Oregon Real Estate Taxes

Oregon's real estate market is an attractive proposition for many investors and homeowners alike, but it's essential to understand the tax implications that come with owning property in the state. Real estate taxes, also known as property taxes, play a significant role in Oregon's revenue system and can impact an individual's financial planning. This comprehensive guide will delve into the intricacies of Oregon real estate taxes, offering a detailed breakdown of the assessment process, tax rates, exemptions, and strategies to manage these obligations effectively.

Understanding Oregon’s Property Tax System

Oregon’s property tax system is a primary source of revenue for local governments, including counties, cities, and special districts. These taxes fund essential services like schools, fire protection, and infrastructure development. The state’s unique approach to property taxation is characterized by a three-year cycle, which includes the assessment, appeal, and collection processes.

The Assessment Process

Each year, the county assessor’s office determines the real market value (RMV) of all properties within their jurisdiction. This value is established through a comprehensive analysis, considering factors such as recent sales data, construction costs, and income potential. The RMV is crucial as it forms the basis for calculating the property tax liability.

After determining the RMV, the assessor applies the maximum assessed value (MAV) calculation. The MAV is the higher of either the RMV or the prior year's MAV plus a maximum of 3%, ensuring that property taxes don't escalate drastically from one year to the next. This step is followed by the assessed value (AV) calculation, which is the lower of either the MAV or the RMV.

Once the AV is established, it is multiplied by the tax rate to determine the property tax liability. The tax rate varies depending on the location and the types of services provided by the local government.

| Property Type | Assessment Ratio | Example Calculation |

|---|---|---|

| Residential | 90% | AV = $300,000 Tax Rate = 1.1% Tax Liability = $3,300 |

| Commercial | 100% | AV = $500,000 Tax Rate = 1.5% Tax Liability = $7,500 |

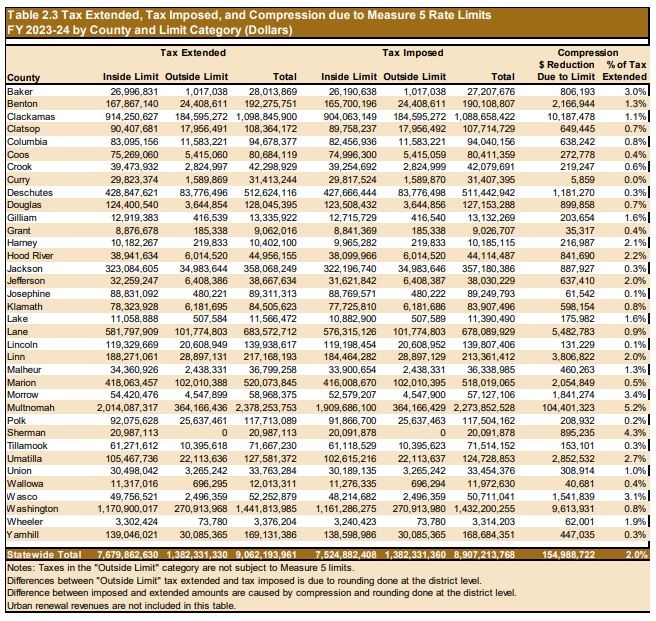

Tax Rates and Limitations

Oregon has a compressed tax rate structure, which means that properties with a higher assessed value pay a lower tax rate, and vice versa. This system aims to ensure fairness and prevent overburdening property owners. The state also imposes a maximum annual tax increase of 3% on most properties, which can provide stability for long-term property owners.

Property Tax Exemptions

Oregon offers several exemptions that can reduce property tax liabilities. These include:

- Homestead Exemption: Provides a reduction in property taxes for primary residences. The exemption amount varies by county but can be substantial, especially for long-term residents.

- Senior Citizen Exemption: Offers reduced property taxes for homeowners aged 62 or older. The exemption amount is based on the individual's income level and can provide significant savings.

- Veteran's Exemption: Provides a property tax reduction for veterans who meet specific criteria, such as having a service-connected disability or being on active duty during a designated period.

- Disabled Veterans Exemption: Extends property tax relief to veterans who are permanently and totally disabled due to military service.

Managing Property Taxes

For those looking to manage their property tax obligations, several strategies can be employed:

- Appealing Assessments: If you believe your property's assessed value is inaccurate, you have the right to appeal. The process involves submitting documentation to support your claim, and if successful, can result in a reduced tax liability.

- Taking Advantage of Exemptions: Ensure you understand and apply for any exemptions for which you are eligible. These can significantly reduce your tax burden.

- Consider Refinancing: If you have an adjustable-rate mortgage, refinancing to a fixed-rate mortgage can provide stability and potentially lower your property tax liability over time.

- Explore Tax Deferral Programs: Oregon offers tax deferral programs for low-income seniors and disabled homeowners. These programs allow eligible individuals to defer their property taxes until they sell the property or pass away.

The Impact of Property Taxes on Investment Properties

For investors considering real estate ventures in Oregon, understanding the property tax landscape is crucial. Higher property values often mean higher tax liabilities, which can impact cash flow and overall investment returns. However, Oregon’s compressed tax rate structure and exemptions can provide opportunities for strategic tax management.

Investors can consider the following strategies:

- Diversifying Investments: Spreading investments across multiple properties can help manage tax liabilities, as the tax rate compression may result in lower overall taxes.

- Optimizing Property Use: Ensuring properties are used efficiently and productively can help maximize returns. For instance, converting a garage into a rental unit can increase income and potentially offset tax liabilities.

- Understanding Rental Property Tax Implications: Rental properties are subject to additional taxes, such as rental income taxes and potential payroll taxes. It's essential to understand these obligations and plan accordingly.

Conclusion

Oregon’s real estate market offers unique opportunities, but it’s crucial to navigate the state’s property tax system effectively. By understanding the assessment process, tax rates, and available exemptions, homeowners and investors can make informed decisions and manage their tax obligations strategically. Whether it’s appealing an assessment, applying for exemptions, or exploring investment strategies, a comprehensive understanding of Oregon’s real estate taxes is key to success in the state’s market.

How often are property taxes assessed in Oregon?

+Property taxes in Oregon are assessed annually, with the assessment process occurring each year to determine the real market value and subsequent tax liability.

Can I appeal my property’s assessed value?

+Yes, if you believe your property’s assessed value is inaccurate, you have the right to appeal. The process involves submitting documentation to support your claim and can potentially result in a reduced tax liability.

What are the tax rates for different property types in Oregon?

+Tax rates vary depending on the location and the types of services provided by the local government. Residential properties typically have a lower tax rate than commercial properties.

Are there any exemptions available for property taxes in Oregon?

+Yes, Oregon offers several exemptions, including the Homestead Exemption, Senior Citizen Exemption, Veteran’s Exemption, and Disabled Veterans Exemption. These exemptions can significantly reduce property tax liabilities.

How can I manage my property taxes as an investor in Oregon’s real estate market?

+Investors can employ strategies such as diversifying investments, optimizing property use, and understanding the tax implications of rental properties. Additionally, staying informed about tax rates and exemptions can help manage tax obligations effectively.