Missouri Income Tax Status

Understanding the tax landscape of a state is crucial for individuals and businesses alike. Missouri, like many other states in the United States, has its own unique income tax system, which can impact personal finances and business operations. This comprehensive guide will delve into the specifics of Missouri's income tax status, providing an in-depth analysis for those seeking accurate and detailed information.

An Overview of Missouri’s Income Tax System

Missouri operates under a progressive income tax system, which means that as taxable income increases, so does the tax rate applied to that income. This system ensures that higher-income earners contribute a larger proportion of their income in taxes compared to those with lower incomes. Missouri’s progressive tax structure aims to maintain a fair and balanced approach to taxation.

The state's income tax system is governed by the Missouri Department of Revenue, which collects and administers the tax. Missouri's tax code is complex, encompassing various provisions, deductions, and credits that impact the final tax liability of individuals and businesses. Understanding these nuances is essential for accurate tax planning and compliance.

Tax Rates and Brackets

Missouri’s income tax rates are divided into six tax brackets, each with its own corresponding tax rate. These brackets are designed to ensure a progressive tax system, with higher tax rates applied to higher income levels. The tax rates for Missouri’s income tax brackets are as follows:

| Tax Bracket (Single Filers) | Tax Rate |

|---|---|

| First $1,000 | 1.5% |

| $1,001 - $2,000 | 2.0% |

| $2,001 - $3,000 | 2.5% |

| $3,001 - $4,000 | 3.0% |

| $4,001 - $8,000 | 4.0% |

| Over $8,000 | 5.3% |

It's important to note that these tax rates are for single filers. For married couples filing jointly, the tax brackets and rates are slightly different, with a generally lower tax burden compared to single filers.

Taxable Income and Deductions

Missouri’s taxable income is calculated based on an individual’s or business’s total income, with certain deductions and exemptions allowed. Some common deductions include:

- Standard deduction or itemized deductions, which can reduce taxable income.

- Personal exemptions for the taxpayer, spouse, and eligible dependents.

- Certain business expenses, including office expenses, travel costs, and advertising.

- Educational expenses for qualifying educational institutions.

- Contributions to retirement plans, such as 401(k)s and IRAs.

It's crucial for taxpayers to understand the specific deductions and exemptions they are eligible for, as these can significantly impact their overall tax liability.

Missouri’s Taxable Entities and Rates

Missouri’s tax system extends beyond individual income tax. The state also imposes taxes on various entities, including corporations, partnerships, and limited liability companies (LLCs). Understanding the tax rates and requirements for these entities is essential for business owners and investors.

Corporate Income Tax

Corporations doing business in Missouri are subject to a corporate income tax. The tax rate for corporations is a flat rate of 6.25% on taxable income. This rate applies to both C-corporations and S-corporations. However, there are certain exemptions and deductions that corporations can take advantage of to reduce their tax liability.

For instance, Missouri allows corporations to deduct certain business expenses, including research and development costs, and provides tax credits for job creation and investment in certain industries. These incentives aim to promote economic growth and development within the state.

Partnerships and LLCs

Partnerships and LLCs in Missouri are not subject to entity-level income tax. Instead, the income of these entities “passes through” to the individual partners or members, who are then responsible for paying income tax on their share of the partnership or LLC’s profits. This pass-through taxation system is designed to avoid double taxation, where income is taxed at both the entity and individual levels.

However, partnerships and LLCs must still file annual information returns with the Missouri Department of Revenue, providing details on their income, expenses, and distributions to partners or members. This information is crucial for accurate tax reporting and compliance.

Missouri’s Tax Incentives and Credits

Missouri, like many states, offers various tax incentives and credits to attract businesses and promote economic development. These incentives can significantly reduce a business’s tax liability and encourage investment in certain industries.

Enterprise Zones

Missouri has designated specific geographic areas as Enterprise Zones, which offer a range of tax incentives for businesses that locate or expand within these zones. These incentives can include:

- Reduced tax rates on qualifying investments.

- Tax credits for job creation and retention.

- Property tax abatements or deferrals.

- Sales tax exemptions on certain purchases.

The goal of Enterprise Zones is to stimulate economic growth in underdeveloped areas of the state, create jobs, and attract new businesses.

Research and Development Tax Credits

Missouri provides tax credits to encourage research and development activities within the state. Businesses that conduct qualified research and development projects can claim tax credits, which can be used to offset their tax liability. These credits aim to promote innovation and technological advancement, making Missouri an attractive location for R&D-focused businesses.

Job Creation and Investment Incentives

To attract new businesses and encourage expansion, Missouri offers tax incentives for job creation and investment. These incentives can include tax credits for hiring new employees, particularly in high-demand industries, and tax abatements or exemptions for certain capital investments. By providing these incentives, Missouri aims to boost employment opportunities and strengthen its economic base.

Performance Analysis and Future Implications

Missouri’s income tax system, like any tax structure, has its strengths and areas for improvement. While the progressive tax rates ensure a fair distribution of tax burden, there are ongoing debates about the state’s overall tax climate and its impact on economic growth.

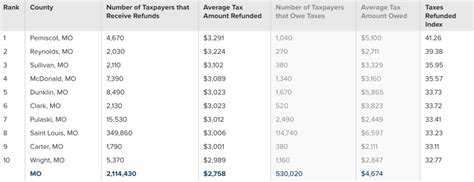

Economic Impact

The tax incentives and credits offered by Missouri have had a positive impact on the state’s economy. They have attracted businesses, created jobs, and encouraged investment in various industries. However, there are concerns that these incentives may disproportionately benefit certain areas or industries, leading to an uneven distribution of economic growth.

Additionally, Missouri's tax system, including its income tax rates, is often compared to neighboring states. This comparison can influence businesses' decisions on where to locate or expand, as they seek the most favorable tax environments. As a result, Missouri faces the challenge of balancing its tax rates and incentives to remain competitive while also maintaining a fair and progressive tax system.

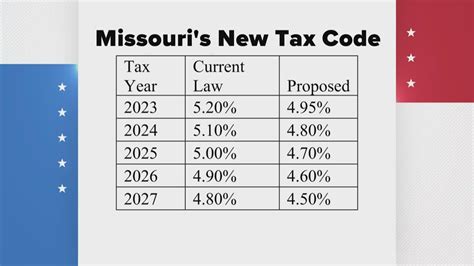

Potential Reforms and Considerations

As Missouri’s tax system continues to evolve, there are ongoing discussions about potential reforms. Some proposed changes include simplifying the tax code, reducing tax rates, and expanding tax credits to promote further economic development. These reforms aim to make Missouri’s tax system more efficient, attractive to businesses, and easier for taxpayers to navigate.

Furthermore, with the ongoing evolution of the digital economy and remote work, there are considerations about how Missouri's tax system can adapt to these changes. Ensuring that the state's tax policies remain relevant and fair in a rapidly changing economic landscape is a key challenge for policymakers.

What is Missouri’s tax filing deadline for individuals?

+The tax filing deadline for Missouri individuals is typically April 15th, which aligns with the federal tax filing deadline. However, in the event that this date falls on a weekend or holiday, the deadline is extended to the next business day.

Are there any sales tax exemptions in Missouri?

+Yes, Missouri offers sales tax exemptions for certain goods and services. These exemptions include purchases related to manufacturing, certain agricultural equipment, and certain educational materials. It’s important to consult the Missouri Department of Revenue for a comprehensive list of sales tax exemptions.

Can businesses in Missouri claim tax deductions for advertising expenses?

+Yes, businesses in Missouri can deduct advertising expenses as long as they are ordinary and necessary for the business. This includes expenses for print, digital, and broadcast advertising, as well as promotional materials and events. It’s advisable to consult a tax professional for specific guidance on deducting advertising costs.