What's The Sales Tax In Florida

In the vibrant state of Florida, the sales tax landscape is an intriguing aspect of its economic framework. With a thriving tourism industry and diverse commercial activities, understanding the sales tax rates and their implications is crucial for businesses and consumers alike. This article delves into the intricacies of Florida's sales tax, shedding light on its structure, variations, and real-world applications.

Understanding Florida’s Sales Tax Structure

Florida’s sales tax is a consumption tax levied on the sale of goods and certain services within the state. It is a crucial revenue generator for the state government, contributing significantly to its overall budget. The tax is imposed on the end consumer, making it a regressive tax, as it affects individuals regardless of their income level.

The Florida Department of Revenue is responsible for administering and collecting sales tax, ensuring compliance with state laws and regulations. This department plays a pivotal role in interpreting tax statutes, providing guidance to taxpayers, and enforcing tax laws.

Florida's sales tax is a combination of a state-level tax and local taxes, which vary across different counties and municipalities. This unique structure means that the total sales tax rate can differ significantly from one region to another, creating a complex tax environment for businesses operating across the state.

State Sales Tax Rate

The state-level sales tax rate in Florida is currently set at 6%. This uniform rate applies to most tangible personal property and certain services across the state. However, it’s important to note that certain items, such as groceries and non-prepared foods, are exempt from this tax, offering some relief to consumers.

Local Sales Tax Rates

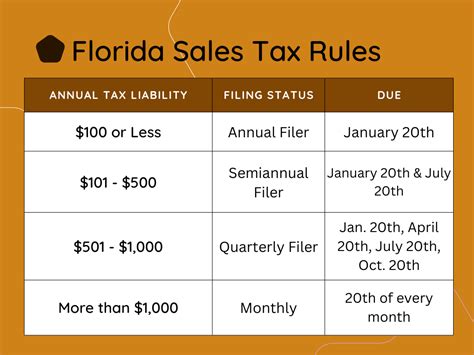

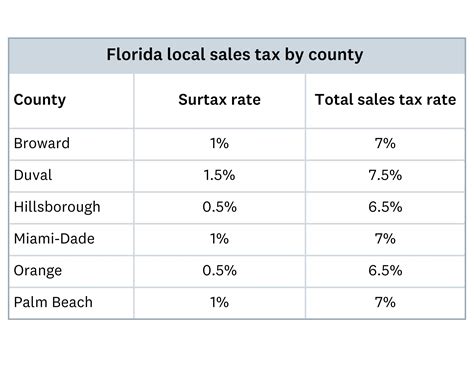

In addition to the state sales tax, Florida allows local governments to impose their own sales taxes. These local taxes, often referred to as discretionary sales surtaxes, are used to fund specific projects or initiatives within a community. The rates for these local taxes can vary significantly, ranging from 0% to 1.5%, depending on the county or municipality.

For instance, the vibrant city of Miami has a local sales tax rate of 1.5%, bringing the total sales tax rate to 7.5% when combined with the state tax. On the other hand, smaller towns or rural areas might have lower local tax rates, resulting in a lower overall sales tax burden for consumers in those regions.

The varying local tax rates create a complex landscape for businesses, especially those with multiple locations across the state. They must ensure compliance with each locality's tax laws and regulations, a task that can be challenging given the diverse tax environment.

| County | Local Sales Tax Rate | Total Sales Tax Rate |

|---|---|---|

| Miami-Dade County | 1.5% | 7.5% |

| Orange County | 1.0% | 7.0% |

| Hillsborough County | 1.5% | 7.5% |

| Pinellas County | 1.0% | 7.0% |

| Broward County | 1.5% | 7.5% |

This table provides a glimpse into the varying local sales tax rates in some of Florida's major counties. It's important to note that there are numerous other counties and municipalities with their own unique tax rates, creating a highly diverse tax environment across the state.

Sales Tax Exemptions and Special Considerations

Florida’s sales tax system is not without its complexities and nuances. The state offers a range of exemptions and special considerations that can impact the tax burden on businesses and consumers.

Exemptions for Specific Goods and Services

Florida exempts certain goods and services from sales tax. This includes a wide range of items, from essential groceries and non-prepared foods to specific industrial machinery and equipment. These exemptions are designed to provide relief to consumers and support specific industries within the state.

For instance, the sale of prescription drugs and medical devices is exempt from sales tax in Florida. This exemption aims to reduce the financial burden on individuals who rely on these essential items for their health and well-being.

Special Considerations for Tourism and Lodging

Florida’s vibrant tourism industry has unique considerations when it comes to sales tax. The state imposes a tourist development tax, often referred to as a resort tax or bed tax, on the rent or lease of living quarters for a term of six months or less. This tax, which varies by county, is typically included in the advertised room rate, making it a hidden cost for tourists.

Additionally, Florida levies a rental car tax on the rental of motor vehicles for periods of less than one year. This tax, which can vary by county, is a significant revenue generator for the state, particularly in regions with high tourist traffic.

These special taxes, while adding to the complexity of Florida's sales tax system, provide a dedicated funding stream for tourism-related projects and initiatives, helping to maintain and enhance the state's allure as a top tourist destination.

Compliance and Enforcement

Ensuring compliance with Florida’s sales tax laws is a critical aspect for businesses operating within the state. The Florida Department of Revenue employs a range of strategies to enforce tax laws and ensure that businesses are meeting their tax obligations.

Businesses are required to register with the department and obtain a sales tax permit. This permit allows them to collect and remit sales tax on behalf of the state. Failure to register or comply with tax laws can result in penalties, interest, and even criminal charges in severe cases.

The department conducts regular audits to verify that businesses are accurately calculating and remitting sales tax. These audits can be detailed and thorough, examining financial records, sales data, and even physical inventory to ensure compliance. Non-compliance can lead to significant financial penalties and damage to a business's reputation.

In addition to audits, the department utilizes data analytics and modern technology to identify potential tax evasion or non-compliance. This includes monitoring electronic sales records, analyzing credit card transactions, and employing advanced data mining techniques to detect anomalies that may indicate tax avoidance.

Sales Tax and Online Sales

With the rise of e-commerce, Florida, like many other states, has had to adapt its sales tax laws to address online sales. The state has implemented a sales tax nexus standard, which defines the conditions under which out-of-state sellers must collect and remit Florida sales tax.

Under this standard, out-of-state sellers are required to collect and remit sales tax if they have a certain level of economic presence in the state, such as through affiliates, warehouses, or a significant number of sales transactions. This ensures that online retailers contribute to the state's tax revenue, even if they do not have a physical presence in Florida.

Florida's approach to online sales tax is designed to level the playing field for local businesses, ensuring that they are not at a competitive disadvantage against online retailers. It also helps to maintain a stable tax base for the state, allowing it to fund essential services and infrastructure.

Future Implications and Potential Changes

Florida’s sales tax landscape is subject to ongoing discussions and potential changes. As the state’s economy evolves and new technologies disrupt traditional business models, the sales tax system may need to adapt to maintain fairness and generate adequate revenue.

One potential area of change is the treatment of digital products and services. With the rapid growth of the digital economy, there are questions about whether and how sales tax should be applied to digital transactions, such as software downloads, streaming services, and online advertising. Finding a balance between generating tax revenue and supporting innovation in the digital space will be a key challenge for policymakers.

Additionally, there may be discussions around simplifying the sales tax system, particularly in relation to the varying local tax rates. While these rates provide local governments with a dedicated funding stream, they also add complexity for businesses and consumers. Finding a balance between local autonomy and a more uniform tax system will be a delicate task for lawmakers.

Conclusion

Florida’s sales tax system is a complex yet crucial component of its economic framework. From the state-level tax to the diverse local tax rates, businesses and consumers navigate a dynamic tax environment. Understanding these rates and their implications is essential for making informed financial decisions and ensuring compliance with state laws.

As Florida continues to evolve and adapt to new economic realities, its sales tax system will likely undergo further changes and refinements. By staying informed and engaged with these developments, businesses can adapt their strategies and ensure they remain compliant with the state's tax laws, contributing to Florida's vibrant economic landscape.

What is the current state-level sales tax rate in Florida?

+The current state-level sales tax rate in Florida is 6%.

Are there any sales tax exemptions in Florida?

+Yes, Florida offers a range of sales tax exemptions for specific goods and services. This includes exemptions for essential groceries, prescription drugs, and certain industrial machinery.

How does Florida handle sales tax for online sales?

+Florida has implemented a sales tax nexus standard, requiring out-of-state sellers with a certain level of economic presence in the state to collect and remit Florida sales tax. This ensures that online retailers contribute to the state’s tax revenue.

What are the potential future changes to Florida’s sales tax system?

+Potential future changes may include addressing the treatment of digital products and services and simplifying the varying local tax rates to strike a balance between local autonomy and a more uniform tax system.