Washington Dc Income Tax Rate

The District of Columbia, often referred to as Washington D.C., has a unique tax system due to its status as the capital of the United States. The income tax rate in Washington D.C. is a significant aspect of its fiscal policy, and understanding its intricacies is crucial for residents, businesses, and anyone interested in the economic landscape of the nation's capital.

For the 2023 tax year, the income tax rate for single filers with an income of 50,000 in Washington D.C. is 7.85%.">What is the current income tax rate in Washington D.C. for single filers with an income of 50,000? +

The Washington D.C. Income Tax Structure

The District of Columbia's income tax system is progressive, meaning that higher income levels are taxed at higher rates. This structure aims to ensure fairness and generate adequate revenue for the city's operations and development.

The tax rates in Washington D.C. are determined by tax brackets, similar to the federal income tax system. The brackets and corresponding tax rates are as follows:

| Tax Bracket (Taxable Income) | Tax Rate |

|---|---|

| $0 - $10,000 | 4.00% |

| $10,001 - $40,000 | 6.00% |

| $40,001 - $60,000 | 7.85% |

| $60,001 - $100,000 | 8.50% |

| $100,001 - $250,000 | 8.75% |

| $250,001 - $500,000 | 8.95% |

| $500,001 and above | 8.95% (plus a 3.45% surtax) |

It's important to note that these tax rates are subject to change annually, and residents are advised to refer to the official District of Columbia government websites for the most current tax information.

Filing Status and Deductions

The income tax rates in Washington D.C. are applicable to various filing statuses, including single, married filing jointly, married filing separately, and head of household. The tax brackets and rates are adjusted based on the filing status, ensuring fairness for different household compositions.

The District also offers various deductions and credits to alleviate the tax burden on residents. These include deductions for dependents, charitable contributions, and certain medical expenses. Additionally, residents can claim credits for income tax paid to other states or jurisdictions, further reducing their taxable income.

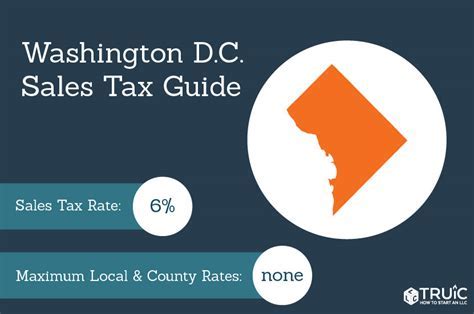

Local Tax Variations

While the District of Columbia has a unified tax system, it's worth noting that there are some local variations. Certain neighborhoods or wards within Washington D.C. may have slightly different tax rates or specific tax initiatives. These local variations are designed to address specific community needs and fund local projects and services.

The Impact of Income Tax on Washington D.C.'s Economy

The income tax system in Washington D.C. plays a crucial role in shaping the city's economic landscape and development. The revenue generated from income taxes funds essential services, infrastructure projects, and social programs that benefit residents and contribute to the overall well-being of the city.

Infrastructure and Development

A significant portion of the income tax revenue is allocated towards maintaining and improving Washington D.C.'s infrastructure. This includes funding for road repairs, public transportation, and the development of new projects that enhance the city's connectivity and accessibility.

For instance, the District's Department of Transportation utilizes income tax revenue to implement initiatives such as the Vision Zero program, which aims to eliminate traffic fatalities and improve road safety. This program, along with other infrastructure projects, not only benefits residents but also attracts businesses and tourists, contributing to the city's economic growth.

Social Programs and Community Initiatives

Washington D.C.'s income tax revenue also supports a range of social programs and community initiatives aimed at addressing social and economic disparities. These programs provide critical support to low-income families, the elderly, and individuals with disabilities, ensuring their access to essential services and resources.

The District's Department of Human Services, for example, utilizes income tax funds to administer programs like the Temporary Assistance for Needy Families (TANF) and the Supplemental Nutrition Assistance Program (SNAP), which provide financial assistance and food support to eligible residents.

Business and Economic Development

The income tax system in Washington D.C. also plays a vital role in supporting business growth and economic development. A portion of the tax revenue is directed towards initiatives that foster entrepreneurship, attract new businesses, and create job opportunities.

The District's Department of Small and Local Business Development, for instance, utilizes tax revenue to provide grants, loans, and other financial incentives to support small businesses and startups. These initiatives not only stimulate economic growth but also contribute to the city's vibrant and diverse business landscape.

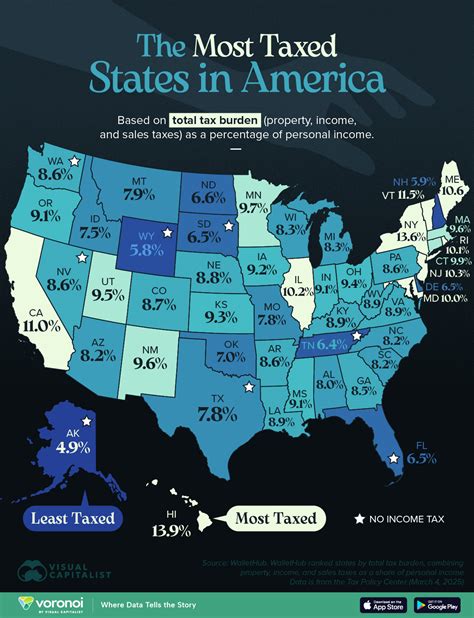

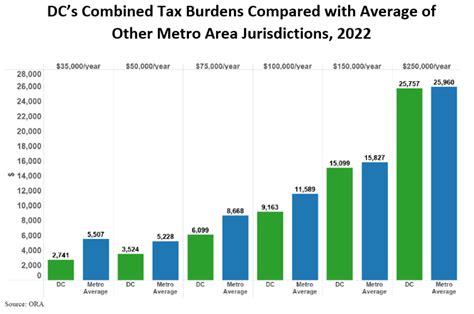

Comparative Analysis: Washington D.C. vs. Other U.S. Cities

Washington D.C.'s income tax system can be compared with those of other major U.S. cities to understand its uniqueness and potential implications.

Tax Rates and Brackets

When compared to other large cities like New York, Los Angeles, and Chicago, Washington D.C.'s income tax rates are relatively competitive. While the exact tax brackets and rates vary across these cities, Washington D.C.'s progressive tax structure ensures that it remains attractive for businesses and residents alike.

For instance, New York City has a higher top marginal tax rate of 3.876%, which is applicable to income above $528,000 for single filers. In comparison, Washington D.C.'s top marginal rate of 8.95% (plus a 3.45% surtax) is only applicable to income above $500,000.

Tax Incentives and Benefits

Washington D.C. offers a range of tax incentives and benefits to attract and retain businesses and residents. These include tax credits for research and development, film production, and historic preservation. Additionally, the District provides tax exemptions for certain types of income, such as military retirement pay and certain types of pension income.

These incentives, coupled with the city's vibrant culture, diverse job market, and proximity to federal institutions, make Washington D.C. an attractive destination for professionals and businesses, despite its relatively high cost of living.

Future Implications and Tax Reform

The income tax system in Washington D.C. is subject to ongoing discussions and potential reforms. As the city's economic landscape evolves, so too must its tax policies to ensure they remain fair, efficient, and aligned with the needs of its residents and businesses.

Potential Tax Reform Initiatives

Proposed tax reform initiatives in Washington D.C. often focus on improving tax equity and efficiency. This includes exploring options like a flat tax rate, which simplifies the tax system and makes it more transparent. However, implementing a flat tax rate may require careful consideration to ensure it doesn't disproportionately impact lower-income residents.

Another potential reform is the expansion of tax credits and deductions to provide more relief to specific demographics, such as low-income earners and families with children. These measures aim to reduce the tax burden on vulnerable populations and promote social and economic equity.

Long-Term Economic Impact

The future of Washington D.C.'s income tax system will have significant implications for the city's economic health and development. A well-designed and progressive tax system can attract businesses, create jobs, and generate revenue for essential services. Conversely, an ineffective or unfair tax system can hinder economic growth and strain the city's finances.

As the District continues to grow and evolve, its tax policies will play a pivotal role in shaping its future. Balancing the needs of residents, businesses, and the city's fiscal health will be crucial to ensuring Washington D.C.'s long-term prosperity.

What is the current income tax rate in Washington D.C. for single filers with an income of 50,000?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>For the 2023 tax year, the income tax rate for single filers with an income of 50,000 in Washington D.C. is 7.85%.

Are there any tax incentives or credits available for businesses in Washington D.C.?

+Yes, Washington D.C. offers various tax incentives and credits to businesses, including tax credits for research and development, film production, and historic preservation. Additionally, there are tax exemptions for certain types of business income.

How does Washington D.C.’s income tax system compare to that of other U.S. states or cities?

+Washington D.C.’s income tax system is relatively competitive when compared to other large cities. While specific rates and brackets vary, D.C.’s progressive tax structure ensures it remains attractive for businesses and residents. It offers a balance between tax revenue generation and resident incentives.