Iowa Tax Rebate

The Iowa Tax Rebate program has been a topic of interest for many residents of the state, offering a potential financial boost during challenging economic times. This program, aimed at providing relief to taxpayers, has gained significant attention due to its potential impact on individual finances and the state's economy. In this article, we delve into the intricacies of the Iowa Tax Rebate, exploring its origins, eligibility criteria, and the process involved in claiming this rebate.

Understanding the Iowa Tax Rebate Program

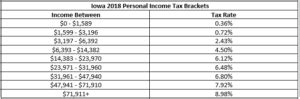

The Iowa Tax Rebate program, officially known as the Individual Income Tax Credit Refund, is an initiative by the Iowa Department of Revenue to return a portion of the state income tax paid by residents. This program, which has been in effect since 2018, is designed to provide direct financial support to Iowans, especially those with lower to moderate incomes.

The idea behind the tax rebate is to stimulate the economy by putting money back into the hands of taxpayers, who can then use it for various purposes, such as paying off debts, investing in education, or simply covering daily expenses. This injection of funds into the local economy can lead to increased consumer spending, which in turn benefits businesses and can create a positive economic cycle.

Eligibility Criteria

Not all Iowa residents are eligible for the tax rebate. The program has specific criteria that determine who qualifies. Here's a breakdown of the key eligibility factors:

- Residency: You must be a resident of Iowa for the entire tax year for which you're claiming the rebate. Part-year residents are not eligible.

- Income: The rebate is designed to benefit lower to moderate-income individuals and families. The income threshold varies depending on your filing status. For example, single filers must have an adjusted gross income (AGI) below a certain limit, while married couples filing jointly have a higher threshold.

- Filing Status: Your filing status (single, married filing jointly, head of household, etc.) will impact your eligibility and the amount of rebate you can receive.

- Tax Liability: To be eligible, you must have paid state income tax during the tax year. If you had no tax liability due to deductions or credits, you won't qualify for the rebate.

It's important to note that the income limits and other criteria can change from year to year, so it's advisable to refer to the official Iowa Department of Revenue website for the most up-to-date information.

Determining Your Rebate Amount

The amount of rebate you can receive depends on several factors, including your income, filing status, and the number of dependents you claim. Generally, the rebate amount is calculated as a percentage of your total state income tax liability, with higher rebates for lower-income earners.

For instance, if you're a single filer with a low income, you might be eligible for a rebate of up to 100% of your state income tax liability. On the other hand, a higher-income earner might receive a rebate of a lower percentage.

Here's a simplified table to illustrate the potential rebate amounts based on filing status and income (note that these are fictional examples and not official figures):

| Filing Status | Income Level | Potential Rebate Amount |

|---|---|---|

| Single | Low Income | $500 - $1,000 |

| Married Filing Jointly | Moderate Income | $750 - $1,200 |

| Head of Household | High Income | $400 - $800 |

Claiming Your Iowa Tax Rebate

The process of claiming your Iowa Tax Rebate is relatively straightforward, but it's essential to follow the correct procedures to ensure a successful claim.

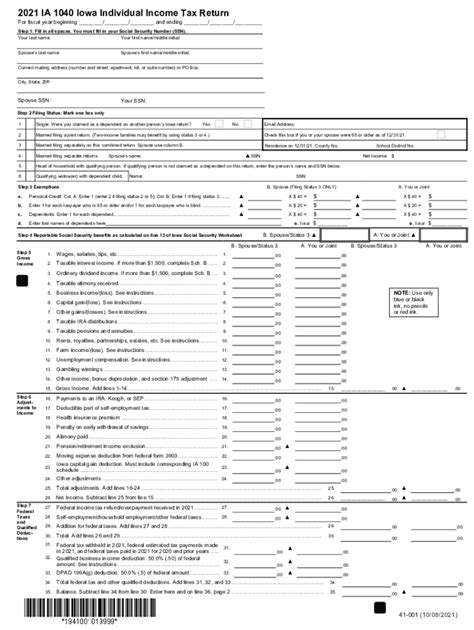

Filing Your Tax Return

The first step in claiming your rebate is to ensure you've filed your Iowa state income tax return accurately and on time. This return should include all relevant income, deductions, and credits.

When filing, make sure you select the appropriate filing status and claim any dependents you're eligible for. This information will impact your tax liability and, consequently, your rebate amount.

Understanding the Rebate Application Process

Once you've filed your tax return, you can proceed to apply for the tax rebate. The Iowa Department of Revenue provides a dedicated online portal for this purpose, which is accessible and user-friendly.

To apply, you'll need to provide basic information, such as your name, address, and taxpayer identification number. You'll also need to confirm your eligibility based on the criteria outlined earlier.

It's crucial to ensure that all the information you provide is accurate and up-to-date. Inaccurate information can lead to delays or even rejection of your rebate application.

Receiving Your Rebate

After successfully applying for the rebate, the Iowa Department of Revenue will process your request. The time it takes to receive your rebate can vary depending on various factors, including the volume of applications and the method of payment you choose.

Generally, rebates are issued within a few weeks to a couple of months after the application is submitted. You can choose to receive your rebate as a direct deposit into your bank account or as a paper check mailed to your address.

Impact and Benefits of the Iowa Tax Rebate

The Iowa Tax Rebate program has several notable benefits and impacts on both individuals and the state's economy.

Financial Relief for Individuals

For many Iowans, the tax rebate provides much-needed financial relief. It can help individuals and families cover essential expenses, pay off debts, or even save for future needs. For those living paycheck to paycheck, this rebate can be a significant boost to their financial stability.

Stimulating the Local Economy

By putting money back into the hands of taxpayers, the Iowa Tax Rebate program has a positive impact on the local economy. Increased consumer spending can lead to more sales for local businesses, which in turn can create jobs and stimulate economic growth.

Encouraging Tax Compliance

The program also serves as an incentive for taxpayers to comply with their tax obligations. Knowing that they might be eligible for a rebate can encourage individuals to file their tax returns accurately and on time, ensuring a smoother tax system for the state.

Future Implications and Potential Changes

The Iowa Tax Rebate program has been well-received by many residents and has shown positive impacts on the state's economy. However, like any policy, it is subject to change and evolution.

As economic conditions fluctuate, the state may adjust the program's eligibility criteria, rebate amounts, or even the program's structure itself. For instance, during periods of economic downturn, the state might consider increasing rebate amounts or expanding eligibility to provide more support to residents.

Additionally, as the program continues, the Iowa Department of Revenue may gather valuable data and insights, which can inform future iterations of the rebate program, ensuring it remains effective and beneficial for Iowans.

Frequently Asked Questions

When is the deadline to file for the Iowa Tax Rebate?

+The deadline to file for the Iowa Tax Rebate varies each year but generally aligns with the federal tax filing deadline. It’s essential to stay updated with the official Iowa Department of Revenue website for the most accurate and up-to-date information on deadlines.

Can I claim the Iowa Tax Rebate if I filed an extension for my tax return?

+No, you cannot claim the Iowa Tax Rebate if you filed an extension for your tax return. The rebate is only available to those who have filed their tax returns by the official deadline.

Are there any restrictions on how I can use the tax rebate funds?

+No, there are no restrictions on how you can use the tax rebate funds. The program is designed to provide financial flexibility, so you can use the funds for any purpose, whether it’s paying off debts, investing in your future, or covering daily expenses.

Can I claim the Iowa Tax Rebate if I’m a student or have a part-time job?

+Yes, students and part-time workers can claim the Iowa Tax Rebate as long as they meet the program’s eligibility criteria. Income from part-time jobs or student employment is considered when determining eligibility and rebate amounts.