales Tax Rates

Cabell County, like other counties in West Virginia, imposes a sales tax on retail transactions. The sales tax rate consists of a state-level tax and a local tax, with the county adding an additional percentage to the state’s base rate.

| Sales Tax Type | Tax Rate |

|---|---|

| State Sales Tax Rate | 6% |

| Local Sales Tax Rate (Cabell County) | 1% |

| Total Sales Tax Rate | 7% |

Tax Exemptions

Cabell County offers various tax exemptions to eligible individuals and organizations. These exemptions are designed to provide relief to specific groups and promote certain initiatives.

- Homestead Exemption: Eligible homeowners can apply for a homestead exemption, which reduces their property's assessed value, resulting in lower property taxes.

- Veterans' Exemption: Cabell County extends tax relief to qualifying veterans, offering a reduction in property taxes as a token of appreciation for their service.

- Senior Citizen Exemption: Older residents may be eligible for property tax exemptions based on their age and income, making it easier for them to manage their tax obligations.

- Nonprofit Organization Exemption: Charitable and nonprofit organizations often receive tax exemptions, ensuring their resources are directed towards their mission rather than tax liabilities.

Assistance and Resources for Taxpayers

Cabell County recognizes the importance of providing support and resources to taxpayers, ensuring they can navigate the tax system with ease and confidence.

Taxpayer Assistance Programs

The county offers a range of taxpayer assistance programs, including workshops and seminars, to educate residents about their tax obligations and rights. These programs cover topics such as tax filing, payment options, and understanding tax notices.

Additionally, the Assessor's office provides personalized assistance to taxpayers who may require additional support. This includes helping with property assessments, resolving tax-related issues, and offering guidance on available exemptions.

Online Resources and Tools

The Cabell County Tax Lookup portal is a valuable online resource, but it’s not the only tool available. The county’s official website offers a wealth of information, including tax guides, frequently asked questions, and contact details for various tax-related departments.

Additionally, Cabell County utilizes social media platforms to keep taxpayers informed about tax-related news, updates, and deadlines. Following the county's official social media accounts can be a convenient way to stay updated.

Conclusion: A Transparent and Accessible Tax System

Cabell County’s commitment to transparency and accessibility in its tax system is evident through initiatives like the Cabell County Tax Lookup portal. By providing residents and businesses with easy access to tax information, the county fosters a culture of engagement and understanding.

As we've explored, the tax system in Cabell County is designed to be fair, efficient, and supportive of the county's growth. With a range of resources and assistance programs, taxpayers can navigate the tax landscape with confidence, ensuring they fulfill their obligations while benefiting from available exemptions and support.

Whether you're a resident, business owner, or simply curious about Cabell County's tax system, the information and tools provided by the county ensure you have the knowledge and resources to make informed decisions.

How often are property assessments conducted in Cabell County?

+

Property assessments in Cabell County are conducted annually to ensure that property values remain up-to-date and accurate. This annual assessment process is a critical component of the county’s tax system, allowing for fair and equitable tax distribution.

Can I appeal my property’s assessed value if I disagree with it?

+

Absolutely! Cabell County provides a formal appeals process for taxpayers who wish to challenge their property’s assessed value. This process involves submitting an appeal to the County Assessor’s office, presenting evidence and arguments to support your case. It’s important to note that appeals must be filed within a specific timeframe, typically within 30 days of receiving the assessment notice.

Are there any online tools to estimate my property’s tax liability before the official assessment?

+

Yes, the Cabell County Tax Lookup portal offers a tax calculator tool that allows users to estimate their property’s tax liability based on various scenarios. This tool can provide a rough estimate, helping taxpayers understand the potential impact of different factors on their tax obligations.

How can I stay informed about tax-related news and updates in Cabell County?

+

Cabell County utilizes multiple channels to keep taxpayers informed. This includes regular updates on the official county website, social media platforms, and even email newsletters. By following these channels, you can stay abreast of tax-related news, changes in tax rates or policies, and important deadlines.

Are there any tax incentives or programs for businesses in Cabell County?

+

Indeed, Cabell County recognizes the importance of supporting local businesses and offers various tax incentives and programs. These may include tax abatements, tax increment financing, or special tax districts. It’s recommended that businesses explore these opportunities and consult with the County Assessor’s office or economic development agencies for more information.